Bitcoin (BTC)

Market overview

Bitcoin’s market position is hovering near the $90,000 mark at this moment, and it has redeemed itself a bit from the recent lows, which means an increase of about 2 to 3 percent day by day. For the last day, the price movement has been limited to the range of an intraday low close to $87,400 and a high of a little over $90,200, which has led to the conclusion that Bitcoin is trying to stabilize rather than to make a jump in one or the other direction. This stabilization is after the historic selloff in November, which was the largest monthly decline in Bitcoin’s history in absolute dollar terms and the cause of more than $1 trillion being erased from the total market value of digital assets.

Even though Bitcoin made an attempt to recover recently, it is still far from its peak of around $110,000 in early autumn. The price situation led the market to be considered as a place for post-distribution and digestion rather than an active expansion. Pricing at the moment is about the same as the estimated cost of short-term holders, thus making it a very sentiment-sensitive area. Consequently, the market is divided between those who buy the dips thinking of the correction as a long-term opportunity and sellers who take the chances of the market going up to shrink their exposure or cash in on the remaining profits. This situation has resulted in a somewhat horizontal price action that has been going on through the end of the year, marked by a falling volatility but a still-present uncertainty.

Technical structure

Bitcoin’s technical setup still has the characteristics of a late-cycle correction rather than the onset of a deep bear market. The most important and surprising signal in this regard was the fall in momentum, as indicated by the velocity-based RSI indicators, which dropped to the extremely oversold level of nearly 10 out of 100. In the past, such low readings could be seen only at times of heavy selling, or during mid-cycle resets in wider bull markets, and this scenario is now hinting that the selling pressure may have reached its limit and not that there is a structural breakdown.

Nevertheless, Bitcoin has now gone below the 50-week moving average which is a very important factor in the medium-term trend assessment. The moving average has always been a major point of reference for trend continuation and, therefore, trading below it for a long time is often followed by either a prolonged consolidation or a deeper pullback. Hence, the horizontal support and resistance areas have gained more importance than the trend-based indicators. The most significant support area now is between $80,000 and $82,000 which was formed by October consolidation, high-volume trading, and previous demand absorption. If a weekly close below this zone is confirmed, it could very likely validate the bearish continuation and, thus, lead to a decline into the mid-$70,000 range.

On the positive side, the resistance around $97,000 is still the main technical turning point. The point is where the upper part of a forming bear-flag pattern meets and signifies the point that the bulls need to take back to cancel the bearish interpretation. The breakout of such a scenario is not yet there; this is why the zone of $87,000–$90,000 is seen as a place of consolidation. The buyers and sellers are particularly attentive to observing whether the current oversold bounce can develop into a persistent reversal of trend or the opposite i.e. retreat into another lower high.

Derivatives and positioning

The derivatives market keeps indicating that the situation is still a bit unstable rather than showing the conviction anew. One of the more worrying signals has been the continuous existence of very much skewed long-to-short ratio even with Bitcoin’s price declining. The traders have habitually been trying to buy the dip and thus continuing their bullish exposure in spite of the weakening price movement. This kind of behavior makes the risk of the downside asymmetric, as the volume of the long position can be taken advantage of if the price goes down steeply, which in turn will call for the triggering of forced liquidations.

On the other hand, funding rates show a more complicated situation. Perpetual futures funding has been adjusting from euphoric heights to neutral levels, and this is the end of the normalization process. The upstream purchase of a significant part of the leverage has already occurred, which means that the risk of liquidation taking place in a massive way is reduced immediately. However, the continuous imbalance favoring longs implies that the market is still susceptible to nasty shocks, especially when there is little liquidity around.

Institutional activity has also cooled off. Spot Bitcoin ETFs which incorporated huge inflows at the beginning of the year have experienced around $3.5 billion in net outflows in November. This change indicates selling of profits, rearrangement of portfolios and a pause in institutional allocation.In fact, liquidity conditions have thinned and order books are showing less depth at the current prices. Options market is another area that discloses high hedging demand and hence it can be inferred that investors are taking a defensive position in anticipation of what they consider to be a period of increased volatility as Bitcoin moves closer to a macro and technically inflection point.

