In May 2022, Ethereum transactions cost the most, with fees averaging over $200 per transaction. Since then, they have been going down.

This week, the Ethereum mainnet set a new milestone by processing 2.2 million transactions in one day. The average fee is now just 17 cents.

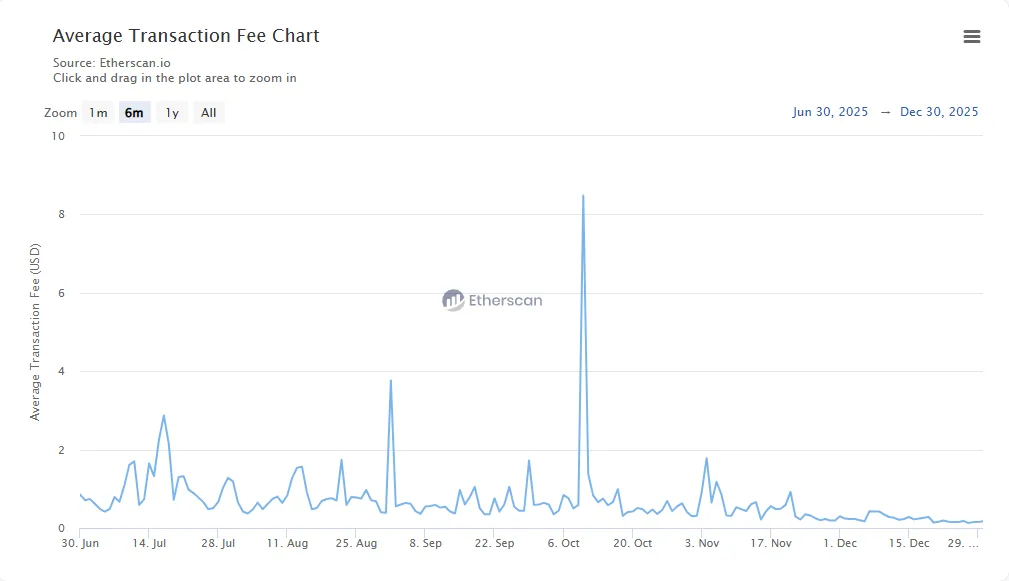

Block explorer Etherscan says that the layer-1 blockchain reached its new transaction record on Tuesday. Over time, the fees for transactions have also gone down a lot.

In May 2022, Ethereum users had to pay the most in transaction costs, which were over $200 per transaction.

However, costs have gone down a lot thanks to ongoing enhancements, even if the network’s demand is still growing.

Since October 10, when they were at $8.48 during the big liquidation event that caused the whole market to bleed, fees have likewise been going down.

Source: Etherscan

Mainnet usage rebounds despite layer-2 competition

In the past, higher Ethereum costs have made users go for cheaper options like layer 2s. However, the increasing number of transactions on the mainnet shows that users are going back to the layer 1 blockchain and using it more.

At the same time, more and more developers are selecting Ethereum as a settlement layer. Data from Token Terminal shows that the number of new smart contracts generated and published on the Ethereum blockchain reached a record high of 8.7 million in the fourth quarter.

Network upgrades drive scalability gains

There were big modifications to the Ethereum blockchain in 2025, including two upgrades that probably caused the number of transactions to go increase and the costs to go down.

In May, Pectra worked on making validators better, making staking more flexible, and getting Ethereum ready for features that would make it easier to scale in the future.

Fusaka raised the gas limit from 45 million to 60 million and was also meant to greatly improve scalability, data handling, and network efficiency. In February, more than half of Ethereum validators said they supported expanding the network’s gas limit. This would raise the maximum amount of gas that can be utilised for transactions in a single Ethereum block.

On Monday, Ethereum’s staking queue turned the exit line for the first time in six months. Now, almost twice as much ETH is queuing up to be staked as ETH seeking to leave the network.

People often think that unstaking means that validators want to sell Ether, while staking means that they trust it enough to keep it locked up for a long time.