For much of the last ten years, cryptocurrency has been viewed as an unusual asset: unstable, speculative, and insignificant in comparison to the influence of global stocks or government bonds. Bitcoin was regarded as a novelty, Ethereum as a trial framework, and altcoins as gamble tokens. However, the past three years have changed the landscape. The endorsement of Bitcoin and Ethereum ETFs in the U.S. has lifted digital assets from the margins to the forefront of institutional investment. This moment is akin to a diplomatic acknowledgment: cryptocurrency has entered the realm of sovereign-level financial assets.

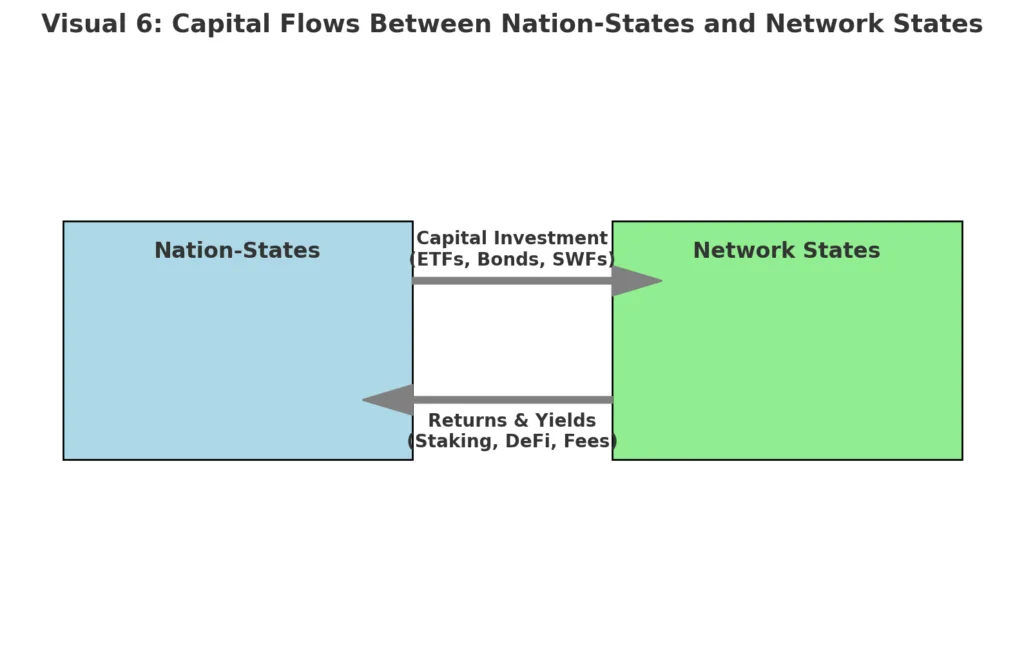

The change has significant consequences. Cryptocurrency is no longer merely another high-risk investment. It is evolving into an independent asset class featuring monetary systems, treasuries, governance structures, and participants as tokenholders. In this regard, blockchains are evolving beyond mere protocols. They are transforming into “network states” where their influence is wielded not via territory or military forces, but through programming, agreement, and financial movements.

