During the most part of the history of cryptocurrencies, attention was the primary driving force. The stories circulated quicker than the money and liquidity, hype overshadowed the fundamental aspects, and noise was the only reason for price movements. There was more of a narrative in the market than structural factors. People’s feelings decided the level of their participation and the flow of money was dependent on the triggers. The market was very unstable but the narratives were the ones who brought that instability. This phase is coming to an end. In 2026, crypto is not anymore responding to every piece of news, every influencer’s thread, or every speculative story. The market has become quite selective in its participation.

Money is still there, but the market is the one to decide how much attention it gets. The traders are not anymore running after the tales. They are considering the market structure, liquidity conditions, and macroeconomic alignment. This transition is not an indication of loss of interest; it is an indication of growth. Crypto is moving from an attention-based ecosystem to a discipline-based market.

The attention economy was crypto’s growth engine

In the past cycles, the attention itself was a precursor. Visibility brought the deal to a market that they could sell and buy. The market became more unstable and more people started to pay attention. The cycle of feedback was self-empowering. The stories did not have to be rational from an economic viewpoint. They just had to be interesting. The social media interactions indicated the demand. The hype cycles were like the compressing of the timelines. The projects went from being almost unknown to being worth a billion dollars in weeks, not years.

The market was guided by the momentum rather than by the basics. This kind of environment made it ideal for the quick to gather more profits than the structured and the creative. But the systems based on attention are weak by nature and require continuous novelty. When the stories get to be told again, the power of the stories diminishes. By the year 2026, the crypto had run through most of the novelty cycles.

