Bitcoin (BTC) compression deepens as momentum waits for signal

Market overview

On Monday, November 24, 2025, Bitcoin starts trading around USD 84,900, moving within a confined intraday high of USD 86,120 and a low of USD 83,740. The USD 83,000–USD 88,000 range is the most obvious indicator of the market’s further narrowing. Liquidity has remained dense at both ends of this range during the last few days. Every time Bitcoin approaches the top of the structure, sellers consistently reemerge, while buyers continue to absorb losses toward the mid-USD 83,000s.

The candles’ characteristics shorter bodies, less directional impulses, and symmetrical wicks on several timeframes stand out the most. This indicates that the market is in equilibrium and that neither side is sufficiently committed to drive a breakout. Bitcoin maintains market domination above 54% despite the calm tape, suggesting that capital is still fixed in BTC while traders await a clear signal. Order-book depth shows no evidence of concern, and market-making activity is still orderly. Rather, a general readiness to allow the market to contract until fresh information forces it to expand is reflected in the sideways movement.

Macro conditions do not change. Bond yields are moving sideways, global equity indices are marginally up, and volatility indexes are still muted. A neutral-positive environment is being created by the lack of shock, allowing Bitcoin to sustain structural support while waiting for a directional catalyst. Whether this compression resolves upward or downward will probably be decided over the next week.

Technical structure

The technical environment is still tightly wound. Between USD 87,800 and USD 88,500, Bitcoin is still pushing into a flat resistance zone that has rejected all attempts at recovery since the middle of the month. The short-term bearish structure would be neutralized by a consistent daily close above this area, creating a clear path toward USD 90,000, USD 92,000, and possibly USD 95,000 if momentum increases.

On the downside, support is still firmly held between USD 83,500 and USD 84,000, where extended lower wicks have repeatedly shown up over the previous few sessions. The bias would move toward a deeper test of USD 81,500, where the late-summer value area is located, if it broke below this support level. The next big draw is the round number at USD 80,000 if the price drops below that threshold.

The concept of compression, as opposed to breakdown, is supported by momentum indicators. While MACD oscillates about zero with decreasing amplitude, RSI stays around the mid-40s, showing neither vigor nor weariness. Bollinger Bands are currently at their narrowest point in over three weeks, a state that typically precedes the kind of expansion move that determines weekly direction. From a structural standpoint, Bitcoin is accumulating stored energy; the final resolution tends to be stronger the longer the compression persists.

Derivatives and positioning

Instead of reflecting speculation, derivative flows still show balance. There is no aggressive long or short positioning, and funding rates are close to neutral. Due to the constant and uniform distribution of open interest across key exchanges, excessive leverage will not skew the ultimate breakout or breakdown. Call demand in options markets is concentrated between USD 90,000 and USD 92,000, indicating expectations of a potential upward rise if resistance breaks. In the meanwhile, place interest clusters between USD 82,000 and USD 83,000 to provide protection in the event of a decline.

The compression shown on the spot chart is echoed by implied volatility, which is near the lower end of its recent range. Any significant push through this area could result in faster activity as hedging changes are forced into the market because dealers have little gamma around USD 86,000. Derivatives positioning may intensify the increase if Bitcoin recovers USD 88,000. On the other hand, volatility would probably decrease at a comparable rate if USD 83,500 failed.

On-chain and macro alignment

The price’s stability is supported by on-chain measures. Exchange reserves are still declining, which may indicate less sell-side pressure from liquid balances. Despite the absence of impetus, long-term holders continue to exhibit excellent accumulation tendencies. The distribution of miners is normal and there are no indications of distress.

The macroenvironment is stable and encouraging. Bond yields do not exhibit any disruptive movement, the dollar index trades without significant volatility, and equities mood is quiet. While traders wait for a catalyst, these neutral-positive conditions assist Bitcoin in maintaining its structure. The current context favors a breakout once an order-flow imbalance appears, as Bitcoin frequently responds to macro settling with directional expansion.

Outlook

Bitcoin is still trapped in a clearly defined compression phase. Whether the price can cross its upper or lower border will determine the next significant action. The route to USD 90,000, USD 92,000, and USD 95,000 becomes clear if Bitcoin closes above USD 88,000. A retest of USD 81,500 is likely if it closes below USD 83,500, and the psychological USD 80,000 barrier would be relevant. The most likely scenario is prolonged sideways movement until either edge breaks, with volatility gradually tightening as liquidity increases for the subsequent expansion move.

