Bitcoin (BTC) volatility returns as the market resets into december

Market overview

In contrast to the controlled compression that characterized late November, Bitcoin has undergone a dramatic transformation as it approaches the 1 December 2025 session. After a swift and severe overnight decrease that momentarily drove Bitcoin into the lower USD 85,000 range, the price is currently trading close to USD 86,000. A significant amount of leveraged long positioning was liquidated by the decline, removing speculative excess that had built up over the course of two weeks of exceptionally tight consolidation. A cleaner, more structurally stable environment with deeper liquidity at lower levels and already absorbed forced sellers has arisen as a result.

The psychological harm frequently connected to more significant market risk events was absent from the collapse itself. Rather, it served as a forceful but beneficial recalibration of congested placement. Order-flow shows that as the price got closer to the lower edge of the November distribution, big purchasers intervened almost instantly. Spreads rapidly narrow following each volatility rise, and depth across major venues is maintained. The market essentially underwent a stress test, passed it, and went back to neutrality in a matter of hours.

Sentimentally speaking, the mood is cautious but far from gloomy. On-chain flows show that long-term holders are not in a panic, and institutional desks seem to be more concerned with opportunity than defense. Macro conditions are still mixed: the currency is trading sideways, rates are protective, and equity markets begin December with uncertainty. Macroeconomic indicators indicate a transition period, a change from stagnation to increasing volatility, rather than a structural breakdown.

Technical structure

In technical terms, Bitcoin has returned to a structure that is similar to the beginning of a new range. The severe absorption around USD 85,000–USD 85,500 identifies the lower barrier of near-term resistance, while the rejection from the USD 89,000–USD 90,000 level denotes the upper limit. Following the liquidity flood, the market now fluctuates along this corridor, seeking guidance.

The most significant finding is that Bitcoin maintained the deeper structural levels between USD 83,000 and USD 84,000, which served as an anchor for accumulation throughout the middle of November. BTC stays inside the larger upward framework set earlier in the quarter by remaining above that band. Following the selloff, lengthy and decisive recovery wicks are produced, indicating both the existence of demand and buyers’ willingness to participate at reduced prices. Before attempting another directional expansion, this conduct frequently anticipates the creation of a new equilibrium, or an area where Bitcoin gains strength.

The inherent distortion that occurs after a quick deleveraging event is reflected in indicators. RSI momentarily fell into oversold area before rising back into mid-range, indicating that the market absorbed the move rather than entering a long-term decline. After a few weeks of flatness, MACD displays a fresh bearish cross; nevertheless, the slope is mild, indicating momentum loss rather than trend collapse. After weeks of being suffocated by tight compression, Bitcoin suddenly has room to breathe thanks to the rapid widening of volatility bands. The market typically enters a discovery phase when bands grow, during which time the price revisits important liquidity spots before determining its next leg.

Whether Bitcoin can regain acceptance above USD 87,000–USD 88,000 is a crucial structural question. Reclaiming that area would restore buyer control because it was the midpoint of November’s balance zone. If this isn’t done, Bitcoin remains trapped in a recovery phase and is susceptible to testing the lower bounds of the growing range.

Derivatives and positioning

Derivatives markets show that yesterday’s action was actually a liquidation-led flush rather than a conviction-driven selloff. As long positions were eliminated, funding rates, which had subtly moved into positive territory in late November, fell back to neutral. A layer of brittle leverage that had been hidden beneath market structure for weeks was removed when open interest experienced a sharp but healthy fall. Markets with cleaner leverage profiles typically move more smoothly and react more forcefully to new catalysts, so this reset is beneficial.

Additionally, options activity changed suddenly. Although implied volatility increased during the selloff, it has already started to decline, indicating that stability has returned. A cluster of upside calls between USD 90,000 and USD 95,000 can be seen in the open interest distribution, while downside protection rises between USD 82,000 and USD 84,000. This balanced setup, which combines practical downside hedging with significant upside exposure, shows that the market is positioned for movement rather than collapse.

The next directional push is unlikely to encounter significant opposition from hedging flows because dealer gamma exposure is still low around the present price. As soon as Spot decides on its next structural intent, this paves the way for Bitcoin to move more freely.

On-chain and macro alignment

The resiliency of Bitcoin is still based on on-chain data. Supply dynamics and dormancy statistics suggest no distribution increase, and long-term holders are unwavering. A slow decline in exchange reserves indicates less pressure to sell in the near future. There are no indications of acute stress or capitulation in the output and transfer behavior of miners.

As December approaches, the macroenvironment is neutral but cautiously positive. Risk sentiment is divided but not hostile, global markets appear to be rotating into year-end positioning, and inflation expectations have stabilized. Because uncertainty lowers correlation and strengthens BTC’s position as a non-traditional asset, it has historically flourished in situations where macro direction is unknown. Cryptocurrency has historically been volatile in December, and early indicators suggest that this trend will continue.

Outlook

Rather than being weak, Bitcoin starts December in a state of reset. The market was cleared of froth and replaced with a more resilient, balanced structure as a result of the liquidation event. Whether Bitcoin can recover the USD 87,000–USD 88,000 range is the current emphasis. If this is the case, the market will swiftly return to USD 90,000 before reopening the higher goals of USD 92,000–USD 95,000. Instead, if Bitcoin returns to USD 85,000, the range will widen and tests of USD 84,000 and the deeper liquidity pockets around USD 82,500–USD 83,000 would be encouraged.

