During the last decade, at least for the most part, family offices regarded cryptocurrencies as peripheral investments similar to frontier markets or early-stage venture capital: interesting, asymmetric but peripheral. The amounts allocated were minimal, tentative, and often interpreted as optionality rather than conviction. However, this approach is gradually changing. Ultra-rich family offices all over the regions including Europe, the Middle East, and parts of Asia, are now moving crypto from a speculative section to a strategic allocation. This transition is, however, not taking place because of hype cycles or short-term price movements.

Rather, it is a reaction to continual changes in the capital markets, custody infrastructure, and digital assets’ place in a world where inflation risk, sovereign debt expansion, and geopolitical fragmentation are perpetual. By the year 2026, crypto exposure in the family office portfolios will not resemble a tech bet but will rather be seen as a macro hedge with embedded optionality.

From experiment to allocation

The trait that most sharply differentiates family offices from other kinds of investors is their long-term perspective. They are more like a rock than a river in their investments. They are patient and steadfast; once a family office takes a step, it will not take another until it is very sure of its next move. The aftermath of 2022 was a major step in this change.

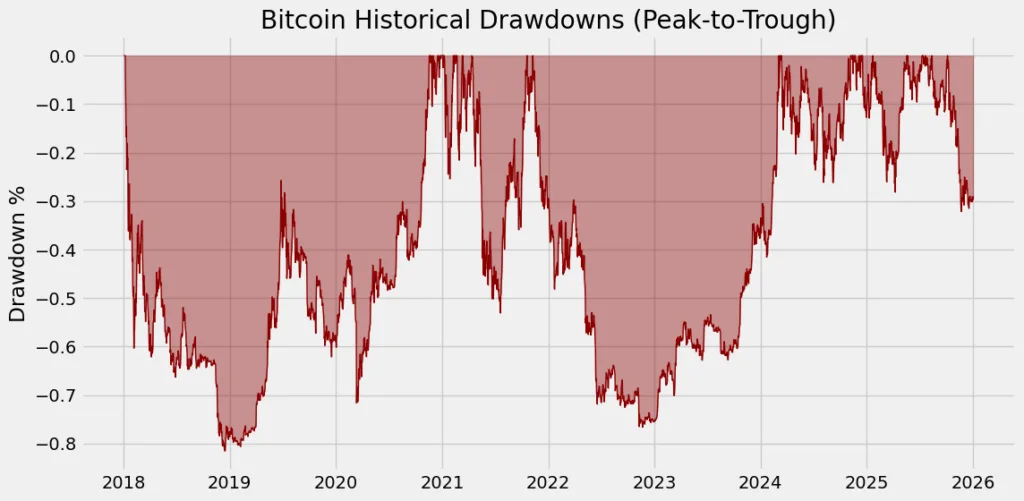

The demise of a big chunk of the crypto world led to a general cleaning-up process in which not only poor-quality but also badly-structured and risky players went out of business. Clearing out these forces did not just lead to higher-quality infrastructure; it also resulted in a clearer-cut division between speculative leverage and base-layer assets being. During the upheaval, family offices noticed an important thing: Bitcoin did not go away, Ethereum did not split, and even though centralized giants went bust, the basic connections between networks still worked.

For those capital allocators, whose principal task is to ensure capital does not lose its purchasing power over generations, that argument was stronger than price. Therefore, the present shift is less about turning to different places for higher returns and more about legalizing exposure. The move into cryptocurrency is no longer considered as a venture-style moonshot, it is being depicted as a non-sovereign monetary asset class with asymmetric upside and limited correlation to traditional portfolios when structured correctly.

