Perpetual futures better known as perps have become the beating heart of the modern crypto economy. Originally introduced as a clever financial engineering trick on BitMEX in 2016, perps allow traders to take long or short positions on digital assets without an expiry date. Unlike traditional futures contracts, which require settlement, perps can be rolled over indefinitely, making them uniquely suited for a market that never sleeps.

What began as a specialized tool for adventurous investors has expanded into the leading influence in cryptocurrency trading. By 2023, daily trading volumes in perpetual futures frequently surpassed spot markets by three to four times, as exchanges such as Binance, Bybit, and OKX reported billions of dollars being traded daily. In decentralized finance (DeFi), platforms like dYdX, GMX, and Hyperliquid have adopted this model, making perpetual contracts a fundamental aspect of on-chain trading.

The attraction is straightforward: leverage. For retail traders, perps offer a method to enhance profits without requiring substantial funds. For institutions and quantitative funds, they provide access to advanced tactics such as arbitrage, hedging, and liquidity supply. However, the very traits that render perps appealing high leverage, constant liquidity, and low entry barriers also create an environment ripe for systemic risk. Market crashes such as the May 2021 downturn and the FTX collapse in 2022 revealed how cascading liquidations in perpetual markets can instigate widespread industry contagion

Authorities have become aware. Perpetual futures are facing heightened examination across different jurisdictions due to their volatility, risks to retail investors, and capacity to circumvent established derivatives regulations. Simultaneously, innovation consistently surpasses oversight, as DeFi perps introduce fresh concerns regarding jurisdiction, enforcement, and investor safety.

This characteristic analyzes the perp phenomenon via three crucial elements: strategy, risk, and regulation. We will explore how traders use perps, the dangers lurking in their swift growth, and the forthcoming regulatory challenges that may influence their future. Perps have transitioned from just a speculative domain to functioning as a case study for the evolution of global crypto markets.

The Rise of Perps

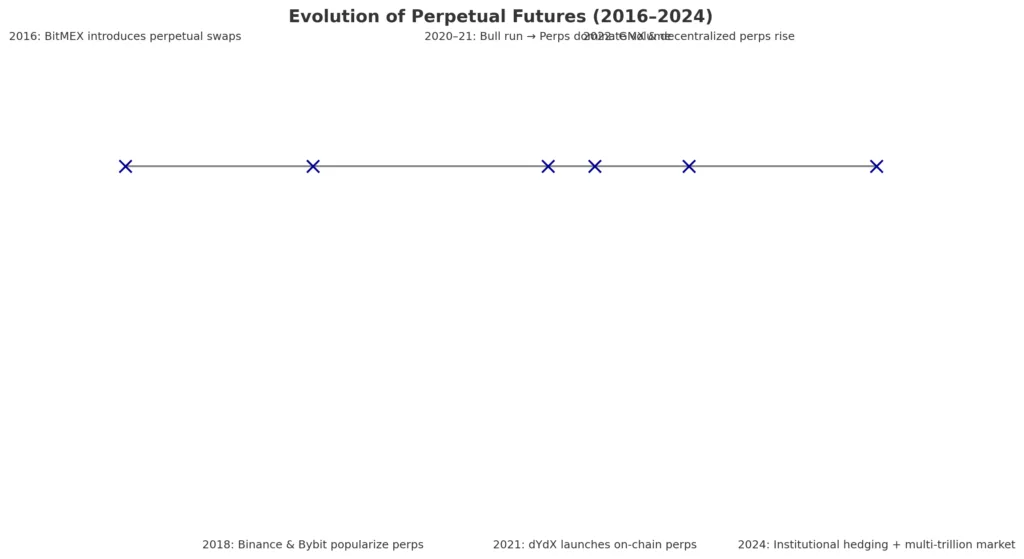

The narrative of perpetual futures started in 2016 with BitMEX, the platform that introduced the concept. At that moment, crypto derivatives were nascent, primarily governed by conventional futures that had predetermined expiration dates. These contracts presented a difficulty: they needed settlement and rollover, making them cumbersome for traders seeking ongoing exposure to fluctuating digital assets. BitMEX’s innovation, the perpetual swap, addressed this issue by removing expirations and linking the contract price to the spot market via a smart funding rate mechanism.

