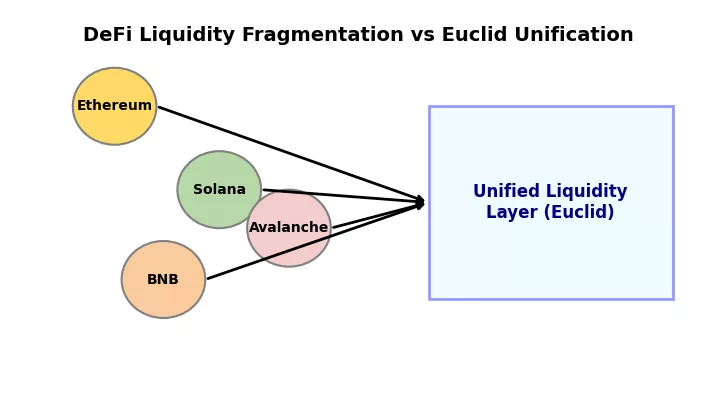

Why a unified liquidity layer matters

Decentralized finance expanded by extending outward rather than upward. Every emerging blockchain introduced its unique AMMs, routers, bridges, and wallets, leading to the gradual migration of liquidity into numerous separate pools. Traders adapted to slippage and diversions. Developers repeatedly learned to bootstrap depth. Liquidity providers discovered that capital dispersed across various chains seldom acts as a unified market. A cohesive liquidity layer presents an alternative framework for DeFi: liquidity must be accessible from any location and assembled as needed, allowing every swap, vault, or order to access the optimal global depth without requiring users to manage multiple chains or bridges. This is the driving force behind the Euclid Protocol.

Who Euclid is and the vision they’re pursuing

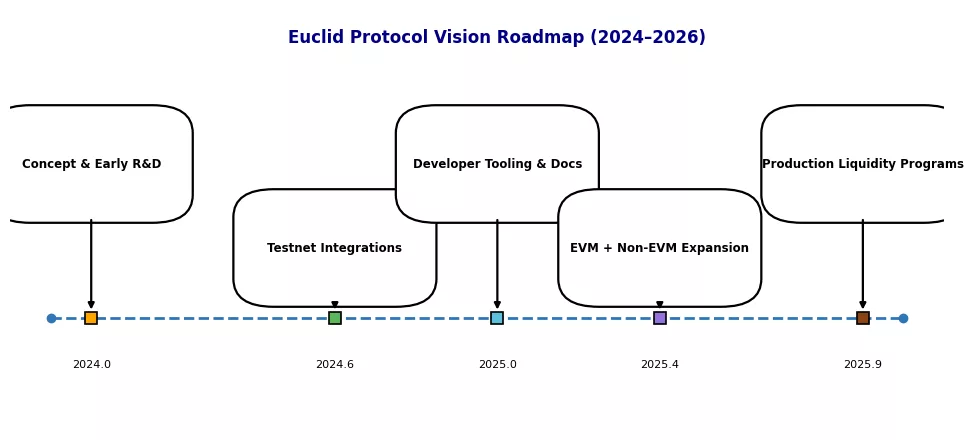

The team’s argument is that the future of DeFi lies not in quicker bridges or more attractive DEX interfaces, but in a communal liquidity framework that eliminates chain limitations. They convey a vision where the typical user never questions where assets are stored, and where applications negotiate pricing and depth with a worldwide, chain-independent pool. In their public documents and resources, a developer-centric tone is evident: modular components, integration pathways without permissions, and a roadmap focusing on testnets, audits, and partner implementations in both EVM and non-EVM environments.

What Euclid actually builds

Central to Euclid is a cohesive liquidity layer managed by a virtual settlement engine and interconnected via a cross-chain messaging framework. The virtual settlement layer performs the core functions: it manages liquidity across interconnected chains as if it were a single pool, calculates the best execution strategies for swaps or allocations, and organizes asset delivery based on user preferences. The messaging protocol serves as the interchain messenger that transmits intent and confirmations. On every chain, Euclid implements a concise collection of smart contract patterns including factory, router, and escrow to link users and dApps to the unified layer. The design is intentionally straightforward: maintain clear trust surfaces, keep modules compact, and ensure developer ergonomics resemble standard AMM processes while allowing the global layer to manage cross-chain intricacies.

How a cross-chain swap actually flows

Picture a trader possessing Token Y on Chain A who seeks Token X on Chain B. The trader authorizes a transaction on Chain A via an app that works with Euclid. The contract at the factory on Chain A receives the order and communicates intent to the messaging layer. The virtual settlement layer examines the consolidated liquidity perspective, determines which pools on which chains should fulfill the order at the optimal overall price, and creates a strategy. Instructions for messaging are sent to the intended chains, escrows manage the settlement process, and the user gets Token X at their desired location, with the arrangement crafted discreetly in the background. For the trader, it seems like one location; for Euclid, it represents a collection of synchronized, verified actions across various areas.

Why this model improves UX and capital efficiency

For a user, Euclid means fewer steps and reduced uncertainty. The exchange transforms into a single clear intention instead of a bridge-approve-wait-swap journey. For a developer, Euclid is an advantage: a single integration provides access to global liquidity without needing to establish new pools for each chain. For liquidity providers, Euclid presents a chance to optimize capital usage; a single unit of liquidity can support transactions across multiple chains instead of just one. The overall impact results in improved pricing for traders, a quicker time-to-market for applications, and a more favorable long-term utilization profile for LP capital. All of this isn’t free; you still require thorough audits, meticulous routing logic, and transparent economics, yet the architecture directly addresses the inefficiencies that caused the multichain period to seem more burdensome than necessary.

What still has to go right

The flywheel begins with acceptance. The greater the number of dApps, wallets, and chains that connect to the unified layer, the higher the route quality and the clearer the UX advantage becomes. Security is essential as cross-domain collaboration increases the attack surface; the messaging infrastructure, settlement processes, and on-chain components all require multi-layered safeguards and public scrutiny. Incentives need to be consistent to ensure that liquidity truly gathers and remains. Ultimately, transparency is essential: identified integrations, confirmable volumes, audit documentation, and a token and fee structure that connect usage with sustainability. If those components come together, the unification story transforms from hopeful to unavoidable, and DeFi acquires the foundation it has been striving for since its initial bridge.