Ethereum (ETH) holding the mid-range while pressure builds beneath USD 2,900

Market overview

After an intraday top of about USD 2,812 and a low of about USD 2,728, Ethereum opens the session on November 24, 2025, trading at USD 2,765. Beneath the well-known USD 2,880–USD 2,900 ceiling, the structure is still dominated by a multi-week standstill. ETH is still the market’s stabilizing power, although it has less momentum than Solana, is more stable than meme-driven assets, and reacts more quickly than Bitcoin during intraday liquidity swings. Because of this placement, Ethereum has maintained a stable mid-range posture with seemingly regulated rather than chaotic volatility.

The underlying bid profile is still strong even in the absence of a breakout. Liquidity maps indicate clustering at these levels, and dips into the USD 2,730–USD 2,750 range continue to draw instant absorption. Order-book symmetry indicates that the market is in a disciplined pause mode rather than a state of anxiety. Despite being well aware of the technical, psychological, and liquidity significance of the USD 2,900 ceiling, traders continue to concentrate on it. The asset is waiting rather than failing or trending.

This equilibrium is enhanced by macro circumstances. Since there have not been any outside shocks, ETH has been able to quietly establish structure as volatility indexes for bonds and stocks have been oscillating at low ranges. When the larger risk cycle changes, both assets are likely to move in tandem as Ethereum tightens in tandem with Bitcoin’s compression at its own resistance zone.

Technical structure

Technically, a consistent tightening below the USD 2,880–USD 2,900 resistance range characterizes Ethereum’s chart. Since early November, this area has refused numerous attempts, creating a flat and respectable roof. A daily close above it would end the multiweek deadlock and pave the way for a retest of USD 3,000, which would be followed by levels with historical supply significance at USD 3,050–USD 3,120.

Every time the price tests this range, wick-driven absorption consistently reinforces support at USD 2,740–USD 2,760. The market would probably go into the larger demand cluster of USD 2,680–USD 2,700, where previously traded volume is densest, if this area fails. Since the significant October reversal, the area below USD 2,700 has not been touched, making it a significant downside checkpoint in the event that weakness materializes.

The neutrality of the present price action is shown by momentum indicators. RSI stays in the middle of the range, neither extended nor under pressure. The absence of a strong impulse in either direction is confirmed by MACD’s fluctuations around a shallow baseline. Similar to BTC, ETH is approaching the latter phases of compression, as evidenced by the shrinking of volatility bands. In the past, this kind of framework ends with an expansion candle that establishes the course for multiple sessions.

Derivatives and positioning

The quiet observed in the spot is mirrored by derivative flows. There is no sign of an imbalance between longs and shorts because funding rates tend to be close to neutral. The disciplined behavior of open interest suggests that traders are getting ready to respond rather than forecast, since it neither rises sharply nor unwinds in a panic. Clearer hints can be found in options posture: protective put strategy creates a defensive layer around USD 2,700, while call interest continues to cluster between USD 3,000 and USD 3,200.

The volatility curve is still squeezed. The market’s comfort level within the current structure is reflected in implied volatility, which is at the lower end of its monthly range. Dealers have moderate gamma exposure in the vicinity of USD 2,800, therefore hedging activity will probably accelerate rather than delay movement once ETH breaks out of the range. Therefore, a clean break under USD 2,740 might cause a short decline into the USD 2,680 pocket, while a breakout through USD 2,900 could cause a quick surge toward USD 3,050.

On-chain and ecosystem dynamics

On-chain indications do not change. Long-term sideways periods are naturally supported by the quantity of ETH locked by staking, which continues to constrain the liquid supply. Even when the Layer-1 pricing stops, L2 networks maintain continuously high throughput, keeping the larger Ethereum ecosystem operational. Gas prices are still reasonable, which promotes consistent contract execution and user activity.

A minor but positive sign of less short-term selling pressure is the slight outflow bias in exchange flows. The ecosystem’s developer participation is showing no signs of slowing down, indicating that the network’s value is increasing despite price stagnation. In order to maintain on-chain fundamentals consistent with the larger narrative of Ethereum as the settlement backbone of the cryptocurrency economy, NFT activity and DeFi volume remain constant rather than booming.

