The earnings paradox in crypto

The lack of fundamentals in cryptocurrency markets is one of the most common criticisms leveled at them. Crypto assets are sometimes written off as narrative-driven products that fluctuate based solely on conjecture, in contrast to stocks, which are valued on earnings, cash flows, and balance-sheet strength. However, this framing is becoming less and less relevant. Crypto now produces actual, quantifiable revenue across layer-1 networks, decentralized finance, and application-specific protocols. Recurring cash flows that closely mirror traditional finance earnings include trading fees, transaction expenses, MEV capture, sequencer income, staking commissions, and protocol-owned liquidity.

The paradox isn’t that cryptocurrency doesn’t make money. The contradiction lies in the fact that most markets won’t price them.

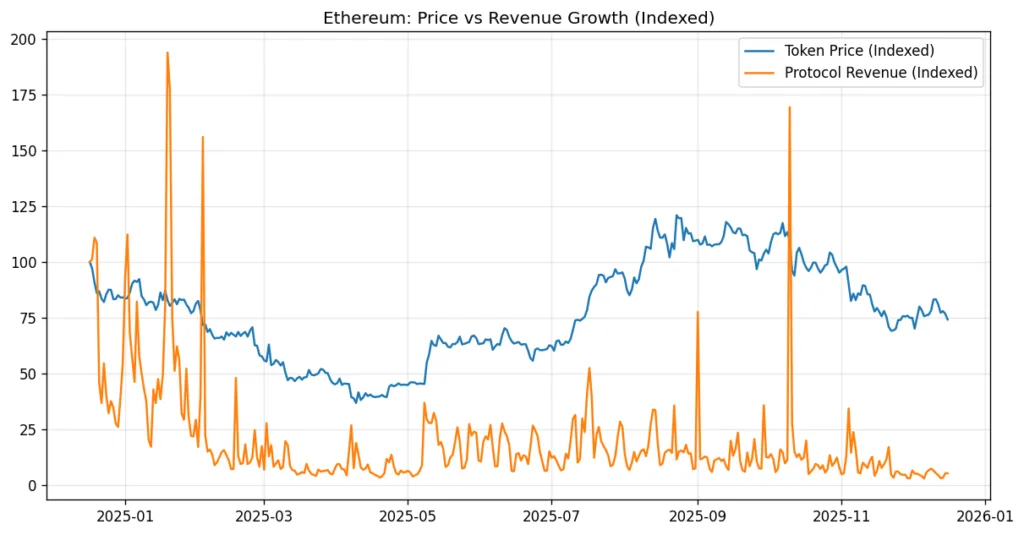

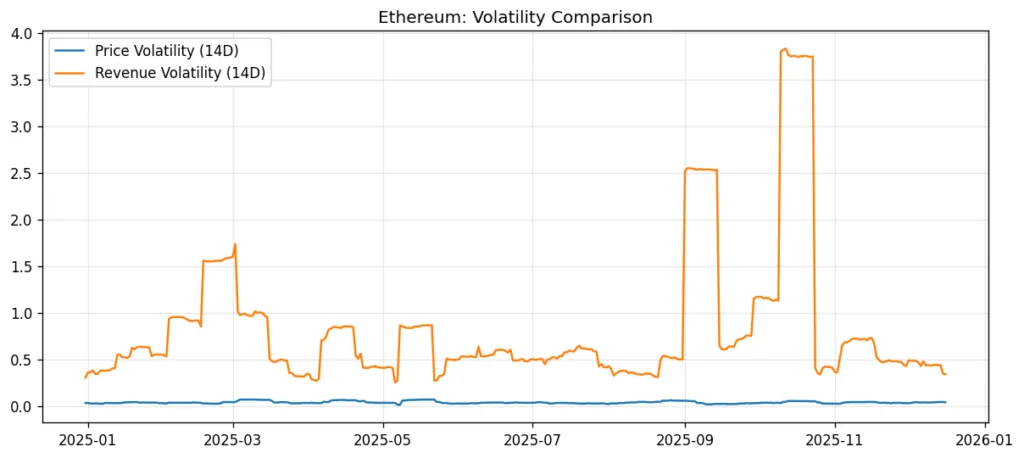

Token values continue to react more to momentum, macro narratives, and liquidity cycles than to steady income creation, especially in spite of billions of dollars in annualized protocol revenue. For investors, this discrepancy poses a basic question: are cryptocurrency markets inherently inefficient, or are earnings just not yet the appropriate valuation anchor?

What “earnings” actually mean in crypto

It is first required to define earnings in this environment in order to comprehend why crypto earnings are undervalued. The majority of cryptocurrency protocols do not pay out dividends on revenues, in contrast to businesses. Revenue can be partially diverted to validators and liquidity providers, burned, accumulated in a treasury, or used to support users. Token holders are frequently fundamentally cut off from the cash flows they contribute to.

