Signal: a short, sharp correlation break

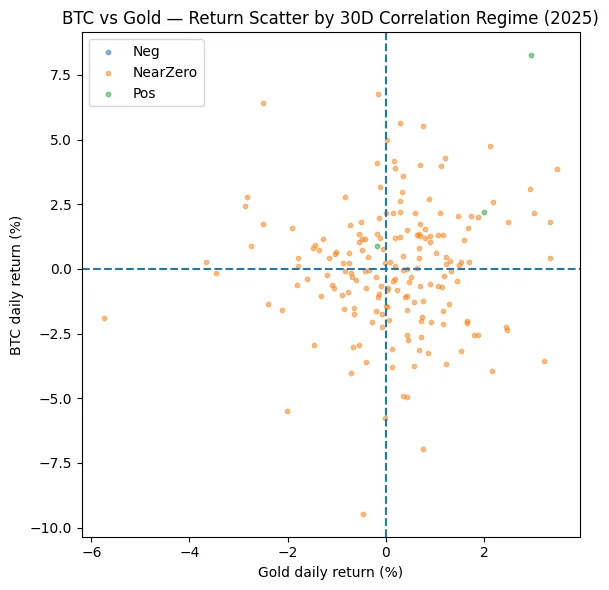

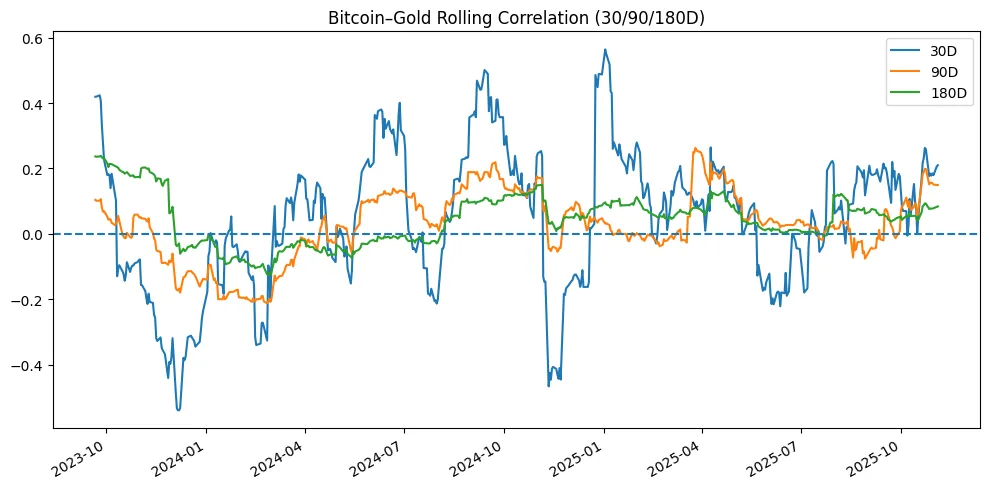

In 2025, the connection between Bitcoin and gold changed under several governments. The correlation, which had been close to zero through Q3, abruptly shifted to the negative in early September as gold rose and Bitcoin weakened. However, it quickly recovered into mid-October as both assets attracted safe-haven flows. The indication that investors are not treating the “store of value” as a single trade is that whipsaw. Depending on the shock, they alternate between two distinct safety narratives. In early September, trackers noted a completely negative print, while FXStreet described the cross-asset linkage for Q3 as “near-zero.” By the middle of October, fresh articles referencing CryptoQuant data saw the connection rise once more in tandem with gold’s string of all-time highs. The market now divides the “store of value” into two separate buckets: monetary and seizure risk hedging with upside convexity (bitcoin) and policy and liquidity risk hedging (gold). This is shown by the regime-switch itself, not by any one level.

What actually broke: two different safe-haven triggers

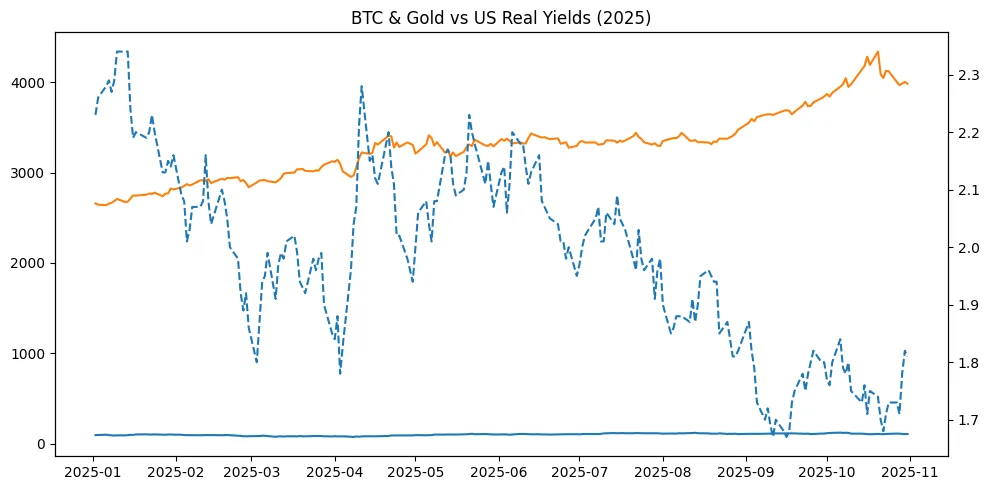

Gold’s 2025 rally to repeated all-time highs was driven by classic safe-haven demand: persistent geopolitical risk, tariff-driven inflation fears, and exceptionally strong central-bank buying. When those risks dominate, gold attracts defensive flows, sometimes at bitcoin’s expense. At several points this year, gold vaulted above $3,000 and then $3,500–$4,000 as headlines compounded, while bitcoin lagged or chopped, creating negative or near-zero co-moves. In those windows, “safety” meant policy predictability and deep, century-old liquidity gold’s lane.