Macro alignment

Ethereum still exhibits characteristics of a mid-beta macro asset. It can function as a bridge between defensive and aggressive risk postures since it responds to changes in global risk more quickly than most altcoins but more slowly than Bitcoin. A sideways-moving dollar and stability in global yields have helped ETH maintain its structure. ETH would probably follow Bitcoin’s example in regaining the USD 2,900 range if macro conditions became riskier. Instead of breaking sharply lower, ETH is likely to drift back around the USD 2,700 demand region if the macro tightens.

Outlook

The capacity of Ethereum to recover or reject the USD 2,900 resistance will determine its near destiny. The path to USD 3,000, then USD 3,050–USD 3,120, where a more robust supply is anticipated, is made possible by a persistent closure above this level. The market moves near USD 2,700 if it closes below USD 2,740; deeper declines are only likely if overall risk sentiment declines. As compression approaches exhaustion, Ethereum stays trapped in a neutral, tightening structure that is steady, balanced, and ready for a decisive move until either boundary breaks.

Solana (SOL) rising lows, flat ceiling: A market waiting for release

Market overview

After hitting an intraday high at USD 134.20 and a low just above USD 127.40, Solana starts the 24 November 2025 session trading around USD 129.80. Solana’s distinctive characteristics high engagement liquidity, abrupt intraday rotations, and significant participation from both retail and systematic flows remain evident in the market. However, the system has taken on a definite organized shape beneath the surface cacophony. For almost two weeks, SOL has been continually pushing into the well-known resistance band between USD 135 and USD 140 while creating a string of higher lows.

Despite the asset’s propensity for volatility, the recent few sessions have demonstrated an atypical degree of moderation. Dips almost immediately find buyers again, particularly when wick extensions are between USD 127 and USD 128. When Solana finds enough power to break the ceiling that has contained every advance since early November, liquidity maps reveal weaker resistance above USD 140 and thicker support pockets beneath that zone, indicating that market participants expect the larger upswing to continue. Instead of feeling worn out, the atmosphere surrounding SOL feels coiled prepared, serene, and building pressure with each unsuccessful breakdown.

The macro environment has contributed. Solana has room to sustain its rising microstructure due to a steady risk environment, a neutral U.S. currency, and flattening volatility indicators. Even when market activity slows, the asset’s growing reputation as a high-performance settlement layer encourages calm confidence.

Technical structure

In terms of cleanliness, Solana’s chart is one of the best available. Persistent demand is shown by the rising sequence of higher lows, with each trough emerging marginally above the one before it. At USD 135–140, these increasing lows converge toward a nearly horizontal lid, forming an unmistakable ascending-triangle formation. Once the ceiling breaks, this pattern is noted for continuing upward.

A daily close over USD 140 would significantly tip the scales in favor of USD 145, USD 150, and finally the larger momentum goal at USD 155. Once momentum is confirmed, Solana’s price usually moves quickly, therefore directional strength is likely to be present in the first breakout candle.

Support is still well delineated on the downside. As Solana’s short-term value area, the USD 127–USD 129 range keeps catching dips with accuracy. Deeper support is waiting at USD 125 below that, and the larger structure would only be in danger if that level was decisively lost. The tightening coil is supported by momentum indicators: MACD spirals upward but has not yet issued a full bullish crossover, and RSI is centered in the mid-50s, indicating sufficient energy for growth. Solana is merely halted by opposition; it is not weak.

Derivatives and positioning

In recent months, the behavior of derivatives has changed into a more mature pattern. Although the premium is minor and reflects disciplined bullishness rather than irresponsible leverage, funding rates are marginally over neutral. There is directional certainty without the instability of overwhelming leverage, as evidenced by the steady but non-aggressive increase in open interest.

Additional clarification is provided by options data. The technical breakout zone is nearly precisely matched by the highest concentration of call positioning, which is located between USD 140 and USD 150. Due to the low gamma exposure of market makers in this area, dealers might be compelled to hedge into a move if the spot starts to rise through USD 138–140, which would accelerate the upward momentum. This pattern is typical of Solana cycles, when breakout candles frequently move more quickly than anticipated because to hedging flows rather than just organic demand.

The structure supports a recovery toward USD 127–USD 129, where liquidity has continuously rebuilt, if price rejects the ceiling once more. The derivatives posture indicates confidence rather than frenzy, and there is no indication of destabilizing leverage.