The funding rate mechanism represented a significant advancement. Every few hours, longs and shorts exchange a minor fee based on whether the contract price is higher or lower than the spot market. This maintains the perp price in line with reality, while allowing traders the flexibility to hold positions indefinitely. It was straightforward, stylish, and created for the round-the-clock aspect of cryptocurrency.

The adoption process was quick. Retail traders, lured by the prospect of leverage reaching up to 100x, surged into the market. Perps swiftly emerged as the preferred tool for traders aiming to amplify profits on Bitcoin and, subsequently, on all significant altcoins. Exchanges experienced rapid expansion in liquidity, volume, and revenue, as trading fees and funding payments became significant profit sources. By the end of the 2010s, perps had transformed from a niche offering to the fundamental element of the crypto casino.

The bull run of 2020–2021 accelerated this trend. With trillions of dollars in fresh capital entering crypto, perpetual futures volumes often surpassed spot trading by three or four times. Platforms such as Binance, Bybit, and OKX became identifiers of leveraged trading, drawing millions of retail participants. In the meantime, decentralized exchanges (DEXs) started exploring on-chain perpetual contracts, providing non-custodial options that resonated with the principles of DeFi. Platforms such as dYdX and GMX introduced perpetual contracts into the smart contract age, merging composability with leverage.

What really solidified perps’ supremacy, however, was their functionality for both market sides. Traders employed them to wager heavily on price fluctuations. Hedge funds and institutional investors, initially doubtful, discovered perpetual contracts essential for hedge and arbitrage tactics. For instance, Bitcoin miners utilized perps to secure future earnings, whereas quant funds took advantage of funding rate discrepancies to implement low-risk yield strategies. The instrument’s versatility guaranteed that perps were not merely speculative tools but also operational hedging strategies.

The outcome is a market framework in which perps frequently determine the direction for spot. In conventional finance, derivative prices are typically influenced by spot prices. In cryptocurrency, the opposite frequently applies: liquidation events in perpetual contracts leak into spot markets, and funding rates indicate market mood well before price movements validate it. This inversion emphasizes how crucial perpetuals have become in influencing the volatility cycles of crypto.

By 2024, perps had evolved into an international phenomenon. They currently account for the bulk of crypto derivatives trading, accessible on almost all centralized and decentralized exchanges. Though their expansion signifies innovation, efficiency, and accessibility, it also uncovers a more profound reality: crypto markets are distinctly characterized by speculative leverage. Perps not only emerged with the industry but also came to characterize it.

Strategy and use cases

Perpetual futures are not just popular because of their simplicity they are versatile instruments that serve multiple types of traders, from retail speculators to professional quant funds. Understanding the strategies behind their use is crucial to decoding why perps have become so dominant.

