The founding principles of blockchain technology established its core values which included decentralized systems and transparent operations and protection against centralized authority. The initial story presented on-chain operations as an autonomous system which used code to substitute traditional institutions while its transparent nature prevented any attempts at deceitful activities. The current state of cryptocurrency markets presents an outcome which differs from the initial expected results. The rise in capital investments together with the growing involvement of institutional investors resulted in a transformation of illegal operations which now operates in a different manner.

The market now demonstrates clear signs that hacking and fraud activities which used to exist as isolated events have become integrated into market operations. The entire financial system now operates through organized money laundering activities which use existing financial systems to exploit digital currency networks. The current situation shows that criminal networks now operate complete on-chain systems which enable them to conduct their activities through legally recognized financial markets.

The financialization of illicit flows

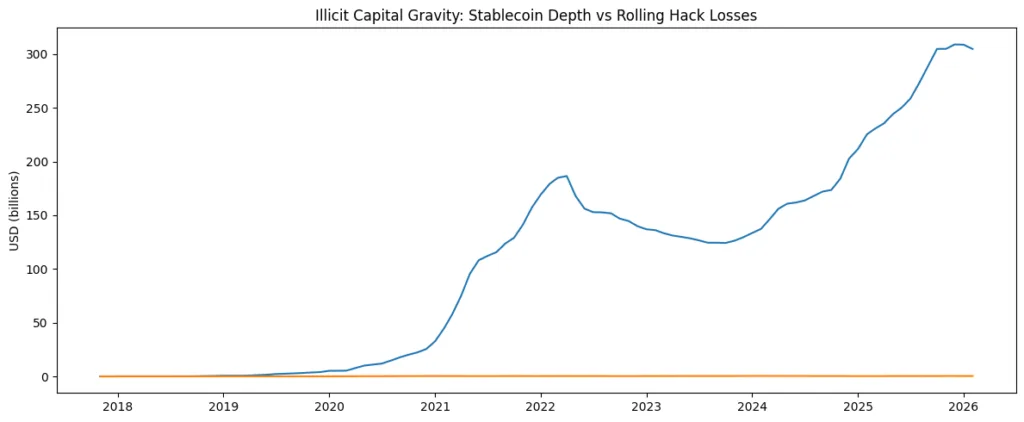

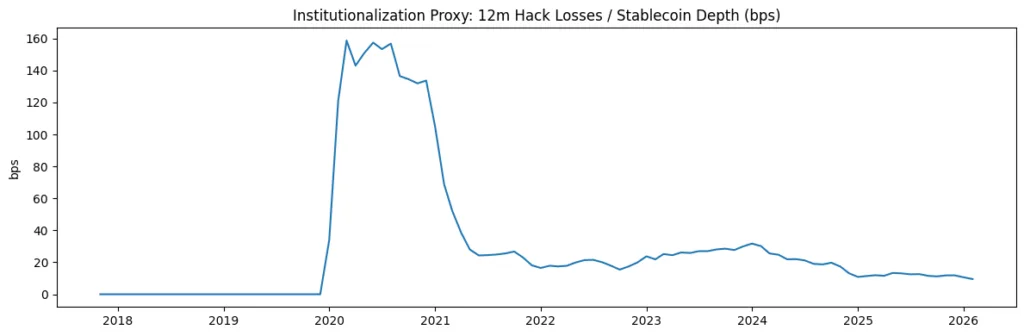

The early blockchain criminal activities used basic methods which involved theft and immediate sale of stolen assets. The current situation appears completely different from the past. The process of funds movement now involves multiple decentralized exchange layers which include cross-chain bridges and automated liquidity pools until funds reach their centralized destinations. This development creates a new type of financial system evolution. Criminal organizations now operate with the same advanced asset management techniques that professional portfolio managers use. The organization utilizes multiple blockchain networks to manage assets while using stablecoins to protect against risks and capitalizing on fragmented markets to hide their activities.

The infrastructure which supports this development exists within DeFi systems. Automated market makers enable users to divide large transactions into smaller individual transactions. The use of cross-chain bridges prevents users from tracking asset origins. Privacy-enhanced protocols create temporary anonymity layers while maintaining liquidity access.The result is not merely “crime happening on-chain,” but a growing shadow financial system operating within the same liquidity environment as institutional investors.