The overall picture is still the same: Bitcoin is powerful yet erratic, tried but unbreakable. This is the behavior of a market getting ready for its next big move, not that of a peak.

Ethereum (ETH) structure intact after a sharp repricing

Market overview

Ethereum began trading at about USD 2,827 on December 1, 2025, following an intraday high of about USD 3,050 and a low of about USD 2,808.The price action is consistent with ETH’s greater sensitivity to risk rotations, mirroring Bitcoin’s abrupt volatility reset but with a little sharper amplitude. Momentum traders were forced to reconsider after the market recently saw a significant downward repricing that eliminated excessive leverage. However, Ethereum’s overall structure is still intact despite the size of the move: the asset did not lose its primary demand zones, and the recovery from the session low was swift and decisive.

Although cautious, the atmosphere surrounding ETH is far from unstable. Both sides of the book still have a lot of liquidity, especially around the USD 2,800 mark, where buyers reappeared as soon as the pullback forced the price into the lower range of November. Instead than viewing the decline as a thesis failure, the market is viewing it as a structural correction. That distinction is crucial. The recovery phase is typically productive rather than chaotic when a move is motivated by liquidation rather than a breakdown of belief.

In a larger sense, Ethereum continues to fulfill its dual function as a risk asset and the foundation of infrastructure. Longer-term participants perceive a network that continues to anchor DeFi, NFTs, and Layer-2 settlement, while short-term traders concentrate on the dramatic decline from above USD 3,000. ETH continues to be at the core of on-chain economic activities, despite the noisy price volatility.

Technical structure

As of right now, the technical picture shows a high-beta asset going through a controlled reset. This band continues to be the major short-term resistance, as demonstrated by Ethereum’s latest rejection from the USD 3,050–USD 3,100 range. Every attempt to keep the price above USD 3,000 in late November was met with obvious selling pressure, and the most recent setback set off a chain reaction that pulled ETH back into its old mid-range range.

The USD 2,760–USD 2,800 range is currently used to identify support. This session’s intraday low, which is close to USD 2,808, is practically exactly on top of that demand band. An early recovery from that level indicates that buyers were ready to defend it. Ethereum will continue to be in a constructive consolidation where the decline is reinterpreted as a retest rather than a breakdown if this support holds on daily closing. A deeper advance toward the USD 2,700–USD 2,650 range, where previous volume and liquidity gathered, would only be encouraged by a clear loss of USD 2,760.

A market that has just expended its stockpiled downward energy is depicted by momentum indicators. Although selling pressure was strong, it was not prolonged, as evidenced by the RSI’s swift return to neutral after a brief dip out of the comfortable mid-range. After rolling over from its flatline position, the MACD now prints a weak bearish cross that reflects the current downward momentum but does not support a more significant trend reversal. After being squeezed for the majority of November, volatility bands have now widened once more, allowing ETH to fluctuate within a larger range.

The technical narrative changes from “failed breakout” to “successful reset” if Ethereum can remain above USD 2,800 throughout the course of the next few sessions. The ceiling is still between $2,900 and $3,000. Technically, each bounce is a rally within a larger consolidation until that zone is regained. The route toward USD 3,050–USD 3,120 swiftly reopens after it is regained.

Derivatives and positioning

It is evident from derivatives positioning that the recent rise was more of a leverage event than a price event. As long positions were eliminated, funding rates, which had slightly increased as ETH moved closer to USD 3,000, fell back into neutral. The forced closure of speculative longs that were leaning too strongly into the resistance zone was reflected in the dramatic fall in perpetual open interest. There is less froth, fewer weak hands, and more space for new positions to build without being perched atop a minefield of precarious leverage as a result of this cleanup.

This image is made more detailed by options behavior. As the spot recovered support, implied volatility swiftly stabilized after spiking during the decline, showing shock and the need for protection. Upside participation is still favored by the distribution of open interest. Calls are still concentrated in the USD 3,000–USD 3,200 range, suggesting that traders still view that band as a viable and appealing destination once the market picks up steam. In line with portfolios hedging against another leg down without giving up upside exposure, protective put demand has marginally grown around USD 2,700–USD 2,800.

Near the current price, dealer gamma exposure is considerable but not oppressive. As a result, ETH is not constrained by strict hedging flows from market makers. Derivative flows will probably define rather than be defined by the next rash move in spot, whether it is a USD 2,900 gain or a USD 2,760 loss.

On-chain and ecosystem dynamics

Ethereum doesn’t exhibit any of the anguish one would anticipate from a failing asset on-chain. With rollups managing a sizable transaction volume and reducing pressure on the base layer, activity on Layer-2 networks is nevertheless robust. Although fluctuating, gas costs stay within reasonable bounds, enabling the uninterrupted operation of DeFi protocols, NFT platforms, and common applications.

