The liquidity question no one asks

Every market cycle’s secret engine is liquidity. Liquidity in stocks moves slowly and is influenced by long-term capital mandates, institutional asset allocation, earnings visibility, and central bank policy. Liquidity acts extremely differently with cryptocurrency. It comes in and goes out quickly, condensing whole boom-bust cycles into months instead of years.

This distinction is not merely psychological or anecdotal. It can be seen in funding conditions, capital rotation speed, volatility regimes, volume expansion, and pricing behavior. The difference between cryptocurrency and stock markets becomes structural rather than speculative when viewed through the perspective of liquidity.

How equity liquidity cycles actually work

Cycles of equity liquidity typically take place over several years. As monetary circumstances improve, earnings expectations rise, and institutional risk appetite increases, liquidity progressively increases. Pensions, mutual funds, exchange-traded funds (ETFs), and company buybacks are some of the generally slow-moving and sticky ways that capital enters the stock market.

Liquidity does not instantly disappear once it reaches its peak. Instead of experiencing abrupt crashes, equities markets frequently go through extended topping periods, sector rotations, and value compressions even during tightening cycles. This is due to the fact that genuine cash flows, balance sheets, and controlled leverage limitations serve as the foundation for equity liquidity.

In summary, because stock liquidity is institutional, regulated, and fundamentally grounded, it deteriorates gradually.

Why crypto liquidity moves faster

The design of cryptocurrency liquidity is essentially different. Cryptocurrency capital is worldwide, highly mobile, permissionless, and frequently increased by leverage. Capital controls, required holding periods, and settlement delays are nonexistent. Around the clock, liquidity can move between centralized exchanges, decentralized protocols, and derivatives marketplaces at the same time.

Funding rates and open interest make speculative positioning more obvious, retail participation is larger, and leverage is more readily available. Adjustments are made instantly as liquidity conditions change. No buffer is present.

As a result, the market experiences violent, reactive, and constrained liquidity cycles.

