After 2008, investors learned to expect rescue because central banks lowered rates to zero whenever GDP stalled. Ten years of easy liquidity, inflated valuations, and the first cryptocurrency bull markets were the results of this reaction. Today, that response is not working. The “neutral rate” has risen even in the case of a 2025 Fed decrease. Again, there is a cost associated with money, and that cost may stay at 5%.

This new macro structure rewrites the rules for digital assets created in a zero-rate environment. Now, against a backdrop of consistent real returns on cash, the scarcity of Bitcoin, the yield of Ethereum, and the leverage of DeFi will be put to the test.

Macro repricing: From zero to five

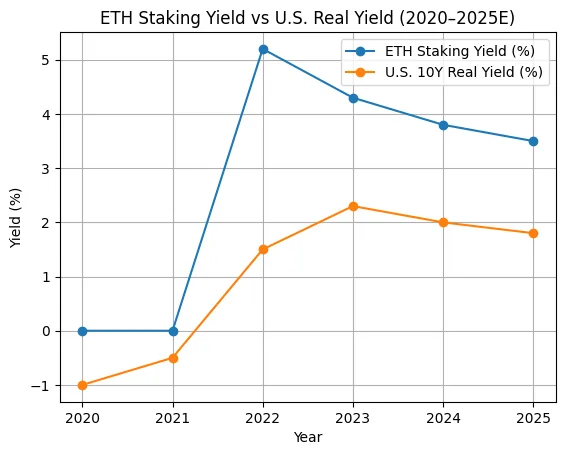

The boom of 2020–2021 occurred while real yields were negative. Risk was the only way to prevent monetary erosion, cash earned nothing, and inflation was high. Real yield was restored in 2023 when policy rates increased more quickly than prices.

Every token in a 5% world has a clear opportunity cost. Investors now inquire, “Is this project worth more than a Treasury bill?” rather than, “Is this project exciting?” Therefore, productive yield staking, on-chain cash flows, or tokenized collateral efficiency rather than printed liquidity must be the driving forces behind the next crypto development.

Bitcoin: Digital gold with a carry trade

The idea behind Bitcoin was to counteract the devaluation of money. However, when cash itself pays 5%, the reasoning behind “digital gold” falters. Holding Bitcoin had virtually no opportunity cost in 2021; today, it costs the same amount of yield per year as a risk-free bond.

Gold has historically underperformed at times when real rates were rising and only recovered when policy became inflationary. This trend is exacerbated by Bitcoin’s volatility, which flourishes when liquidity is abundant but falters when investors can find safe returns elsewhere. Bitcoin might end up as digital collateral valued for its independence rather than its yieldlessness in a persistently positive-rate environment. Its premium no longer depends solely on scarcity but also on cross-border utility, custody quality, and credibility.

Ethereum and the tokenized carry trade

With Ethereum’s switch to proof-of-stake, an endogenous yield mechanism was implemented. ETH now directly competes with government bonds, with staking returns averaging between 3 and 4%. With this new identity, Ethereum is positioned as a programmable yield asset in a global fixed-income layer that generates on-chain carry trades through restaking protocols, validators, and LST providers.

Ethereum’s staking yield may follow sovereign returns if real rates settle around 2% to 3%, grounding its value in macro parity rather than hype. ETH serves as the foundational collateral for a new digital bond market as DeFi protocols tokenize and rehypothecate those yields, connecting crypto finance to conventional yield curves.

RWAs and the yield premium migration

Real-world assets (RWAs) are the area of cryptocurrency that is expanding the fastest as risk-free rates climb. Now offering 4–5% on-chain, tokenized T-bills, corporate debt, and money-market products combine blockchain compatibility with regulatory safety.

DeFi undergoes a structural transformation with this migration, changing from leveraged speculation to an on-chain fixed-income clearing layer. As institutional investors employ blockchain rails to earn regulated income without middlemen, tokenized RWAs may overtake legacy DeFi TVL by 2026. The main theme shifts from leverage to yield.

The stablecoin paradox

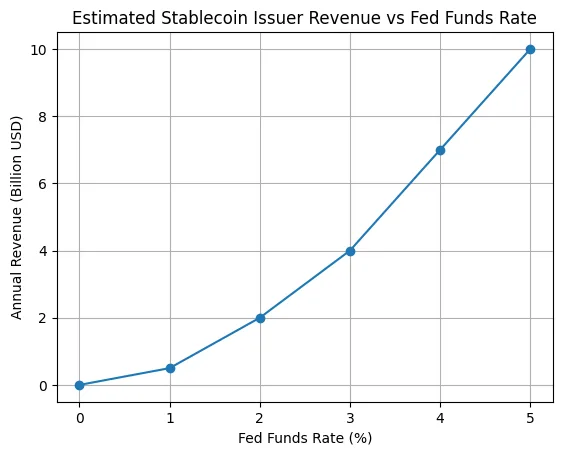

Issuers of stablecoins received marginal float revenue at zero rates. They print billions at 5%. Tether and Circle have become invisible financial institutions, collecting more interest than many mid-sized banks. Both the profit and the regulatory strain increase as the rate does.

Yield-sharing stablecoins, in which users receive a portion of the reserve revenue, are the direction of future innovation. Each token becomes a micro-deposit in a 5% environment, forcing the creation of a “savings-stablecoin.” Thus, stablecoins undergo a silent revolution in monetary design as they transform from neutral payment rails into digital dollars that generate income.

From growth to scarcity: The new crypto premium

The speculative multiple across risk assets is compressed by a structurally higher cost of capital. Once pricing endless growth, the cryptocurrency market now needs to demonstrate robust yield. Protocols driven solely by story will wane; those with tangible revenue, clear risk, and long-term need will prevail.

The digital reserve’s credibility anchor, Bitcoin, is unaffected by dilution. Ethereum serves as a yield-engine’s productive layer that connects capital and code. The financial infrastructure that connects Web3 liquidity and fiat yield is constructed by stablecoins and RWAs. Together, they outline the structure of a disciplined, yield-aware, and macroeconomically integrated “5% crypto economy.”