The delusion of depth

The cryptocurrency markets are getting closer to the year 2026, and they are still confident as before. The prices are high as they have been in the past, volatility is not so noticeable, and all three areas of the market spot, derivatives, and structured products are probably receiving a lot of capital. However, a fragile condition is developing under this superficial stability. What the majority of the market presently interprets as liquidity is, in fact, not liquidity in the traditional sense, but a state that depends on three conditions: the presence of leverage, alignment of narratives, and a continuous risk appetite.

The market has unknowingly been kept in this state for a long time. Over a number of cycles, capital realized that exits were almost always there, that the market would come back soon, and that macro liquidity would come to the rescue of wrong positioning. The conditioning is now turning into a trap. Markets do not open the door for losing optimism immediately, but they lock the door for losing complacency without any prior notice. The next stage of the crypto market will not be characterized by the innovation headlines or the adoption milestones. Rather, it will be characterized by capital’s actions when liquidity is not assured.

The Liquidity Illusion Explained

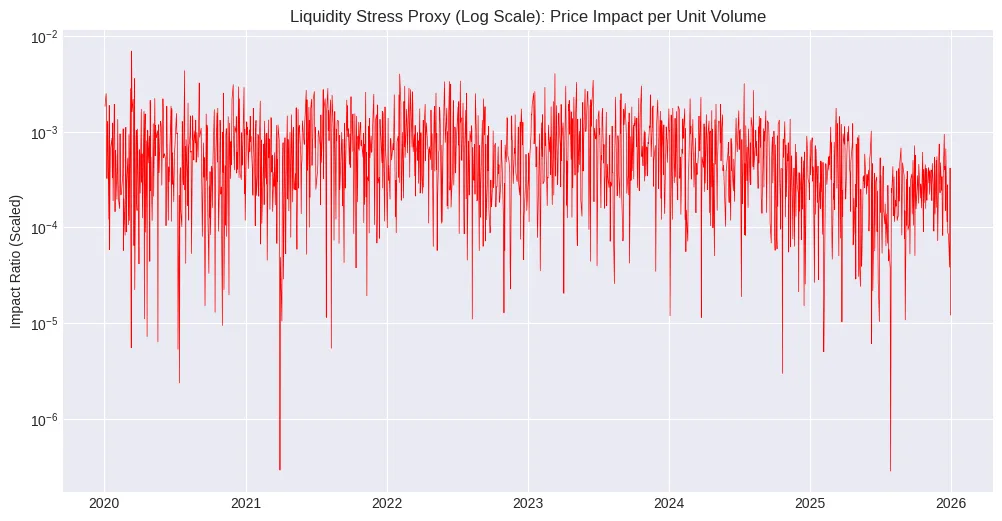

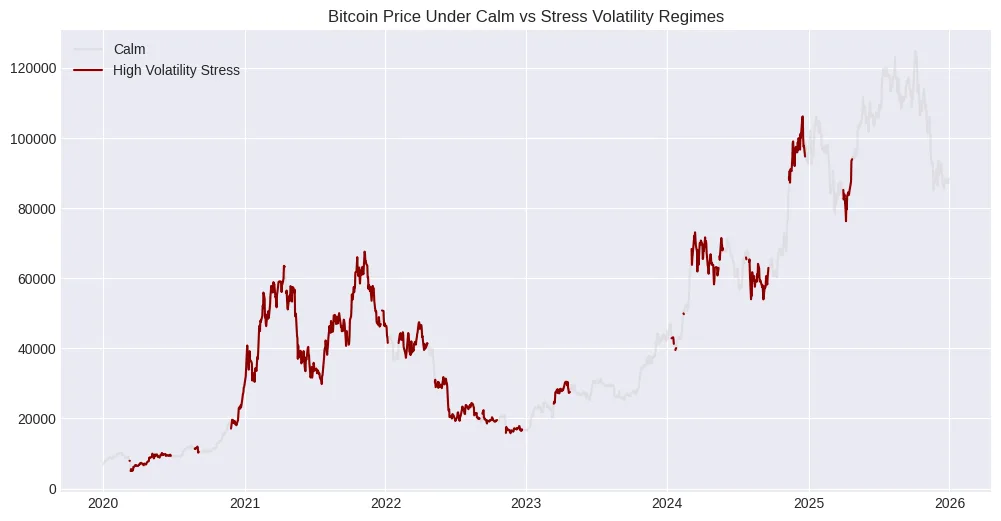

Activity is often equated with liquidity. The resilience of a market is mistaken for high volume, tight spreads, and quick price changes. The reality is that only in times of strife is true liquidity exposed, that is, when big orders are to be executed without upsetting the price, and when sell-offs can happen without being tied to speculative positions or market moods. A lot of the noise in the cryptocurrency market can be said to be just that-noise-most of the liquidity available is there only as long as either the funding is easy or the volatility is one-sided.

Order books can become extremely thin almost immediately after the situation changes. The perpetual futures market, which is the main one for crypto price discovery, relies on speculation rather than authentic two-sided demand. A liquidity reversal is not like a gradual retreat, it is rather a sudden and complete disappearance. This condition makes the market feel like it can still be traded until that very moment when it becomes impossible to trade.

Heap of structural problems under modern crypto markets

This fragility, however, is reinforced by several structural dynamics. The first one is the dominance of derivatives over spot markets. Marginal price action is now dictated by perpetual futures and options, which allow for leverage to substitute for capital. This increases efficiency in calm regimes but dramatically amplifies dislocations during stress. The second is the fragmentation of liquidity. Crypto markets, as opposed to traditional ones, have liquidity spread out through centralized exchanges, decentralized venues, cross-margin products, and opaque OTC flows. These liquidity pools do not act together during periods of volatility.

