The Federal Reserve of the United States, commonly called the Fed, is central to the worldwide financial system. While it is officially the central bank of the United States, its decisions have effects that extend beyond borders and asset classes, influencing economies in both apparent and subtle ways. Fundamentally, the Fed’s mission is to ensure price stability and optimize employment in the U.S. economy, yet since the U.S. dollar serves as the global reserve currency and foundation for international trade and finance, the Fed’s impact reaches well beyond American territory. Every action taken by the institution, every declaration and modification, is examined by investors, governments, and traders globally.

One of the Fed’s most potent tools is its capacity to set and affect interest rates. Though the mechanics may be complex, the concept is simple: by changing the borrowing cost, the Fed can either boost economic activity or reduce it. This monetary policy tool becomes particularly important during periods of inflation, economic downturn, or worldwide financial instability.

What are federal reserve rates and how they work

At the core of the Federal Reserve’s monetary policy tools is the federal funds rate, commonly referred to as the Fed rate. This is the rate at which commercial banks borrow reserves from one another for overnight loans. Although it might appear to be a minor interbank transaction, the significance of this rate is immense, as it establishes the foundation for borrowing expenses across the whole financial system. The federal funds rate directly or indirectly affects mortgages, car loans, credit card interest rates, corporate debt, and even yields on government bonds.

The Fed does not directly control this rate like a store owner establishes prices. Rather, it establishes a target range and employs open market operations along with tools like the interest rate on reserves to steer the actual rate within that range. On the other hand, when the Fed aims to boost growth, it reduces the target range, promoting borrowing and investment.

It’s crucial to recognize that the Fed rate involves more than merely borrowing expenses. It also indicates how the central bank views the condition of the economy. A higher rate typically indicates the Fed’s concern over inflation rising too quickly, whereas a lower rate suggests apprehensions about slow growth or potential financial instability. Investors closely monitor not just the rate itself but also the Federal Reserve’s statements, predictions, and outlook regarding future rate movements.

Traders account for the likelihood of future movements, generating volatility not just in stocks and bonds but also in commodities and, more frequently, cryptocurrencies. Thus, Fed rates act as both an effective tool of economic policy and a psychological stabilizer that influences investor mood.

The Federal Reserve does not randomly alter interest rates; rather, its changes adhere to a purposeful and meticulously organized process based on data and future expectations. This procedure starts with the Federal Open Market Committee (FOMC), the entity tasked with establishing monetary policy. The FOMC convenes eight times annually to assess economic conditions, financial stability, inflation rates, employment statistics, and global risks prior to determining whether to increase, decrease, or hold the federal funds rate steady.

When the Fed hikes rates, it raises the expense of borrowing for banks. Because commercial banks obtain short-term funds directly or indirectly at the federal funds rate, the increased expense is subsequently transferred to businesses and individuals through elevated loan and mortgage rates. Crucially, the Fed’s choices have effects that extend well beyond American borders. Since the dollar functions as the leading reserve currency globally, changes in U.S. interest rates impact worldwide capital movements, foreign currency valuations, and the stability of emerging economies.

Within the realm of cryptocurrency, the Fed’s method for setting rates carries distinct importance. For instance, when the cost of borrowing rises because of increased rates, investors usually withdraw their funds from riskier or more volatile investments, like cryptocurrencies, opting instead for more stable returns in U.S. Treasuries or savings accounts. The opposite is equally valid: in times of low interest rates, investors frequently look for alternative assets that offer better returns, which directs liquidity into the crypto markets.

An additional layer of intricacy exists in the Fed’s communication approach. The central bank seldom catches markets off guard with abrupt or unforeseen changes. Rather, it conveys its intentions via forward guidance nuanced wording in policy announcements, addresses, and media briefings. Markets, such as cryptocurrency traders, listen closely to every statement from the Fed Chair since perception alone can influence asset prices.This psychological and forward-looking element renders crypto particularly reactive to Fed policy.

It is important to mention that the Fed utilizes quantitative methods in addition to rate changes. Policies regarding the balance sheet, like quantitative easing (QE) or quantitative tightening (QT), directly influence the volume of liquidity flowing in the financial system. Although these measures do not constitute strict interest rate changes, they influence rates to enhance or reduce liquidity conditions. In the crypto space, this is essential: increased liquidity usually promotes positive market trends, whereas liquidity shortages often signal declines in digital assets.

The historical relationship between Fed policy and Bitcoin’s performance

Bitcoin was introduced in 2009, following the 2008 worldwide financial crisis. The timing was intentional: its pseudonymous creator, Satoshi Nakamoto, explicitly mentioned the shortcomings of central banks in the genesis block with the statement, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Since the beginning, Bitcoin has established itself as a different financial system one independent of central banks, interest rate regulations, and fiat currency alterations. This ideological basis has influenced how investors view its connection to the Federal Reserve’s policies.

To grasp the impact of Fed rates on crypto, it’s helpful to review significant economic cycles since Bitcoin’s creation and analyze how the asset responded to monetary policy changes. Even though Bitcoin is roughly 15 years old, its brief history already features multiple clear instances of how Fed tightening or loosening cycles correlate with crypto market activity.