On-chain and ecosystem activity

In general, the on-chain metrics are communicating the same message—the consolidation of the market which is still in the process of being completed. Currently, the short-term holders’ realized price is very close to the market price; thus, the area of $85,000–$90,000 is of critical importance from a psychological point of view. If the price of Bitcoin does not go below this region, the last buyers will not be losing which will make it unlikely that any panic selling would take place.

However, the long-term holders and whale entities have increased the volume of their inflows to the exchanges slowly but surely and that is a sign of controlled distribution rather than aggressive accumulation. Signals coming from the transaction volumes and the number of active addresses have weakened and this can be attributed to the fact that retail traders are less engaged while the speculators are not participating as much as before.

The said decline in on-chain activity is in line with the overall negative risk sentiment prevailing in the global markets. As for the mining side, it is still very strong. The hashrate has maintained its position right next to all-time highs which is an indication of the security and resilience of Bitcoin.

Nevertheless, the miners have increased their BTC sales very slightly which is probably for their operational expenses and liquidity for the new year. To summarize, the on-chain signals are indicating a market that is on hold: the experienced traders are very carefully managing their exposure, while the new funds are mostly not involved.

Macro alignment

The price movement of Bitcoin continues to be heavily influenced by macroeconomic factors. Traders are still very much looking at the Federal Reserve’s actions, especially the potential switch from a tight policy to either a pause or eventually to rate cuts by 2026. The expectation that the Fed would loosen up has been a factor in establishing a support area around the $80,000 mark, even when the market was going through some stress. Meanwhile, the macroeconomic factors are still a challenge.

High bond yields, ongoing conflicts, and uncertainties in trade have been the main reasons why the Bitcoin price has not been able to rise above a certain level. In this context, the announcements of tariffs have shown that the Bitcoin market is still very much affected by the global risk appetite and the complete separation from traditional markets is still an open question.

Liquidity is slowly getting better, but the institutions are still not very convinced about it, which is reflected in the low ETF inflows and the cautious positioning. So, Bitcoin is positioned at a macro crossroads.The continuous worldwide liquidity increase might trigger the bull run once again, while the government may opt for inflation-related pressure or geopolitical shocks that would prolong the current consolidation stage.

Investor psychology

An investor’s opinion about Bitcoin has been expressed as cautious neutrality. Winter’s drastic price drop in November has shaken confidence to a certain degree, but fear has not yet led to giving up. There are contra indicators, which hint that the market is similar to the previous resets, but the fact that there is no widespread selling means that the holders of the coins still think they are right to hold. There has been a reduction in retail interest, which is seen in searches, social media, and retail trading volumes that are all significantly less than mid-year highest levels. On the other hand, whales are also reducing their exposure, which brings extra caution into the market. This mixture has resulted in a psychological deadlock where buyers and sellers are depending on a major trigger. In the case of a strong breakout past $100,000 or a plunge beneath $80,000 the market might get reset in the sense that there would be more faith in one direction or the other.

Forward-looking outlook

The 2026 forecast of Bitcoin is dependent on two important levels. If the price stays above $80,000, this would keep the structural support and the bullish market overall. Instead, to get back into the $97,000-$100,000 range would mean the present downward movement is invalidated and could draw in new institutional investments.Until one of these levels is reached, it can be expected that Bitcoin will stay within a certain price range and react strongly to macroeconomic and liquidity factors. The long-term forecast is still tentative but positive, however, the short-term price movement will be heavily influenced by external conditions rather than internal momentum.

Ethereum (ETH)

Market overview

Ethereum is now trading close to $3,000 after a recovery that took it back from a fall in late November. The cryptocurrency has undergone a significant decline within the year dropping from mid-$4,000s and reaching the fourth quarter with a total of about 30% down. However, ETH has managed to bounce back about 15% from its cycle low which shows that buyers were quite determined in defending the $2,700-2,800 area. When comparing with Bitcoin, Ethereum lost its value during most of 2025 but this was due to its higher beta and sensitivity to tightening financial conditions.