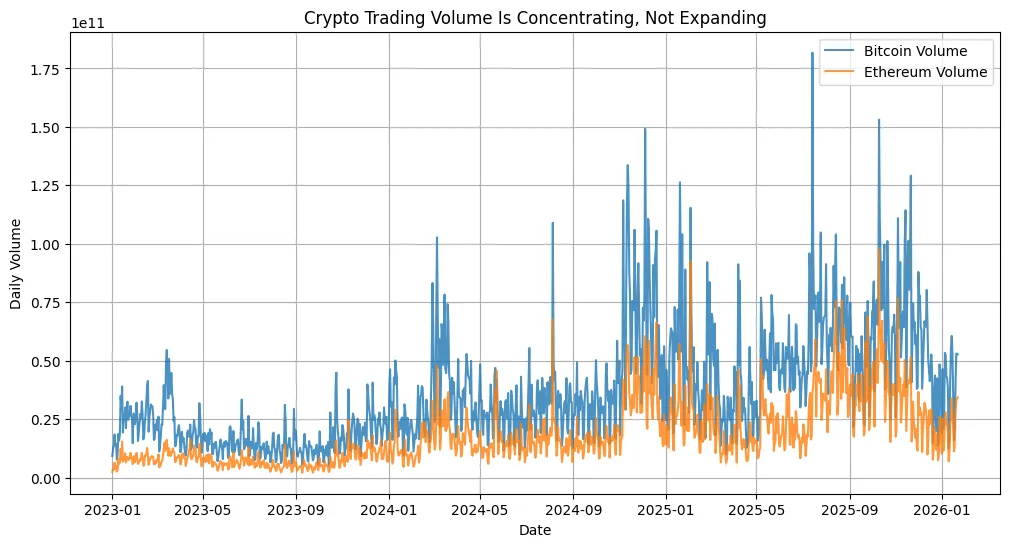

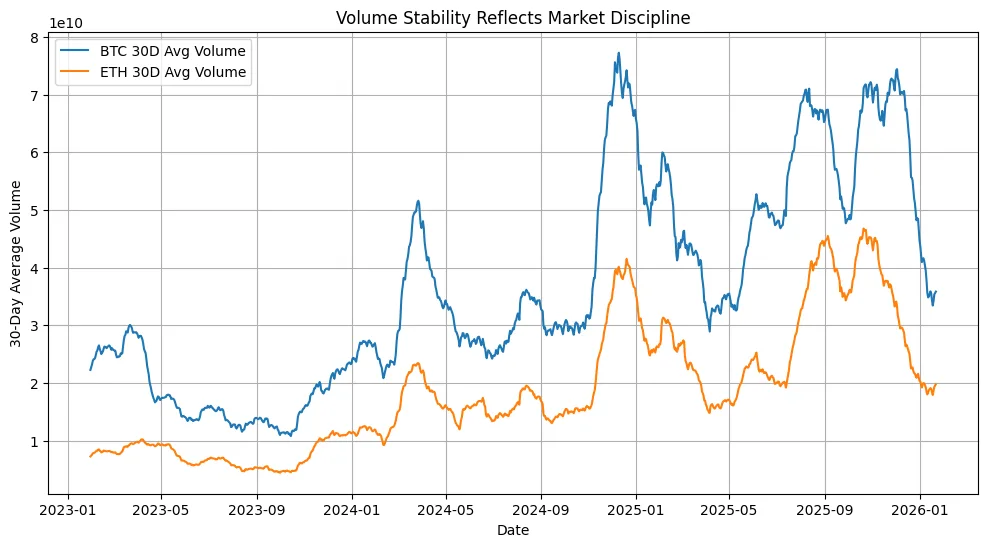

Volume is concentrating, not disappearing

The notion that interest is going down can be traced back to signals that are only perceptibly apparent. The level of social interaction is lower. The life cycle of memes is shorter. Retail activity has been more careful.On the other hand, the activities made on the blockchain, the volume of derivatives, and the involvement of institutions reveal a different narrative.Liquidity has not disappeared. It has been reduced to a small area. The money now focuses on the assets that have a fundamental importance to the market. Bitcoin is still the main macro expression.

Ethereum has not given up on its position as the settlement layer. The largest Layer-1s are the ones that attract infrastructure capital. DeFi platforms that are integrated with the yield-driven flows are the ones that capture the flow. Regulated products are the ones that absorb institutional demand. Smaller assets no longer get automatic inflows just because there is a narrative. The ecosystem does not have evenly distributed attention anymore. It is now selective, conditional, and based on performance. This concentration is a reflection of a more logical market. Now, capital reacts to the situation rather than to the stories.

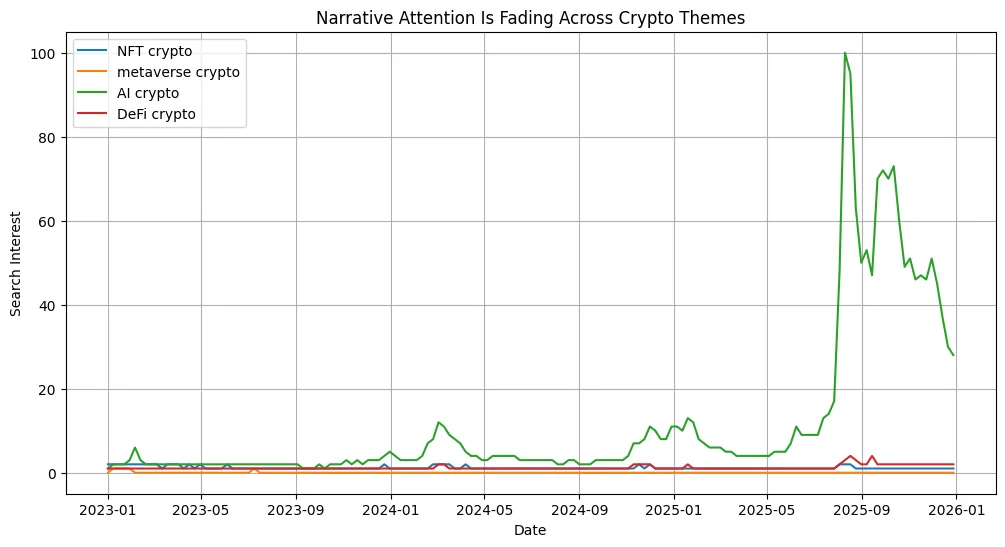

Narrative fatigue is structural, not cyclical

Crypto has been through virtually all of the major narratives one could think of. Decentralized finance was thought to take over banks. The digital art market was said to be replaced by NFTs. Reality was to be replaced by the metaverse. Software use would be restricted to AI tokens only. Each of these narratives created a huge amount of interest and at the same time, each was ultimately exhausted.Nobody is excited about new things anymore.

The market is only responding to what is possible and realistic.The year 2026 has already come with participants developing immunity against the narratives. It is not sufficient anymore to just tell a story. The story has to be backed with economic substance, usage, and liquidity depth, the market’s ability to support traders buying and selling.Even though this is not the case of skepticism, it is at the very least a sign of good judgment.Narrative fatigue is not a passing phase but a major, structural change in how value is perceived.

Attention no longer drives price

In the past cycles, market movements could be influenced solely by attention. Actors like a viral thread, a celebrity endorsement, and a trending story could cause immediate price fluctuations. The situation is now opposite. Price changes are mainly dictated by macro factors, liquidity, big players’ moves, and risk tolerance.