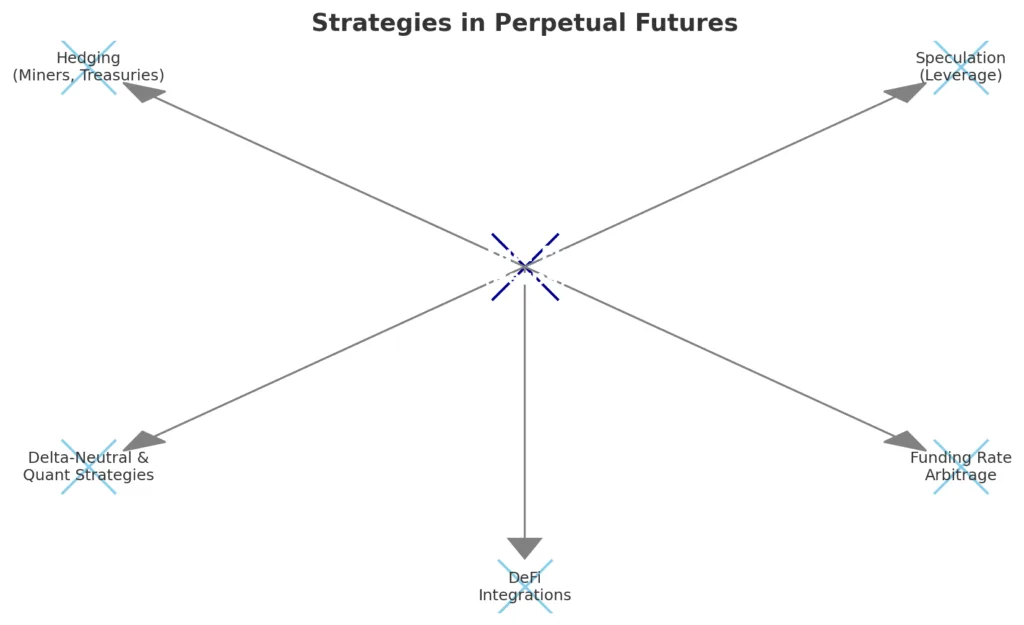

1. Speculation and leverage

For retail traders, the primary attraction of perps is speculation with leverage. Exchanges often allow users to borrow up to 50x or even 100x their capital. A small price move in Bitcoin or Ethereum can translate into outsized profits or devastating losses. This “casino element” has fueled the popularity of perps, particularly during bull runs where traders chase parabolic rallies. Altcoin perps, especially meme-coin pairs, amplify this further, offering high-risk, high-reward opportunities.

2. Hedging for market participants

Perps are also essential tools for hedging. Bitcoin miners, for example, often use short positions in perps to lock in USD value for the coins they generate. Similarly, crypto treasuries and market makers hedge against volatility by holding offsetting perp positions. By doing so, they can protect themselves from sudden price swings while continuing their operations. In this sense, perps function similarly to traditional derivatives in commodities and equities, providing risk management in an otherwise unstable market.

3. Funding rate arbitrage

A highly profitable approach in the professional realm is funding rate arbitrage. As perps utilize funding rates to link contract prices with spot markets, imbalances frequently occur. When there are extended demand spikes, funding rates become positive, signifying that longs need to compensate shorts. Arbitrageurs take advantage of this by taking long positions on spot while shorting perps, generating “free yield” from the funding fees. In bullish phases, this trade proved very lucrative, drawing in hedge funds and affluent individuals looking for crypto-based fixed income.

4. Delta-neutral and volatility plays

Advanced trading desks employ delta-neutral strategies, balancing long and short exposures across spot, futures, and options. The goal is not to bet on direction but to capture volatility, funding differentials, or liquidity inefficiencies. Some funds even build automated strategies that scalp micro-movements in perp markets effectively high-frequency trading adapted to crypto’s round-the-clock pace.

5. DeFi Innovations

In decentralized finance, perps have spawned entirely new strategies. Protocols like GMX, dYdX, and Hyperliquid allow traders to combine perps with on-chain liquidity, yield farming, and composability. Users can collateralize stablecoins or other assets to open leveraged positions, integrate with lending protocols, or even stake LP tokens to earn passive yield alongside perp exposure. This fusion of derivatives and DeFi primitives is expanding what perps can be used for, creating strategies unavailable in centralized finance.

Perps as Market Drivers

The result of these diverse strategies is a market where perps not only reflect sentiment but also drive it. Funding rate spikes foreshadow bullish or bearish reversals. Liquidation cascades in perp markets often set off broader sell-offs in spot. In other words, perps are no longer a mirror of crypto markets they are the engine.

This dual role casino for retail, hedge and yield tool for professionals explains why perps are now indispensable. They embody crypto’s extremes: speculation, innovation, and systemic risk, all bundled into a single product.

The risk Machine

The same attributes that have made perpetual futures the leading crypto derivative leverage, accessibility, and around-the-clock liquidity are also what render them a potential threat to market stability. Perpetual contracts have turned into the essential element of trading and the spark that can trigger systemic crises.