The institutional layer when crime scales like finance

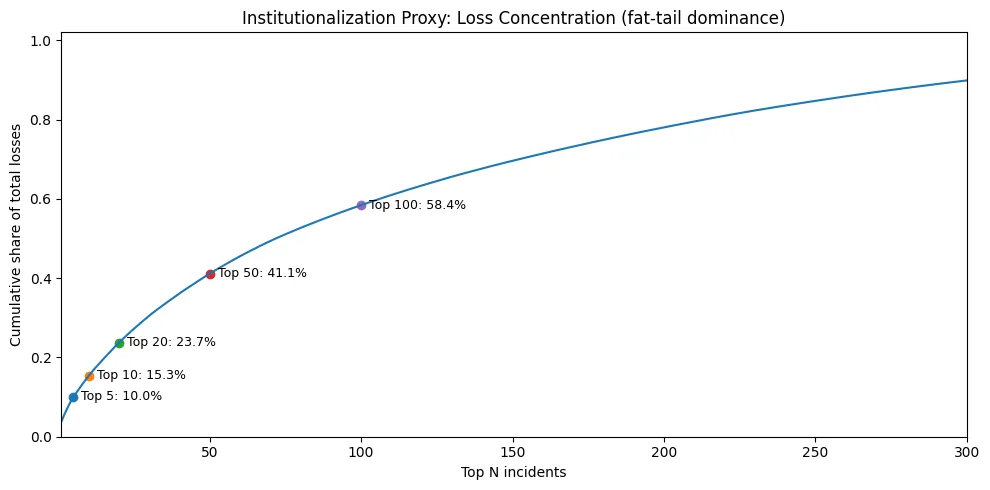

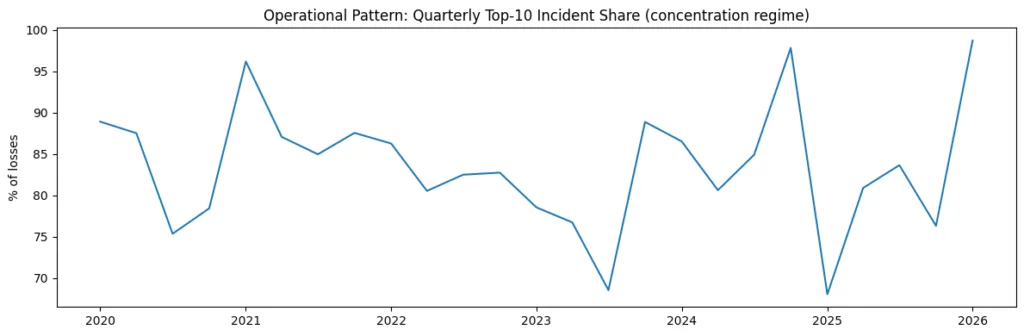

The most concerning shift is structural scale. The on-chain criminal activities of today show growing resemblance to institutional behavior patterns through their operational execution. Capital management strategies show their presence through the analysis of money laundering patterns. The fund managing activities require funds to remain in yield-generating pools while they distribute their assets among different tokens for safer handling of volatility. DeFi ecosystems enable stolen assets to function without detection for extended periods until their value gets converted into cash. Specialization is also emerging.

Some entities focus purely on exploit execution, while others specialize in laundering, cross-chain routing, or liquidity extraction. The operational divisions inside this system replicate the way traditional financial institutions organize their various functions. The institutionalization process creates systemic exposure. The legitimate liquidity providers of the market may establish connections to tainted capital without their awareness, which results in hidden risks that protocols use to enhance their volume metrics through transaction flows. The boundary between legal and illegal capital becomes blurred at the infrastructure level.

DeFi’s structural vulnerability neutral infrastructure, non-neutral outcomes

The design of DeFi protocols establishes their function as unbiased systems which treat all users equally. Smart contracts do not discriminate between users. The technical implementation of this system provides its users with an advantage through balanced operation. The system becomes insecure because high-liquidity protocols turn into perfect channels for money laundering activities which operate silently in the background.

The purpose of automated systems centers around achieving maximum operational efficiency instead of reaching pre-defined objectives. The increased capacity of financial resources to generate financial advantages results in greater difficulties for organizations to obtain their actual benefits. The situation creates an internal conflict which opposes decentralized systems.

The system allows unrestricted innovation through its basic design but this same system enables criminals to conduct financial activities without restrictions. The enforcement process encounters difficulties because regulations usually focus on monitoring financial intermediaries whereas DeFi systems operate without involving any intermediary institutions. The market faces a new risk because criminal activities have shifted from individual operations to basic structural vulnerabilities that exist in liquidity mechanisms which markets are still in the process of discovering.

Market consequences pricing hidden risk

Institutional investors evaluate three factors when they assess smart contract risk and regulatory uncertainty and liquidity volatility. The valuation of hidden illicit exposure still remains unpriced. The market experiences a liquidity freeze which law enforcement operations create because of their sudden effect on markets. The loss of pool volume leads to stablecoin pairs losing stability while confidence shocks spread through all assets that share correlations.

The emerging risk category, which originates from on-chain reputational contagion, demonstrates itself through this case. When major protocols link themselves with substantial illicit financial activities, they will experience capital outflows which will occur regardless of their security systems. The market assesses hidden criminal exposure as an unknown danger which leads to greater uncertainty than it does for confirmed dangers. The DeFi market currently holds an estimating problem because financial institutions fail to recognize the increasing compliance risk premium which affects their valuations.

The regulatory pivot from enforcement to infrastructure control

Regulatory bodies have started to change their approach. The focus of assessment now moves away from individual actors towards infrastructure control systems which include bridge monitoring and stablecoin compliance layers and transaction screening mechanisms which developers build into their protocol frameworks. The present trend demonstrates that decentralized finance will develop into a system which allows open access to its surface while restricting access through its basic operational components.

The question becomes whether decentralization can coexist with institutional compliance requirements or whether liquidity will gradually centralize around regulated rails. The development of innovation faces the risk of being relocated to other locations when regulation takes its enforcement actions beyond acceptable limits. Institutional investors will not increase their capital investments until regulations establish clear guidelines for their operational environment. The balance between two opposing forces remains in a state of uncertainty.