On-chain activity and ecosystem signals

Solana’s on-chain ecosystem continues to reinforce the resilience seen in price. Transaction throughput remains extremely high, with sustained activity in DeFi, liquid staking, and consumer applications. DeFi volumes have stabilized at elevated levels, and new protocol launches continue to attract users in a way competitors struggle to match. NFT activity is not exuberant, but it remains steady, maintaining Solana’s foothold as a multi-dimensional ecosystem rather than a single-sector chain.

A healthy baseline of actual user activity is supported by network fees, which are consistently modest. These elements, along with increased network stability and strong validator engagement, provide Solana with an operational advantage during market stagnation. The ecosystem depends on throughput, which seldom lies, rather than hype. The consistent higher lows on the chart roughly correspond with the steady throughput readings.

Macro positioning

Although Solana’s macro sensitivity is slightly higher than Ethereum’s, it is more stable than smaller cryptocurrencies. Since the focus switches to high-performance L1s with high user activity when volatility drops and liquidity conditions stabilize, SOL has generally profited from a calm global environment. The past week has aptly mirrored this situation. Since yields do not show any disruptive surges and stock risk sentiment is still balanced, Solana has been able to maintain upward pressure beneath its resistance band without exhaustion.

Solana is in a strong position to spearhead the next stage of cryptocurrency rotation if macro conditions shift in favor of risk. The asset probably returns to its clearly defined support zones but maintains its overall structural strength if the macro declines.

Investor psychology

Though confident, the mood surrounding Solana is hardly exuberant. Professional traders continue to clearly appreciate the asset’s liquidity and volatility profile, while retail interest is still mild, showing less speculative excess. There is a general anticipation that Solana’s structure would resolve upward if market-wide momentum resumes, rather than a sense of complacency or anxiety.

A positive indicator is the lack of emotional extremes. In the past, Solana has done best when traders are skeptical of its strength rather than chasing its gains. This ideal situation is reflected in current mentality, which is characterized by cautious optimism, disciplined positioning, and a general conviction that Solana’s ecosystem continues to outperform its rivals in actual activity.

Outlook

The usual ceiling at USD 135–140 will determine Solana’s short-term course. A quick rise toward USD 145, then USD 150, and perhaps USD 155 if the breakout draws significant rotating flows, should be made possible by a daily closing above that area. If resistance cannot be overcome, the price simply returns to the USD 127–USD 129 accumulation zone, where buyers have continuously intervened, extending the ascending triangle formation.

Among the main altcoins, Solana has one of the strongest charts. An asset that is getting ready for growth is indicated by rising lows, steady liquidity, disciplined derivatives positioning, and ongoing on-chain activity. When the overall market picks up steam will determine whether that growth occurs this week or next.

XRP stability around USD 2.00 as market awaits confirmation

Market overview

After recording an intraday high at USD 2.05 and a low around USD 1.95, XRP starts the 24 November 2025 session trading close to USD 1.98. The asset is still circling the psychologically charged USD 2.00 level, which has served as a neutral anchor for almost two weeks. Every test below USD 1.96 has generated buying demand right away, while every attempt to reach USD 2.05–USD 2.12 has run into coordinated sellers. As a result, a remarkable equilibrium is created in which neither bearish pressure nor bullish aspiration has been powerful enough to determine structure.

The tone around XRP is still remarkably balanced. In contrast to high-beta assets like Solana, XRP’s price fluctuations show a combination of quiet confidence and caution rather than being drawn by speculative noise. Every venue has the same level of market depth, which provides continuous two-way liquidity. The market is just waiting for a significant change in flows; it is neither scared nor enthusiastic. For the time being, XRP acts as a stabilizer within a larger crypto environment that is characterized by compression.

This equilibrium is amplified by macro factors. XRP is in a favorable scenario where downside pressure is minimal and upside potential is solely dependent on behavior around its long-standing ceiling around USD 2.12, as major assets are coiling and global volatility is low. The message to investors is clear: since everyone is keeping an eye on the same level, the market is quiet.

Technical structure

Among the majors, XRP has one of the clearest equilibrium structures. The current range’s bottom boundary, which is between USD 1.92 and USD 1.96, is consistently guarded by buyers who confidently intervene whenever the price falls below USD 1.98. Four breakout efforts this month have been thwarted by the horizontal resistance band between USD 2.05 and USD 2.12, which serves as the upper boundary. Signs that momentum is building up beneath the surface include the range’s narrowness, stability, and rising compression.

