Token Terminal says that on-chain development activity on Ethereum has picked up a lot, thanks to tokenised assets, stablecoins, and infrastructure.

Even if the price of Ether has been slow to move, more and more developers are adopting Ethereum as a settlement layer. The fourth quarter is shaping up to be a record-breaking time for the network.

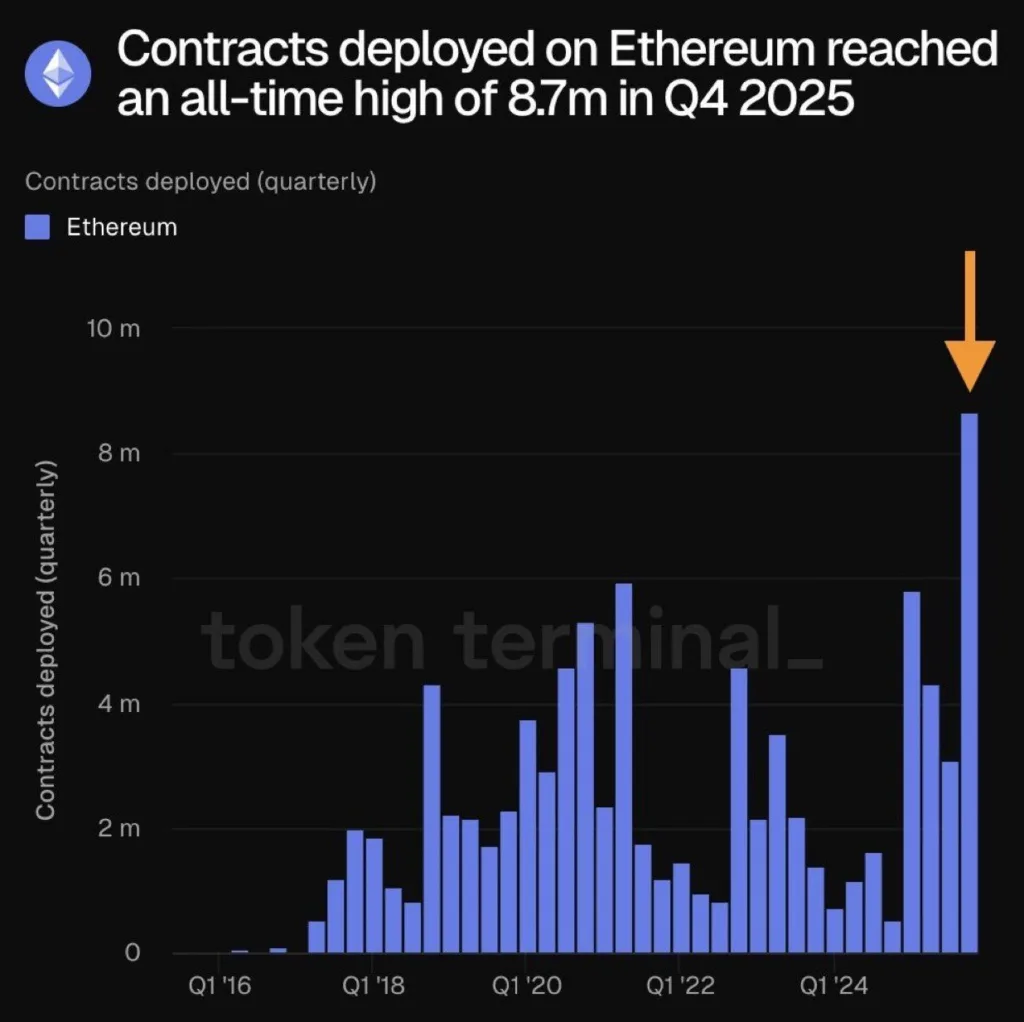

Smart contract deployments reach record highs

According to Token Terminal, the number of new smart contracts written and published on the Ethereum blockchain hit an all-time high of 8.7 million in the fourth quarter.

The milestone was a big jump over the last two quarters, when there was much less activity in deploying contracts.

Token Terminal says that the rise is due to natural growth, which is being driven by the tokenisation of real-world assets (RWA), stablecoin activities, and the development of core infrastructure. The blockchain analytics platform said, “Ethereum is quietly becoming the global settlement layer.”

Source: Token Terminal

Contract activity as a leading indicator of network growth

This pattern is interesting because deploying contracts is generally seen as a sign of future network activity. It usually comes before an increase in users, transaction fees, and maximal extractable value (MEV), which is the value that validators and block builders get from ordering transactions.

These things tend to lead to more economic activity on the blockchain over time, which can affect Ether’s price performance at ETH$2,978. Earlier this year, Ether briefly broke its all-time high of $5,000 before falling drastically after the market-wide liquidation event on October 10. ETH is valued roughly $3,000 right now.

Leadership in tokenisation of real-world assets

As competition between layer-1 blockchains heats up, with Solana focussing on low fees and high throughput, Avalanche focussing on configurable subnets, and BNB Chain using exchange-linked liquidity, data shows that Ethereum is still a key part of the larger digital asset ecosystem.

Ethereum is still the most popular network for RWA tokenisation, and it has the most proportion of the on-chain RWA market capitalisation.

Researchers at RedStone have called Ethereum the “institutional standard” for hosting tokenisation projects since it is safe, has a lot of liquidity, and has a well-established infrastructure.

Ethereum is still the most important stablecoin.DefiLlama says that more than half of the more than $307 billion in stablecoins that are now in circulation are on the Ethereum network.

Tether’s USDt USDT$1 and Circle’s USDC USDC$1 make up most of the network’s stablecoin activity. Together, they make up most of the Ethereum-based supply.