The new crypto threat landscape

Crypto has developed into a worldwide financial system after starting as a retail experiment. Capital growth enables groups to execute their targeted exploitation activities. Ransomware groups use advanced treasury-level wallet systems for their operations. The sanctioned entities use address rotation by implementing multiple address locations. Exploit drain wallets divide their funds into separate cryptocurrency networks.

The innocent counterparties become contaminated because of mixer exposure that spreads through their systems. The modern blockchain system provides transparency but complete transparency does not ensure system security. The raw on-chain data becomes indistinguishable from background noise without human interpretation. The new systemic risk is not hidden activity. The unrecognized exposure which exists today. The ChainWatch Risk Shield™ system provides protection for the current era.

What chainwatch risk shield™ is

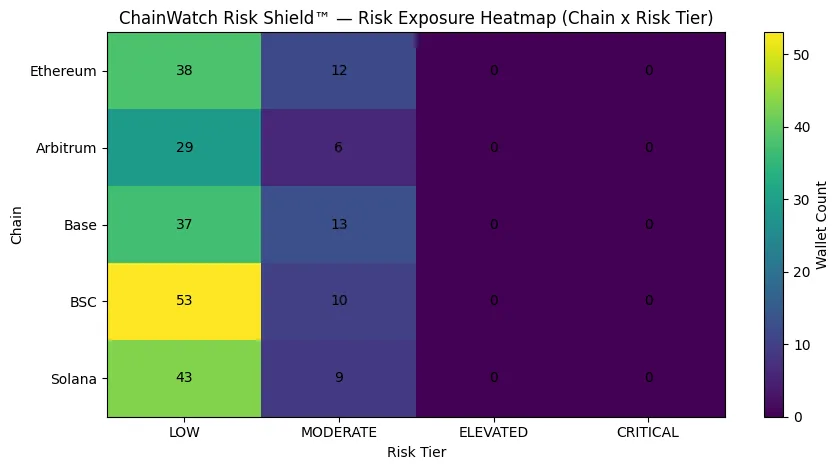

The security system of ChainWatch monitors active cryptocurrency wallets to assess risk before any value transfer occurs. The system uses active user behavior monitoring together with cluster analysis and anomaly detection and sanction proximity analysis to create dynamic risk profiles from wallet addresses.

ChainWatch uses active chain monitoring to update exposure risk calculations instead of depending on fixed blacklists. Every wallet transaction generates an immediate Risk Score™ which shows all direct and indirect links to:Sanctioned entities

Ransomware clusters

Exploit drain addresses

Wash trading rings

Dark-market payment hubs

Mixer propagation chains

Coercive funding networksThe score exists beyond two possible outcomes. It exists as a dynamic system which changes based on different conditions.

How the risk score™ works

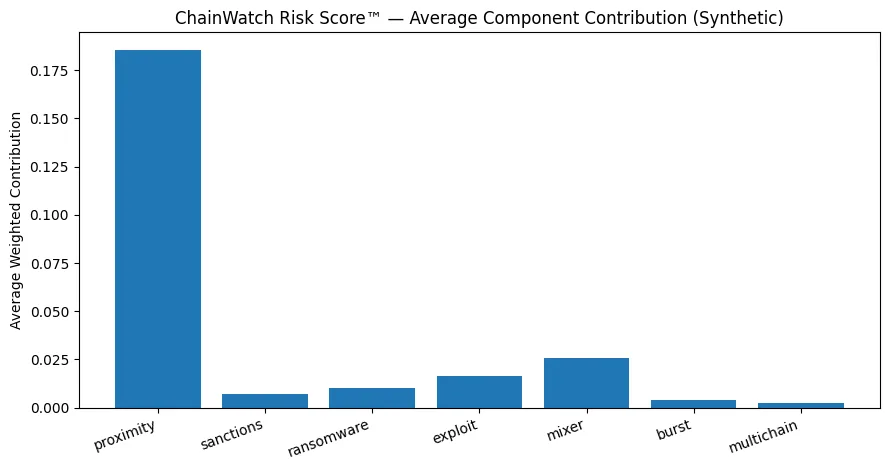

The evaluation process for wallets involves multiple assessment layers which establish their total worth. The model uses multiple factors including transaction graph depth and clustering confidence and flow velocity anomalies and synchronized activity bursts and abnormal bridge routing and interaction density with previously flagged clusters.

The Risk Score™ combines:Behavioral deviation from baseline wallet activity Graph proximity to confirmed illicit clusters Transaction burst timing correlations Bridge and mixer contamination layers Exchange freeze history signals Known exploit pattern signaturesThe system produces an outgoing risk assessment which continuously changes between four different levels of risk.

Users receive notifications which they must acknowledge before completing their deposit and withdrawal transactions. Institutions are provided with risk dashboards which include exportable audit logs.Organizations require immediate access to information during times of compliance uncertainty because every second counts.

Real-time alert infrastructure

ChainWatch establishes direct embedding into exchanges and custody systems and DeFi front-ends and OTC desks and treasury dashboards and payment gateways. The system creates a security barrier which functions as a firewall to protect transactions from unauthorized access. The system needs to evaluate the counterparty address before the transaction gets signed.

The system notifies users about rising risk levels through instant alerts which show them both exposure pathways and chances of infection. Institutions can configure internal thresholds. Retail users get basic risk notifications. Compliance officers access detailed forensic maps together with complete historical exposure information. The system uses a modular API-based design which supports deployment across multiple blockchain networks.

Why this matters now

ChainWatch establishes direct embedding into exchanges and custody systems and DeFi front-ends and OTC desks and treasury dashboards and payment gateways. The system creates a security barrier which functions as a firewall to protect transactions from unauthorized access. The system needs to evaluate the counterparty address before the transaction gets signed. The system notifies users about rising risk levels through instant alerts which show them both exposure pathways and chances of infection. Institutions can configure internal thresholds. Retail users get basic risk notifications. Compliance officers access detailed forensic maps together with complete historical exposure information. The system uses a modular API-based design which supports deployment across multiple blockchain networks.

Institutional use cases

The first time ChainWatch was developed as a solution to help businesses handle their regulatory requirements while it performed asset screening functions. The system helps custodians develop better compliance procedures for their operations. The system helps DeFi protocols stop repeated security breaches from occurring. The system helps OTC desks reduce their risk of receiving contaminated liquidity. The system protects capital assets for treasury managers.

The API layer establishes automatic risk monitoring capabilities that track treasury wallet activities and validator operations and staking flows and cross-chain bridge transactions. The system provides security functions that protect financial assets through its active operational capabilities.

The strategic edge

The cryptocurrency market has reached its current stage which experts describe as its maturity period. The process of institutional investment requires organizations to provide complete information about their operational hazards. Before starting a partnership process capital allocators need to assess the risks associated with their potential business partners.ChainWatch Risk Shield™ transforms blockchain data into intelligence which organizations can use for decision-making purposes. It uses wallet addresses as instruments which enable organizations to establish and assess their potential risks. The system converts unprocessed transaction data into security systems which protect networks from threats. The upcoming period of cryptocurrency development will provide benefits to individuals who recognize that alpha involves more than just yield.

Alpha measures the differences between potential risks and actual results. The system enables all users to access its complete transaction record which creates an advantage for those who can comprehend the data beforehand.ChainWatch provides more than just data analysis services. The system serves as a security framework which protects the digital asset market.