From fixed supply to adaptive economies

For more than ten years, tokenomics adhered to established patterns: constant supply, halving intervals, or unchanging inflation trajectories. Bitcoin is limited to 21 million, Ethereum transitioned to a deflationary model following EIP-1559, and many protocols adopted similar fixed monetary guidelines. However, the market’s conduct is not fixed; it is fluid, illogical, and progressively influenced by outside disturbances. This is why the upcoming generation of cryptocurrency economies is adopting a new model: AI-enhanced tokenomics.

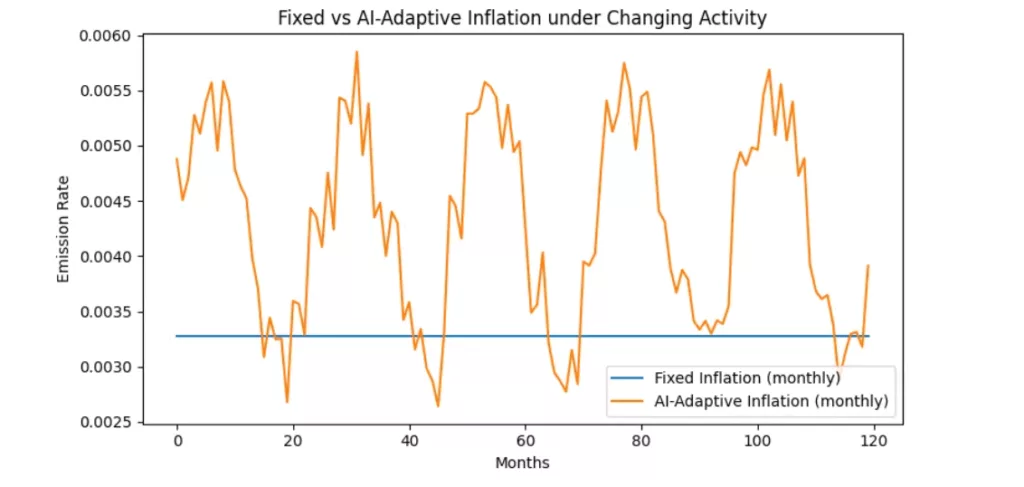

Algorithmic tokenomics reshapes the dynamics of supply, demand, and governance through the incorporation of machine learning feedback loops. Rather than adhering to fixed emission schedules, the protocol adjusts according to market conditions, liquidity depth, or even community actions in real time. Inflation or deflation results from intelligence, rather than being a predetermined rule.

Algorithmic tokenomics transforms the dynamics of supply, demand, and governance through the integration of machine learning feedback mechanisms. Rather than adhering to set emission plans, the protocol adjusts to market conditions, liquidity levels, or even community actions in real time. Inflation or deflation results from intelligence, rather than an established norm.

The core mechanism: Feedback loops in Tokenomics

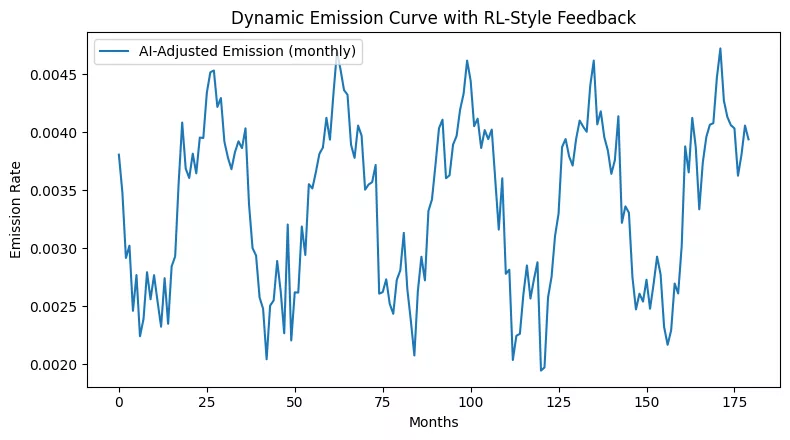

The strength of AI-powered tokenomics resides in its feedback structure. A smart contract evolves beyond merely executing rules; it transforms into a reactive entity. Every block, every transaction, and every liquidity event turns into a data point nourishing the system. By constantly ingesting data, AI models forecast changes in network conditions and modify supply to match.

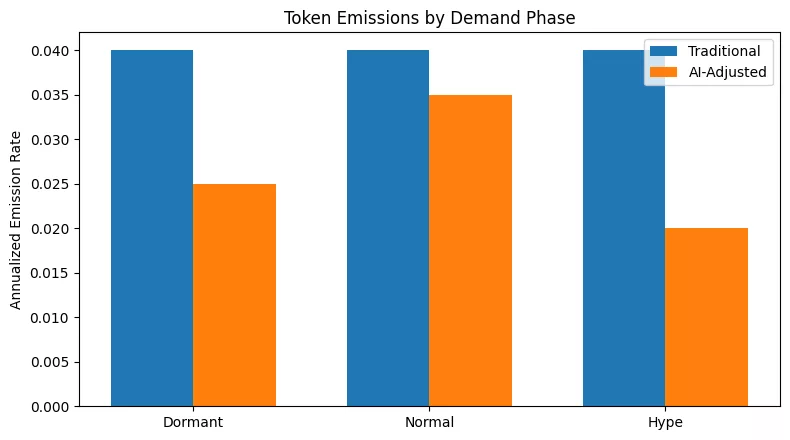

For instance, when transaction volumes decrease, the AI can lower emissions to sustain scarcity and protect token value. When liquidity diminishes, it can enhance staking rewards to draw funds back into pools. When volatility surges, it can trigger short-term deflationary actions by burning tokens or restricting supply to limit speculation. The goal isn’t just to maintain price stability; it’s to actively enhance network health.