However, Ethereum has still been stronger in its structure than the previous bear markets; it managed to stay well above long-term support levels and retained its role as the main actor in decentralized finance and smart contracts infrastructure.

Technical structure

From the tech side, Ethereum still trying to recoup from a deep correction and it is a long way of rebuilding left. The price of the asset is below the critical moving averages which is a sign that the intermediate trend is not yet completely positive. On the contrary, the strength indicators have shown a significant improvement. The daily RSI has moved up from the oversold area towards the neutral zone thereby indicating the reduction in selling pressure.

The area of resistance is still between $3,300 and $3,500 where the previous consolidation and the downward trend lines meet. If the market breaks above this area, it will be a significant change in market structure and it will come along with the buying of momentum that is going to be activated once again. On the other hand, the support between $2,500 and $2,600 is still very much effective as the main defensive zone. ETH/BTC case has found a floor after hitting multi-month lows which could indicate that the relative underperformance is slowing down, not speeding up.

Derivatives and positioning

Ethereum’s derivatives market had one of the most drastic resets of the entire cycle. Roughly $19 billion in leveraged positions were liquidated during one event in October, wiping out all speculations. More than half of the open interest was liquidated, and the leverage ratios were returned to the historical sustainable levels. As a result of this issue, the funding rates became usual and the speculative activities went down.

Although the major part of the positions is still net long, the total derivatives market looks more robust and less likely to face chaotic liquidations. The flows linked to ETFs have become more or less stable as the year comes to an end, and the total assets under management remain very high, which highlights the fact that Ethereum still attracts institutional investors despite the market being volatile.

On-chain and ecosystem activity

The on-chain data reveals a complex but positive scenario. The whale buying and staking activities that took place during the decline period added more ETH to the already non-liquid amount. Staking of almost 30% of the total supply is now active giving rise not only to yield-based incentives but also to structural support for the network.

Exchange balances have been on a decline as well, contributing to lesser selling pressure that can be described as immediate. The usage of the network on the other side declined with the correction. The transaction volumes and the fees dropped which were the indicators of the lesser DeFi and NFT activity among the people who were risk averse.

Even though there was a slowdown, Ethereum is still the backbone for decentralized finance and others are sectors like liquid staking derivatives, on-chain treasuries, and real-world asset tokenization that are coming up and growing underneath the surface.

Macro alignment

Ethereum’s performance is still strongly connected to macroeconomic conditions. The increase in the interest rates had a heavier impact on ETH than on the other cryptocurrencies because of its Innovatory nature. To the future, rate cuts and better regulatory conditions could be the starting point for Ethereum’s yield-generating model’s success. Institutional adoption through ETFs and the establishment of more transparent legal jurisdictions have turned Ethereum into a hybrid asset that possesses both tech exposure and the potential of producing income. This stance may attract even more investors when the rates are lower.

Investor psychology

Over the past few months, Ethereum sentiment has moved slowly from the extreme pessimism to the moderate optimism side. It looks like the capitulation was over and done with during the liquidation event in October which got rid of the weak hands.

The support of long-term investors and institutional players proved the case and brought in the confidence about Ethereum’s long-term fundamentals.Stabilization near $3,000 has brought back some trust, but still the excitement is not that high.

A full change in the sentiment may only come with of the experience of climbing to higher and higher prices and the revival of the network activity as the confirmation of that change.

Forward-looking outlook

It is still the case that Ethereum’s medium-term outlook stays to be constructive but also conditional. A recovery of the $3,500 price would indicate a change in trend while an increase above $4,000 would verify a bull phase that has been newly established. If none of these scenarios play out, ETH might continue to be trapped in a range as it processes the previous gains. Long-term fundamentals remain a source of positivity till 2026.

