The silent bull emerges

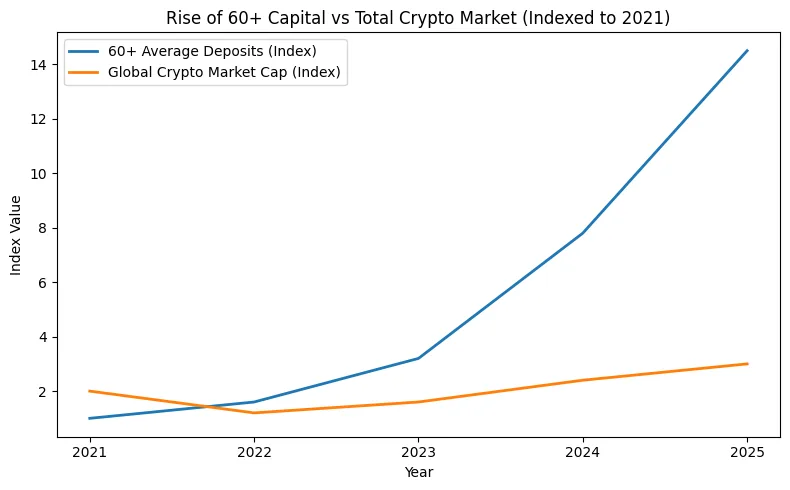

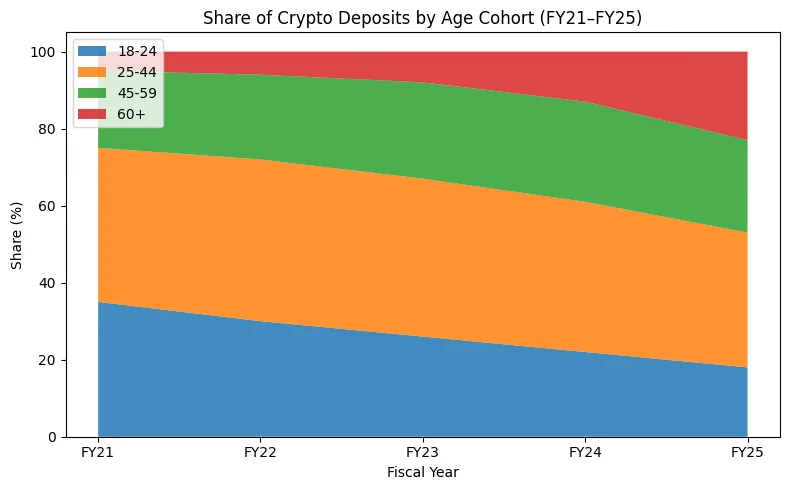

Youth have been at the center of the worldwide crypto narrative for over ten years. From the early adopters mining Bitcoin in dorm rooms to TikTok traders turning meme coins into fortunes, digital assets have been depicted as the realm of the restless and the risk-hungry. However, 2025 has subtly changed that narrative. According to the most recent BTC Markets Investor Study (FY24–25), the highest demographic gain in Australian cryptocurrency history has been seen by those aged 60 and over, whose average crypto deposits have increased by an astounding 723 percent year over year.

Behind this statistic lies a generational shift that few expected. The same individuals who were earlier dubious about “magic internet money” are now investing in exchanges to diversify rather than gamble. They are retirees and pre-retirees looking for security in a world where traditional assets no longer provide the comfort they once did; they are neither day traders nor NFT flippers. Their disciplined, silent money may serve as the unseen foundation of the next bull market liquidity, which will be patient, steady, and driven more by preservation than by speculation.

Additionally, their narrative highlights an industry that is maturing. Chaos and curiosity characterized the early years of cryptocurrency. For the first time, it is being seen as an allocation rather than an adventure, much like gold, real estate, and dividend-paying stocks.

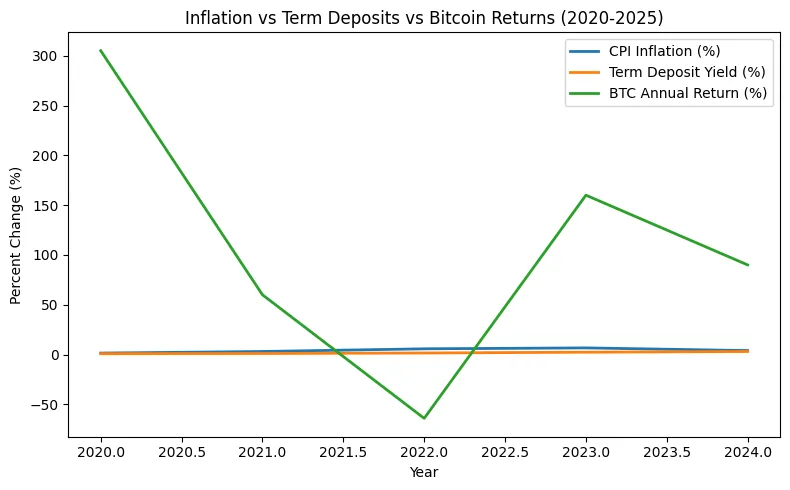

Inflation, discipline & the search for yield

Hard math, not hype, is what caused older investors to suddenly show interest. Savers are caught between risk and stagnation because inflation has reduced purchasing power more quickly than deposit rates have increased. In Australia, the yield on traditional term deposits is still just about 3 percent, while the annual consumer price inflation rate is between 4 and 5 percent. That disparity feels like a tax on time itself to a retiree who is living off of savings.

