The invisible market

The markets show mechanical behavior because they function according to their basic operations. The market develops through candle formations which create breakouts and then execute liquidity sweeps. The chart shows only a limited aspect of market data because it represents collective emotional responses. The market reaches its lowest point not when positive news appears but at the moment when fear reaches its maximum level. The market reaches its highest point when investors stop their buying activity.

The market reaches its peak at the point when investors stop their buying activity. Price constitutes the visible market structure. The market operates through psychological mechanisms that people cannot see. Emotional Alpha operates under a fundamental principle that market price changes follow after sentiment shifts. The market situation changes when traders experience a shift in their emotional state. The market experiences increased price fluctuations when traders change their market positions. When traders change their market positions the market experiences increased price fluctuations. Most traders analyze outcomes.Few measure the emotional cause.

The mechanics of market emotion

The measurement of sentiment shows that it exists as a concrete entity. Fear shows itself through defensive behavior, reduced funding, ETF outflows, decreasing social optimism, and market deleveraging. Greed shows itself through funding growth, strong long positions, increasing capital inflows, and public happiness.Through their actions people create data records which show their activities.

Extreme readings function as market signals according to most participants. But markets often remain fearful or greedy longer than expected. The actual signal exists in momentum changes which display different levels. Sellers reach exhaustion when negative news stops increasing their fear.

The market reaches its peak when buyers stop growing their activities because positive information no longer excites them. The complete emotional experience ends before the market shows its price reversal. Emotional Alpha comes from this state of emotional saturation.

Inflection velocity: The hidden edge

The measurement of sentiment shows that it exists as a concrete entity. Fear shows itself through defensive behavior, reduced funding, ETF outflows, decreasing social optimism, and market deleveraging. Greed shows itself through funding growth, strong long positions, increasing capital inflows, and public happiness.Through their actions people create data records which show their activities. Extreme readings function as market signals according to most participants.

But markets often remain fearful or greedy longer than expected. The actual signal exists in momentum changes which display different levels. Sellers reach exhaustion when negative news stops increasing their fear. The market reaches its peak when buyers stop growing their activities because positive information no longer excites them. The complete emotional experience ends before the market shows its price reversal. Emotional Alpha comes from this state of emotional saturation.