The data: Measuring liquidity compression

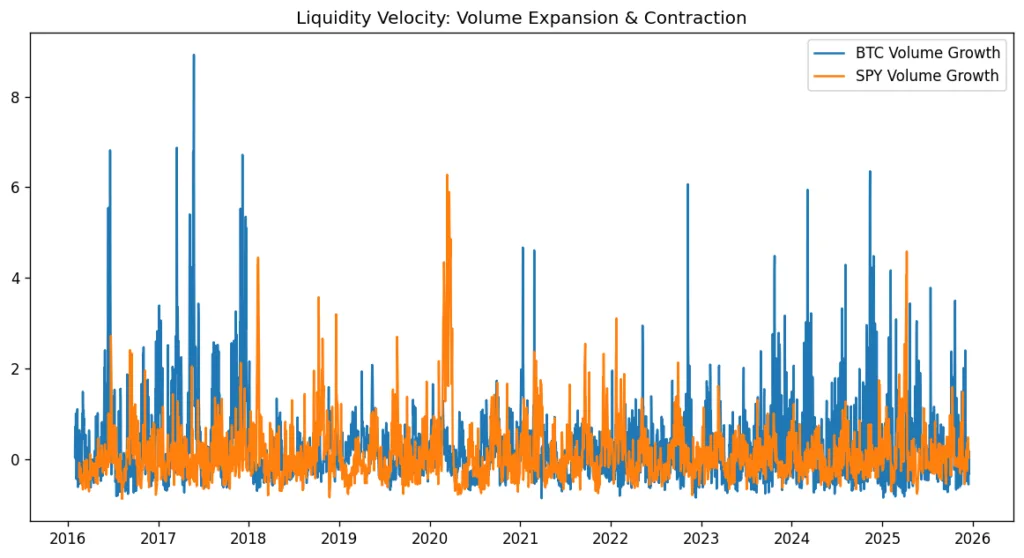

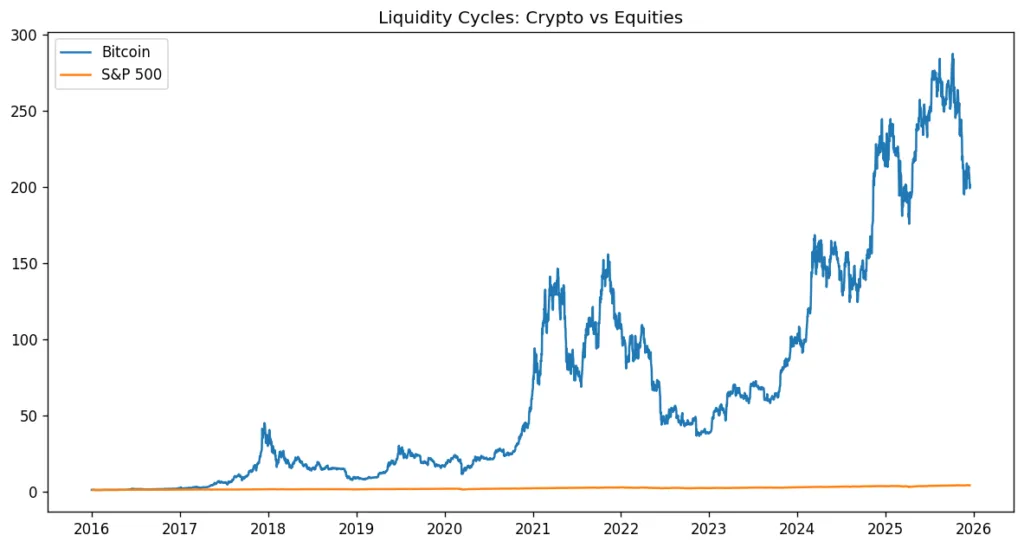

The distinction is clear when we examine past data. When evaluated by volume growth, open interest acceleration, and volatility regimes, Bitcoin and Ethereum liquidity expansions usually reach their peak in six to twelve months. Comparable liquidity expansions in stocks often take three to five years to reach full maturity.

Drawdowns in cryptocurrency also end more quickly. While equity bear markets frequently run far longer than that, particularly when driven by earnings recessions rather than liquidity alone, major cryptocurrency bad markets have traditionally lasted between nine and eighteen months.

Capital rotation speed is another important metric. Within a single cycle, liquidity in cryptocurrency moves from majors to large-cap alts, mid-caps, and speculative microcaps. Sector rotations in stocks can take several quarters or years to complete.

The conclusion is obvious: cryptocurrency liquidity not only moves more quickly, but it also completes entire cycles before stocks complete their initial phase.

Leverage as an accelerator

Leverage elasticity is one of the most obvious causes of shorter crypto liquidity cycles. Regulation, margin restrictions, and institutional risk management all limit leverage in stocks. Leverage in cryptocurrency increases and decreases virtually quickly thanks to on-chain lending and perpetual futures.

Leverage increases the amount of liquidity that enters cryptocurrency. Leverage violently unwinds when liquidity tightens. Compared to stocks, this produces abrupt turning points that define crypto cycles far more clearly.

Funding rates, liquidations, and open interest collapses serve as real-time liquidity indicators that are just not available at the same level of detail in equities markets.

Macro policy still matters but differently

Although the transmission mechanism is quicker and less filtered, macro liquidity still has an impact on cryptocurrency. While equities progressively absorb the same information through earnings revisions and valuation changes, interest rate expectations, dollar liquidity, and risk sentiment move practically immediately into cryptocurrency.

Because of this, cryptocurrencies frequently outperform stocks during pivotal moments. When liquidity decreases, cryptocurrency reacts first. Cryptocurrency breaks first as liquidity tightens. Equities come later, frequently after cryptocurrency has finished a significant amount of its adjustment.

Crypto is extremely sensitive to macro; it is not divorced from it.

What this means for investor

The market should be addressed differently after realizing that crypto liquidity cycles are shorter. Long-term storylines are important, but timing is more important than stocks. The majority of the maneuver is frequently missed while waiting for confirmation. Compared to typical markets, holding through liquidity contractions without modifying exposure might be significantly more detrimental.