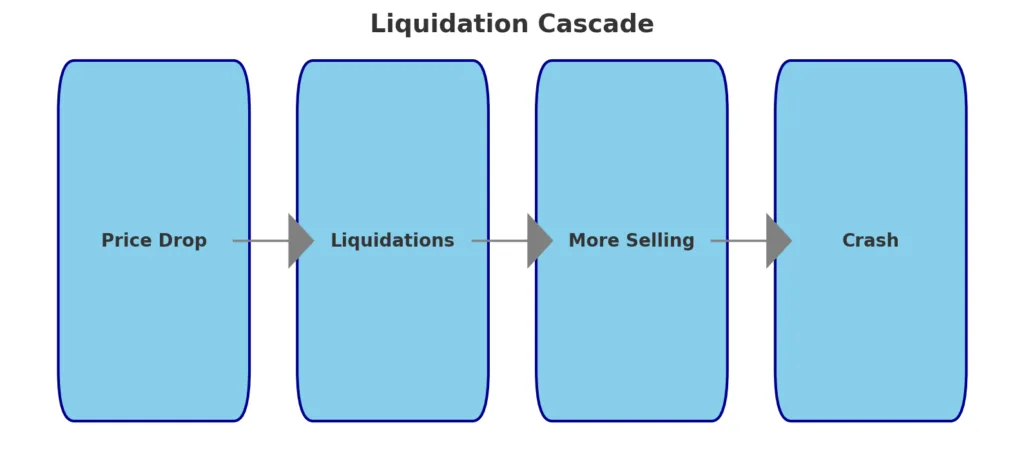

1. Systemic leverage and liquidations

Perpetual contracts offer leverage that greatly exceeds what is typical in conventional finance. While regulated futures markets usually limit leverage to 10x or 20x, numerous crypto exchanges promote leverage of 50x to 100x. This establishes delicate circumstances in which minor price changes provoke large-scale liquidations. Since liquidations occur automatically, they create a chain reaction: the failure of one trader drives prices lower, triggering further liquidations, leading to what is frequently referred to as a “liquidation cascade.” Instances such as the Bitcoin crash in May 2021 and the FTX collapse in 2022 were intensified by these feedback loops.

2. Funding rate distortions

Significantly negative rates during bearish capitulation can incite panic. Funding rates, intended as a stabilizer, frequently serve as an early indicator of fragility.

3. Exchange and counterparty risk

In centralized exchanges, perpetual contracts rely on the platform’s financial stability and trustworthiness. Funds for insurance, created to offset losses from insolvent accounts, are frequently unclear. The downfall of FTX exposed the minimal protection users actually had, as alleged safeguards vanished instantly. Even solvent exchanges encounter liquidity shortages when too many traders are liquidated at once. The “too big to fail” issue is relevant here: when a significant perp exchange stumbles, the whole market experiences the impact.

4. DeFi perps: A different set of risks

Decentralized perpetuities carry their specific risks. Oracles that supply pricing information to smart contracts are susceptible to manipulation. Errors in smart contracts can result in exploits that deplete liquidity pools. Platforms such as dYdX and GMX have pioneered decentralized perpetuals, yet their risk models continue to develop. In 2022, GMX received backlash as whales took advantage of pricing systems to deplete liquidity providers. Although DeFi minimizes counterparty risk by removing intermediaries, it creates new avenues for technical attacks.

5. Contagion and market cycles

One of the most perilous features of perps is their capacity to enhance contagion. Due to perpetual volumes surpassing spot by several times, liquidation events rapidly impact spot prices. This indicates that perp crashes not only impact leveraged traders but also alter the whole market cycle. Bull markets are amplified by speculative leverage, while bear markets are intensified by forced liquidations. In cryptocurrency, the perpetual market leads the spot market.

Perps have built a self-sustaining risk apparatus. Leverage draws traders in, while liquidations drive volatility and funding disparities heighten sentiment fluctuations. For numerous individuals, this dynamic is attractive because volatility means profit. However, for regulators and institutional participants, it highlights why perpetual contracts are seen as highly volatile.

The regulatory squeeze

Perpetual futures might be the highlight of crypto trading, yet they represent the sector’s most significant regulatory challenge. Their combination of significant leverage, retail exposure, and systemic risk has positioned them firmly in the sights of regulators globally.

1. Why regulators worry

Conventional derivatives such as futures and options are heavily regulated due to the risks they present to investors and financial markets. Perpetrators evade numerous protections. They permit high leverage, lack uniform regulation, and are readily accessible to individual traders worldwide. This blend causes them to seem less like genuine hedging instruments and more like exploitative gambling offerings to regulators.