The sentiment overlay architecture

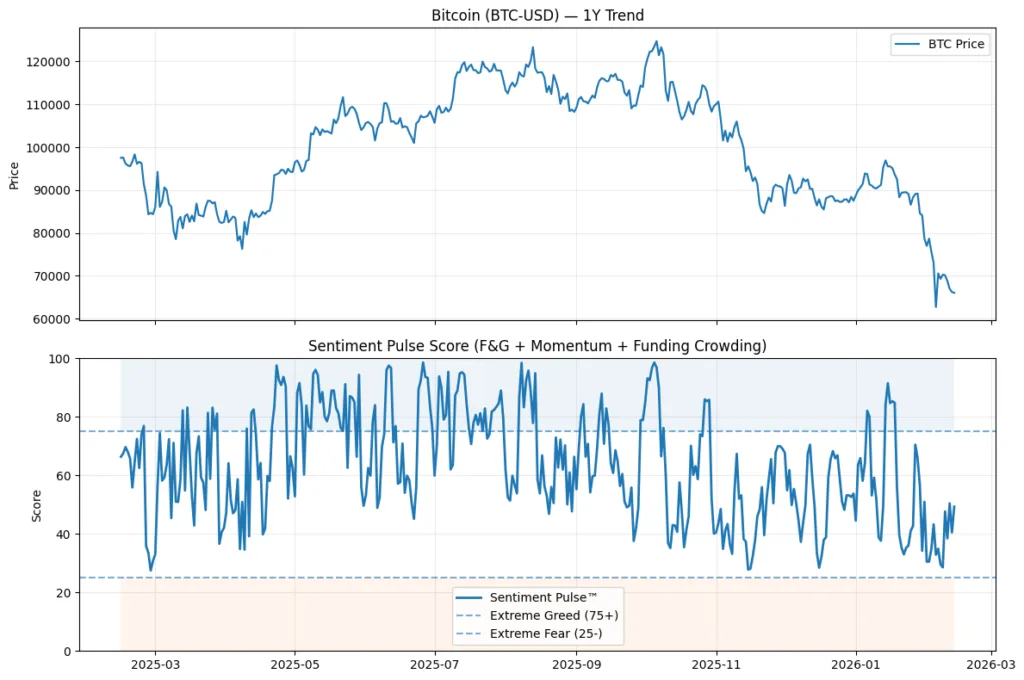

The Sentiment Overlay framework combines three different behavioral components into a single psychological display system.Fear & Greed functions as a tool that measures the overall emotional state of the public. The system monitors three market variables which include volatility and volume momentum and social trading and market dominance.Funding rates reveal leverage structure. Negative funding reflects defensive hedging and short pressure.

Excessive positive funding shows that traders hold long positions which can be easily liquidated.ETF flows expose institutional intent. The media focuses on retail panic but institutional investors make stabilizing moves through their consistent investments which go unnoticed. Social velocity tracks the speed at which narratives develop. The speed at which keywords trend or fade reflects emotional intensity shifts before liquidity fully responds.When these layers align during emotional compression, the probability of structural movement increases. Alignment between these two elements happens infrequently. However its occurrence brings about an increase in market volatility.

Historical reflexivity in Bitcoin cycles

The historical pattern of Bitcoin price movements shows that major price changes follow a repeated sequence.Three market conditions exist during deep bear markets. The market shows extreme panic when fear levels reach their highest point. The market runs through three stages between market reversals. The public discusses current events with strong negative attitudes. The market price stays below the resistance level while price fluctuations decrease. The market establishes an equilibrium point which leads to further price movement. The market establishes a new price level after testing different price points.

The market reaches its highest point during euphoria. The funding shows positive growth while investors become increasingly greedy and customer investments rise because social media claims that the market will rise. The market price keeps increasing while market sentiment starts to decrease. The market makers keep their current high levels of borrowing while new investors begin to enter. The process of asset distribution starts to happen below the visible level.

The price of an asset will eventually move according to the changes in market sentiment which are happening at that time. The financial markets operate as self-reinforcing systems which create feedback loops. People use their emotions to make their investment choices. People use their investment choices to control the available funds. The available funds create changes in market value. Market value creates emotional feedback loops which operate through the entire system. The trading loop system lets traders identify unstable market conditions which will eventually lead to market strength or weakness.

Emotional compression and volatility expansion

Volatility expansion is rarely random. It is often preceded by emotional compression.When fear reaches saturation and sellers have acted, incremental downside pressure weakens. When greed saturates and leverage crowds one side of the trade, fragility increases.The compression phase feels stagnant. Price ranges tighten. Narratives become repetitive.

Traders grow frustrated.But this stagnation masks imbalance.Emotional Alpha identifies these compression zones where positioning is extreme but incremental conviction is fading.When momentum shifts, volatility reawakens.The market does not need optimism to rise. It needs exhaustion.It does not need panic to fall. It needs complacency.

Institutional implications

As crypto matures, behavioral analytics will become central to institutional strategy. On-chain metrics provide structural transparency. Macro data provides contextual framing. But behavioral data provides timing.The next wave of analytics is psychological modeling.Funds that quantify sentiment velocity rather than chase breakouts gain earlier exposure to regime transitions.

Emotional Alpha transforms qualitative narrative into measurable signal.The edge is not predicting the future.

It is detecting when the crowd stops accelerating in one direction.That moment changes probability.

Current market context

The current market cycle shows that fear experiences keep happening because of three events which include liquidity shocks and ETF flow changes and leverage resets. The most important market observation deals with market fear levels. The speed at which fear disappears after its first appearance represents the main measure of fear in the market.

The chart will show structural support when negative funding stops decreasing and inflows maintain their level during market volatility while social pessimism stays the same. The market experiences structural weakness when investors show extreme greed while market funding increases and extra funds enter the market. People experience emotional changes which lead to price market shifts. The trader who only observes price movements will make market decisions. The trader who monitors market sentiment will predict upcoming market movements.