When human emotion becomes a market signal

Financial markets have consistently responded to emotions such as fear, greed, euphoria, and panic, which influence liquidity more significantly than fundamental factors. What is currently evolving is that emotions are no longer merely abstract concepts. AI models are now capable of quantifying global sentiment derived from billions of posts, articles, voice notes, biometrics, and livestreams. This development converts mood from a psychological influence into a quantifiable market variable. Emotional Finance posits that the collective mood can be treated as a priced asset class, paving the way for entirely new markets, instruments, and predictive systems. Rather than waiting for narratives to change, traders will monitor real-time ’emotion dashboards’ that serve as a global indicator of risk appetite.

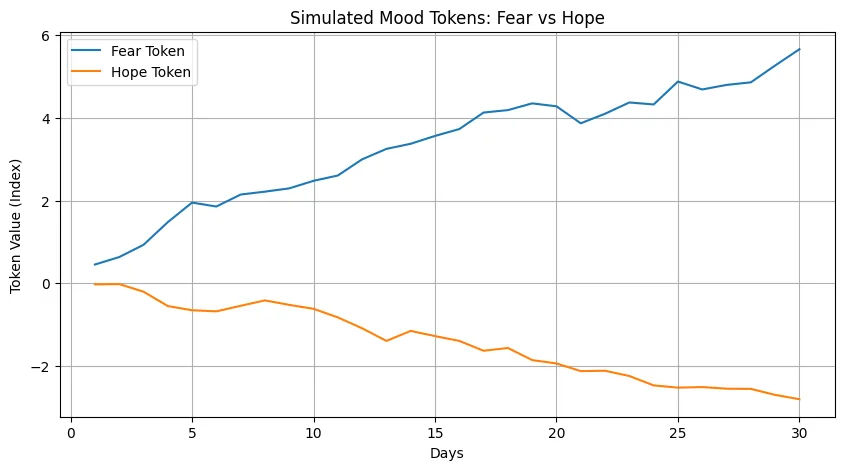

Mood tokens: The birth of emotional assets

Mood Tokens represent collective emotional states that fluctuate based on real-time data. A ‘Fear Token’ appreciates in value during times of increased global apprehension, while a ‘Hope Token’ grows when positivity is prevalent on social media. Cutting-edge networks analyze emotional information through AI mood classifiers designed to detect language tone, emoji usage, video expressions, and vocal stress. These tokens do not represent corporations or systems; rather, they reflect the shared human psyche on a broad scale. Emotional Finance converts crowd psychology into a tradable asset, allowing investors to adopt long or short positions in response to global emotional patterns. This mechanism makes emotions liquid, measurable, and appropriate for investment.

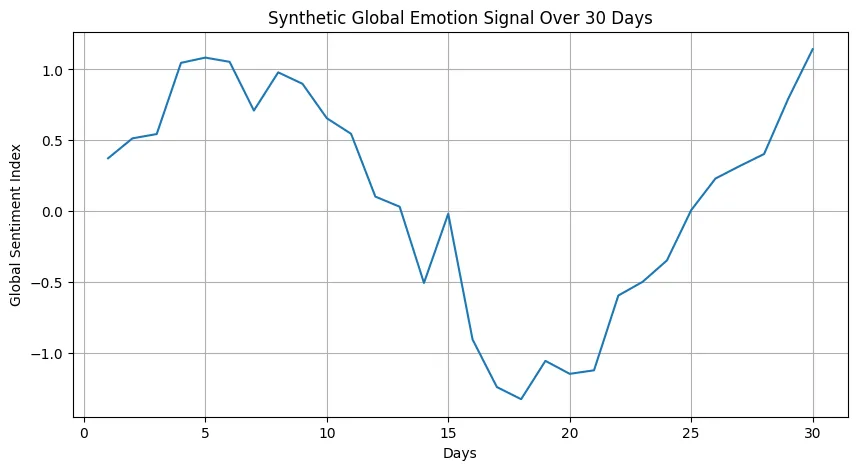

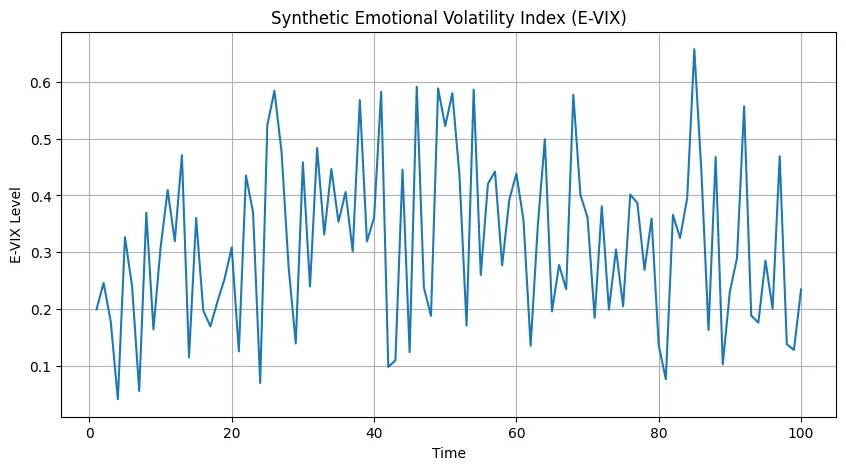

The emotional volatility index (E-VIX)

As emotions become measurable, a new benchmark emerges: the Emotional Volatility Index (E-VIX). Unlike the traditional VIX, which evaluates expected market volatility based on options pricing, the E-VIX tracks the degree of global emotional shifts on an hourly basis. Panic spikes during geopolitical crises can be detected 20–40 minutes before price changes occur. AI models that scrutinize voice tones, the nature of breaking news, meme fluctuations, and sudden shifts in collective feelings make the E-VIX a real-time indicator of sentiment. Traders will handle emotional volatility similarly to how they currently address price volatility.