One important structural pillar is still staking. There is less instantly liquid float available for selling during significant corrections since a sizable amount of the ETH supply is trapped in staking contracts. Particularly when price declines are mechanically caused by leverage rather than fundamental news, this staked supply serves as a dampener against panic. Long-term declines in ETH exchange balances support the idea that a significant portion of investors favor yield or self-custody schemes over active exchange-based trading.

The ecosystem’s developer activity is still going strong. The Ethereum narrative is kept in line with expansion rather than stagnation through protocol upgrades, client diversity enhancements, and application-level innovation. Major selloffs in prior cycles were frequently associated with network exhaustion or developer disenchantment. This cycle feels distinct because, despite the chart’s oscillations, the builders are still working.

Macro alignment

The macro risk tone continues to influence Ethereum’s behavior, but it does not control it. At the start of December, the overall climate is neither aggressively risk-on nor risk-off. The dollar lacks the one-sided strength that typically destroys high-beta assets, equity indices exhibit cautious sideways movement, and rates are not skyrocketing. In that regard, ETH’s abrupt shift seems to be less of a reaction to macro decline and more of a local occurrence, the unraveling of a crowded technical level.

Ethereum is well-positioned to profit if macro indications gradually shift back toward risk appetite later in December, particularly when traders return to assets with actual usage, substantial liquidity, and reliable long-term storylines. On the other hand, if macro conditions worsen much more, ETH might return to deeper support; nonetheless, staking, L2 activity, and structural demand indicate that such drops are likely to draw medium-term purchasers.

Outlook

Ethereum enters December with a controlled recovery posture. The decline from above USD 3,000 has eliminated excessive leverage and reminded traders that resistance zones are still significant, but it hasn’t disproved the larger structural argument. In order for the market to launch another attack on the USD 2,900–USD 3,000 wall, ETH must first stabilize above USD 2,800 and reconstruct a base.

As of right now, the verdict is measured: ETH is reset but not rejected; it is injured but not shattered. The chart shows a market that is modifying rather than abandoning its longer-term trend, and the network still serves as the main economic foundation for cryptocurrencies.

Solana (SOL) high-beta leader absorbs a sharp reset

Market overview

After an intraday high of about USD 139.92 and a low of about USD 125.84, Solana is trading close to USD 127.30 on December 1, 2025.The past twenty-four hours have served as a reminder of Solana’s true nature in this market: the high-beta manifestation of cryptocurrency risk. Solana did not just drift lower when pressure struck the larger complex; instead, it repriced sharply, providing a bigger percentage drop than Ethereum or Bitcoin without showing any structural signs of panic.

The maneuver had a controlled character yet a ferocious speed. When the price gained acceptance at the mid-USD 120s, depth quickly restored, but order books shrank during the steepest portion of the slide. A market that has flushed speculation rather than broken trends is characterized by rapid liquidation, instantaneous re-liquidity, and then measured recovery attempts.

The atmosphere surrounding Solana is still one of cautious reverence. Because traders are aware that SOL has the potential to overshoot in both directions, it has gained popularity as a means of expressing directional opinions about cryptocurrency in general. That status has not been altered by the most recent decline. If anything, it has confirmed that Solana remains at the center of speculative rotation: the market aggressively purchases SOL when it needs beta, and it sells it as rapidly when it wants to reduce risk. What counts is that there is liquidity on both sides, and it remains so for the time being.