The interest is now the result of the price and not the other way around. The market has changed its reflexivity in another sense. The flow of money is the first step and then comes the visibility. This reversal of roles is the reason why the market is perceived to be less active even though there is considerable participation. The lack of noise is not a sign of the lack of activity. On the contrary, it is a sign that there are no impulsive actions taken.

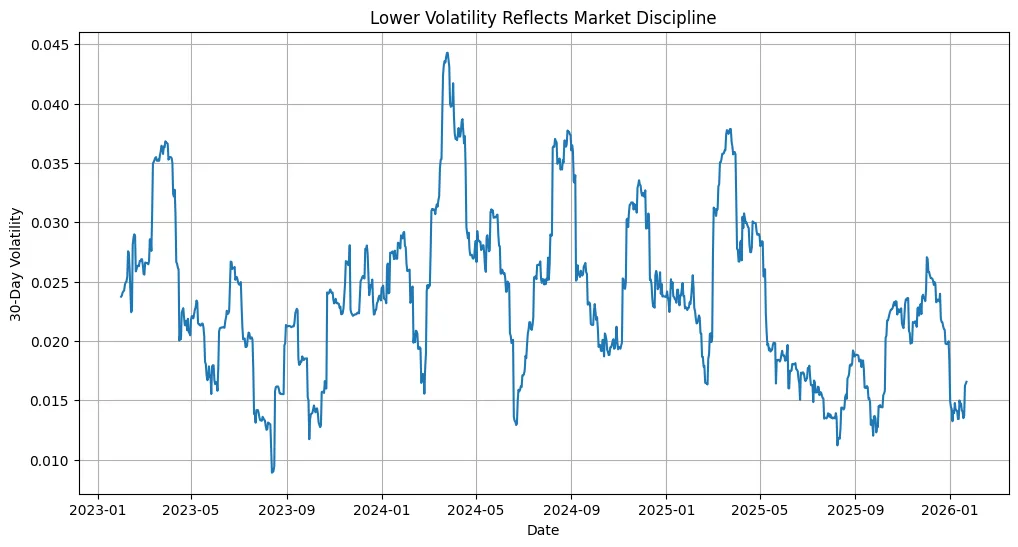

The macro environment enforces discipline

The attention economy of cryptocurrency is gradually decreasing as the macroeconomic environment is not favorable for indiscriminate speculation anymore. Higher rates of interest have made the cost of risking higher. Regulatory scrutiny has raised the compliance bar. The use of leverage is more restricted. Institutional investment wants a very organized and transparent market.

Under these conditions, credibility is not a substitute anymore for basics. The betting wars are between speculators and disciplinarians, and the latter are gradually becoming the winners. The mood of the retail crowd has changed from overbuying to underbuying. Institutions are looking at risk-adjusted exposure rather than the narrative one. The builders’ area is on infrastructure, not visibility. Crypto is no longer casino-like and attractive; it is resistant.

Infrastructure over influence

One more indication of this transition is the direction of investments and human resources flowed. Nowadays, the development efforts are directed towards infrastructure to be at the core, scaling solutions, compliance tools, custody services, and settlement layers. These areas are not getting attention but rather usage.

Companies have cut down on marketing expenses. They have also taken longer in the product development cycle. The numbers of tokens to be launched are fewer and the criteria are stricter. The ecosystem has changed its definition of success from visibility to other metrics in a financial manner rather than a social media platform’s.

The psychological reset

The slowing of the attention economy also reflects a psychological reset among participants.After multiple boom-and-bust cycles, traders have become less reactive. Expectations are more grounded. Risk management has improved.

Emotional trading has declined.This is not apathy. It is experience.Crypto participants have matured alongside the market. They no longer confuse excitement with opportunity or noise with signal.Attention has become a resource, not a reflex.

What this means for the next cycle

It is quite certain that the upcoming period of cryptocurrency growth will not solely depend on hype. Therein, the decisive factor will be structure. Even though the narratives will continue to be present, only those, which very rooted in real usage, liquidity depth, and economic relevance will attract the attention of the people for a long time. The expansion will take time, but it will be not easily broken.

The ups and downs in the market will be less frequent, but they will carry more weight. The new investors will make less noise, but they will be more dedicated. The attention economy has changed its role; it is not the driving force of the market anymore. It has become a product of strength rather than its source. To put it differently, the crypto world isn’t losing its attractiveness, it is, however, becoming more selective.