Solana (SOL)

Market overview

After a slight recovery, Solana is priced around $128. The cryptocurrency went through very volatile times along the whole 2025, reaching $300 during some speculative excess periods and then going back almost to its previous value. However, even with the price drop, SOL is still at a great distance from its last cycle lows and is still securing a place in the top tier of large-cap crypto assets.

Technical structure

From a technical analysis perspective, Solana is making an effort to bounce back from a severe downtrend. The RSI, one of the momentum indicators, has moved up from extremely low or oversold levels and thus is no longer indicating a strong selling pressure on the asset, but the price is still below the important moving averages which shows that the overall trend is still down.

The resistance area around $132-$135 is very important for the market participants as it is a critical point where their decision can go either way. A conclusive breakout could lead to $150 and the next higher levels, on the contrary, rejection would mean once again downward to $116 or even the psychological $100 mark.

Derivatives and positioning

The derivatives market of Solana is characterized clearly with a strong long crowding, and the ratios of long to short are at the level of those in Bitcoin and Ethereum. The structural demand base is provided by the institutional ETF inflows, which are quite large in terms of volume, but on the other hand, leveraged positioning brings with it a downside risk if there is a shift in sentiment. Moderately high funding rates reveal the presence of leverage, yet it is still not at the stage of being euphoric.

On-chain and ecosystem activity

Solana on-chain metrics continue to be one of the best in the ecosystem. The high transaction throughput, large DeFi volumes, and increasing stablecoin use are the indicators of the network’s technological capabilities. Regular updates and a vibrant developer community srtengthen the long-term Solana’s value proposition.

Macro alignment

Solana’s behaviour is that of a high-beta macro asset, which means it also enhances both the upside and downside moves. The easing of monetary conditions would help SOL more than the other coins, while the renewed risk-off sentiment could further losses. Along with the institutional adoption and regulatory clarity, the long-term support is provided.

Investor psychology

The mood of the investor in financial markets has changed from speculative euphoric phase to a very optimistic but foggy state. The story line of retail over buying is gone, and a more institutional oriented narrative has come in its place. Volatility continues to be one of the major characteristics, but confidence in the Solana ecosystem has reached a mature stage.

Future-oriented impression

The view on Solana is still uncertain but it has potential. If macroeconomic conditions are good, still the technical reliability and ecosystem expansion could create huge upside. The risk for the short term is still high because of the heavy positioning.

XRP (XRP)

Market overview

After the market’s dramatic mid-year rally, XRP is now trading at almost $1.90 and has been consolidating. Legal Clarity and ETF launches have been the main propellants for XRP’s price increase above $3 earlier this year, however, the profit-taking and macroeconomic pressures combined resulted in a sharp retracement. Currently, the price seems to have found its resting point at equilibrium and is steadily fluctuating around that level.

Technical Structure

XRP is currently consolidating within a specific trading range. The support level close to $1.80 has consistently been maintained, whereas the resistance level close to $2.00 is limiting the upward movements. A breakout could have a target of the mid-$2 range, while a breakdown would take the price to about $1.50.

Derivatives and positioning

The inflows into ETFs gave a hard time to the supply, but a whale distribution took up a big part of the demand. Futures positioning has come back to the normal state, with a slight increase toward the end of the year. The market still sees high volatility as a given.

On-chain and ecosystem activity

Ripple has made progress in its payment infrastructure and licensing but on the other hand, organic XRP demand is still modest. There is a slight increase in user activity but overall large-scale adoption has not yet resulted in continuous price rise.

Macro alignment

XRP has gained better access to institutions due to the regulatory uncertainty being mostly cleared. The price will be impacted by the general liquidity trends, but XRP’s unique legal position might give it a relative strength.

Investor psychology

The mood of the XRP investors has come back to normal after the very high and very low periods. People who are long-term supporters still exist, but the speculative excess has gone off. The attention is now on execution and adoption in the real world.

Future vision

The increase in XRP’s price entirely relies on the transformation of regulatory acceptance into the long-term demand that is mainly driven by utility. The flows from the ETF give a permanent foundation, but the significant price increase needs a real development in the adoption.

