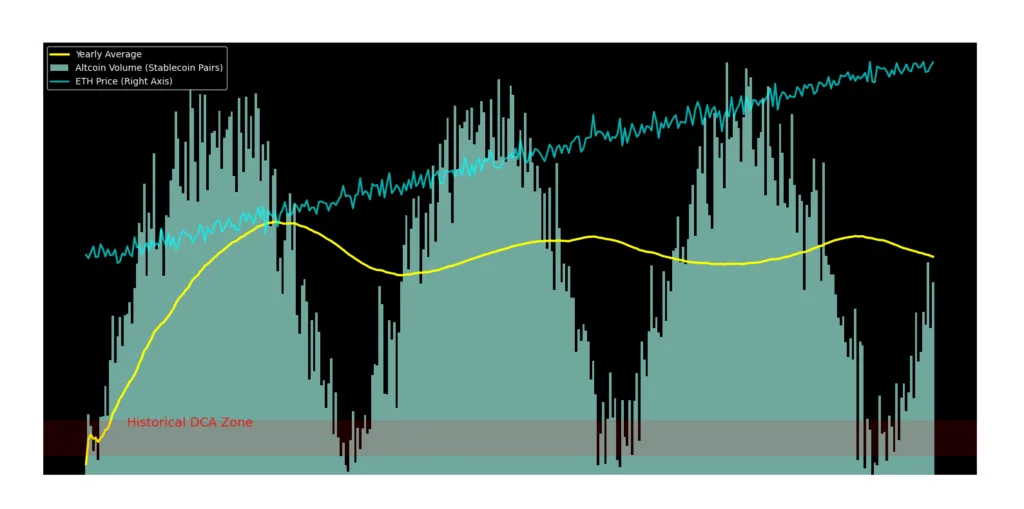

Aggregated altcoin trading activity for stablecoin pairs has dropped below its annual mean, according to recent CryptoQuant data, placing the market inside what their models refer to as the ‘historical DCA zone.’ Suppressed volatility, less liquidity, and decreased speculative activity are typical characteristics of this scenario. These structural characteristics often precede periods of slow accumulation from long-duration participants, according to analysis across previous cycles.

Volume dynamics and the structure of the current downturn

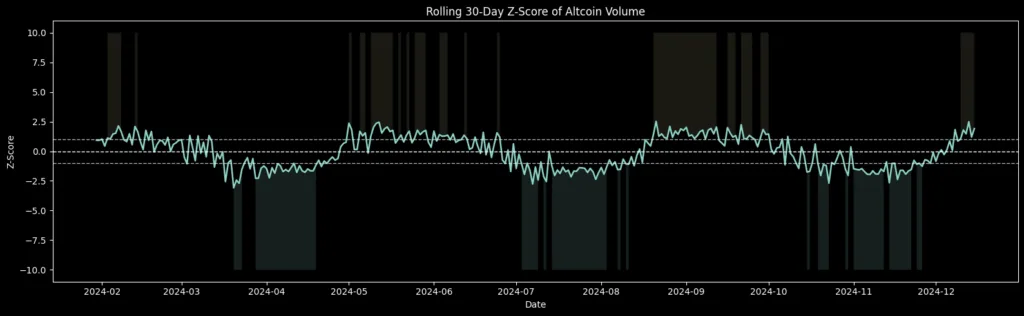

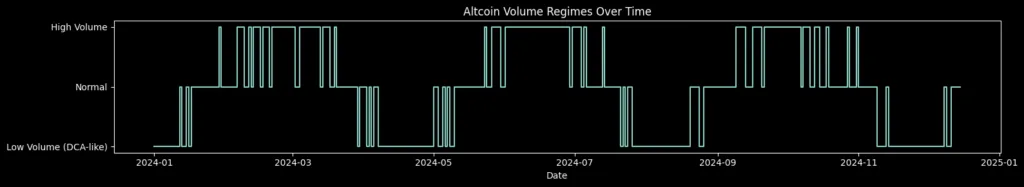

A distinct cyclical pattern can be seen in the time-series chart. Since early 2023, there have been successive declines in trading volume, indicated by wide red arcs, amid the transitional stages between market expansion and consolidation. Every contraction has been preceded by a period of high speculative intensity, indicating that structural reversion to mean liquidity is not a deviation but rather a regular element of the market.

A multi-month spike in cryptocurrency activity in the first half of 2025 preceded the current downturn. The market returned to a lower-liquidity environment as speculative momentum subsided and volatility stabilized. In this multi-year context, the decrease is not unusual; rather, it is a regular stage of the cryptocurrency liquidity cycle.

Stablecoin liquidity as a leading indicator

Since stablecoin-paired trading data shows cash-equivalent liquidity rather than BTC-linked rotation, it is a trustworthy stand-in for actual capital movement into altcoins. Both short-term and long-term volume patterns in the current dataset exhibit quantifiable decline. The decrease in transaction density indicates that both institutional and retail players have reduced their activity at the same time.

The chart’s historical analogs demonstrate that comparable low-volume circumstances were associated with passive accumulation behavior. The data shows persistent buy-wall formations during previous volume troughs, indicating intentional position-building by investors seeking to minimize execution slippage. These circumstances typically arise when sentiment is low and liquidity is scarce, favoring systematic dollar-cost averaging over momentum-driven tactics.

ETH price behavior and cross-asset liquidity transmission

Plotting the ETH/USD trend along the secondary axis provides a significant macro-structural signal. A wider decline in altcoin liquidity is correlated with ETH’s decline into the mid-$1,500 to $1,700 level. In the past, the altcoin complex’s risk-on behavior has been transmitted through ETH strength. On the other hand, cross-asset liquidity flows have generally been restrained during ETH standstill or retracement periods.

The market is still in a liquidity-light regime, according to the current ETH trend. Altcoin markets are expected to stay fundamentally restricted in the absence of a clear upward reversal in ETH that would reintroduce risk appetite. This supports the idea that the current environment is not directive but rather transitory.

Interpreting low volume through a cycle-theoretic lens

A more complex picture is presented by cycle-theoretic analysis, even though the drop in trading volume may seem bearish at first glance. Volume troughs have coincided with accumulation stages in preceding multi-year cycles, when long-term investors gave cost-basis optimization precedence over immediate profit. These investors typically work in low-volatility environments where structural order-flow imbalances rather than speculative demand are the primary drivers of price discovery.

This past behavior is the basis for CryptoQuant’s identification of the current environment as a ‘DCA zone.’ The phrase does not suggest that prices will rise in the near future. Rather, it refers to a structural arrangement where long-term accumulation has traditionally yielded positive forward returns over periods of several quarters.

Forward-looking considerations

A number of crucial factors will determine when the current low-liquidity regime ends. Stablecoin inflows would be a sign that shelved capital is returning to riskier assets. Any long-term increase in ETH’s price or dominance would improve the transfer of cross-asset liquidity and possibly bring back speculative rotation. Further evidence that institutional or systematic accumulators are re-establishing exposure would come from the obvious reappearance of sizable buy-wall clusters inside order books.

In previous cycle recoveries, each of these indications has been crucial. Whether the current DCA zone represents the beginning of a larger liquidity expansion or an extended period of consolidation will depend on how they behave in the upcoming months.

Instead of a fundamental collapse, the drop in cryptocurrency trading volumes below their annual average indicates a cyclical shift. Similar conditions have preceded accumulation eras that laid the groundwork for later market expansions, according to historical data. Market structure and liquidity signals indicate that the current low-volume regime is more compatible with reset dynamics than with systemic weakness, even though the timing and scope of any future recovery are yet unknown.