Macro & liquidity landscape

The crypto industry as a whole has reached a pivotal period of change. The Federal Reserve has declared that quantitative tightening will end on December 1 after two straight rate cuts, signaling a fundamental change from taking liquidity out to supporting it. However, the market does not interpret this as a message of happiness. What would normally be an expansionary push has instead become a cautious wait-and-monitor phase as investors see the reductions as a sign of macro instability rather than growth confidence. Risk assets are valued in this context as though the easing cycle had already been used up completely before it began.

Bitcoin is no longer trading as a straightforward reflection of monetary conditions, despite historically reacting to changes in liquidity more quickly than stocks. Rather, it now serves as a gauge of a wider willingness to take risks. Ironically, mood is still defensive even when liquidity is theoretically improving. The U.S. currency has temporarily recovered its strength, the global equities indices are down, and investors are gravitating for Treasury bills rather than speculative risks. Crypto prices are subject to the invisible gravity of that background. A feedback cycle of ETF redemptions and margin cutbacks has ensnared the money flow that propelled the market to early-year highs. Every macro data point, including manufacturing, inflation, and employment, directly influences the market’s readiness to assume risk overnight.

The cryptocurrency market is reflecting confidence in this type of cycle rather than fundamentals. For speculators, each Fed cut turns into a Rorschach test: is the central bank easing because it can or because it has to? Digital assets are supported by the first interpretation and undermined by the second. The latter is in charge for the time being. We are therefore seeing ongoing price and participation declines in spite of a change in policy that should improve liquidity. Therefore, the macro cycle has produced a paradoxical window where fear and easing coexist, compressing prices even as the nominal cost of capital declines.

Institutional flows and the ETF regime

If the macroenvironment explains the stage, then institutional flows through ETFs explain the actors. Significant capital currently enters and exits the bitcoin market mostly through spot exchange-traded funds during this cycle. Instead of watching fragmented exchange order books, analysts now monitor daily ETF launches and redemptions as if they were the lifeblood of adoption. Over the past few sessions, that heartbeat has gotten irregular. Significant net withdrawals have occurred from Ethereum and Bitcoin ETFs, with hundreds of millions of dollars’ worth of money departing in a matter of days. That kind of flow is qualitatively distinct from retail selling since it reflects risk committees, asset allocation calls, and portfolio-level de-risking rather than impulsive profit-taking.

Just as important as the headline figures is the pattern inside those flows. Large single-day redemptions from flagship funds indicate that some institutions are no longer comfortable keeping ETH exposure into increased volatility and security concerns, making Ethereum products especially vulnerable. Meanwhile, more recent Solana-related items have subtly amassed consistent inflows. This gap demonstrates that institutional investors are reshaping their exposure along storylines they believe to be cleaner and more scalable rather than completely abandoning cryptocurrency. Solana embodies the “growth” narrative with its consumer-app positioning, high-throughput, and innovative ETF wrapper. The macro proxy is still Bitcoin. Ethereum is momentarily caught in the crossfire as it sits at the nexus of regulatory uncertainty and DeFi complexity.

A hierarchy of flows is evolving. Liquid ETF vehicles and assets with straightforward, easily communicated narratives are at the top. Even in a risk-off regime, they can draw long-horizon investors. Assets that rely on more complex narratives, such as smart-contract ecosystems, restaking, and programmable finance, are in the middle. Their worth is more difficult to defend when hacks and drawdowns dominate the news. The lengthy tail of illiquid tokens that rely heavily on speculative leverage is at the bottom. ETF flows demonstrate how capital is moving up this hierarchy from intricate or delicate narratives to more palatable, institutionally acceptable ones. This implies that for the general market, pricing is now significantly influenced by whether a coin is part of a framework that big funds can access, justify, and risk-manage, rather than just on-chain activity or developer metrics.

The practical upshot is that ETF flow data should be seen as primary, not secondary, in any in-depth analysis of the current cryptocurrency market. A structural bid is successfully created beneath the market when net creations prevail for an extended length of time, absorbing volatility and enabling the growth of narratives. Redeemables become a mechanical headwind when they take over. Institutional de-risking through ETF channels can counteract even robust spot buying elsewhere. The current situation, where Bitcoin and Ethereum ETFs are losing money but Solana funds stealthily amass assets, indicates that the market is intentionally limiting its exposure to cryptocurrency rather than being enamored with or terrified of it. The market is wondering whether tokens belong on the speculative periphery and which should be permanent portfolio assets.

