When the lights went out the perfect regulatory storm

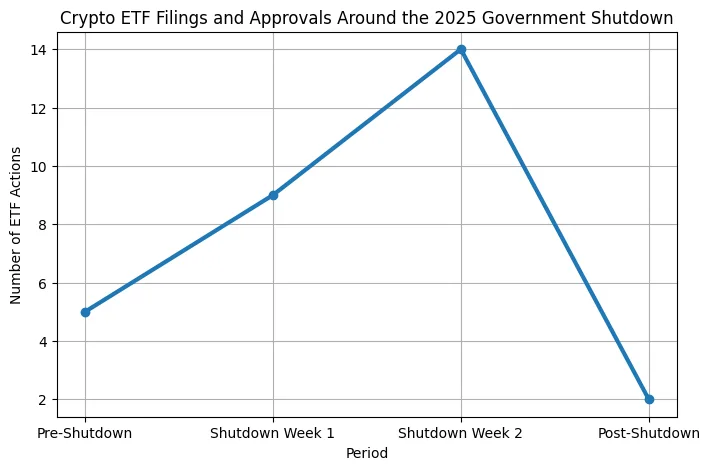

In late 2025, Washington lost all power. A lengthy government shutdown halted the Securities and Exchange Commission’s regular activities, pausing reviews, hearings, and enforcement actions. However, even as the regulatory machinery came to a stop, the financial realm continued. Veiled amidst the gaps of administrative quietude, a subtle transformation emerged crypto ETFs made their entrance.

Prominent asset managers such as BlackRock, Fidelity, and VanEck leveraged procedural loopholes and established frameworks to complete their spot Bitcoin and Ethereum ETFs amidst the shutdown. It was discreet, entirely lawful, and carefully scheduled. When the SEC resumed operations, the ETFs had already been trading with billions in volume. The shutdown not only hindered oversight but also unintentionally generated a space where crypto innovation progressed without restraint.

The loophole nobody saw coming

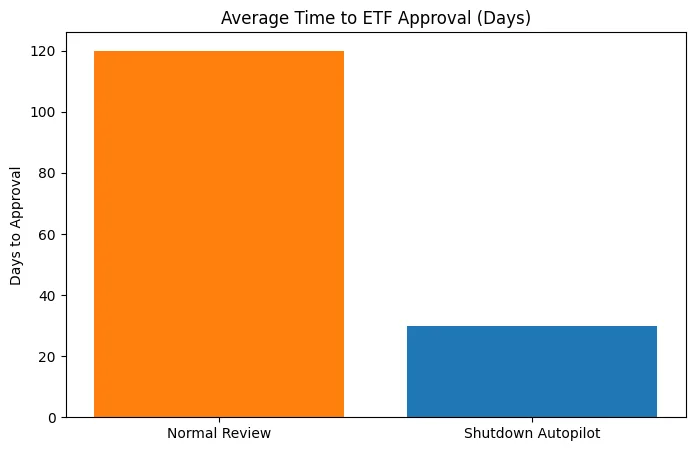

The approach wasn’t misleading; it was expertise in procedures. When the government was closed, new regulatory evaluations were halted, but the SEC’s delegated authority processes continued to operate. This indicated that submissions currently being examined could move forward automatically if no official objections were noted. A bureaucratic formality evolved into a billion-dollar chance.

Companies such as Grayscale and ARK Invest acknowledged this “autopilot” feature. By submitting amendments related to previously assessed proposals, they enabled their ETF structures to progress under current 19b-4 regulations. The market acted without seeking approval; it just took advantage of inertia. Essentially, the regulations stayed unchanged, but the officials had briefly exited the field and in that quiet, the industry took action.

