Bitcoin has stopped trading as a solely narrative-driven asset. The market has entered a stage where the macroeconomic situation, the amount of liquidity, and the decisions about capital investments have a direct and measurable impact on the price movements.

The speculative instrument that used to be very reflexive is now more and more resembling a macro-sensitive asset whose value is determined by the changes in interest rates, the dynamics of the balance sheet, and the expectations of future risk-adjusted returns.

This change does not remove volatility, but it puts a new perspective on it. Bitcoin is no longer evaluated only on the basis of how much it can rise during the bullish cycles, but on its ability to maintain its position, withstand shocks, and earn its risk premium over time. Grasping this change is vital for the assessment of Bitcoin’s path to 2026.

Formation of price footholds and structural support

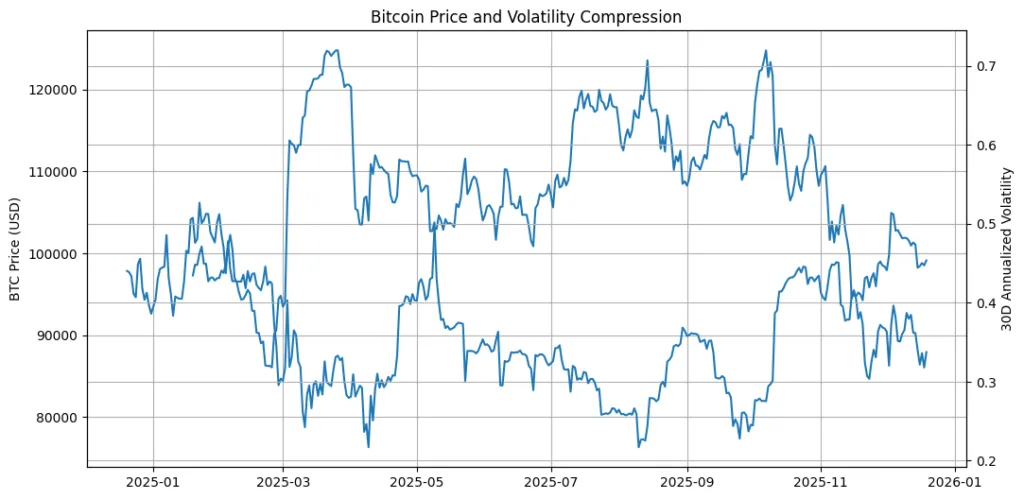

The recent Bitcoin market structure has clearly shown a transition from vertical price discovery to horizontal consolidation. These consolidation zones serve as price footholds where the investment of capital relies less on momentum and more on asymmetric risk-reward. Footholds are created during periods of low volatility and shallow drawdowns compared to historical cycles, which is neither through speculative tops nor panic-driven bottoms. This pattern is indicative of an investor base that is becoming more sophisticated.

A long-term holder is now more price-sensitive and less reactive, so she/he absorbs the supply that comes during the difficult times instead of giving up. On account of this, the price stability of Bitcoin is now determined by the market’s ability to defend and not by the continual inflows. These footholds do not provide an immediate upside but do set a stage where future expansion can happen without the destabilization of excess leverage. The visual that goes with this showing the price of Bitcoin along with the decreasing rolling volatility should come right after this section because it helps to demonstrate that the consolidation is actually happening during the time of volatility compression and not breakdown.