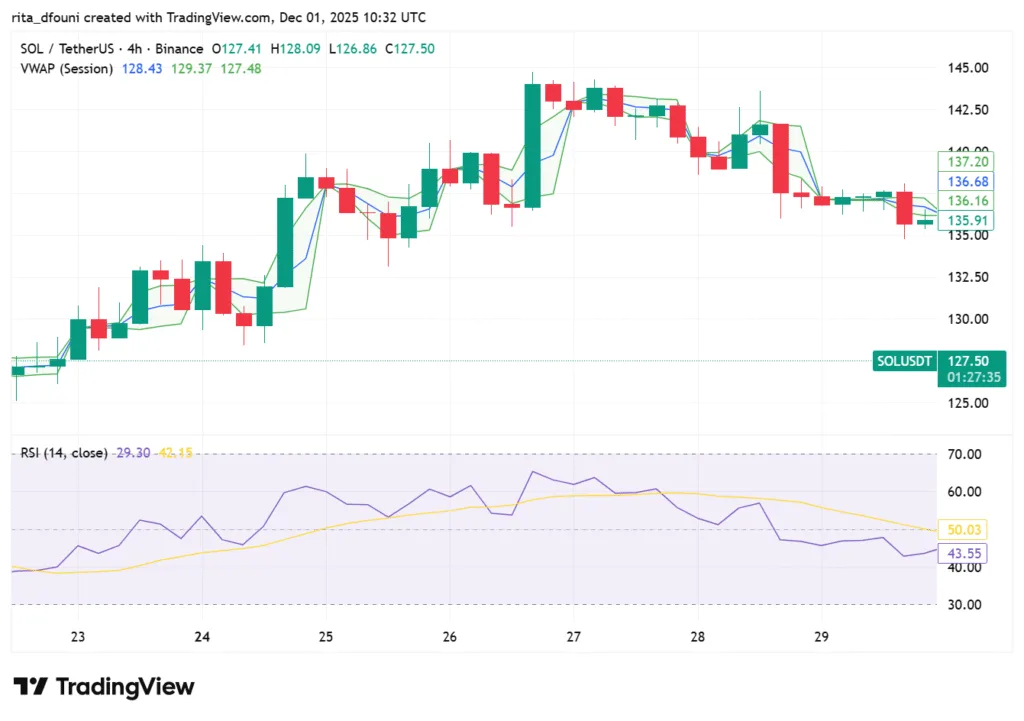

Technical Structure

Technically speaking, Solana’s chart displays a structural uptrend that is still alive on top of a textbook volatility event. SOL had been consistently pushing into the USD 135–USD 145 region prior to the selloff; this resistance area matched previous distribution and psychological focus. The price fell back into the core of November’s value area, which is now centered around USD 125–USD 130, as a result of the inability to hold above that area. Whether this area serves as a springboard or a trap is a crucial question.

Thus far, support has been where it was needed. Near USD 125.84, the intraday low is nearly exactly in line with the recent cluster volume’s bottom boundary. As soon as the price dropped below USD 127, buyers intervened, leaving longer lower wicks that indicate a rejection of lower levels. The larger pattern can still be interpreted as an aggressive retest rather than the beginning of a deeper downturn as long as Solana closes sessions above USD 125. The medium-term bullish narrative would only be seriously threatened by a clear loss of the USD 120–USD 122 band, which would encourage a return to the USD 110–USD 115 consolidation from earlier in the quarter.

Resistance is still well-defined on the topside. The most recent failure has strengthened the USD 135–USD 140 band, which served as a near-term cap throughout late November. Sustained volume and increased market cooperation will be necessary for any new effort to retake that area. The route to USD 145 and USD 150 reopens rapidly if Solana can close firmly above USD 140 because this area has less historical congestion and typically trades thinly once momentum is created.

The momentum indications have changed from being overextended to being reset. The digesting of recent gains is reflected in the RSI’s fall from high levels into a more neutral zone. Although the MACD has rolled over, indicating that the previous short-term uptrend has been broken, the longer-term slope is still positive, indicating that the move’s speed rather than its existence is being tested. The price has opportunity to fluctuate without indicating a structural collapse due to the significant widening of volatility bands. Although Solana’s underlying pattern of higher lows on the longer timescale has not been refuted, it has transitioned from tight pressure beneath resistance into a more fluid search of support.

Derivatives and positioning

The derivatives environment surrounding Solana reveals a market that was forced to adjust after leaning too much upward. As long positions were liquidated during the decline, funding rates, which had been clearly positive as SOL pushed into the USD 140 region, compressed toward neutral. A significant amount of speculative leverage has been eliminated from the system, leaving behind a cleaner foundation of spot and low-leverage directional exposure, which accounts for the noticeable drop in open interest.

Solana’s position as a preferred instrument for directional wagers is highlighted by options data. As traders hurried to hedge, implied volatility surged on the decline, especially in short-dated tenors. Nonetheless, there is no severe contango or backwardation, and the term structure is still generally well-behaved. While downside protection has shifted toward strikes around USD 120 and USD 110, upside call open interest is still concentrated in the USD 140–USD 160 range. This pattern implies that rather than the start of a protracted down phase, market players view the latest move as a setback inside a larger rally.

Dealer posture is light enough around spot levels that hedging overhead is unlikely to limit the next directional price initiative. Hedging flows may actually intensify the move by compelling market makers to chase higher if the spot starts to regain territory toward USD 135. On the other hand, since there is less leverage in the system, the potential of uncontrollable liquidation cascades is reduced compared to before this reset, even though a failure to hold the USD 125 region might still result in another volatility spike.

On-chain and ecosystem dynamics

Solana’s on-chain reality don’t match a project under pressure. With the network continuously handling high volumes of DeFi, NFT, and consumer-app activity, transaction throughput is still among the greatest in the sector. Users wanting yield without leaving the Solana ecosystem have consistently engaged with liquid staking solutions, and core DeFi protocols continue to draw substantial total value locked.

Additionally, the quality of the activities has changed. In contrast to Solana’s previous cycles, which were primarily driven by speculative frenzy, the current environment shows a wider range of consumers and use cases. Sustained throughput is influenced by DeFi farmers, application users, NFT market participants, and high-frequency traders. This variety of action supports the claim that Solana’s worth is more dependent on practical utility rather than just speculative hoopla.

Validator involvement is still high, and security is strengthened by financial incentives and technological advancements. Recent periods of increased market activity have not resulted in systematic failures, and network dependability, which was a cause of concern in previous eras, has stabilized dramatically. This is important because it promotes confidence and supports the willingness of capital to return following corrections when volatility strikes and the network continues to function.

Macro and market role

The massive personality of Solana is still evident. It functions as a high-beta lever on the general emotion surrounding cryptocurrencies, flourishing during periods of high risk appetite and suffering more severely during flights to safety. SOL is in an intriguing intermediate position because to the uncertain but not blatantly risk-off macroenvironment at the start of December. Although the asset just saw a steep repricing, more general circumstances do not currently support widespread surrender across digital assets. Rather, they make the case for differentiation: markets are penalizing leverage-driven excess and rewarding initiatives with solid on-chain fundamentals. Solana’s price reset appears to be more in line with alignment than rejection based on that metric.

