The market thinks this is about price. it isn’t.

The cryptocurrency market experienced an upward movement during this month But it reached its first regulatory milestone. While traders were watching candles and debating resistance levels lawmakers approved a $30 billion legislative framework which will change the entire financial system for digital asset treatment. The document lacks existence as a crypto bill. The document received no social media promotion. The event did not include any festive displays.

The event achieved a result of higher significance than all other events. The event established official links between cryptocurrency systems and national financial systems. The first signal of the market breakout pattern does not have greater importance. The entire system undergoes transformation after governments recognize cryptocurrency as a permanent financial system. The current situation does not involve cryptocurrency adoption. The current situation requires recognition.

From speculative asset to settlement layer

Through the majority of its existence, virtual currencies existed in a state that lacked clear legal boundaries. Digital assets existed as tradable assets. People could consider them as investment assets. The assets gained recognition at certain times. The assets were never essential for maintaining operation of the entire system. The new framework establishes complete operational procedures for organizations.

The law provides blockchain-based payment systems and tokenized assets and regulated custody systems with more than 30 billion dollars through funding and guarantees and operational support. The document establishes regulations which organizations must follow to maintain stablecoin operations. The document establishes regulations which organizations must follow to maintain stablecoin operations. The document establishes custody requirements which organizations must follow to maintain custody operations. The system enables financial institutions to conduct transactions with digital currency networks without facing legal uncertainties. The system enables digital currencies to function within the existing banking framework. People use digital currencies as a financial system which runs parallel to traditional banking methods.

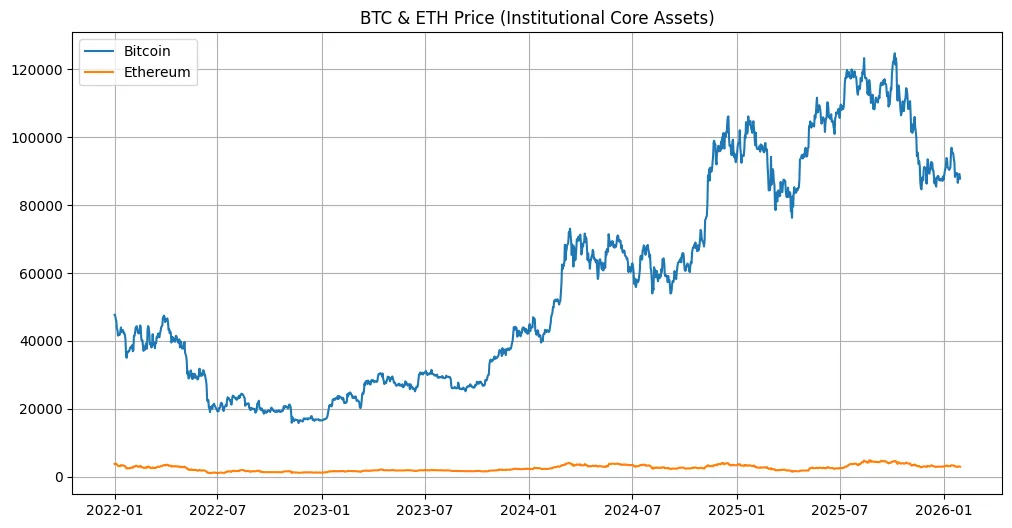

The current time period represents an important historical turning point. The legal framework which allows assets to conduct value transactions and maintain reserves and connect with government systems transforms them from temporary testing projects into permanent financial instruments. The assets transform into fundamental building blocks of the financial system. Bitcoin has evolved into more than a digital asset that functions as a value store. Ethereum now extends beyond its role as a platform for executing smart contracts. The systems are being transformed into essential parts of formal monetary infrastructure which operates under government regulations.