Institutional opportunism meets retail FOMO

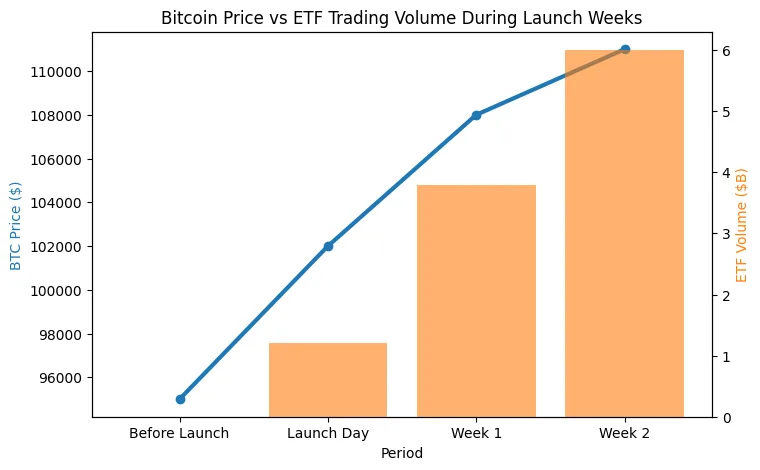

When the initial ETFs launched, the response was immediate and overwhelming. Retail investors viewed the launches as confirmation that cryptocurrency had officially joined Wall Street’s mainstream. Institutions, conversely, recognized an arbitrage opportunity, a chance to obtain compliant Bitcoin exposure prior to the wider market adjusting its prices. Trading volumes on Nasdaq and CBOE surged as billions of dollars flooded into newly authorized funds.

By the middle of the month, Bitcoin flows associated with ETFs exceeded six billion dollars. The market reacted with an increase in demand, driving Bitcoin past the one hundred ten thousand threshold. Ironically, a bureaucratic halt turned into one of the most positive regulatory occurrences in crypto’s history, mixing institutional credibility with the retail excitement that characterized previous.

The politics of post-fact regulation

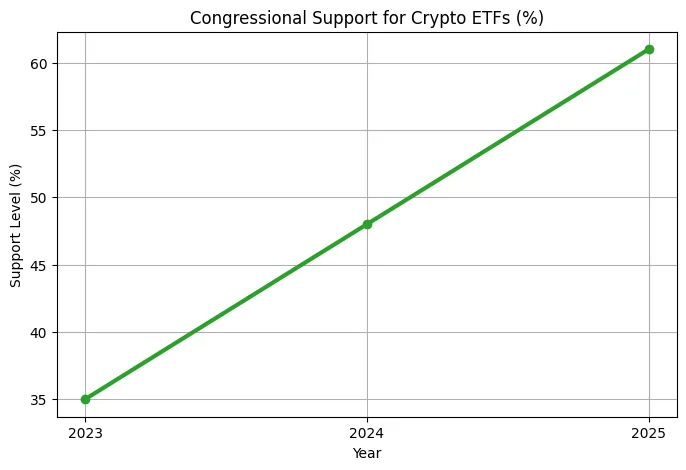

Once the government reopened, the ETFs had already been woven into the market’s fundamental framework. Policymakers and officials had to decide whether to withdraw approvals and risk economic turmoil or acknowledge that the products had essentially achieved legitimacy. They opted for the latter. Political hearings took place, yet the damage or advancement, based on viewpoint, had already occurred.

This episode revealed a paradox within the institution. The SEC had invested years in discussions regarding crypto ETF frameworks, but a few weeks of bureaucratic standstill accomplished what years of lobbying failed to do. The political atmosphere changed nearly instantly. Legislators, recognizing the connection between voter excitement and financial stability with these products, started viewing crypto ETFs as a question of national competitiveness instead of a regulatory challenge.

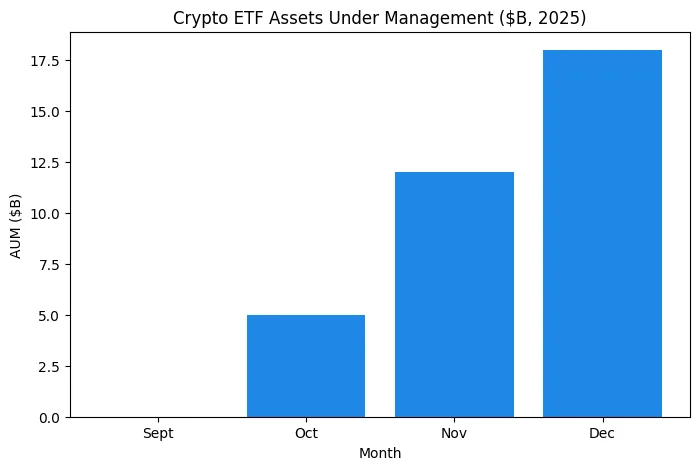

The legacy regulating after the revolution

The covert endorsement of crypto ETFs unveiled a significant reality about contemporary markets: regulation seldom drives innovation; it follows it instead. By becoming part of established financial systems, crypto didn’t oppose Wall Street but rather integrated into it. The shutdown served as a trigger, inadvertently pushing traditional markets to integrate digital assets.

Currently, ETFs serve as the link that validates cryptocurrency for pension funds, asset managers, and governmental entities. What started as a gap evolved into a fundamental change, reshaping the relationship between regulation and innovation. Looking back, the “ETF back-door” wasn’t a scandal; it served as a clear indication that the future of finance doesn’t pause for bureaucracy. It just identifies the gaps and moves through.