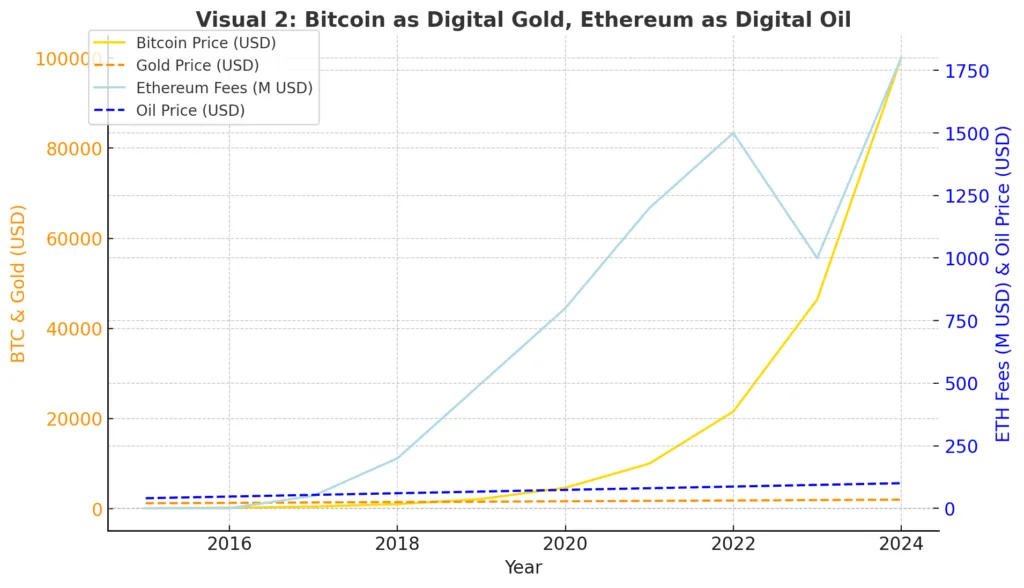

Bitcoin as digital gold, Ethereum as digital oil

The comparison between Bitcoin and gold is now generally acknowledged. Similar to gold, Bitcoin is rare, easily transferable, and not reliant on government-issued currency. Its limited supply and decentralized creation render it resistant to the inflationary tendencies of government-issued currency. Institutional investors are progressively viewing Bitcoin as a safeguard against currency devaluation, serving as a non-political store of value similar to a reserve asset for the 21st century.

Ethereum, on the other hand, has taken on the position of digital oil. Its blockspace powers decentralized applications, similar to how oil drives industrial economies. Gas fees act as the tolls of this economy, while staking yields are akin to sovereign bond coupons. While Bitcoin remains static and unchanging, Ethereum is active and innovative serving as a base for decentralized finance, NFTs, and smart contract frameworks. Collectively, they demonstrate how crypto assets have surpassed the realm of speculative tokens. They now reflect essential goods in worldwide markets.

Network states in capital markets

The phrase “Network State,” made well-known by Balaji Srinivasan, embodies this change. A network state is an online community that ultimately attains financial, cultural, and possibly territorial independence. In capital markets, significant protocols are currently functioning as such entities. Ethereum acts as a legal framework where regulations are implemented through smart contracts. Solana is a fast competitor, designed for efficiency akin to a bustling industrial center. Cosmos functions as a federation, connecting various jurisdictions via common standards.

All of these networks exhibit the characteristics of a state economy. They gather income through fees. They hold treasuries that invest funds in growth. They allocate returns to individuals, who engage in governance. They have security personnel known as validators, who uphold consensus. Total value locked (TVL), staking returns, and transaction volumes serve as GDP-like indicators for these digital domains. Capital markets are progressively recognizing them in this manner, viewing protocols not merely as software startups but as independent entities.