This is accomplished via reinforcement learning models that are trained using both historical and real-time data. The model constantly evaluates various actions by altering yield, adjusting burn percentages, or tweaking inflation and assesses which policy achieves the most stable equilibrium. With time, it understands what maintains the sustainability of the ecosystem.

In contrast to Bitcoin’s unchangeable policy, these systems can respond to real-world changes, macroeconomic pressures, liquidity spikes, or even meme-coin crazes. AI acts as the unseen force steering the crypto economy, able to react more swiftly than human regulation

Use Cases: How projects are implementing AI feedback

The most thrilling instances of algorithmic tokenomics aren’t just theories; they are real-time experiments occurring within DeFi.

Hyperliquid’s AI Vaults adjust liquidity mining rewards in real-time according to predictions of market volatility. As price volatility increases, the system automatically lowers reward emissions to mitigate speculative farming. On the other hand, during times of low volatility, the motivation increases to uphold engagement and liquidity equilibrium.

In the meantime, Autonolas DAO has led the way in decentralized AI agents that predict governance involvement and treasury operations. Through the examination of on-chain voting patterns, these agents can anticipate times of community inactivity and decrease reward distributions until participation stabilizes, thereby protecting DAO treasuries from unnecessary inflation.

Tether.ai models examine supply adjustments influenced by macroeconomic data and capital inflow predictions. Instead of responding to demand spikes, its AI predicts liquidity shifts and increases issuance proactively. This changes token issuance into a prospective economic tool, rather than a retroactive modification.

These systems together indicate a transition toward flexible crypto economies that think, react, and develop. Similar to how algorithmic trading changed conventional finance, algorithmic tokenomics might revolutionize DeFi into a realm of self-governing monetary policy labs, where feedback mechanisms consistently adjust incentives for balance.

Governance, transparency, and the rise of algorithmic central banks

Nonetheless, with independence also comes responsibility. Algorithmic tokenomics presents significant governance challenges. Who evaluates the model? What measures can we take to guarantee that training data remains unbiased and unaltered? When a reinforcement model chooses to reduce supply, is the community able to counteract this and ought they to do so.

The incorporation of AI into monetary design leads to what certain researchers refer to as Algorithmic Central Banks (ACBs), which are DAOs managing AI feedback mechanisms. Rather than policy committees, we will implement model auditors and oracle councils tasked with validating parameters and reworking logic. Token holders transition into citizens of a digital economy ruled by clear algorithms instead of bureaucrats.

However, achieving transparency in AI governance is far from straightforward. Numerous models function as black boxes, prioritized for efficiency over understandability. Minor data alterations, even a handful of faulty oracles, might trigger destabilizing feedback loops, resembling the disastrous decline of algorithmic stablecoins such as Terra. Consequently, forthcoming ACBs will need auditable AI systems, ensuring that each model modification is traceable, understandable, and validated by the community prior to implementation.

The irony is profound: decentralization aimed to remove the need for trust, but in AI-driven economies, faith in transparency and auditability is now more crucial than before.

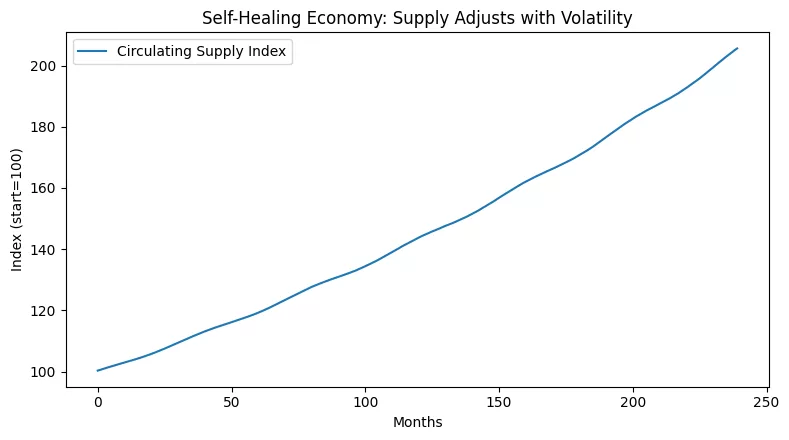

The future: Toward self-healing economies

Envision a realm where blockchain systems identify macro stress prior to its occurrence. Transaction volume decreases, risk models forecast lower liquidity, and immediately issuance schedules tighten, staking rewards increase, and burn rates speed up. The system maintains stability similarly to how the human body controls temperature. This represents the pinnacle concept of algorithmic tokenomics: an economy that self-repairs and self-regulates.

These networks will not require manual intervention or random forks. Rather, they will function as flexible ecosystems that are robust against fluctuations, impervious to manipulation, and attuned to sentiment. Eventually, these self-regulating systems may integrate with AI-enhanced governance, creating a novel financial framework where networks transform into independent entities steered by shared intelligence.

If Bitcoin marked the inception of programmable currency, this signifies the dawn of programmable macroeconomics where AI systems take the place of central banks, token supply transforms into a neural parameter, and markets evolve into dynamic, thriving entities. The key question is not if these systems are capable, but if humanity is prepared to entrust them with control over money.