Cardano (ADA)

Market overview

After a year of steady recovery, Cardano has almost reached the $0.38 mark. The performance of ADA was not marked by drastic ups and downs and was carried by the effects of early loss and thus became one of the strongest large-cap assets in terms of price recovery, although from a low starting point.

Technical structure

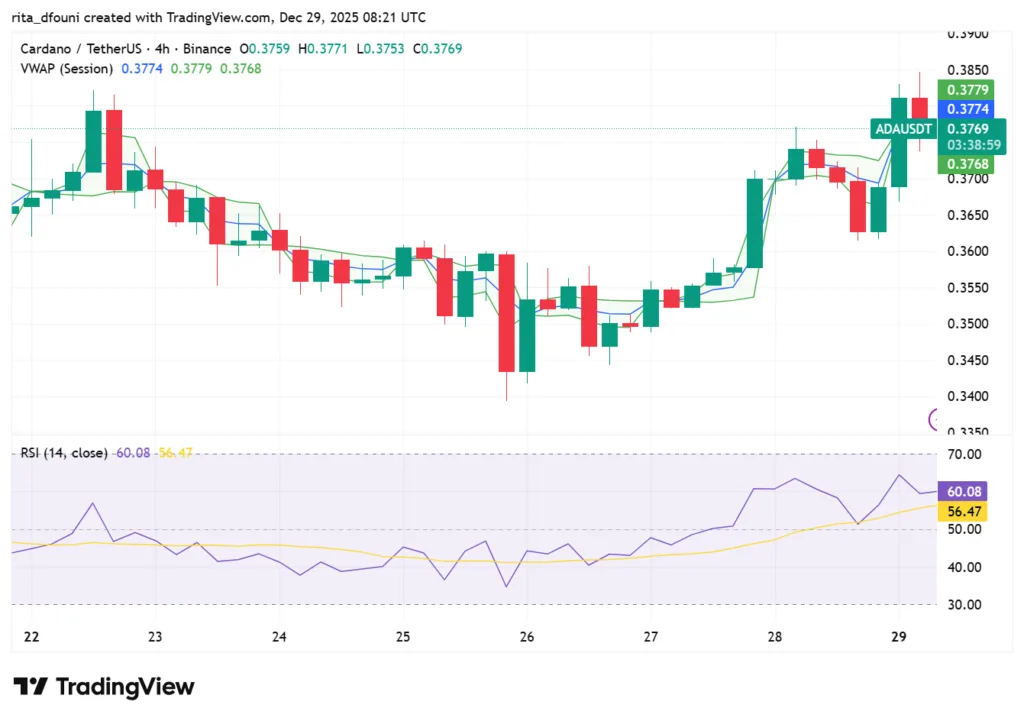

From a technical standpoint, ADA hints at a bottoming after losing the long-term support that had held for a long time earlier in the year. RSI values at the brink of the oversold zone indicate the possibility of selling pressure being over. The level of $0.50 as resistance is still the most important obstacle for the reversal of the trend.

Derivatives and positioning

Leverage is still relatively low while positioning is mostly for the long term and staking. ETF speculation gave a short-lived rise to activity, but the derivatives markets are still quiet and in balance.

On-chain and ecosystem activity

The Cardano ecosystem is still small but gradually growing. If the scaling solutions, infrastructure integrations, and privacy-oriented projects are all done right, the usage might go up a lot.

Macro alignment

The government regulatory engagement and ESG alignment have placed Cardano in a position to improve the macro environment favorably. The approval of an ETF would signify a significant turning point for the participation of institutions.

Investor psychology

The investor community of Cardano is still very patient and focussing on long term investment. The low hype decreases the speculative risk but at the same time, it is a way to delay the momentum. The overall feeling still is of being very slightly optimistic and cautious.

Forward-looking outlook

The potential increase of Cardano is strikingly unbalanced. If the scaling and adoption programs are executed properly then in 2026 large profits may be realized, while if those programs fail then the loss of value will not be great if there are no major disturbances in the market.