Solana is probably going to be one of the first big altcoins to react if economic signs shift back toward a risk-on regime later this month. It is an effective platform for revived speculative flows because of its trading footprint and depth of liquidity. SOL will most likely continue to be under pressure if the macro declines, but the robustness of its ecosystem indicates that any prolonged decline would be more influenced by global risk aversion than by project-specific failure.

Investor psychology

Respect, not hopelessness, characterizes the attitude surrounding Solana following this relocation. Many short-term speculators have been flushed out as a result of being penalized for crowding into late-stage upside. What’s left is a more sober group of participants: long-term investors who have seen the ecosystem develop and are prepared to endure more severe fluctuations in exchange for exposure to its expansion, as well as active traders who are aware of Solana’s volatility profile.

Although the abrupt decline has dimmed retail excitement, it has not vanished. The market is questioning if this decline is an opportunity or a warning as social emotion has changed from exuberant confidence to analytical curiosity. However, rather of viewing the move as a sign of fundamental breakdown, institutional desks seem to be handling it as a normal volatility event in a high-beta asset. If and when the overall market stabilizes, this collective mindset creates a favorable environment for a subsequent recovery attempt.

Outlook

The way Solana acts in the vicinity of its recently restored equilibrium will determine its future course. The story changes to one of constructive rebuilding if the price can stay above USD 125 and start making higher lows inside the USD 125–USD 135 range. Renewed tests of USD 145 and USD 150 would thereafter be possible if a fresh push through USD 135–USD 140 confirmed that the previous selloff was a deep but ultimately healthy reset. However, the market will probably reprice once more, aiming for the prior consolidation base closer to USD 110–USD 115 before a more durable floor is built, if SOL is unable to defend the USD 125 zone and falls toward USD 120.

For the time being, Solana is still the sharpest edge of the majors, just as it has been for a large portion of this cycle. It is fluid, dynamic, and structurally alive, yet it is also erratic, emotive, and harsh on complacency. That combination keeps Solana at the forefront of the discussion in a market that recently recalled what true volatility is like.

XRP stability tested but not broken as the market resets

Market overview

After hitting a peak of about USD 2.01 and a low of about USD 1.90 during the volatility-driven repricing that engulfed the whole cryptocurrency market, XRP is currently trading close to USD 1.93 as of December 1, 2025. Compared to the crashes observed in higher-beta assets, the movement in XRP was noticeably more controlled despite being sharper than its typical daily amplitude. This is in line with XRP’s changing character since it no longer exhibits the macro rhythm of Bitcoin or behaves like a purely speculative token. Rather, it functions as a hybrid asset that is part speculative instrument, part institutional liquidity rail, and part payments infrastructure, which naturally dampens market volatility.

The recent drop did not significantly change XRP’s overall posture. The market created a foundational support zone between USD 1.92 and USD 1.95 throughout November, and XRP once again held that area while selling pressure increased elsewhere. rapidly after the flush, buyers showed up, order books handled the situation without any disruption, and liquidity rapidly restored to normal. XRP saw a chance for strengthened positioning where other assets saw chaos. Despite risk aversion spreading throughout the larger complex, the market still sees value in this sector and is eager to participate, as evidenced by the return to the USD 1.97–USD 2.00 range.

XRP sentiment is still measured. While investors looking for high-beta performance temporarily withdraw during times of economic uncertainty, traders who view it as a stability asset continue to base their expectations on range-bound behavior. This division of participants produces an amazing resilience: enthusiasm does not turn into frenzy, and fear does not turn into panic. Even in difficult environments, XRP stays stable.

Technical structure

The XRP technical outline shows a tested but uncompromised structure. The token had been fluctuating between USD 1.92 and USD 2.12 for almost three weeks, creating a clear equilibrium. The most recent decline caused the price to dip to the very bottom of that range, briefly hitting USD 1.90 before rising again. Buyers are still firmly rooted in this zone, as evidenced by the quick recovery from the lows marked by a protracted lower wick and quick re-acceptance at higher levels.

The range doesn’t change as long as XRP stays above USD 1.92. Around USD 1.98–USD 2.00, which frequently serves as the range’s gravitational center, the price is currently moving back toward the midline. XRP will be positioned for another attempt at the range high near USD 2.12, which has repeatedly resisted upward momentum but is still the key to unlocking further potential, if the price can stabilize here. The next pockets of liquidity are located between USD 2.20 and USD 2.30, which can be reached with a daily close above that level.

With the chart, momentum indicators consistently convey a narrative. During the volatility episode, RSI momentarily fell close to oversold circumstances before rising to neutral readings as the price stabilized. MACD gradually flipped over, indicating a break in the short-term bullish pressure but no discernible change in the larger trend structure. The shock caused the volatility bands to widen somewhat, but not enough to disprove the long-term tightening that had been taking place throughout November. Now, XRP can expand without endangering its fundamental framework.

