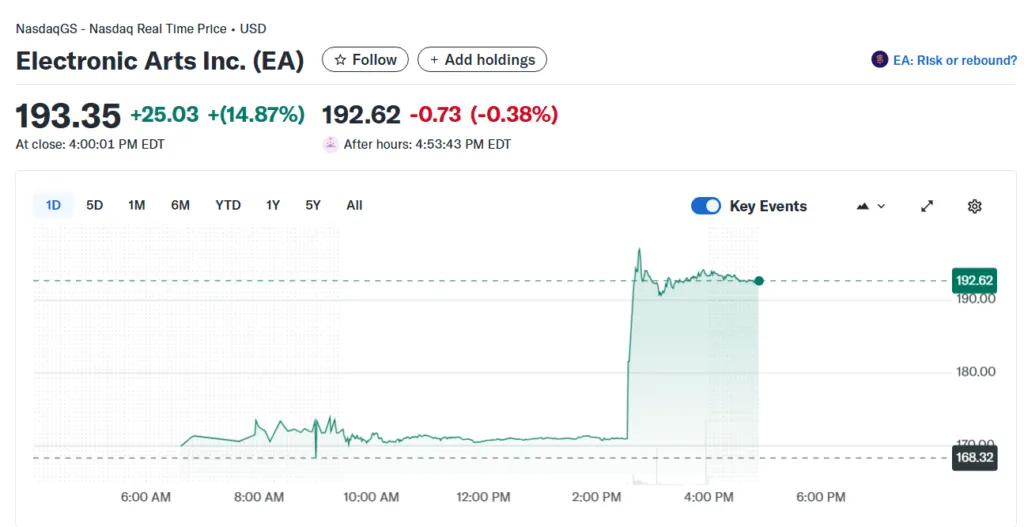

Electronic Arts (EA) shares leapt ~15% on Friday after The Wall Street Journal reported that the video game giant is nearly ready to be taken private in a deal pegged at $50 billion. According to multiple sources, the proposed buyout would be led by a consortium including the private equity firm Silver Lake and Saudi Arabia’s Public Investment Fund (PIF). Affinity Partners, the investment vehicle tied to Jared Kushner, may also be involved.

While EA’s current market capitalization sits near $42–48 billion, this transaction would represent a significant premium and could be among the largest leveraged buyouts ever. The reported buyout would take EA off the public markets, putting future direction under private hands and potentially alleviating short-term earnings pressure, regulatory scrutiny, and public market volatility.

EA shares upward trajectory

EA stock has been steadily climbing, supported by anticipation around major game launches like Battlefield 6. On Friday, the spike pushed EA shares to an all-time high, reaching near $197.33 intraday before settling around $193. The move marked EA’s largest one-day gain in percentage terms since February 2019.

Source: Yahoo Finance

If the company eventually goes private, it could take a longer time on game development, allocate capital more aggressively, and manage to weather storms if any product flops with less immediate investor backlash. However, leveraging such a large acquisition entails debt burdens. If revenues don’t grow as projected, the balance sheet could come under stress.

Take-private deals in tech

Other noteworthy tech/gaming companies that have gone private include Qualtrics, which was bought for a whopping $12.5 billion by Silver Lake and Canada Pension Plan Investment Board (CPPIB). Cybersecurity firm McAfee was rescued from public scrutiny by Advent International and Permira in a $14 billion deal.

Founded in 1982, Electronic Arts has grown into one of the world’s leading video game publishers. Its portfolio includes franchises like Madden NFL, The Sims, Battlefield, FIFA, Need for Speed, and Star Wars titles. Over the years, EA has expanded via acquisitions, internal development, and portfolio diversification across console, PC, and mobile gaming. In 2025, the company undertook a massive restructuring plan, with layoffs in studios to streamline costs.