Technically speaking, a daily closing above USD 2.12 is significant. It would reveal upside objectives at USD 2.20, followed by USD 2.28–USD 2.30, where previous rallies ran into supply, and indicate a breakout from the two-week coil. The history of XRP demonstrates that when such resistance breaks way, the follow-through candle frequently moves swiftly due to the combination of trapped shorts and new spot demand.

The market would only contemplate retesting the deeper value range around USD 1.88–USD 1.90 if the first test, which is around USD 1.92, fails in the event that negative volatility materializes. Momentum indicators do not show any signs of buildup or exhaustion; MACD is flat and RSI stays close to the mid-50s. As the range resolves, volatility bands continue to pinch inward, indicating the possibility of expansion.

Derivatives and positioning

Derivatives provide the same message as the chart: readiness and balance. Instead of speculative leverage wars, funding rates stay neutral, in line with trading profiles driven by ETFs. There is no excessive building that could skew the next directional move, and open interest in futures and perpetuals indicates a stable base. There are traders, but they are disciplined.

The true expectations of the market are revealed via options flows. Near-term call posture is most concentrated above USD 2.12, with strikes clustered around USD 2.20 and USD 2.30. For short-term protection, put interest is still small and localized, usually between USD 1.85 and USD 1.95. While realized volatility has decreased in line with a traditional pre-breakout shape, implied volatility is muted, mirroring the visual compression on the chart.

Any breakout over USD 2.12 could compel hedging activity that speeds up the move higher because dealer gamma exposure is low in the vicinity of USD 2.00. On the other hand, given the lack of aggressive leverage, a decline back toward USD 1.92 would momentarily increase volatility but is unlikely to start a destabilizing cascade. The derivatives landscape for XRP shows that the market is ready for movement rather than being distorted by it.

On-chain and ecosystem signals

Instead of growing mania, on-chain activity still shows steadiness. Steady throughput is demonstrated by the high yet constant transaction counts. Participation levels are neither falling nor rising, and active addresses maintain a steady basis. Reliability is highlighted by network health indicators: validator distribution is stable and settlement velocity is still high.

The valuation of XRP is subtly but steadily supported by liquidity corridors linked to institutional payment flows. These flows provide a stable basis of utility-driven demand that sustains the asset during periods of quiet trade, despite not being explosive. Large wallet movements indicate more consolidation than distribution, whereas exchange balances have stayed slightly net-negative over the past week, suggesting continued light accumulation.

Essentially, XRP has been mostly shielded from severe speculation due to its status as a settlement and liquidity-bridge asset. The chain is in a favorable position when the overall market is contracting since it is operational, active, and in line with its story.

Macro positioning

The sensitivity of XRP to macro factors has changed over time. XRP now reacts more judiciously, with stronger alignment to liquidity conditions, global payments narratives, and long-horizon capital flows, as opposed to formerly moving nearly in lockstep with Bitcoin’s extremes. The macro environment neither presses nor accelerates XRP because U.S. yields are stable and the dollar index lacks direction. Instead, it maintains a neutral backdrop that allows the structural dynamics of the chart to become the dominant driver.

Assets like XRP frequently go through prolonged coil episodes during times of macro quiet as traders await proof that capital will shift into assets with more stable use cases and lower volatility. The market seems to be doing precisely this right now.

Investor psychology

Disciplined patience and quiet confidence define the mood surrounding XRP. Knowing that the USD 2.12 level is the pivot at which emotion will swing, the community is still cautious but invested. Professional traders continue to handle XRP as a structured range asset, while retail activity is limited and shows no indications of spike-driven frenzy. There is cautious timing, faith in the story, and respect for the levels.

A sound basis is created by this psychological balance. Since the structure is sound and the range has been long enough for conviction to naturally rebuild, when a breakout ultimately happens, it will probably be welcomed rather than questioned.

Outlook

The way the market reacts to USD 2.12 will largely determine XRP’s trajectory for the rest of the week. The asset’s short-term profile is altered by a daily close over that mark, which opens up a clear route toward USD 2.20, USD 2.28, and USD 2.30. The consolidation between USD 1.92 and USD 2.12, which has been stable for almost fourteen days, is merely extended by a rejection. Deeper support between USD 1.88 and USD 1.90 becomes important if USD 1.92 fails, however there is not any structural weakness at the moment.

XRP is still in a controlled equilibrium. The market waits, expectations become more stringent, and compression takes over. The momentum for the rest of November will be determined by the next pivotal candle.