The technical image is one of a range that has been retested, confirmed, and is currently awaiting guidance rather than one of collapse. The support for XRP persisted. Resistance doesn’t alter. Even if sentiment is momentarily disrupted, the structure remains stable.

Derivatives and positioning

Although subdued, the derivatives flows around XRP are instructive. The fact that funding rates are still almost neutral suggests that leverage is not determining the course. The likelihood of forced liquidation cascades is decreased by this lack of aggressive long or short positioning, which has been particularly advantageous during the current market volatility. XRP’s leverage profile served as a buffer against chaos while other assets saw dramatic washouts.

There is a tiny decrease in open interest, which is more indicative of healthy de-risking than surrender. The options market is still balanced, with structured put protection between USD 1.85 and USD 1.90 and moderate call demand centered around USD 2.20. XRP’s position as a mid-volatility asset among the majors was further reinforced by the fact that implied volatility increased during the selloff, albeit not significantly compared to many other altcoins.

Spot movements are unlikely to be mechanically enhanced or artificially controlled because dealer gamma exposure is modest across the relevant ranges. This makes it possible for XRP to trade more smoothly on spot-driven flows, which is crucial when the market is recovering from a shock. Derivative positioning just adjusts rather than crowds or competes with pricing.

In general, the resilience thesis is supported by the derivatives landscape. XRP was able to withstand the storm with fewer distortions and forced changes since it did not have excessive leverage or one-sided positioning. As the market recalibrates, this creates a strong basis for stability.

On-chain and ecosystem dynamics

XRP-related on-chain activity is steady and steady. Despite the market-wide volatility, transaction throughput has not significantly decreased, indicating that utility-driven flows are unaffected. The payment-focused architecture of the ecosystem continues to supply transactional demand unrelated to speculative sentiment. This is crucial for XRP because usage-based demand serves as a stabilizing factor during volatile times, preserving a baseline of activity that lessens price shocks.

The use of large wallets is still beneficial. There is no indication that institutional-sized addresses or long-term holders are widely distributed. There are no significant surges that would suggest getting ready to sell on a huge scale; instead, exchange balances move within typical ranges. Strategic players are still confident, and their lack of response supports the idea that the most recent action was technical rather than fundamental.

Furthermore, XRP’s long-term use case is still supported by continuous improvements in cross-border payment connections. Although these changes don’t necessarily have an immediate impact on price, they do add to the narrative strength that keeps long-term investors stable over market cycles.

Macro alignment

Among the majors, XRP continues to be distinctive in its alignment with macro conditions. XRP frequently acts more like a mid-volatility infrastructure asset, whereas Bitcoin and Solana react dramatically to changes in liquidity mood. Although there is less amplification, its price fluctuations are indicative of broader crypto risk conditions. Macro uncertainty contributed to selling pressure across digital assets during the recent upheaval, but XRP maintained a more regulated trajectory, indicating its relative immunity from pure speculative mania.

As December approaches, the macroenvironment is unpredictable but not hostile. Bond markets are stable, equity markets are unsure, and the dollar is neither sharply increasing nor decreasing. Assets that prioritize utility above speculation typically maintain their range better in such a setting. XRP is a good fit for this position. XRP will react as macro clarity develops later in the month, but probably in gradual, proportionate stages rather than sharp fluctuations.

Investor psychology

Investor sentiment around XRP is still remarkably unchanging. Long-term investors seem unfazed, still viewing XRP as a project that develops through cycles rather than trades through them. Though not to the extent of fear or surrender, retail sentiment has somewhat decreased. Rather, there is an awareness that XRP is still inside a well defined range and that the recent retest of support was more of a confirmation than a threat.

The emotional atmosphere is steady, logical, and leisurely. Instead of seeing XRP as a ticking time bomb or a runaway catalyst, traders see it as a stable structure. During a time of increased volatility, XRP is positioned as one of the more balanced assets in the majors thanks to its emotional stability and subdued speculative activity.

Outlook

Compared to many of its competitors, XRP emerges from the volatility event in a more stable state. It maintained the integrity of its multi-week range and avoided the deeper breakdowns saw elsewhere by skillfully defending the USD 1.92–USD 1.95 support region. In order to restart momentum and enable another challenge to the USD 2.12 limit, the immediate objective is to regain continuous acceptability over USD 2.00. The next upward run towards USD 2.20–USD 2.30 becomes a plausible scenario if XRP can close above that upper boundary.

The market will return around USD 1.88–USD 1.90, where liquidity is still positive but attitude may become more cautious, if XRP is unable to sustain USD 1.92. As of right now, the structure supports stability: XRP is holding, absorbing, and waiting for guidance from the larger market.

XRP stands out not as an asset in distress but rather as one that confirmed its structural base when it mattered most in a landscape that recently saw a brutal reminder of volatility’s potency.

Cardano (ADA) quiet resilience at the edge of its range

Market overview

After tracing an intraday high of about USD 0.427 and a low of about USD 0.382 during the most recent volatility wave that shook the cryptocurrency complex, Cardano starts trading around USD 0.386 on December 1, 2025.

In percentage terms, the move lower is significant, but its nature is recognizable: ADA endured a sharp repricing once more without losing its composure. Cardano’s tape exhibited controlled selling, orderly order books, and a quick return of purchase interest when the price got closer to the lower end of its current range, while certain higher-beta assets showed acceleration and dislocation.

