Bitcoin (BTC) compression at lower highs

Market overview

After fluctuating between USD 85,381 and USD 92,318 over the day, Bitcoin begins the Friday session close to USD 85,572. The tape is tense but orderly: bids are still defending the mid-USD 80,000s, liquidity is thick around round numbers, and every push over USD 90,000 has been sold back into. The similar “calm surface, latent torque” pattern has been observed throughout the quarter, but traders are waiting for confirmation before following the trend.

Technical structure

Below a hard shelf at USD 92,000 USD 93,000, the chart is printing a series of lower highs. The short-term decline would be neutralized by a daily closure above that zone, reopening at USD 95,000, then USD 98,000 USD 100,000. The working line of defense on the downside is USD 85,000; if it is lost on a closing basis, the price probably checks USD 83,500, with a deeper magnet close to USD 80,000, where the 2025 value area thickens. The MACD histogram is flat around zero, the daily RSI is in the mid-40s, and candles have extended lower wicks classic absorption inside a coil all of which indicate that momentum is compressed rather than broken. Range continuance is the least difficult course of action until the balance is resolved by a definitive daily print.

Derivatives & positioning

In periods like this, funding is usually small, and when the spot stabilizes, the skew leans significantly call-side. This configuration can swiftly flip if USD 92,000–USD 93,000 gives way. Near inflection levels, dealer gamma is frequently weak; any push through resistance tends to quicken as hedges pursue. Under USD 85,000, the opposite is also true. Patience is rewarded by the setup: defined-risk expressions into the break, as opposed to anticipatory leverage, maintain the advantage.

On-chain & macro

Exchange balances drifting lower and long-holder supply rising are consistent with the steady bids seen around USD 85,000, while a softer dollar and calmer equity volatility keep the macro backdrop supportive without being euphoric. If global yields bleed lower into month-end, BTC typically responds with beta outperformance; if they back up, range trade persists. The next big candle is likely to be decisive rather than incremental.

Outlook

Acceptance beyond USD 93,000 makes room for USD 95,000 → USD 98,000–USD 100,000. A closing below USD 85,000 gives selling dominance in the direction of USD 83,500 → USD 80,000. Expect liquidity to recycle between USD 85,000 and USD 92,000 with a small upward bias on benign macro until either boundary breaches.

Ethereum (ETH) the apex below USD 2,900

Market overview

With an intraday range of USD 2,782 to USD 3,040, Ethereum is trading at about USD 2,794 into Friday. While declines toward USD 2,750–USD 2,780 find rapid absorption, prices continue to respect a well-telegraphed lid into USD 2,900–USD 3,000. ETH continues to be the market’s “productive beta,” responding more quickly than BTC but being more susceptible to fatigue in the vicinity of resistance.

Technical structure

The battleground in the near future is between USD 2,840 and USD 2,900. August supply initially surfaced at USD 3,050–USD 3,120 after a daily closing above USD 2,900 reopens USD 3,000. Support stacks at $2,750, followed by $2,700–$2,620. Beneath a level ceiling, the structure is a traditional compression triangle with static resistance above and higher lows since late October. Short MAs have curled below price, indicating that underlying demand is still present even as momentum slows at the round number. RSI is close to neutral-positive.

Derivatives & positioning

In this position, funding usually stays relatively stable, with protective puts piled at USD 2,700 and options interest clustering at USD 3,000–USD 3,200 calls. Short-gamma hedging, which can compress time to USD 3,050 faster than spot alone would predict, frequently helps push over USD 2,900. On the other hand, failure at the lid prevents rotating methods from working inside the band by providing support and fade resistance.

On-chain & macro

Fees are moderate components that stabilize ETH during periods of low volatility, staking maintains a significant portion of supply illiquid, and L2 throughput stays high. Similar to Bitcoin, macro is a two-sided story: stickier yields suggest for more coil, but easier financial circumstances favor a recapture of USD 2,900–USD 3,000.

