Convicted paedophile Jeffrey Epstein allegedly had links to the crypto industry as well, making business leaders find excuses and justifications for any alleged links with the tainted Washington fixer.

Newly released DOJ files give a glimpse into an unexpected side of Jeffrey Epstein, showing his early curiosity about cryptocurrency.

In a 2016 email, Epstein claimed to have spoken directly with Bitcoin’s creators and pitched a digital currency designed to follow Sharia law, alongside a Middle East-focused fiat currency.

Parallelly, Epstein had been in constant contact with tech giants like Boris Nikolic and Bill Gates, exploring the hype of Bitcoin in the silicon valley.

The situation has deteriorated to such an extent that crypto players like Blockstream CEO Adam Back have now released twitter posts, explaining and defending their positions in the whole saga.

Epstein’s early crypto interest reveals talks with tech-giants

Newly released emails show that Epstein had been in touch with tech industry behemoths, understanding and exploring Bitcoin’s growth.

The emails also show him weaving into discussions among venture capitalists, debating projects like Ripple and Stellar, and talking with major tech investors.

While his involvement is controversial, the documents suggest Epstein was trying to plant himself at the heart of a financial revolution, exploring how new technologies and global finance could intersect.

It’s a rare look at how he engaged with one of the world’s most cutting-edge industries, long before crypto became mainstream.

Newly released emails show Jeffrey Epstein was deeply involved in early cryptocurrency discussions as well.

In 2013, he received an email from Boris Nikolic that included a detailed write-up on Bitcoin by Tren Griffin, which had also been sent to tech figures like Bill Gates and Michael Larson.

The email described Bitcoin’s rapid rise in Silicon Valley and Seattle, particularly among libertarian venture capitalists, and noted that some liberal economists opposed it, fearing a loss of control over money.

A 2014 email from Austin Hill revealed behind-the-scenes tensions: his company was frustrated that investors were backing both Ripple and Stellar, which he likened to betting on two horses in the same race, and asked for a call to resolve the issue.

Other opinions from the Winklevoss twins, economist Steve Hanke, and journalist Kurt Eichenwald covered Bitcoin as both a potential bubble and a math-based alternative to traditional money.

The emails show Epstein’s early access to key players and debates in the crypto world, highlighting his unusual presence in the industry.

Epstein moves from observer to direct crypto investor

Interestingly, after getting enough exposure to crypto’s hype and growth prospect, Epstein had later taken a direct part in the industry by investing in tokens.

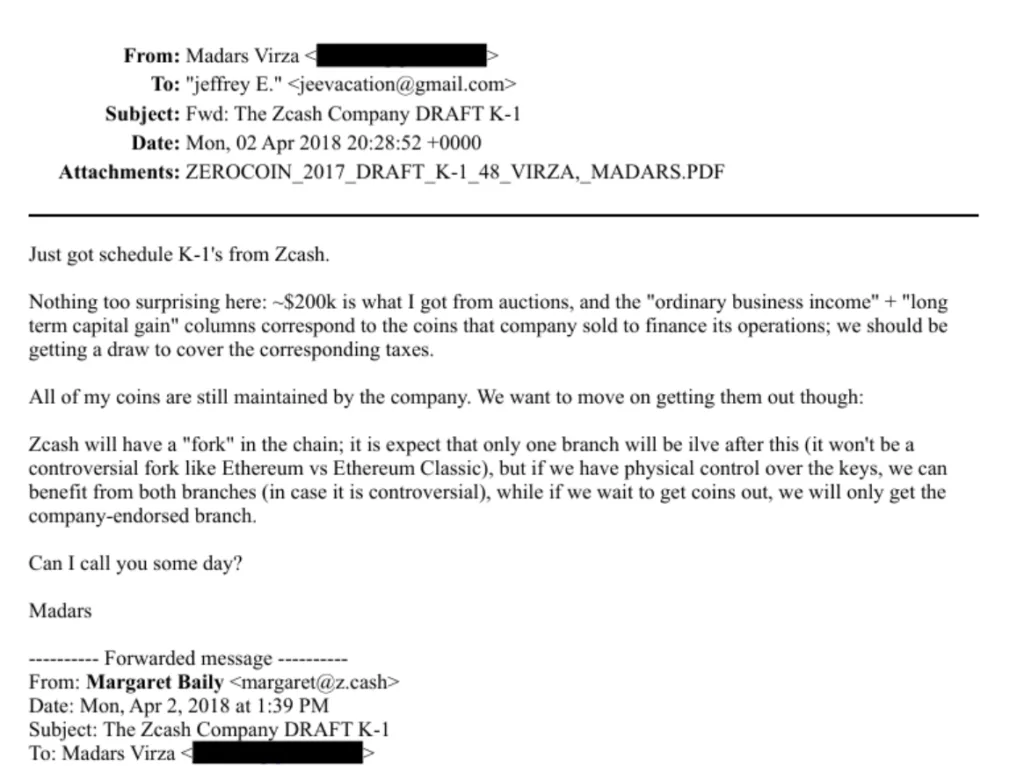

An email from Zcash shows that Epstein received his Schedule K‑1 tax forms, detailing profits, losses, and capital gains from the company’s coin sales.

Interestingly, the K-1 highlighted a $200,000 transactions from auctions, while noting that the company plans to provide funds to cover related taxes.

The email also showed that Epstein had pointed out the possibility of reaping more profits from Zcash. Allegedly, all his coins were still with the company at the time the email was sent, but the criminally accused wanted to get them out and have control.

He had explained that Zcash is going to have a fork soon and most likely only one chain would have survived.

With the market not expecting the fork to be a big fight like Ethereum and Ethereum Classic, Epstein had limited chances of growing his wealth. However, he suggested that if “I control my own keys, I could get coins on both chains if things do get messy.”

He further explained, “ If I leave them with the company, I’ll only get the coins on the branch the company chooses. I just want to make sure I have full control so I don’t miss out.”

Blockstream CEO clarifies company had no financial ties to Jeffrey Epstein

Blockstream CEO Adam Back has publicly clarified that the company has no financial ties, direct or indirect, to Jeffrey Epstein or his estate.

The connection arose back in 2014, when Epstein was introduced to Blockstream through Joi Ito, then director of the MIT Media Lab, as a limited partner in Ito’s fund.

The fund made a small, minority investment in Blockstream during its seed round but pulled out just a few months later over potential conflicts of interest and other concerns.

Importantly, Epstein never invested directly in the company. Back’s statement comes amid renewed scrutiny over crypto’s early funding and seeks to make clear that Blockstream’s operations and growth were independent of Epstein, underscoring the company’s distance from his controversial legacy.

As more allegations and evidence about Jeffrey Epstein come to light, the crypto world is on edge, trying to figure out who might have had any connection to him, directly or indirectly.

People are watching closely to see which companies and figures step forward to explain their position and stance. Even small or indirect links are now drawing attention, making investors and the community rethink early partnerships and funding, and showing just how much Epstein’s shadow is affecting the crypto industry.