The Era of zero interest rates (2009–2015)

After the global financial crisis, the Federal Reserve reduced interest rates to nearly zero and kept them at that level for several years. This policy, along with quantitative easing, provided liquidity to the system and motivated investors to pursue riskier assets for better returns. Amid this context, Bitcoin evolved from a marginal experiment to a specialized asset attracting interest from initial users.

In its initial years, Bitcoin’s price fluctuations were influenced primarily by internal elements like adoption, mining conditions, and speculative interest while the backdrop of inexpensive money created a conducive atmosphere. Risk-taking flourished when borrowing expenses were minimal, and Bitcoin gained indirectly, despite its market size remaining too limited for Fed policy to be the direct driver of price fluctuations.

The first rate hike cycle (2015–2018)

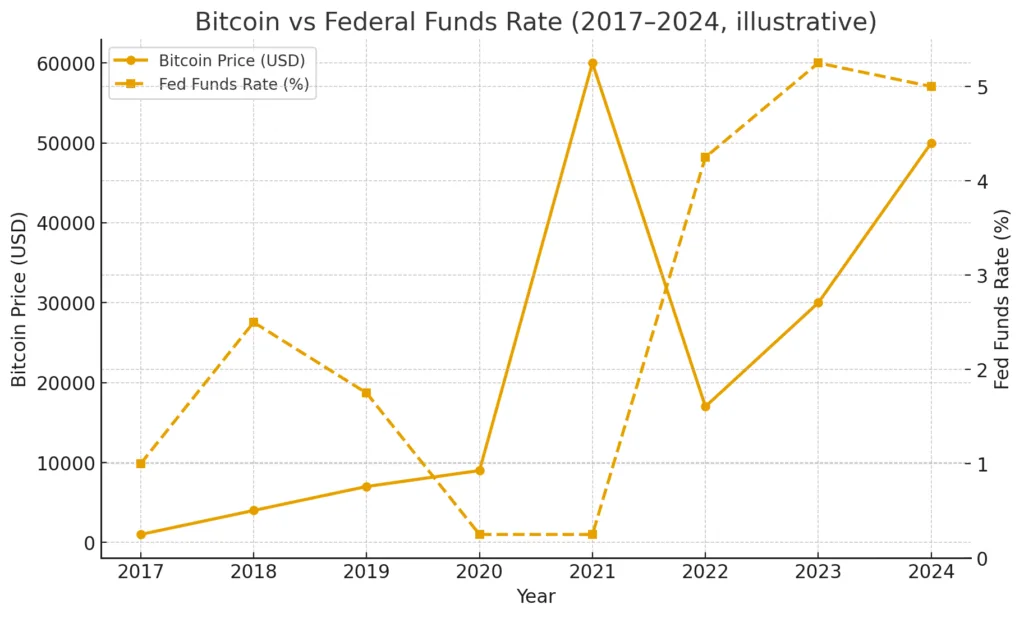

In December 2015, the Fed increased rates for the first time after the crisis. This signified the start of a gradual tightening phase, during which rates slowly increased until 2018. Traditional beliefs indicated that a stricter monetary policy would negatively impact risk assets, yet Bitcoin’s path revealed a more complex narrative.

Throughout this time, Bitcoin underwent its initial significant bull run, reaching a high point close to $20,000 in late 2017. The timing coincided with incremental Fed rate increases, but Bitcoin surged because of its novelty, increasing awareness, and the ICO frenzy that created immense speculative interest. Crucially, Bitcoin’s actions during this period demonstrated that although Fed policy establishes the environment, crypto can pursue its own adoption-focused cycles that occasionally surpass macroeconomic challenges.

By 2018, the synergy of Fed tightening and a waning crypto craze led to Bitcoin’s significant drop. The asset declined over 80% from its high, reflecting the wider “risk-off” sentiment as liquidity conditions became more stringent. This time frame underscored that although crypto can disregard monetary policy in the short term, extended tightening ultimately diminishes the speculative capacity that drives bubbles.

The pandemic and the great liquidity wave (2020–2021)