Why thirty Billion matters more than any ETF flow

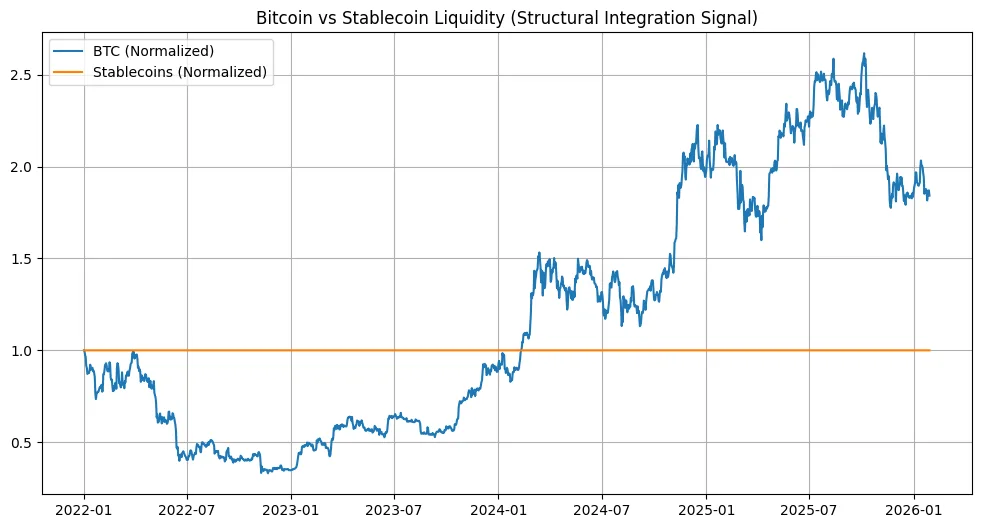

The financial markets demonstrate an excessive fascination with tracking exchange-traded fund inflows together with monitoring daily trading volumes and assessing market liquidity through major news events. Sovereign capital operates through different mechanisms. The current allocation intends to establish infrastructure instead of purchasing cryptocurrency coins. Custody providers are receiving financial support. Blockchain technology is being used to establish settlement systems. Financial institutions are adopting tokenized financial instruments. The legal framework establishes stablecoin issuance requirements and reserve guidelines.

The existing system provides available funds for structural operations. The operational functions of structural liquidity differ completely from those of speculative capital. Speculative money moves toward financial instruments that show rising value. Structural money creates essential systems that support sustainable growth. The movement of capital becomes difficult after foundations have been established. The system becomes entrenched. The legislation carries greater significance than any temporary market upswing. The legislation establishes a permanent connection between cryptocurrency and regulated financial systems.

The quiet death of the Crypto versus TradFi narrative

For years crypto marketed itself as an alternative to banks. The previous narrative has now become outdated. The legislation establishes new financial rules which include cryptocurrency regulations as part of its framework. The law incorporates cryptocurrency into its existing framework. Banks have received approval to handle digital currency storage. Payment networks now have permission to conduct transactions through blockchain technology.

Stablecoins now receive official recognition as financial instruments. Digital asset treasury bonds are now recognized as valid bankable assets. The process does not create disruption instead it establishes new systems. The current system will not face destruction through cryptocurrency developments. The technology is being implemented as part of the existing system. The market has transitioned from its unregulated period into its phase of institutionalized control. Market fluctuations will continue to exist. Speculative activities will not decrease. The fundamental system has established its new permanent state.

Why most traders completely missed this

For years crypto marketed itself as an alternative to banks. The previous narrative has now become outdated. The legislation establishes new financial rules which include cryptocurrency regulations as part of its framework. The law incorporates cryptocurrency into its existing framework. Banks have received approval to handle digital currency storage. Payment networks now have permission to conduct transactions through blockchain technology.

Stablecoins now receive official recognition as financial instruments. Digital asset treasury bonds are now recognized as valid bankable assets. The process does not create disruption instead it establishes new systems. The current system will not face destruction through cryptocurrency developments. The technology is being implemented as part of the existing system. The market has transitioned from its unregulated period into its phase of institutionalized control. Market fluctuations will continue to exist. Speculative activities will not decrease. The fundamental system has established its new permanent state.

What legal tender really means in this context

The present day shows that cryptocurrencies will not replace traditional money systems which exist today but they have achieved official status as part of established financial systems. Regulated institutions now have permission to hold digital assets which they can use to complete real-world transactions and create tokenized financial products and connect with payment systems and use as authorized collateral.

Price value becomes unimportant after that event. The asset reached legitimate status. Your activities now involve authenticated market behavior which drives the development of monetary systems.