Asset selection: Why BTC and ETH dominate

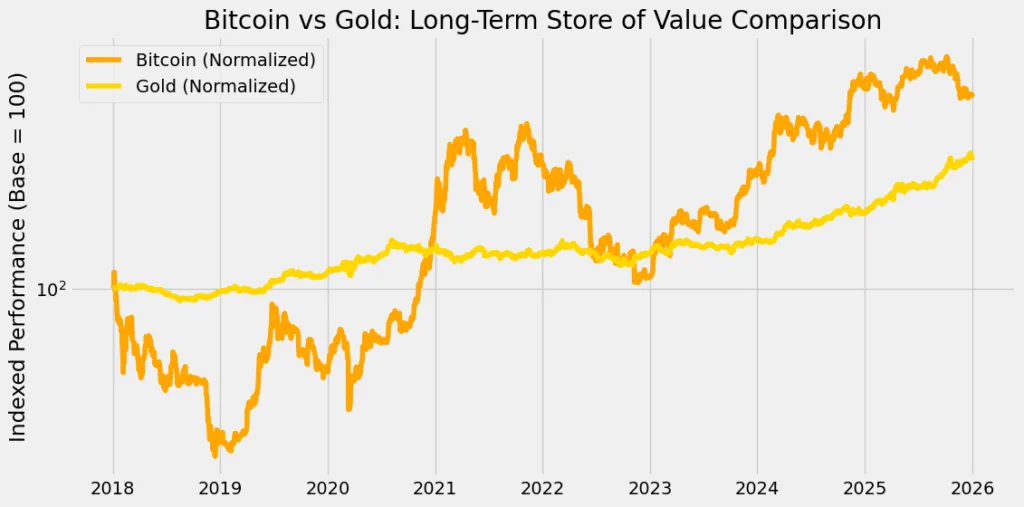

The situation in the family office allocations is still very much the same, despite the thousands of tokens that are in circulation. The vast majority of Bitcoin and Ethereum together represent long-term exposure, and there is a clear intention behind this concentration.Bitcoin has been more and more treated as digital monetary infrastructure rather and a technology play, which is the reason why most people have not given up on it. Its fixed supply, predictable issuance, and independence from fiscal policy are all characteristics that can be associated with those that once justified gold holdings. For family offices operating across jurisdictions, Bitcoin’s neutrality is a feature, not a risk. It is portable, censorship-resistant, and increasingly liquid at institutional scale.Ethereum plays a completely different role.

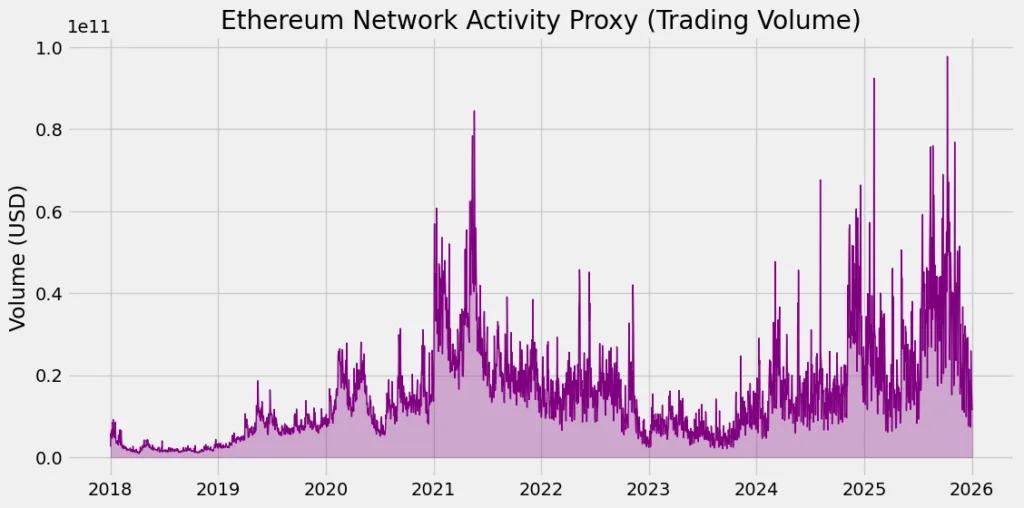

Money is not its envisioned use but rather that of a settlement infrastructure for a growing amount of financial activities taking place on-chain. Security tokens, stablecoins, collateralized lending, and programmable settlement are some areas where Ethereum gets the most attention as the base layer. For family offices, ETH means a risk in transaction volume, financial experimentation, and the long-term development of digital capital markets.Smaller investments in other assets are still made, but they are often considered as infrastructural investments rather than based on the stories told.

This includes custody-centric tokens, some Layer-2 scaling solutions with no more than real fee generation, and sometimes the very best stablecoin issuers in terms of regulation. The durability, cash-flow potential, and integration into broader financial plumbing are the common thread between these assets.

Infrastructure as the Enabler

To begin with, the major hurdle that kept family offices at bay was not volatility, but rather operational risk. However, that barrier is slowly but surely going away. With the strong and reliable custody of institutions, the situation now looks pretty much the same as it was with traditional prime brokers in terms of structure and governance. Multi-signature cold storage, insured custodial solutions, and segregated account structures allow family offices to hold crypto without violating the internal risk standards set by the offices. Next to that, the reporting, tax compliance, and audit tools have already reached a high level of sophistication, allowing the crypto holdings to be shown as part of the consolidated balance sheets. Risk management has also moved on.

Family offices are trading crypto not in the retail way but rather in a sophisticated way. The exposure is often unlevered, is held through regulated vehicles, and is supported by drawdown tolerance frameworks that accept extreme volatility. In some instances, crypto is even explicitly sized up as a long-duration option instead of a return-seeking engine. What changed is not the risk profile of the asset itself but rather the institution’s ability to manage that risk.

The significance of 2026

The transition’s timing comes at no surprise. Family offices are getting ready for a structural change that will happen soon. Many factors will be together in 2026. public debt will still be growing, and central banks will find their hands tied during the next recession and eventually, capital movement will be under more stringent political control. Meanwhile, asset tokenization is speeding up, stablecoins are becoming more integrated into global payment systems, and on-chain settlements are getting more common.

In such a scenario, the exposure to crypto will serve the dual purpose of insurance and participation. The investment will protect against erosion of money value and risk of transfer between jurisdictions while giving the investor a stake in a parallel financial arena that is still very much in the process of being developed for institutional players. Family offices have a better vision than the market they see that the smartest allocations are those made before the majority opinion changes.