Cardano (ADA) quiet accumulation beneath a heavy ceiling

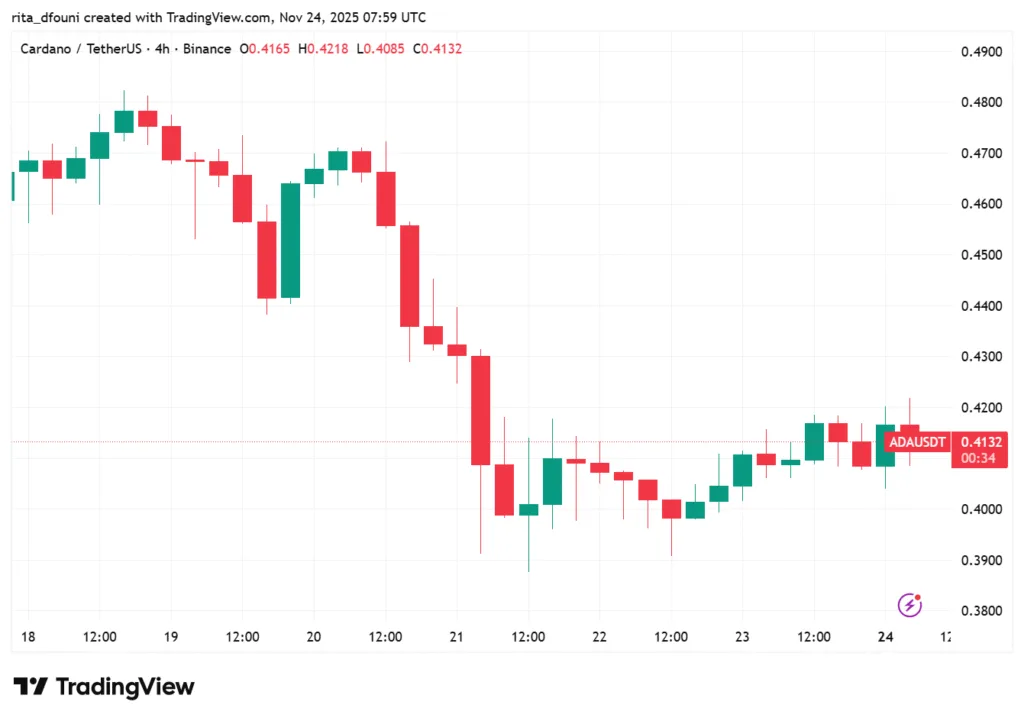

Market overview

After an intraday top of about USD 0.441 and a low of about USD 0.408, Cardano starts the 24 November 2025 session trading close to USD 0.422. The asset maintains its distinctive stability, avoiding both the longer volatility cycles that impact smaller-cap cryptocurrencies and the violent rotations observed in Solana. Rather, ADA continues to be anchored within a broad consolidation structure, steadily shifting between the USD 0.40–USD 0.46 zone that has characterized almost its whole November.

An environment of muted confidence has been created by this slow-moving behavior. Spreads are still tight, liquidity is consistent, and longer-horizon traders continue to steadily absorb falls below USD 0.42. The market is patiently constructing a narrative rather than hurrying toward one. ADA trades more like a structural asset than a speculative one in many respects. This is confirmed by exchange depth: sellers wait passively above rather than actively making offers, and purchasers reload at clearly defined levels. A token that is neither missed nor overhyped is suggested throughout the entire tape.

This tranquility is enhanced by macro stability. ADA is given a gradual, regulated environment to preserve its accumulation structure because volatility indicators are still restrained and general risk sentiment is stable. Cardano seems to be laying the groundwork for its next directional impulse rather than displaying any signs of stress in its current posture.

Technical structure

For ADA, the technological picture is extremely stable. Above USD 0.40, which has been the core of support since late October, the price is still forming a circular foundation. Strong wick rejections have been obtained in every test in this location, indicating a well-organized bid density. The other boundary, at USD 0.46, serves as the range’s ceiling, precisely capping each effort at a rally.

As a result, a wide yet well-organized conduit for consolidation is created. A significant change would be indicated by a daily close above USD 0.46, which would turn the range into a developing uptrend and reveal upside targets at USD 0.50, followed by USD 0.52–USD 0.54, which is in line with the distribution cluster for September. Although ADA has not yet developed the necessary momentum to challenge this ceiling, it is as noteworthy that it has refused to break down from the USD 0.42 region.

