Origin & narrative of 67

The tale of 67 starts in popular online culture, not on the blockchain. The shout, the readily identifiable number, and the global emergence of the “67 kid” produced a viral loop on TikTok, YouTube shorts, Instagram reels, and TV snippets. In just a few weeks, the meme traveled throughout the world and became a cultural shorthand. 67 has a clear link to its creator, Mav Trevillian, who accepted the notion of turning this cultural event into an on-chain asset, in contrast to anonymous crypto memes.

This provides the 67 meme coin with a confirmed and respectable lineage, something that most meme tokens never accomplish. The coin presents itself as a digital artifact of the viral phenomena, a piece of culture, and a token of participation. It is simple, unreserved, and based on fun rather than attempting to be DeFi, infrastructure, or AI.

Market structure & price behavior

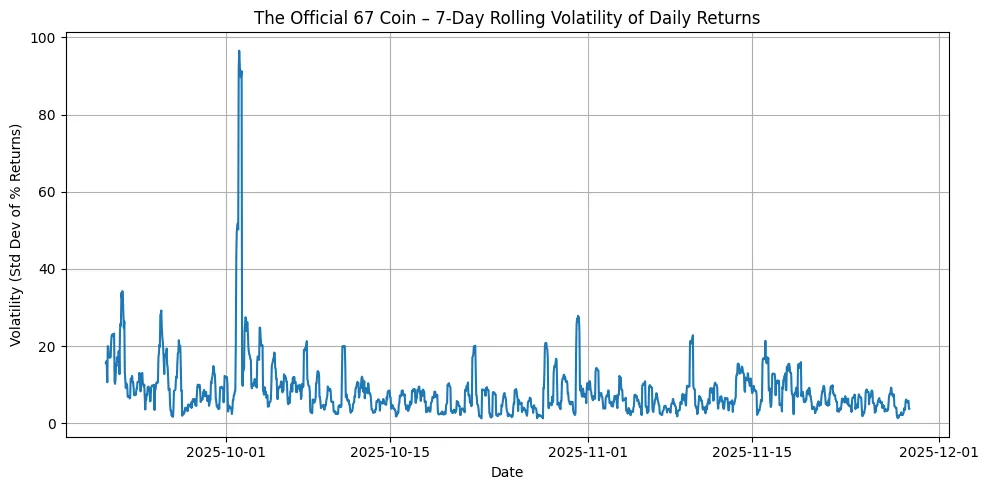

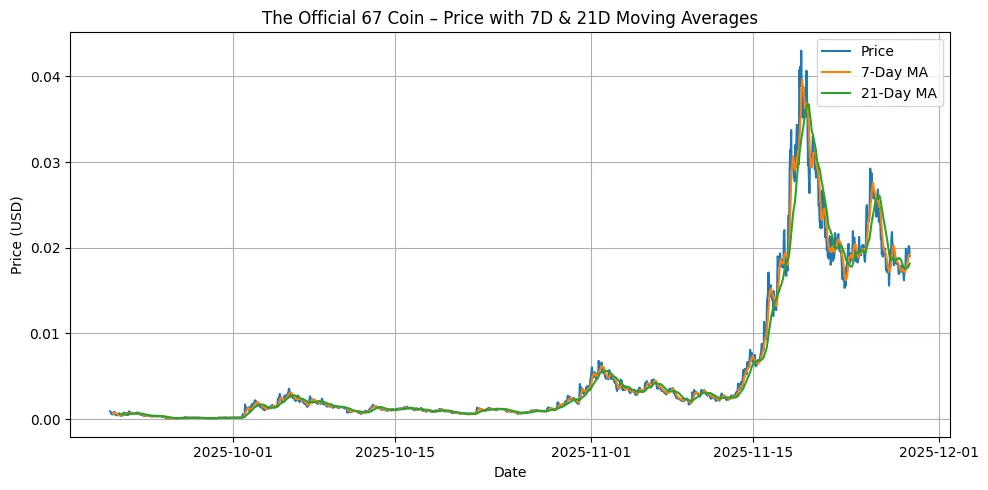

A traditional parabolic Solana meme cycle is shown in the market performance of 67. In less than a month, the coin’s value increased by more than ten times following its initial microcap period on Pump.fun. Midway through November, it hit its highest point ever before seeing a severe decline that wiped off half of its market value, leaving it trading in the two-cent area.

Liquidity was still high despite this decline, with millions of transactions every day. This degree of activity suggests that 67 has transitioned from the microcap category to the actual speculative money market. A clear cycle of ignition, exhilaration, retracement, and recalibration can be seen in the structure. The meme’s continued dominance of worldwide internet attention will determine whether the next phase is a new expansion or a fade.

Tokenomics & supply structure

67’s tokenomics are purposefully simple. With no ongoing minting or emission plan, the supply currently stands at one billion tokens, which were created at launch. With a set supply, no dilution, no staking, no governance, and no complicated utilities that would confuse or discourage retail participation, the structure is similar to the most successful meme-economy ideas. Its worth is solely based on cultural momentum. The coin lives on narrative velocity rather than on-chain economics; its lack of utility is an intentional design decision rather than a shortcoming. The token only acts as a cultural asset, with demand, sentiment, and viral energy rather than financial fundamentals determining its price.

Community, culture, and social sentiment

The source of 67’s volatility, importance, and visibility is its community. The meme has attained an exceptionally high level of ongoing participation on TikTok, X, Telegram, Reddit, and YouTube. Strong positivity is revealed via sentiment research from sites like Coinbase’s social dashboard, which is unusual for early-stage meme assets. A significant portion of 67’s cultural influence stems from its ability to be remixed; people produce edits, duets, remixes, memes, and little movies that consistently bring the trend back. A self-sustaining attention engine is created by this continuous flow of content.

Even criticism raises awareness. The cacophony that results from doubters calling the coin “the kid coin” or unsuitable keeps the meme alive. Its identity revolves around this dynamic: 67 is a cultural organism that reacts to social pressure, discourse, and visibility rather than a financial product.

Risk dynamics & attention fragility

67’s reliance on social momentum is its main concern. The coin loses the one fundamental that sustains its value once the meme cools. A drop in interest cannot be offset by yield, revenue, or utility. big early Pump holders.Aggressive sell-offs have the potential to quickly destabilize the price because the enjoyment phase may still control a significant amount of the supply. Similar to a speculative culture index, the profitability of this kind of asset is contingent upon the meme’s continued relevance. Time is the biggest threat, just like in every meme cycle. In order to prevent stagnation, the community must constantly create new levels of relevance as culture changes swiftly.

Outlook & narrative continuation

Whether the meme changes or fades will determine 67’s trajectory. 67 may become one of the enduring meme assets like WIF, BONK, PEPE, or FLOKI if the chant and persona behind it continue to be ingrained in online society. This calls for continuing remix culture, constant visibility, and creator interaction.

The coin might follow the usual decline path of most tokens issued during viral moments if the meme turns into a one-season phenomena. 67 is distinct since it originates from popular digital culture rather than cryptocurrency. It has a larger potential audience thanks to this crossover, but there is also a higher chance of burnout. The meme’s longevity will be reflected in its long-term trajectory.