Additionally, the role of perps in exacerbating crashes has intensified worry. Instances such as the FTX failure exposed the deep connections between perpetual markets and overall liquidity. Regulators worry that without oversight, perpetual contracts could disrupt not only cryptocurrency but ultimately impact traditional finance as well.

2. The U.S.: Enforcement by lawsuit

In the U.S., the Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) have targeted exchanges that provide perpetual contracts. Legal actions involving Binance, Coinbase, and others underscore claims of unauthorized derivatives trading and inadequate consumer protection. In contrast to Asia, regulators in the U.S. favor litigation for enforcement rather than providing straightforward licensing routes. For exchanges, the outcome has been unpredictability and withdrawal from U.S. markets.

3. Europe: MiCA’s blind spot

The Markets in Crypto-Assets (MiCA) regulation in Europe is one of the most extensive frameworks globally, yet it places derivatives in an unclear area. Perpetuals are not directly addressed, prompting regulators to modify conventional financial regulations. Although this uncertainty provides momentary relief, it also causes exchanges to speculate on compliance.

4. Asia: innovation meets caution

Asia exhibits a varied landscape. Singapore has limited retail access to high-risk derivatives while promoting innovation within regulated sandboxes. Hong Kong, eager to establish itself as a crypto center, is examining structures for regulated derivatives markets. In the meantime, offshore locations such as Seychelles and the British Virgin Islands continue to be favored hubs for exchanges due to their minimal regulatory constraints.

5. The rise of DeFi perps

One of the greatest challenges for regulators is the transition of perpetual futures into decentralized finance. Protocols such as dYdX v4, GMX, and Hyperliquid function independently of central intermediaries. Implementing KYC, leverage limitations, or even closures becomes significantly more challenging. Although regulators can focus on developers or front-end providers, the decentralized characteristics of these systems restrict control. This brings up essential inquiries: Is it possible to regulate DeFi perps effectively? Or will they develop alongside regulated TradFi, existing within a legally ambiguous space.

6. Possible paths forward

Certain regulators support limits on leverage, reflecting conventional futures regulations. Some advocate for more robust insurance funds and more explicit disclosure mandates. An alternative method is to mandate exchanges to separate retail and professional markets, reducing risk for non-institutional participants. In the end, the regulatory pressure will not be consistent. The result will probably be a mosaic of international strategies, with some areas providing licensed perp markets while others completely prohibit them.

What’s clear is that regulators now view perps as too big to ignore. Whether in the U.S., Europe, or Asia, the pressure is mounting. How exchanges and DeFi protocols adapt to this squeeze will determine whether perps evolve into a mature financial instrument or remain a speculative product under constant threat of crackdown.

It’s evident that regulators now see perps as too significant to overlook. Pressure is increasing, whether in the U.S., Europe, or Asia. The way exchanges and DeFi protocols respond to this pressure will decide if perps develop into a sophisticated financial tool or continue as a speculative asset facing ongoing regulatory risks.