Security, DeFi risk premium and the yield question

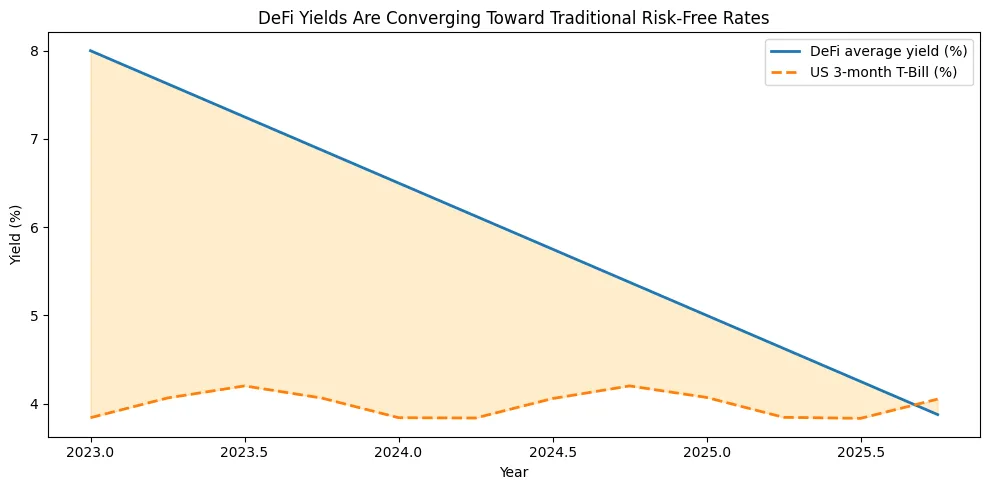

The third act of this market downturn concerns trust in the digital plumbing itself, whereas the first was macro and the second was institutional. DeFi is still the weakest link in the chain, despite being the layer that demonstrated cryptocurrency could reconstruct banking without middlemen. The ecosystem had a number of high-impact exploits in late October and early November, including the Balancer event, which cost more than $120 million over several chains. The psychological underpinnings of yield in DeFi are undermined, in addition to the financial harm. Every double-digit APR is now viewed by investors as a possible warning sign rather than an opportunity.

These security shocks must be timed carefully. They are showing up just when the macro climate is generating a risk-free yield of 4 to 5 percent on money-market instruments and Treasury bills. This comparison compels DeFi to revalue its yields in order to account for counter-party, protocol, and smart-contract risk. Since investors may now obtain comparable returns in fiat space without having to worry about governance attacks or flash-loan exploitation, the old defense that “our yields are higher, thus the risk is warranted” is no longer valid. DeFi’s primary offering, yield, is thus going through the same stress test that banks went through in the early stages of the credit crunch: who do you trust with your liquidity when volatility spikes?

The on-chain flows show the market’s reaction. Even while there is still a stablecoin supply of almost $300 billion, the total value locked across major protocols has decreased, suggesting that capital is remaining in the ecosystem rather than leaving it completely. It is important to note that money has merely gone risk-off within cryptocurrency, not left it. That underutilized liquidity is being tapped by protocols that provide tokenized T-bills, on-chain money-market funds, and yields guaranteed by actual assets. A subtle but significant progression is being marked by this shift: crypto is gradually creating its own internal flight-to-quality mechanism.

As a result, the entire asset class’s psychological anchor is moving away from speculative yield and toward secure yield. Those that approach security as product design rather than as a cost will emerge victorious in the upcoming cycle. DeFi needs to learn how to transparently and consistently price smart-contract risk, much as traditional finance did with credit risk. Until then, protocols that are unable to provide institutional-grade safety will have their prices suppressed by a continuous risk premium. The market has stated unequivocally that yield without trust is leverage masquerading as innovation.

