Deel will let its customers pay workers in the UK and the EU. Later, the company plans to expand to the US.

Next month, workers in the UK and EU will be able to get their salaries in stablecoins through a partnership between MoonPay and the global payroll platform Deel. Employees can now get their paychecks directly in stablecoins to non-custodial crypto wallets. A US launch is planned at a later phase.

In October, the business reported that Deel processes $22 billion in payroll for more than 150 million workers throughout the world every year. According to Tuesday’s announcement, it will employ MoonPay to manage stablecoin conversion and distribution of on-chain wallets. This would effectively add crypto settlement rails to its existing payroll system.

Workers can choose to receive some or all of their pay in stablecoins instead of local fiat currency. Deel will keep running the payroll and compliance layer, while MoonPay will handle the conversion and settlement.

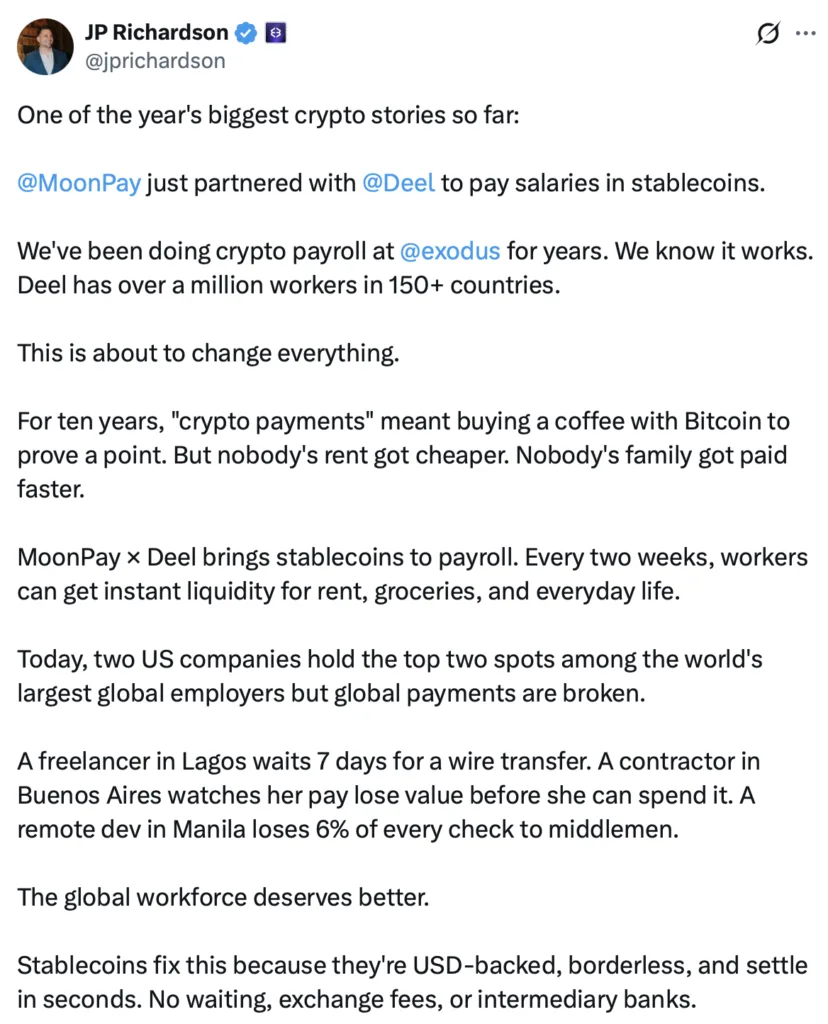

JP Richardson, co-founder and CEO of Exodus, stated that the relationship is an indication of a bigger trend toward using crypto in everyday life. “You don’t get people to use crypto by writing whitepapers. “You do it with pay cheques,” Richardson wrote on X, saying that stablecoin payroll will speed up payments across borders and lower fees for workers around the world.

Source: JP Richardson

Regulatory positioning and infrastructure expansion

The cooperation gives Deel more ways to pay out in cryptocurrency and gives MoonPay another way to reach businesses. MoonPay has a New York BitLicense, money transmitter licenses in all 50 states, and permission under the EU’s MiCA framework.

The company did not say which stablecoins would be supported or how many people they think will sign up when the service goes live. They also didn’t say when the US expansion would happen or give any details about the regulatory approvals needed for the second phase.

Growing competition in the stablecoin sector

MoonPay and Deel’s rollout is aimed at workers in the UK and EU, although the agreement comes at a time when the US dollar-pegged token market is growing quickly. A lot of companies have started to create regulated stablecoins in the US since the US Congress passed the GENIUS Act in July 2025, which set up a regulatory framework for payment stablecoins.

In March, World Liberty Financial, a DeFi platform connected to the Trump family, released its USD1 stablecoin. In January, Wyoming became the first US state to issue its own stablecoin, the Frontier Stable Token (FRNT).

In the same month, Tether, the company that generates the world’s largest stablecoin, USDt USDT$1, announced the debut of USAt, a US dollar-pegged token issued by Anchorage Digital Bank and marketed as a federally authorised payment stablecoin for usage in the US.

Some traditional US banks are also getting ready to enter the stablecoin market. This is because the Federal Deposit Insurance Corp. suggested a plan in December for how subsidiaries of FDIC-supervised banks may apply to issue payment stablecoins.

Even though a lot of new companies have entered the industry, it is still very concentrated. DeFiLlama says that Tether’s USDt makes up roughly 60% of the overall stablecoin market capitalisation, and Circle’s USDC USDC$1 makes up about 24%.