Looking ahead: Innovation vs. Containment

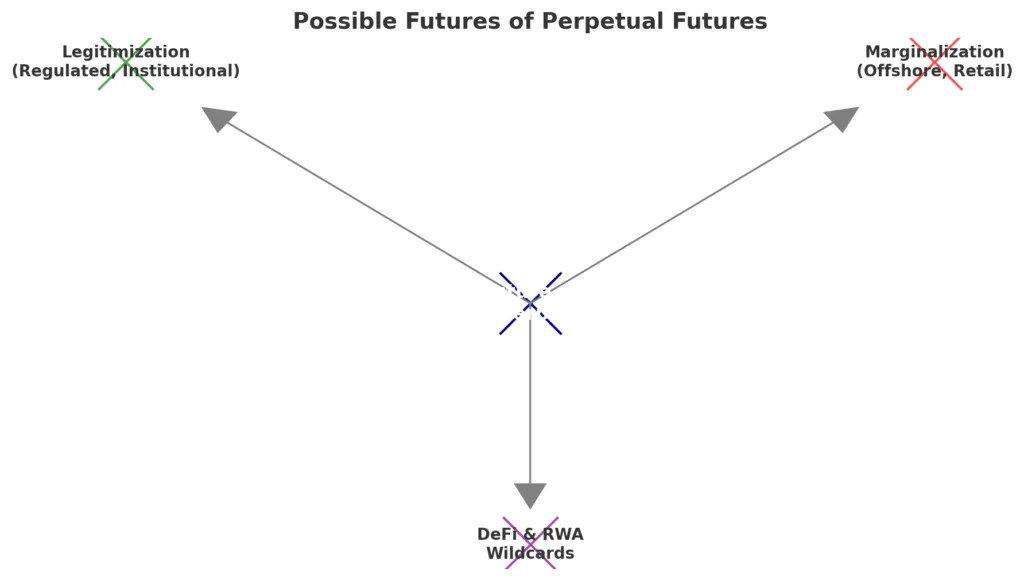

The future of perpetual futures is uncertain. They are essential to crypto markets to vanish, yet too dangerous to go unregulated. What follows will hinge on the evolution of innovation, regulation, and market dynamics.

1. Institutional integration or marginalization?

A potential route is validation. As institutions expand their involvement in crypto, exchanges may advocate for regulated perpetual markets featuring reduced leverage, strong insurance funds, and enhanced supervision. This would cause perps to look like conventional derivatives, making them accessible to pension funds, corporations, and asset managers. However, it would also eliminate the “wild leverage” that initially attracted retail users.

The contrary route is marginalization: authorities might impose such strict measures that perps are forced abroad or into exclusive DeFi environments. In this scenario, perps will continue to be a high-risk asset primarily for retail investors and hedge funds prepared to engage in legal gray areas.

2. DeFi as the perp frontier

Decentralized perpetual contracts are advancing quickly. Protocols such as dYdX v4, GMX, and Hyperliquid are experimenting with innovative approaches to risk-sharing, oracle architecture, and community governance. Should they address liquidity and stability issues, DeFi perps might surpass centralized exchanges, emerging as the primary method for trading derivatives without KYC. This path poses challenging inquiries: will regulators evolve, or will enforcement become stricter towards developers and front-end interfaces.

3. Tokenization and market expansion

The next advancement might arise from assets not native to crypto. With tokenized real-world assets (RWAs) such as stocks, commodities, or bonds transitioning on-chain, perpetual contracts may emerge as the favored method for trading these assets. Envision an Asian trader initiating a perpetual swap on U.S. Treasury bonds without engaging a broker-dealer. This expansion might either convert perps into a genuine worldwide tool or increase the need for regulation.

4. Balancing innovation and containment

In the end, the outcome for perps hinges on their ability to evolve from speculative leverage tools into reliable financial instruments. The equilibrium will be fragile: excessive regulation threatens to stifle innovation, whereas insufficient oversight could lead to systemic failures. What is clear is that perps will continue to play a key role in crypto’s identity, reflecting both its strengths and weaknesses.

The question is no longer if perps will remain. It’s a question of whether they will develop into a robust foundation of digital markets or persist as casino tables that regulators are intent on eliminating.

Conclusion

Perpetual futures have undergone a notable evolution. Originating as an experimental offering on BitMEX, they have evolved into the fundamental backbone of crypto trading, fueling volumes, liquidity, and speculation well beyond the limits of spot markets. For numerous individuals, perps represent the essence of crypto: limitless innovation, serving as a means to democratize access to advanced financial techniques.

Currently, regulators are closing in. From American legal battles to the ambiguous areas of Europe’s MiCA and Asia’s careful trials, the regulatory pressure is increasing. Simultaneously, DeFi protocols are reinventing perps in ways that fundamentally challenge enforcement, while tokenization aims to broaden their reach beyond cryptocurrency assets into worldwide markets.

The future of perps will depend on their ability to balance innovation with containment. Should they progress into trustworthy, regulated offerings, they might serve as a foundation for digital capital markets. If they stay at the casino tables of crypto, they face the chance of being marginalized and under constant scrutiny.

In the end, perps reflect crypto itself daring, innovative, and full of risk. Their path will show if crypto can evolve into a sophisticated financial system or stay a frontier characterized by volatility and speculation.