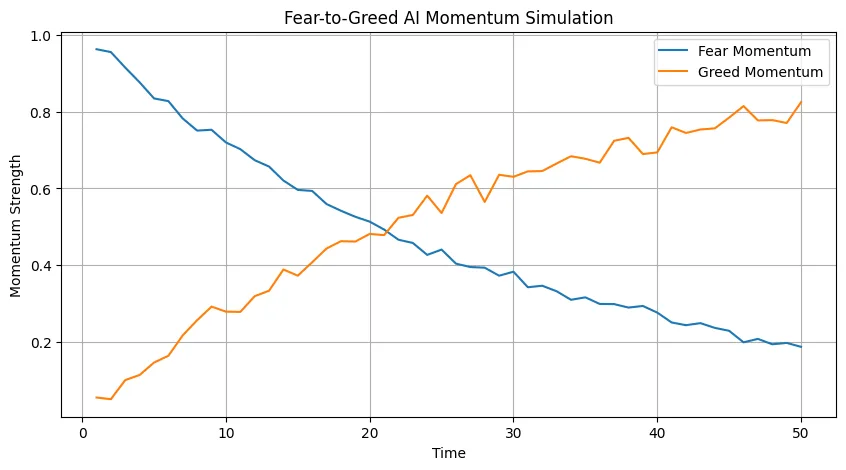

Fear-to-greed AI prediction models

The traditional Fear & Greed Index loses its relevance when machines are capable of assessing numerous emotional variables at the same time. Advanced AI models forecast market fluctuations by analyzing emotional momentum, meme acceleration, linguistic instability, and the clustering of influencer sentiment. When worldwide fear increases at a rate that surpasses historical norms, AI is able to predict market drawdowns with greater precision than conventional charts. Emotional divergence, which occurs when the collective sentiment differs from price movements, serves as a significant indicator for potential reversals. These models revolutionize markets from being reactionary to becoming anticipatory, utilizing shifts in mood as primary indicators.

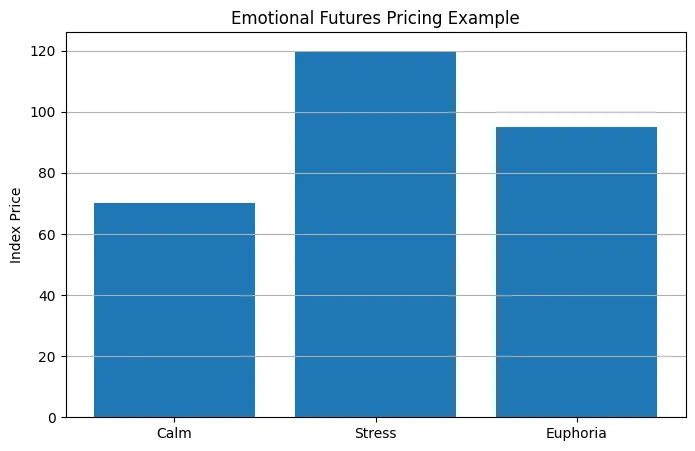

Emotional futures & hedging markets

Once emotions are quantifiable, financial engineering comes into play. Exchanges introduce Emotional Futures, enabling investors to protect themselves against global stress, optimism, or panic. A hedge fund making significant announcements might purchase ‘Calm Futures’ to mitigate volatility during news releases. Media firms may opt for ‘Excitement Futures’ prior to unveiling major projects. Individuals could safeguard their workplace or national sentiment during elections or periods of economic uncertainty. Emotional hedging evolves into a robust layer of financial security, with each emotional state linked to a tradable asset.

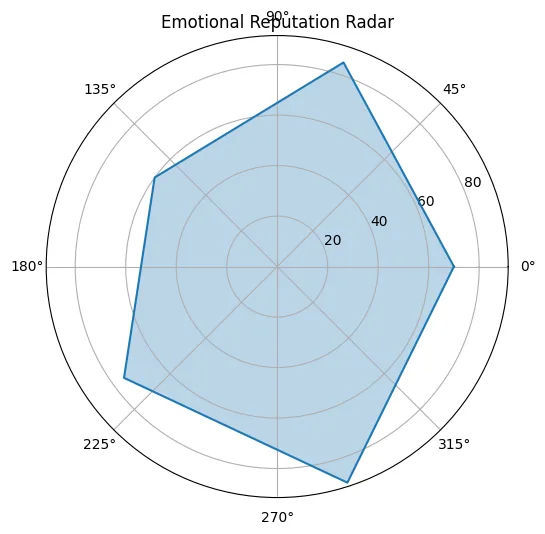

Mood-based reputation systems

Reputation evolves to be dynamic and responsive to mood. Rather than relying on fixed on-chain scores, both individuals and brands cultivate “Emotional Reputation Profiles” that reflect the impact of their actions on the collective mood. A founder who regularly soothes market tensions earns elevated emotional trust scores.

Influencers who exhibit erratic emotional fluctuations face variable reputation valuations. In the future, sectors such as job recruitment, dating applications, and lending systems may integrate emotional reliability as a crucial criterion. This creates a landscape where emotional stability is regarded as an economic advantage, while emotional turmoil is seen as a disadvantage.