Trading platform e-Toro has posted its Q3 earnings, showing double digit growth, as per an official press release—after a year of tinkering with AI and cryptocurrency integrations to capture market share in emerging sectors.

The update comes after the firm has launched multiple updates, building on top of its existing product line in an effort to remain competitive in the market, some of which include recurring investments, AI trading tools, and an expansion of trading hours.

“We remain focused on executing our strategy across our four key pillars of trading, investing, wealth management, and neo-banking, developing new products and services that deliver value to users across every step of their investing journey. This robust product offering, combined with our unique shared social experience for users worldwide, creates a powerful flywheel that drives increased engagement and activity platform while establishing a durable competitive moat,” said e-Toro’s CEO Yoni Assia.

Adjusted net income for the quarter increased 35% year-over-year to $60 million while adjusted EBITDA increased by 43% year-over-year to $78 million. Assets under administration were marked at $20.8 billion while cash, cash equivalents, and short term investments were valued at $1.2 billion.

e-Toro has also committed to repurchase upto $150 million worth of company stock, of which $50 million will be purchased under an accelerated share repurchase agreement.

According to Investopedia, an accelerated share repurchase agreement occurs when a company buys its own shares immediately from an investment bank in exchange for cash upfront. The investment bank procures these shares by borrowing them from institutional investors.

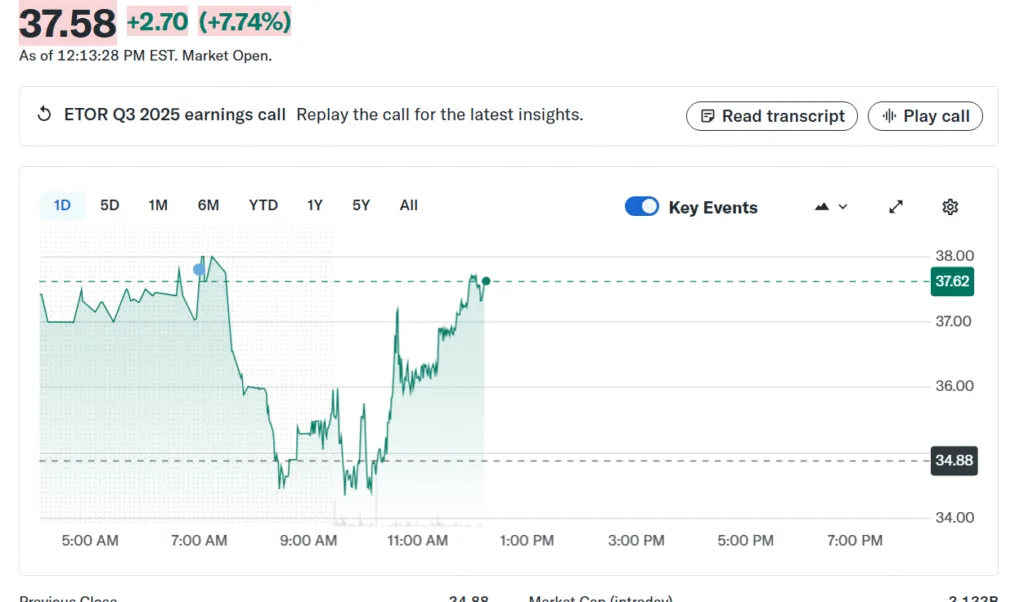

The trading platform went public in May this year on the NASDAQ stock exchange at a debut price of $52 per share. At the time of writing, e-Toro’s shares were trading at $37.58 per share. Since its debut, the stock has lost 28% in value.

Source: Yahoo Finance