Market structure and price regime

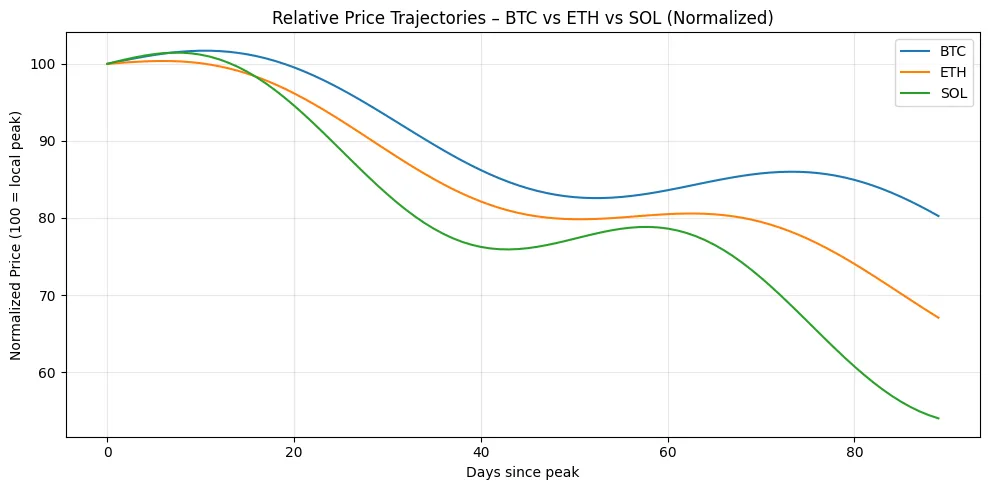

The architecture of the market now reflects redistribution rather than collapse. With almost 60% of the market value, Bitcoin continues to be the gravitational center, but behind that supremacy is a fundamental weakness. About one trillion dollars in total cryptocurrency worth has been erased during the past month as the price of Bitcoin has dropped from its October highs above $130,000 to the $100,000 range. The gradual evaporation of leverage across derivatives and ETFs that had amassed during the previous exuberant months, rather than panic, is what caused this downturn.

The trend has not spared Ethereum. It has experienced larger percentage losses than Bitcoin, trading close to $3,300, with its decline exacerbated by negative ETF flows and fresh worries regarding DeFi exposure. Ethereum’s underperformance demonstrates the market’s preference for simplicity under stress. Capital moves away from ecosystems that rely on sophisticated governance or technological advancements and toward assets that can act as macro proxies and have the least narrative noise in high-volatility regimes.

Despite being technically sound and institutionally validated by ETF inflows, Solana is still seen as having a greater beta. When compared to the severity of the market’s liquidity contraction, its decline to the $150 area is sharp in nominal terms but rather shallow. This indicates that the deleveraging reflex can be slowed, but not stopped, by structural demand via ETF channels.

More broadly, liquidity has shifted toward stablecoins and top-tier tokens, moving away from speculative NFTs and long-tail altcoins. As a reminder that capital is resting rather than escaping, the stablecoin supply, which is still above $300 billion, serves as an internal liquidity buffer. In the past, cyclical recoveries have been preceded by such high stablecoin domination, but only after volatility has stabilized and a new rationale for taking risks has emerged. Until then, crypto trades as a single macro instrument, its internal diversity reduced to a binary: Bitcoin vs everything else.

Narrative and thematic outlook

Every cryptocurrency cycle starts with technology and finishes with narrative. Layer-twos, restaking, DePIN, and real-world assets are multiplied by storylines throughout expansion, and each one promises to be the frontier that redefines utility. These same narrative are compressed during a contraction as investors start to wonder what really adds value when liquidity stops flowing. That inflection has been achieved by the market today: narratives are being revalued in light of a more difficult macro reality, necessitating a differentiation between themes with theoretical potential and those having revenue traction.

Tokenized real-world assets, this year’s most prominent subject, have managed to hold onto some degree of legitimacy. The yields are observable, the legal wrappers are developing, and institutional players comprehend the product. Therefore, RWAs serve as a link between the traditional finance environment, which now offers risk-free rates close to five percent, and the on-chain world. Their perseverance demonstrates how crypto’s survival strategy frequently involves hybridization, as it appropriates the framework of the system it originally aimed to replace in order to remain relevant.

In the meantime, DeFi has changed its focus from expansion to restoration. Protocols that previously sought high TVL are now learning to prioritize resilience, audit transparency, and sustainable revenue sharing in the wake of many attacks and liquidity drains. On the other hand, liquidity has dried up to pre-2021 levels for speculative verticals like meme coins, experimental gaming tokens, or esoteric metaverse assets. Although they no longer serve as portfolio anchors, these segments continue to provide social volume. More than on-chain fundamentals, narrative stickiness and ETF credibility are responsible for the survival of a small number of AI-related and Solana-ecosystem projects.