Macro crosswinds and the repricing of opportunity cost

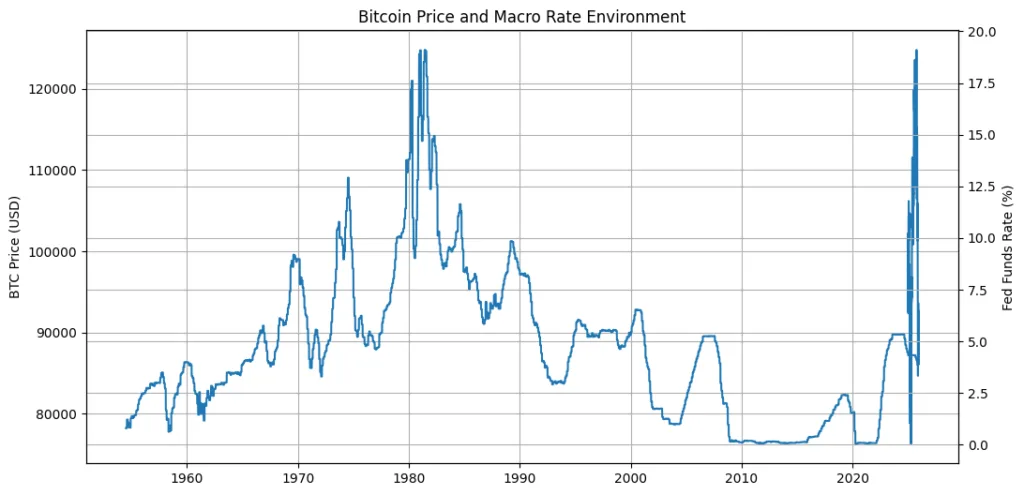

At present, the price of Bitcoin indicates a direct relationship with the opportunity cost. The high policy rates have taken away the neutrality of the decision concerning the holding of Bitcoin vis-à-vis cash or yield-producing instruments. Investors have to be aware of the trade-offs and give up yield for convexity, bear volatility for optionality, and wait for the potential future upside rather than the immediate one.

However, what is really important in this regard is liquidity expectations, not the absolute level of interest rates. The history of Bitcoin shows that the price does not respond to the first rate cut, but to the changes in balance sheet expansion, easier financial conditions, and the belief that money is becoming less tight.

In this way, Bitcoin does not fight against rates; it responds to liquidity.Between the Bitcoin price and the macro rate environment, the relationship shows that the price action is increasingly in line with the broader monetary conditions rather than being driven by isolated crypto-specific narratives.

This alignment is a sign of a structural change in the pricing of Bitcoin, especially as institutional capital starts to factor macro signals into their allocation decisions. To strengthen this macro linkage, the second visual, which compares the Bitcoin price to the Fed Funds rate, should be placed here.

Risk-adjusted return evolution and market maturation

The primary change that is happening now is not so much the return profile of Bitcoin in terms of money but rather its risk-adjusted behavior. The volatility is getting smaller and the big losses are happening less often, and so the Sharpe ratio of Bitcoin is getting better even when the returns are not too high.This is a normal development for assets that are moving from being speculative instruments to being parts of portfolios. The relevant question for the investors by the year 2026 is not anymore whether Bitcoin can be the best performing asset in the absolute sense.

The question has changed to whether Bitcoin is delivering a big enough expected return compared to its volatility to be allocated to in the long run. The data more and more suggests that it is, especially when looking at different portfolios that consider the changes in economic environments. A change this big does not mean that the upside is forever reduced. It rather means that the future upside is going to be coming from longer holding periods and structural positioning over time rather than fast speculative cycles.

The risk efficiency of Bitcoin is getting better and better and sending a signal of maturity rather than of stagnation. The chart showing the rolling Sharpe ratio is a perfect visual representation of this transition, and it deserves to be placed right after this paragraph.

Forward outlook into 2026

Looking ahead, the trajectory of Bitcoin is likely to be marked by stability first and then expansion. The new regime consists of long periods of consolidation, clearer macro sensitivity, and less reflexive volatility. This situation enables the deployment of capital in a disciplined manner rather than taking the risk of exposure affected by the market momentum.

Instead of explosive cycles with all the hype and noise around Bitcoin, the next stage of this digital currency appears to be a longlasting structural relevance. Its strength will not be tested in the sudden crashes, but in the prolonged periods of macro uncertainty when it will have to keep its value.