For most of November, ADA had been oscillating between roughly USD 0.40 and USD 0.46, building what looked like an extended base. The latest selloff pushed price just below the psychological USD 0.40 threshold, probing the market’s willingness to defend Cardano at cheaper levels. The response was measured but unmistakable: liquidity refilled, spreads normalized, and intraday bounces from the low USD 0.38 region confirmed there is still a constituency prepared to accumulate ADA during market stress.

Neither fear nor euphoria are prevalent in the Cardano community. It has patience. Investors who have tracked the project through several cycles are used to these grinding, plodding stages where fundamentals advance faster than the chart and price trails narrative. That rhythm hasn’t altered with the latest transfer. While ADA isn’t dominating this market, it’s also not collapsing; instead, it’s quietly rebuilding structure down to the bottom of its current band and making adjustments and adjustments.

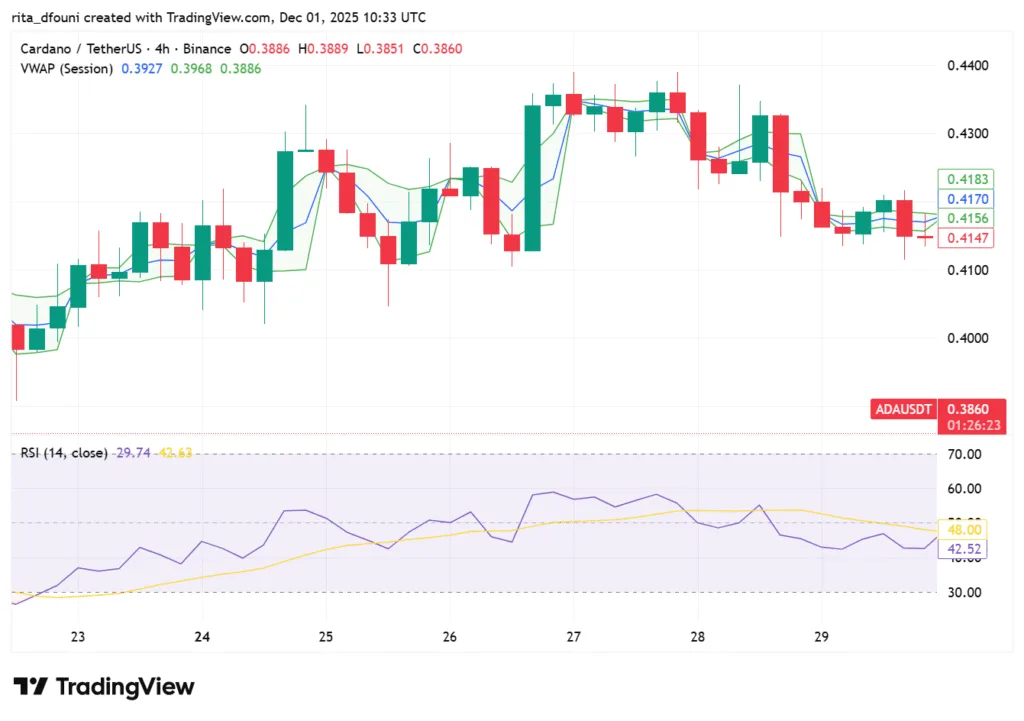

Technical structure

From a technological perspective, the picture is plain but complicated. For the first time in weeks, the extended USD 0.40–USD 0.46 range that characterized November has been tested from below. The market is essentially asking one question now that the spot is close below the previous floor: will USD 0.38–USD 0.40 turn into a fresh accumulation zone or the peak of a deeper corrective leg?

An essential first checkpoint is the intraday low around USD 0.382. By the end of the session, the price had returned to the USD 0.39–USD 0.40 range as buyers intervened with sufficient vigor to deny further immediate declines. This location may develop into a new short-term platform if closing bases are maintained during the coming days. This would recast the collapse from USD 0.40 as a stop-hunt and liquidity sweep, a brief dip below the band intended to purge weak hands before recovering, rather than the beginning of a trend.

The first significant test on the upswing is currently located between USD 0.40 and USD 0.41, which used to be a level of support but is now acting as early resistance. After that, the more important ceiling is still between USD 0.44 and USD 0.46. Only a prolonged recovery of that higher region would fully reassert the attempt to move from base-building into an advance into USD 0.50 and above. Until then, ADA’s chart should be interpreted as a lower-range consolidation, leaving open the question of whether this new, slightly depressed band is structural or transient.

Although momentum indicators show the current repricing, a serious structural breakdown has not yet been confirmed. As the price fell below USD 0.40, the RSI slipped below oversold levels, but early stabilization sent it back toward the low-mid region, indicating that the immediate selling pressure is lessening. The attempt to create upward momentum in November has been halted, as evidenced by the MACD’s significant roll over on short-term frames. On longer timeframes, though, the indicator still more closely resembles a sideways drift than a clear downward trend. After being constricted for the majority of the previous month, volatility bands have now significantly expanded, enabling ADA to fluctuate within a wider range without necessarily indicating additional collapse.

