A market that pretends capital is free

The fundamental tenet of traditional financial markets is that capital has a cost. Investors’ perceptions of time, risk, leverage, and opportunity cost are influenced by interest rates. The risk-free rate serves as the pivot around which the stock, bond, and credit markets revolve.

On the other hand, cryptocurrency markets function in an odd parallel reality. There is no explicit cost of capital, no universally recognized discount curve, and no central policy rate. However, cryptocurrency capital is anything but free. Risk is always priced, but it’s not always clear.

As a result, funding costs, volatility, and dilution subtly take the place of interest rates as the true cost of capital in a market where investors feel rates rather than see them.

A large portion of the dramatic boom-bust behavior, mispricings, and abrupt regime changes in cryptocurrency can be explained by this invisible cost of capital.

What “cost of capital” normally means and why crypto lacks it

In traditional finance, the cost of capital represents the minimum return required to justify deploying funds. It is derived from observable components: risk-free rates, credit spreads, equity risk premiums, and volatility expectations.

There are three reasons why cryptocurrency lacks this framework. First, short-term rates are not anchored by a central bank or sovereign issuer. Second, the majority of cryptocurrency assets don’t produce discountable, predictable cash flows. Third, market mechanisms, not regulated institutions, supply leverage and liquidity.

Investors still have to deal with opportunity cost, though. A token’s locked capital may have been employed in a different protocol, earning income somewhere else, or just kept in stable form. Even though it isn’t referred to as a “interest rate,” that opportunity cost still remains.

The cost of capital is there in cryptocurrency, but it is concealed by market dynamics.

Funding rates: Crypto’s shadow interest rate

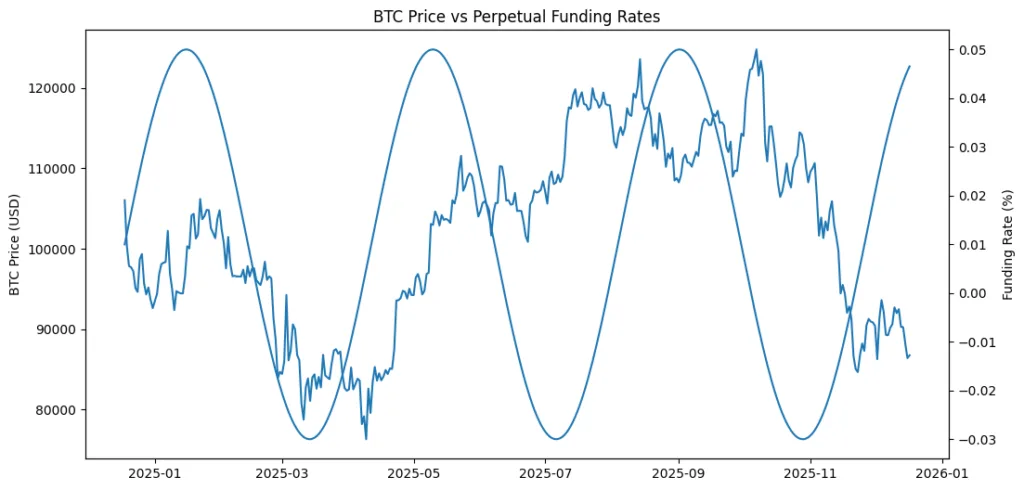

The most obvious indicator of the implicit interest rate in cryptocurrency is perpetual futures financing rates. Longs pay shorts to keep leverage when financing is positive, indicating that capital is willing to assume directional risk. Leverage becomes costly and risk appetite falls when finance gets extremely negative.

Funding is erratic and reactive in contrast to established rates. It reflects crowd behavior and positional imbalance rather than macro aims or policy actions. Because of this, the cost of capital for cryptocurrency is extremely procyclical, being lowest during market peaks and highest at market bottoms.

One of the reasons crypto cycles are so violent is this inversion. Capital seems unrestricted when optimism is at its peak. Capital suddenly becomes unaffordable when fear arises.

Volatility as a capital tax

Volatility in stocks raises the necessary returns. Volatility is the necessary return in cryptocurrency.

Due to the lack of cash flows in the majority of cryptocurrency assets, investors expect price growth as compensation. High volatility turns become a means of paying for capital. But volatility is also a tax because it raises the danger of liquidation, the need for margin, and psychological strain.

This leads to a dilemma. In bull markets, high volatility draws speculative capital, but in times of stress, it increases the effective cost of capital. When volatility spikes, projects that depend on token values to finance development suddenly run out of useful capital.

In this way, volatility takes the place of interest rates as the primary risk pricing factor.

Token dilution as an implied interest payment

Many crypto protocols fund themselves not through debt but through token issuance. Payments to capital providers are represented via inflation schedules, staking rewards, liquidity mining, and ecosystem incentives.

These distributions aren’t free. They serve as an implicit interest expense and diminish current holdings. A protocol’s effective cost of capital increases with the speed at which it produces tokens to draw in capital.

This is finally priced in by markets. When issuance surpasses demand, tokens with strong emissions may see an initial spike but find it difficult to maintain value. This is similar to the dynamics of high-yield debt in conventional markets, where excessive borrowing causes long-term underperformance.

Instead of using balance sheets to conceal this truth, cryptocurrency just uses tokenomics.

Stablecoins and yield: When crypto admits rates exist

The emergence of yield-bearing stablecoins subtly admits what cryptocurrency previously denied: interest rates are important.

Risk assets lose value when stablecoin yields increase. Speculative appetite reappears as yields decline. Despite the fact that no central bank is actively involved, this closely resembles conventional rate cycles.

Global interest rates are basically imported into cryptocurrency through stablecoins. Through capital rotation and arbitrage, money-market returns, repo rates, and Treasury yields now affect on-chain behavior.

Interest rates did not escape cryptocurrency. It just took longer to identify them.

Capital efficiency and the maturity gap

Narratives, growth promises, and optionality were rewarded in early cryptocurrency markets. Instead of earnings, capital flowed freely to ideas. Capital becomes more picky as the market develops.

Protocols that rely solely on hype now have a higher effective cost of capital than those that have genuine revenue, steady fee streams, and sustainable economics. This is similar to the shift that stocks experienced as markets shifted from an obsession with growth to a discipline with cash flow.

Differentiation is making the invisible cost of capital visible. These days, some assets are valued similarly to venture bets. Others are beginning to resemble financial infrastructure that is productive.

The structural risk of a rate-less market

Stabilizers are absent from a market without clear rates. There is neither a soft landing mechanism nor a gradual tightening. Instead of changing policy, adjustments are made through crashes.

Funding rates rise when leverage increases unchecked. Capital costs skyrocket overnight when cash disappears. The rapid and nonlinear appearance of cryptocurrency crises can be explained by this structural fragility.

In the absence of clear capital price, risk builds up covertly until it stops.