However, in terms of the economy, these revenues are just as real as corporate profits. Trading fees are collected by decentralized exchanges. Gas costs are collected by Layer-1 blockchains. Commissions are charged by staking systems. Interest spreads are earned via lending processes. With operating margins that would be regarded as extraordinary in traditional finance, a number of cryptocurrency protocols continuously produced revenue in 2024 and 2025 that was on par with mid-cap public firms.

The lack of earnings is not the problem. It is the lack of explicit, legally binding claims to those profits.

Why markets ignore crypto cash flows

For institutional, behavioral, and structural factors, cryptocurrency markets have difficulty pricing profitability.

In terms of structure, the majority of tokens do not give their owners a mechanical or legal right to cash flows. In contrast to equities, where profits are finally distributed to shareholders, cryptocurrency revenue frequently builds up in treasuries under the supervision of sluggish, uncertain, or political governance procedures. Earnings without a certain route to distribution are discounted by investors.

In terms of behavior, cryptocurrency has developed in a speculative setting. Rather than cash generation, adoption curves, narrative changes, and liquidity growth drove returns for over ten years. Investors were conditioned to prioritize price momentum over valuation indicators as a result. The market frequently views earnings as secondary signals rather than primary drivers, even when they do exist.

Classifying cryptocurrency revenue continues to be a challenge for traditional asset managers. Are dividends, commodities royalties, or platform fees more comparable to protocol revenue? It is challenging to predict, compare, and defend earnings inside traditional portfolios in the absence of standardized frameworks. Because of this, institutional capital still values cryptocurrency more as a macro-risk asset than as a yield-producing one.

The token-holder disconnect problem

The mismatch between token value accrual and protocol success is one of the key reasons earnings are still underpriced.

Many protocols make a substantial profit without providing token holders with any real benefits. Stablecoins may be used to pay fees, but token demand is never converted. Despite good top-line success, tokens may dilute holders if they inflate more quickly than revenue. Value capture may be further delayed if growth subsidies are given precedence over profitability in governance choices.

This disconnect creates skepticism. Investors learn, often painfully, that rising protocol revenue does not necessarily translate into rising token prices. Over time, markets internalize this lesson and discount earnings entirely, even in cases where tokenomics are improving.

Ironically, despite the fact that more recent designs specifically address value accrual through fee burning, staking yield, and buyback mechanisms, this mistrust endures.

When earnings do start to matter

Even though cryptocurrency earnings are generally ignored, there are times when they become quite important.

Speculative capital withdraws when liquidity is scarce. Stories deteriorate. Momentum wanes. Protocols with genuine, long-term income typically do better in these settings. The economic activity they enable, rather than the hype, is what limits their downside.

Throughout cycles, this pattern has been repeated. Investors choose investments that resemble businesses over experiments when their risk appetite declines. Even if revenue does not entirely drive valuation multiples, it becomes a stabilizing anchor.

The subtle but significant implication is that cryptocurrency profits are not permanently disregarded. Until they are required, they are disregarded.

Valuation without anchors: The cost of ignoring earnings

There is a price for not pricing earnings. Valuations become extremely reactive in the absence of cash-flow anchors. Prices fluctuate due to changes in the market. This dynamic raises the possibility of abrupt regime changes and increases volatility.

The lack of earnings-based pricing makes it challenging for long-term investors to discern between transient speculation and sustainable growth. The market sees two processes as identical risk exposures even though they generate quite different quantities of revenue and trade at similar market capitalizations.

This does not indicate a sophisticated market. It indicates that price discovery is not yet complete.

The slow transition toward financialization

The transfer of cryptocurrency from story markets to financial markets is happening gradually but irreversibly. Earnings will be more difficult to overlook as institutional involvement grows, regulatory clarity improves, and token design places a greater emphasis on value capture.

This change won’t occur right away. Asset by asset and protocol by protocol, it will happen unevenly. As pure sentiment vehicles, certain tokens will still be traded. Others will become more and more like yield-bearing instruments, priced more for sustainability than for thrills.

The repricing may occur suddenly when this transition quickens. As investors reevaluate what counts, assets that currently produce significant revenue but are traded as speculative tokens may undergo structural reratings.

Crypto markets are incomplete, not unreasonable, in their disregard for profits. The frameworks, incentives, and investor conditioning are still developing, but the technology for pricing cash flows is already in place. Stories over spreadsheets and momentum over margins are preferred in today’s market. This indicates that earnings are latent rather than inconsequential.

Finding protocols where revenue is genuine, long-lasting, and increasingly correlated with token value but the market continues to price the asset as if none of that matters is the true potential. This is referred to as mispricing in conventional finance. It is still accepted as typical conduct in cryptocurrency.

This normalization won’t continue indefinitely.