The 21 million coin cap on Bitcoin provides an obvious hedging. It appeals to a generation that was taught the value of tangible possessions. Ethereum’s shift to a deflationary supply model and proof-of-stake increases its allure as a digital network with quantifiable yield and declining issuance. Originally an abstract technology experiment, it now appears to be a macro-hedge tool that directly competes with inflation-linked bonds or even gold.

The pursuit of alternatives by older wealth has happened before. Every age, from gold rushes to real estate bubbles, looks for the next source of wealth when fiat fails. The distinction is that cryptocurrency at last provides accessibility: transparent pricing, round-the-clock liquidity, and custody that retirees can manage right from their phones.

Behavioral shift: From speculation to strategy

The behaviors of older investors are shaped by decades of market cycles. They diversify, they rebalance, and most importantly, they refrain from emotional trading. Although the activity of the 60+ group rose 93% year over year, BTC Markets reports that their modest trading frequency was a sign of conviction rather than panic. These investors frequently use SMSFs (Self-Managed Super Funds) to purchase cryptocurrency, treating it like a stock or exchange-traded fund (ETF) position with quarterly weight adjustments as opposed to daily ones.

Their portfolios exhibit traditional risk categorization, with stablecoins and developing tokens making up the remaining portion and Bitcoin accounting for about 55%, Ethereum for 20%, and XRP for 12%. This allocation reflects their conventional investing philosophy, which consists of core holdings with smaller, more speculative edges. They build up positions during market declines, similar to how they would average into blue-chip stocks, as opposed to following meme rallies.

This behavioral profile is important to analysts. These investors tend to propel markets toward greater maturity. Through methodical accumulation, they reduce volatility, and their capital serves as a buffer amid speculative

Trust, technology and accessibility

Five years ago, crypto onboarding required gas fees, seed words, and a high level of worry. Today, that experience has changed thanks to regulated Australian exchanges. SMSF-friendly interfaces, real-time performance monitoring, and simplified tax and compliance reporting are now integrated into platforms like BTC Markets. This decrease in friction is important because it substitutes familiarity for anxiety.

Psychology has reached a midway point with technology. Digital wallets are no longer seen as opaque or dangerous by older investors. These days, custodial solutions offer multi-signature protection, insurance, and language-speaking help lines. These advancements, along with more precise government regulations regarding the taxation of digital assets, have made cryptocurrency a respectable component of retirement planning.

The majority of Australia’s disposable wealth is held by those over 60, which is another demographic advantage that aligns with the accessibility revolution. Even a small reallocation from this capital base can have a significant impact on market liquidity as user interfaces improve and anxiety fades. Every senior who invests a few thousand dollars in Bitcoin contributes to a larger structural shift in wealth toward the digital era.

The invisible cohort that may define the next cycle

What happens when erratic innovation and patient capital collide? The response could shape the digital banking landscape of the ensuing ten years. A new equilibrium is brought about by seniors investing in cryptocurrency: more consistent accumulation and less leveraged manias. They have a calibrated risk tolerance, but ironically, they have a long time horizon. Instead of liquidating their digital assets, many plan to keep them as intergenerational wealth to be passed down.

Macroeconomically speaking, this conservative capital influx may support market stability. Institutional confidence increases, liquidity deepens, and volatility decreases as elder investors hold. For both financial firms and regulators, the existence of such investors indicates maturity. Crypto starts to take on the characteristics of a respectable, multigenerational asset class and stops being a fringe experiment.

However, reality is crucial. This group still makes up a small portion of all users, and the 723 percent rise is the result of a small base. However, direction is more important than proportion. When elder capital accepted what it had previously rejected, from tech stocks in the 2000s to stocks in the 1980s, every bull cycle in financial history was enhanced. That cycle is reoccurring in blockchain form in 2025.

“DeFi for Boomers” refers to development rather than irony. Ten years ago, cryptocurrency was seen as a revolt against conventional finance. It now symbolizes its digital extension. The foundation of the market is being rebuilt by habit rather than enthusiasm as senior Australian investors stealthily purchase Bitcoin using the same iPads they use for banking. The next bull run might hum softly from retirement accounts rather than roaring from youth.