This neutrality is further supported by momentum indicators. RSI is close to the midline and does not indicate either weakness or enthusiasm. While volatility bands continue to tighten a signal that ADA is accumulating energy even though it is not yet visible on the surface, MACD’s gradual oscillation near zero reflects the range’s pattern. The graphic conveys preparation rather than excitement.

Derivatives and positioning

ADA’s reputation for structural calm is reflected in the derivatives landscape. The fact that funding rates are just over neutral suggests that neither longs nor shorts have taken control of leverage flows. The small but steady level of open interest indicates that traders are taking part without hurrying toward directional conviction. Liquidation clusters and unbalanced positioning situations, which frequently precede forced, excessive moves, are not evident.

A slight bullish skew towards late-month expiry is evident in options data. Call interest is concentrated around USD 0.50, with secondary positioning between USD 0.52 and USD 0.54. Put interest is low and generally protective, with a range of USD 0.38 to USD 0.40. It is clear that traders are not preparing for an impending shock because the IV surface is still soft and consistent with low realized volatility.

Since dealer gamma exposure is restricted across ADA’s key levels, an unnatural volatility spike is unlikely to occur in the market absent a real change in spot flow. This supports the idea that any breakthrough, particularly over USD 0.47, would be organic and driven more by genuine demand than by market-making forces.

On-chain and ecosystem dynamics

In contrast to short-term speculation, Cardano’s on-chain footprint is still growing at a rate that indicates long-term development. Active addresses do not change, preserving a baseline that indicates ongoing network activity. With a significant portion of the circulating supply locked and paying yield, staking participation is still quite high. This structural advantage gives ADA steady holder stability throughout market stagnation.

One of the ecosystem’s strengths is still developer activity. Infrastructure advancements in Hydra scalability and sidechain frameworks continue to progress, new smart contracts are being implemented at a consistent pace, and user-facing applications continue to gain moderate but steady traction. Because Cardano’s ecosystem grows incrementally and in layers rather than depending on hype cycles, it can withstand extended periods of consolidation without losing its core traction.

As more ADA is locked into staking or self-custody, exchange balances continue to decline. The claim that ADA is subtly gaining strength below the range ceiling is supported by this gradual but consistent supply reduction, which serves as a natural buffer against downside volatility.

Macro positioning

Cardano occupies a comparatively special macro position. It does neither follow the hyper-defensive pattern of settlement tokens, nor does it act like a high-beta asset that rises with speculative liquidity. Rather, ADA’s staking strategy, gradual issuance, and essentially developing ecosystem have created a medium ground. As a result, it is less sensitive to sudden changes in the perception of global risk.

An climate where accumulation periods have traditionally flourished is provided to ADA by a steady macro backdrop that softens yields, calms equities flows, and maintains a neutral dollar. ADA frequently becomes a later-stage player in the rotation, trailing BTC and SOL with more controlled, trend-driven momentum, should risk appetite spread throughout the crypto complex. ADA is more likely to stay in its tranquil consolidation rather than surrender or break out if macro conditions stagnate.

Investor psychology

Patience, conviction, and a lack of hype continue to shape the mentality behind ADA. Behavior is dominated by long-term holders, whose activities show consistent involvement as opposed to reactive trading. Retail sentiment is muted but not negative, which is a positive mix that lowers the possibility of panic-selling or exuberant buying.

Cardano’s storyline is not particularly showy right now, but that is precisely why its structure is so consistent. Instead of short-term triggers, investors see ADA as a slow-burning enterprise whose value will emerge through ecosystem maturity. This leads to a psychological foundation that favors accumulation over volatility.

Outlook

The way Cardano interacts with the USD 0.46–USD 0.47 resistance band will determine its immediate trajectory. The first structural change since early autumn would be indicated by a daily close above this area, which would encourage a rise toward USD 0.50, followed by USD 0.52–USD 0.54. If resistance is not broken, the price will continue to oscillate between USD 0.40 and USD 0.46, reinforcing the larger accumulation pattern.

Deeper support at USD 0.38 becomes important if ADA drops USD 0.40, although current order movement indicates that such a fall is improbable without a wider shift in risk-off across the cryptocurrency market. For the time being, Cardano is steady, patient, and well-positioned to continue once the overall constriction of the market is resolved.