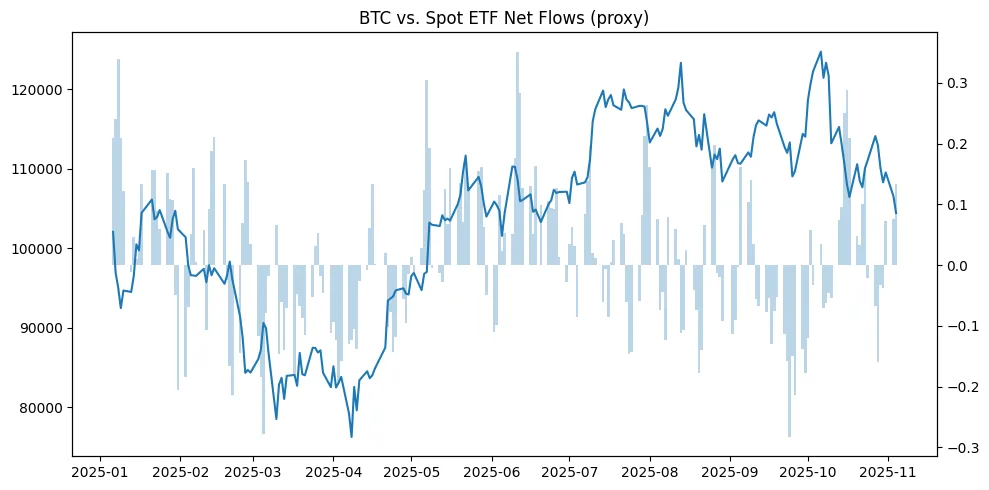

What re-coupled: structural bitcoin demand from ETFs

Where bitcoin diverges from gold is the presence of a mechanical demand conduit: U.S. spot ETFs. Inflows clustered into streaks this autumn created an absorption layer for dips and periodically pulled BTC back into gold’s slipstream when macro stress widened. Research roundups in October highlighted multi-billion streaks, with IBIT dominant, while analysts noted that ETF flow sensitivity to price has been rising versus 2024. This plumbing doesn’t exist for gold in the same way central-bank purchases do, so the two assets can be simultaneously “safe” but flow on different rails.

Store-of-value is not one thing: three premiums

Three premiums that fluctuate with the shock mix are highlighted by the correlation break. Both assets now have a scarcity premium, but bitcoin’s is programmatic and highly reflexive, while gold’s is institutional and slow-turning. The majority of the censorship-resistance premium is endogenous to Bitcoin and rises in response to reports about capital control or de-platforming risk. Due to the depth of the bullion and FX collateral markets, gold continues to benefit from the liquidity premium during flight-to-quality panics. The 2025 tape showed all three moving at different speeds: bitcoin’s upward bursts centered around ETF flow streaks and post-drawdown rebounds, but when inflation and growth concerns flared together, bitcoin’s upward bursts snapped back into gold’s orbit. Gold, on the other hand, printed ATHs repeatedly on geopolitical and rate-cut narratives

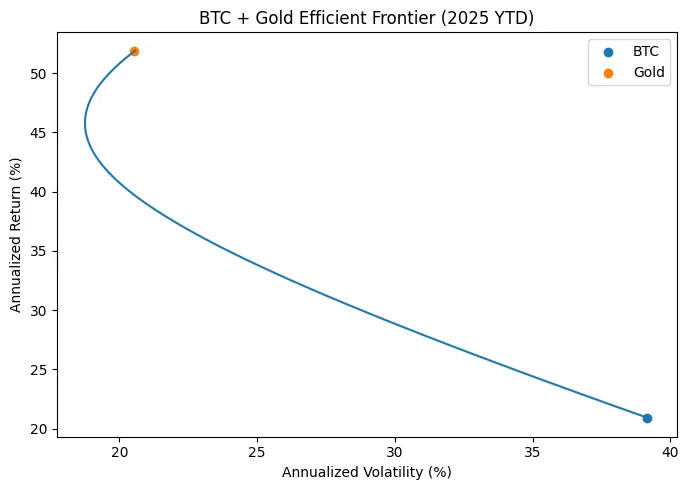

Portfolio construction: complement, don’t substitute

Instead of treating gold and bitcoin as replacements, allocators should view them as complimentary hedges. The BTC gold link continues to fluctuate between low averages, with periods of both positive and negative correlation, according to medium-term studies. Specifically in 2025, transient re-couplings during macro stress or ETF flow squeezes interspersed extended periods of negative or near-zero correlation. The convex upside of bitcoin is maintained while single-hedge risk is decreased using a blended sleeve.

Forward map: how the “digital gold” rhyme behaves into 2026

Which safe-haven trigger wins out will determine how the Bitcoin-gold connection develops in 2026. If central bank purchases and geopolitical tension continue to define the tape, gold can continue to lead and the correlation will be choppy to low. If policy uncertainty and worries about U.S. growth push more money into bitcoin ETFs during flight-to-quality weeks, mechanical inflows could cause bitcoin and gold to recoup on the upside.

Furthermore, gold might stabilize higher as a balance-sheet hedge and bitcoin might re-correlate more with stocks if the soft-landing theory is validated. This would bring the BTC gold correlation back to its long-run, low average. With recurrent gold ATHs and intermittent spikes in cryptocurrency inflows, all three patterns were already evident this year: negative in September, near zero through Q3, and then higher into October. Use the regime instead of the narrative.