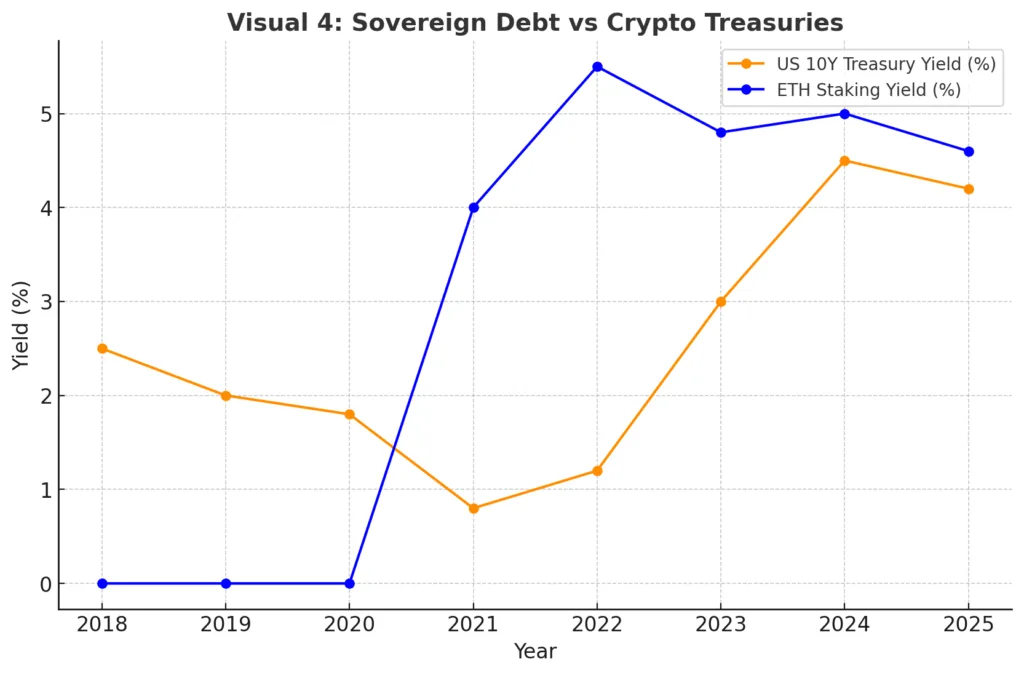

Sovereign debt and treasuries within cryptocurrency

Nothing demonstrates crypto’s independence more distinctly than its developing debt markets. Similar to how countries release bonds to fund expenditures, protocols oversee treasuries and introduce staking derivatives that are akin to government debt. Lido’s stETH functions like a government bond within the Ethereum ecosystem: it is liquid, generates yield, and is largely recognized as collateral. MakerDAO’s DAI stablecoin is supported by reserves and governance structures that resemble central bank asset holdings.

Protocol-controlled value (PCV) serves as a backup fund, similar to sovereign wealth funds. DAOs distribute funds to important investments, much like how governments utilize fiscal policy. Yield farming initiatives resemble stimulus programs. These tools uncover a developing economic dimension, similar to the function of sovereign debt in conventional finance. Through the possession of staking tokens or governance bonds, investors are effectively funding the operations of network states

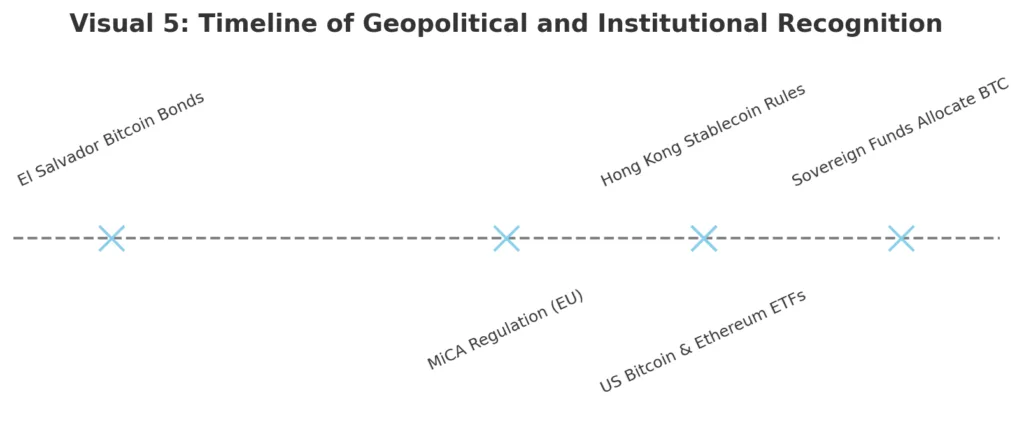

Geopolitics and institutional capital

The rise of crypto as an independent asset class is not happening in isolation. Governments and financial entities are already adjusting their strategies accordingly. El Salvador launched Bitcoin bonds to integrate digital finance with sovereign finance. Hong Kong is creating a regulatory framework for stablecoins, indicating a willingness to embrace network-native currencies. The European Union has enacted MiCA, establishing a legal framework for digital assets across the continent.

The institutional shift is the most important. Pension funds, sovereign wealth funds, and hedge funds are increasingly acquiring Bitcoin and Ethereum, viewing them not merely as speculative technology investments, but as macro hedges similar to gold, commodities, or debt from emerging markets. The approvals of ETFs in the United States go beyond being mere product introductions. They signify the integration of cryptocurrency into the established framework of capital distribution. Cryptocurrency is now valued, exchanged, and compared to national assets.

Risks and the road ahead

Referring to crypto as sovereign does not imply it is unbeatable. The experiment continues to be delicate. Regulatory pressure persists in molding its boundaries, ranging from SEC actions in the U.S. to China’s total prohibitions. Governance continues to be susceptible to concentration, allowing whales and venture funds to influence votes. Discussions on energy continue, particularly concerning proof-of-work. Fragmentation among chains threatens to weaken network effects.

Nevertheless, the path is clear. With the integration of crypto into capital markets, these networks will encounter the same requirements as governments: transparency, accountability, and standardized disclosures. Investors will seek dashboards monitoring protocol revenues, debt issuance, and reserves. Analysts will create credit ratings for DAOs. Risk frameworks will evolve to regard staking yields as similar to sovereign bonds and token revenues as comparable to fiscal receipts.

The rivalry exists not just between Bitcoin and Ethereum, but also among nation-states and network states for validation in capital markets. Crypto is no longer just a source of disruption. It is becoming essential: a concurrent sovereign layer integrated into global finance.