Outlook

The market will probably check between USD 2,700 and USD 2,620 before reevaluating if a verified daily close over USD 2,900 targets USD 3,050 → USD 3,120; loss USD 2,750. Until then, ETH stays coiled, and if BTC stabilizes, the breakout potential is biased upward.

Solana (SOL) high-velocity coil near USD 135

Market overview

After printing USD 143.62 at the session high and USD 130.62 at the low, Solana is currently trading close to USD 131.24. The asset maintains its high beta reputation, but the order book appears more polished than in previous cycles: reactive two-way depth keeps the tape honest, and liquidity endures across time zones.

Technical structure

The final intraday cap is approximately USD 144, while the ceiling is placed at USD 135–140. USD 145–USD 150 are in play after a daily close above USD 140, with USD 155 following on momentum extension. Support starts at USD 128–129, followed by USD 125 and USD 120. Since early November, price movement has resembled a rising-lows squeeze beneath a flat top; this geometry stores energy. The candles exhibit recurrent lower-wick absorption into USD 130–USD 131, while the RSI is in the mid-50s, close enough to extend without tripping overbought signs.

Derivatives & positioning

In SOL, funding often has a slight long bias, but this quarter, leverage has been much less careless. Around USD 140/150 calls, options flow clusters; a clean break frequently necessitates dealer hedging, which speeds up the transition to the following figure. Expect a reset into USD 125–USD 129, where dip buyers have been waiting, if the asset fails once again at USD 140.

On-chain & macro

The drop bids are nonetheless anchored by throughput and app usage: a base of actual users beneath the speculative layer is created by high transaction counts, strong DeFi settlement, and consistent NFT traffic. SOL’s growth-equity profile is favored by pro-risk macro; a fluctuation in rates or stock volatility would only lengthen the coil rather than shatter the network’s core bid.

Outlook

Acceptance of more than USD 140 unlocks USD 145–150, followed by USD 155. If you lose USD 128 on a close, the price will probably check between USD 125 and USD 120. The market will continue to buy the floor and fade the lid until the issue is resolved, with a slight upside tilt assuming BTC/ETH maintain steady.