The chart’s hidden message is that Cardano is not yet tumbling from its previous structure, but rather standing on its brink. Whether this is just a painful retest or the beginning of a new, lower base will depend on what transpires around USD 0.38–USD 0.40 in the upcoming sessions.

Derivatives and positioning

In settings like this, Cardano’s minimal derivatives footprint is a strength rather than a weakness. Funding rates hover near to neutral with only small negative tilts during the worst period of the selloff, indicating that there was no severe build-up of speculative shorts pursuing momentum. Instead of forced unwinds brought on by excessive leverage, open interest declined in tandem with the price, indicating a managed reduction in exposure.

The options markets surrounding ADA are extremely small in comparison to big cryptocurrencies like Bitcoin and Ethereum, but the movement that does exist is instructive. Upside calls that had been centered around USD 0.50 and USD 0.52–USD 0.54 have not been dropped, despite changes in the tenor and intensity of activity. Clearly, traders are recalibrating timing expectations rather than breaking down the playbook. Protective puts have attracted interest around USD 0.36–USD 0.38, hinting that participants see this region as a plausible but not catastrophic downside extension.

The lack of leverage extremes is significant. It implies that spot flows and investor confidence, rather than binary liquidation events, are more likely to direct ADA’s future actions. When markets reset like this, clean derivatives positioning often provides a more natural rebound path once sentiment steadies.

On-chain and ecosystem dynamics

Cardano’s narrative on-chain still deviates from its price. A significant portion of the circulating supply is locked in delegation, and staking participation is still high. This minimizes liquid float and acts as a permanent buffer against uncontrolled sell pressure. There was no discernible increase in unstaking or exchange inflows from long-term wallets following the recent decline, indicating that investors who are structurally committed have not altered their opinions.

Protocol-level advancement and developer activity continue to be strong. Upgrades are still being shipped by ecosystem projects, Cardano’s DeFi platforms continue to have steady, if not explosive, involvement, and the Hydra scaling framework’s infrastructure is gradually improving. None of these improvements quickly reflect in the market, especially during macro-driven volatility, but they key for the medium-term assumption that Cardano is developing durable capacity for future growth.

Instead of collapsing, user metrics like active addresses and transaction counts demonstrate resilience. Cardano is not in a frenzy, but it is not in retreat either. A structural environment where downside tends to be gradual and grinding rather than catastrophic is created by this medium state incremental usage, high staking, and obstinately patient holders.

Macro positioning

Cardano’s temperament determines how it relates to macro circumstances. It is less susceptible than Solana to abrupt changes in risk appetite, yet more subject than Bitcoin to sustained risk-off regimes. ADA’s response has been proportionate in the current context, where macro signals are mixed but not overtly hostile: it has lowered its prices in tandem with the market but has not displayed any symptoms of submission.

Capital is likely to shift first into Bitcoin, then Ethereum, and finally into a few large-cap altcoins with robust communities and development footprints if global risk sentiment improves toward the middle of December. Cardano frequently joins that third wave after the leaders do, but when confidence recovers, they follow through rather well. The structural anchoring of staking and on-chain activity imply that ADA will bleed in an orderly manner rather than collapse if the economy continues to worsen.

Investor psychology

Endurance shapes the psychological environment surrounding Cardano. Many of its holders have experienced numerous cycles of both exhilaration and disappointment; they neither pursue every increase nor quit lightly. Both positive and negative reactions are tempered by that maturity. Shorter-term participants are undoubtedly negatively impacted by the recent decline below USD 0.40, but the core community has not experienced an emotional break.

ADA-related retail discourse is muted but not depressing; there are fewer audacious forecasts, more subdued traffic, and more subdued accumulation narratives. Professional traders categorize ADA as a fundamentally conservative altcoin: not a vehicle for explosive intraday transactions, but a name that belongs in a diversified crypto portfolio when the purpose is to blend yield, decentralization, and development advancement.

The chart and this emotional profile match. Cardano is not the coin traders gloat about; it is the one they tolerate in the background, knowing that its cycles are long and its moves tend to arrive once conviction is reestablished across the market.

Outlook

Cardano closes this volatility event on a knife-edge that has not yet cut. The quick defense near USD 0.382 and the re-acceptance back toward USD 0.39–USD 0.40 indicate that buyers are unlikely to give up the structure without a fight, but the decline below USD 0.40 is a warning that the prior range has weakened. The upcoming sessions are crucial. If ADA can stabilize in this new, slightly lower area and resume printing higher intraday lows, it can turn the recent selloff into a deeper yet constructive retest, eventually re-targeting USD 0.42–USD 0.44 and, with broader market cooperation, a return to USD 0.46 and above.

If, instead, Cardano fails to hold USD 0.38 on closing bases and slips into USD 0.36–USD 0.37, the market will start to see the November base as broken and search for a new equilibrium lower down. Even in that event, structural supports staking, ecosystem development, and patient holders are likely to halt the descent, but the narrative would briefly shift from “basing” to “rebuilding.”

For now, ADA stands where it frequently does at the conclusion of a shock: not in the center of attention, but quietly intact. It has moved down, but not out. In a market that just rediscovered real volatility, that is an achievement in itself.