Capital retreated unevenly causing sharp price gaps even in assets that are considered liquid. The third is narrative synchronization. Capital clusters quickly around themes whether artificial intelligence, restaking, or tokenized real-world assets not because underlying fundamentals justify sustained inflows, but because the assumption is that there is exit liquidity while the narrative holds. Narratives once lose momentum liquidity evaporates faster than price can adjust. The result is a market that seems deep during expansion phases but at the same time reveals extreme brittleness during contraction.

Why 2026 is a structural inflection point

The year 2026 is not significant due to the decline of crypto fundamentals, but rather due to the shift in macro tolerance. The yields on risk-free investments are still attractive. There is no longer a necessity for capital to go outwards to get the return. Every allocation now has to contend with cash, treasuries, and structured yield products that have much lower volatility. This situation implicitly raises the cost of capital for crypto even if there are still nominal inflows. Investors will require better reasons for taking the risk, more efficiency in the use of capital, and more reliable liquidity in case of stress.

Meanwhile, the participation of institutions is going through a process of maturation. Institutions do not make markets stable merely by their entrance. They actively rotate capital, systematically hedge, and pull exposure whenever liquidity is poor. Their presence reduces the time interval for market adjustment. Price recovery happens quicker, not slower. In 2026 the market will come to realize that institutional capital is not patient capital.

The reckoning for lazy capital is near

Lazy capital is far from being unsophisticated in its approach. It is the kind of capital that counts on continuing the same way as before. It believes that the supply of money will return to normal, that the fluctuations in the markets will be very small, and that the exits or sell-offs will still be available as they have always been before.

These predications are deeply rooted in the high-risk long positions, passive index investments, and holding stocks for a long time which are only justified by adoption stories and not by cash flow logic. They are still there because they have been rewarded in the past, not because they are structurally strong. When it is hard to get cash, these positions do not go down.

Money changes hands, price differences shrink, and selling off piles up until months of re-pricing is done in just a few days. The penalty is not that a fund performs worse than others. It is that it has to sell at a loss. The markets do not give a signal to lazy capital. They just take away the right to sit tight.

What is left when the mirage disappears

The assets that will survive the transition will not be the ones attracting most attention. They will be the strongest ones, structurally that is. They will get the capital that can stand the drawdown rather than the one that pulls out at the first signs of trouble.They will keep liquidity through all regimes, not only during the boom periods. Survival will prevail over narrative leadership. Resilience will prevail over velocity. This does not mean superior returns. But it means the relevance of the capital that is selective.