XRP round-number gravity at USD 2.00

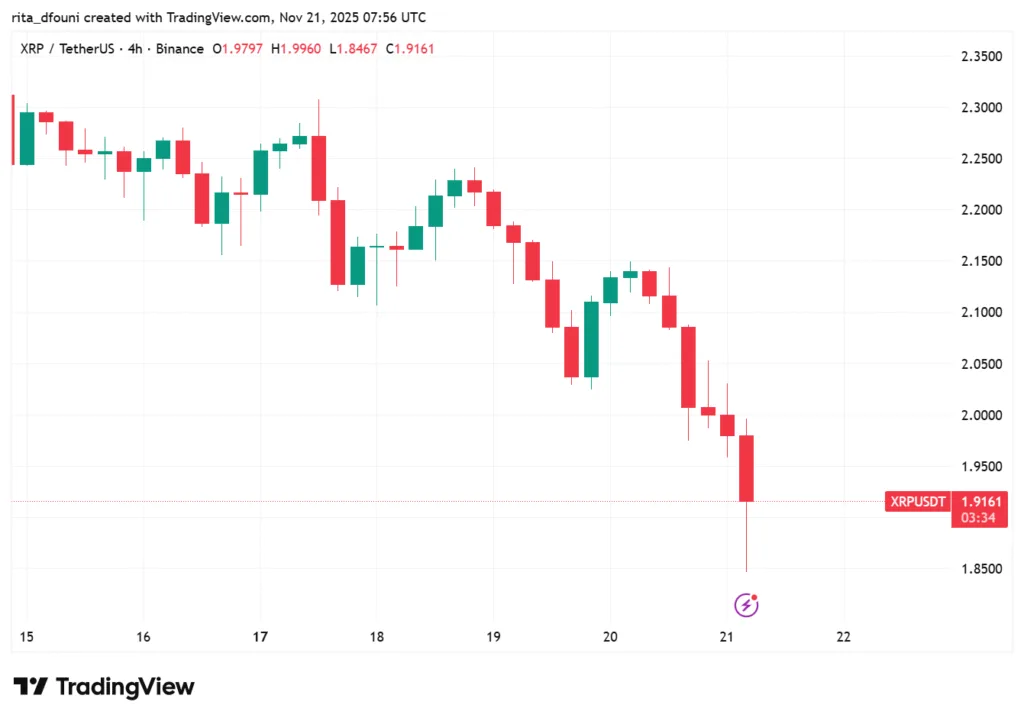

Market overview

With USD 1.96 at the intraday low and USD 2.14 at the high, XRP is trading in a narrow range around USD 1.97. The round number at USD 2.00 continues to function as a hinge and magnet: offers rebuild just above, bids refill just below. The outcome is a calm coil that values perseverance over bluster.

Technical structure

A daily close over USD 2.12 should invite USD 2.20–USD 2.28, with a bigger shelf between USD 2.30–USD 2.35 where previous rallies stalled. The immediate barrier is USD 2.05–USD 2.12. Support layers at USD 1.92–1.96, followed by USD 1.88–1.90. The RSI is in the mid-50s, and the MACD is flattening traditional late-stage compression, indicating a balanced set of indicators. Instead of saying “front-run the move,” the structure states “wait for the candle.”

Derivatives & positioning

With options interest building in USD 2.10–USD 2.30 calls and USD 1.85–USD 1.95 puts, perp funding in XRP typically hovers around flat throughout this regime. As hedges adjust, a clean print through USD 2.12 may see rapid temporal compression to USD 2.20; rejection merely expands the box around the USD 2.00 axis.

Fundamentals & macro

Settlement-rail narratives keep long-horizon bids sticky, especially when volatility drops elsewhere. Macro calm supports the idea of incremental appreciation once resistance yields; a macro hiccup likely pins price around USD 2.00 rather than forcing trend capitulation.

Outlook

The path opens to USD 2.20–USD 2.28, then USD 2.30–USD 2.35, after clearing USD 2.12 on a daily close. The market undergoes a stress test between USD 1.88 and USD 1.90 after losing USD 1.92. Until then, the range behavior around the round-number hinge should be disciplined.

Cardano (ADA) controlled base-building

Market overview

Following an intraday high of USD 0.4704 and a low of USD 0.4203, Cardano is traded at USD 0.4217. The coin’s personality remains the same: patient involvement, firm structure, and no drama. While rallies toward the mid-USD 0.40s meet measured supply, bids continue to emerge in the low-USD 0.40s.

Technical structure

The operating range is between USD 0.40 and USD 0.46. A consistent closing above USD 0.46–USD 0.47 reverses the trend and sets USD 0.50, followed by USD 0.52–USD 0.54. USD 0.39–USD 0.40 is the first defense, followed by USD 0.37–USD 0.38, if support falters. Momentum is muted but not negative: Bollinger width is squeezed, short MAs are flat, and RSI stays close to 50 conditions that never persist. The playbook is simple: commit on confirmation outside the band, fade extremes inside.

Derivatives & positioning

When the ADA contracts, funding usually approaches zero, and once a signal prints, open interest growth remains moderate and healthy circumstances for durability. In breakout attempts, options skew usually leans significantly call-side; dealer hedging may intensify the first leg if USD 0.47 clears.

On-chain & macro

ADA’s floor is more resilient than its headline volatility suggests thanks to high staking participation, muted exchange balances, and consistent developer cadence. Yield-bearing L1s are favored by macro normalization as diversifiers; once rotation broadens, ADA typically participates later than SOL/ETH but with clearer follow-through.

Outlook

USD 0.50 → USD 0.52–USD 0.54 is indicated by a value over USD 0.47. A test is given to USD 0.38–USD 0.39 below USD 0.40. Expect controlled base-building until the issue is resolved, with an eventual expansion upon significant confirmation.