The two institutional allocation pillars, Ethereum and Bitcoin, are likewise changing within new narratives. The story of Bitcoin has shifted from “digital gold” to macro collateral; it now trades alongside gold and Treasury bonds, exhibiting behavior similar to a liquidity hedge in reverse. As if to remind investors that scalability will still be its difference until trust in DeFi is restored, Ethereum is working to reframe its thesis around efficiency rollups, data availability, and execution layer income.

Therefore, the main narrative of 2025 is one of convergence: cryptocurrency is now a highly volatile layer of finance rather than an alternative system operating in parallel. Its cycles are more determined by institutional flows, liquidity, and regulation than by community or code. Analysts’ framing of value is being influenced by this realization: tokens are repriced like commodities during contraction and valued like early-stage stocks during expansion. Any project’s capacity to endure in both settings will rely more on the narrative’s credibility under pressure than on its level of ambition.

Forward outlook and recovery triggers

Instead of just surrendering, the final act in every crypto cycle is the slow restoration of conviction. All signs point to the fact that we are living in this temporary period. The market’s structural growth was characterized by fundamentals that have remained unchanged, notwithstanding the waning enthusiasm of mid-2025. Future advancements will depend more on restoring trust in infrastructure, liquidity, and governance than they will on innovation.

Whether Bitcoin can continue to serve as a macro hedge during a period of declining growth and inflation is the key question. If the Federal Reserve’s rate reduction are effective in increasing risk appetite without triggering a recession, Bitcoin might regain its standing as a liquid, non-sovereign store of wealth. ETF inflows would likely start up again in such a scenario, and prices would likely re-anchor over the key $100,000 mark. However, if easing is viewed as a panic move intended to counteract more serious economic deterioration, Bitcoin may behave more like a cyclical equities equivalent. As institutions lessen their exposure to all hazardous assets, this could result in additional drawdowns.

Simon Peters, Crypto Market Analyst and UK Account Management Team Leader at eToro, commented: “Ahead of the meeting, the market’s probability of a rate cut stood as high as 96%. After the press conference, this dropped drastically to less than 70%, highlighting a clear shift toward risk-off sentiment. The Crypto Fear and Greed Index has since fallen into ‘Extreme Fear’ territory.”

According to market data, liquidations totalling approximately $915 million since the start of November have further amplified selling pressure across crypto assets. Peters added that while the correction may unsettle some investors, volatility of this scale is not unusual for Bitcoin.

“Bitcoin has seen several 30%+ drawdowns in recent years – the last between January and April, when it dropped from $109,000 to $74,500, before rallying 70% to its current all-time high of $126,300,” he said.

Ethereum’s outlook is similarly binary, despite being impacted by internal factors rather than external ones. The network must demonstrate its ability to convert its extensive ecology into measurable cash flows and security. It will be determined by rollup costs, restaking economics, and Layer-2 activity if ETH can restore its standing as a “productive asset.” It risks being seen as merely a Bitcoin beta instead of a cutting-edge platform in the absence of such proof of revenue. Solana’s rising consumer applications, fast expanding developer community, and ETF validity have made it the structural challenger in the approaching bull phase, putting it in a strong position despite the short-term difficulties. If macro conditions stabilize, Solana, the intersection of retail and institutional flows, might emerge as the next liquidity magnet for risk-on sentiment.

Reviving stablecoin liquidity will be essential to the market’s recovery on a broader scale. Currently, stablecoins make up about a tenth of the total market capitalization and act as the system’s reserve currency. When that capital begins to move, whether into RWAs, staking pools, or ETF products, a new accumulation period will officially begin. These shifts usually follow a pattern: funding rates normalize, volatility decreases, and capital redeploys into blue chips before leaking down the risk curve.

Therefore, whether cryptocurrency enters a protracted sideways period or has an early recovery will be determined over the coming months. The market is scared but not unfaithful, hurt but not broken. This correction may be remembered as the repricing that set the stage for sustainable growth rather than as the end, provided that trust in institutional flows returns and DeFi security stabilizes.