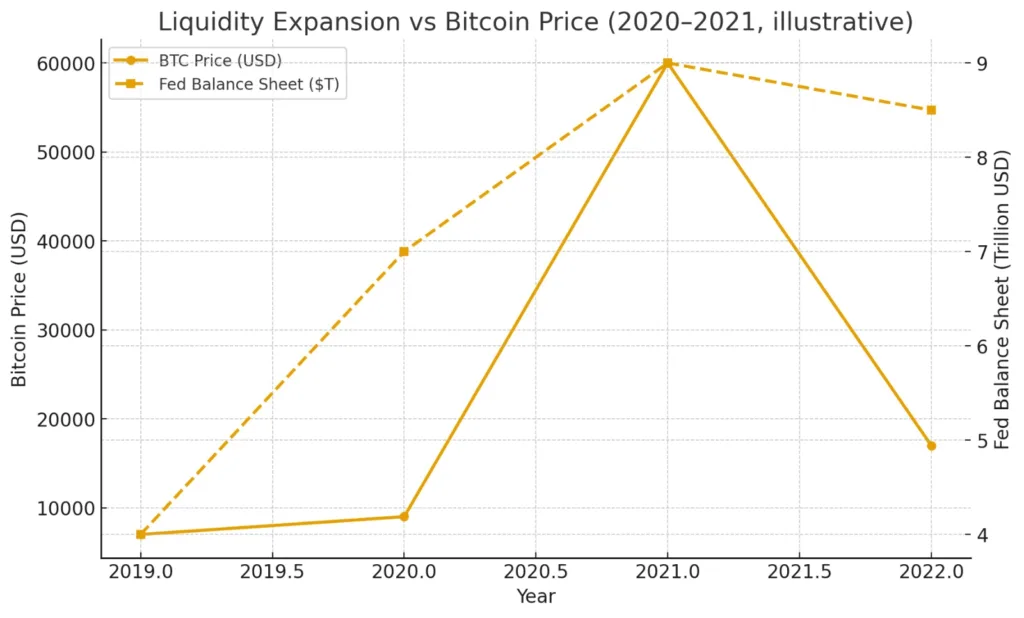

The beginning of the COVID-19 pandemic in March 2020 sparked a worldwide economic crisis. The Fed took extraordinary measures: reducing rates to zero, enacting significant quantitative easing, and pouring trillions of dollars into the financial system. This remarkable surge of liquidity generated an ideal situation for Bitcoin and various other cryptocurrencies.

As real interest rates became negative indicating that inflation exceeded nominal rates investors looked for protections against currency devaluation. Bitcoin’s story as “digital gold” intensified, institutional acceptance increased, and retail investors flocked to the market. The outcome was one of the most powerful bull markets in cryptocurrency history, with Bitcoin climbing from below $5,000 in March 2020 to almost $69,000 by the end of 2021.

This era highlights the clearest link between Fed policy and Bitcoin’s prosperity: when money is inexpensive and abundant, and real yields are significantly negative, Bitcoin flourishes as both a safeguard against fiat depreciation and a high-beta speculative investment.

The aggressive rate hikes of 2022–2023

In 2022, a change occurred. Inflation surged to levels not seen in decades, compelling the Fed to initiate its most stringent tightening measures since the 1980s. Interest rates increased from almost zero to over 5% in slightly more than a year, as quantitative tightening reduced liquidity within the system.

The effect on cryptocurrency was instant and intense, erasing trillions in market worth throughout the digital asset landscape. The failure of prominent companies such as Terra, Celsius, and FTX worsened the decline, but the overarching environment of restricted liquidity and increased risk-free yields created the conditions for the suffering.

For the first time ever, Bitcoin experienced an entire Federal Reserve rate hike cycle as a significant, commonly owned asset. The findings highlighted the increased sensitivity of crypto to monetary conditions: as cash and Treasuries unexpectedly provided safe returns, the attractiveness of volatile assets such as Bitcoin waned.

The shift toward stabilization (2023–2024)

By late 2023 and into 2024, inflation started to stabilize, and the Fed indicated that its cycle of rate increases was coming to a close. Markets began incorporating anticipated cuts, and Bitcoin started to bounce back, moving closer to former peaks. Institutional adoption resurfaced, driven by conversations about Bitcoin ETFs and increasing regulatory transparency.

This phase highlighted another common trend: cryptocurrency markets often anticipate and react to expectations regarding Federal Reserve policy. Even prior to the realization of cuts, the simple expectation of looser liquidity can spark rallies. Investors prepared for a scenario where embracing risk could soon yield returns, illustrating how Fed messages beyond just rate changes can influence sentiment.

Lessons from history

Reflecting on these cycles reveals several important lessons. Initially, Bitcoin often flourishes in an environment of loose monetary policy, characterized by plentiful liquidity and negative real yields. Secondly, it encounters difficulties during intense tightening periods, as increased risk-free returns diminish speculative investments in crypto. Third, although Bitcoin experiences distinct adoption-related cycles, the overall macro environment now significantly influences its trajectory, particularly with increasing institutional involvement.

The historical record clearly indicates one thing: Bitcoin, though created as an anti-establishment asset, cannot evade the influence of the Federal Reserve. Its function as “digital gold” and as a high-beta speculative asset guarantees that Fed policy continues to play a crucial role in influencing its path.

The Crypto market’s sensitivity to Fed rate decisions

The realm of cryptocurrencies is frequently depicted as a self-sufficient financial environment decentralized, transnational, and resistant to conventional monetary influences. However, in spite of these attributes, the cryptocurrency market is highly responsive to the actions taken by the U.S. Federal Reserve. Changes in the Fed rate impact the worldwide financial system, altering the actions of institutional investors, retail traders, and blockchain developers. This section will examine the various channels by which crypto markets react to interest rate fluctuations and why these reactions can be both prompt and enduring.

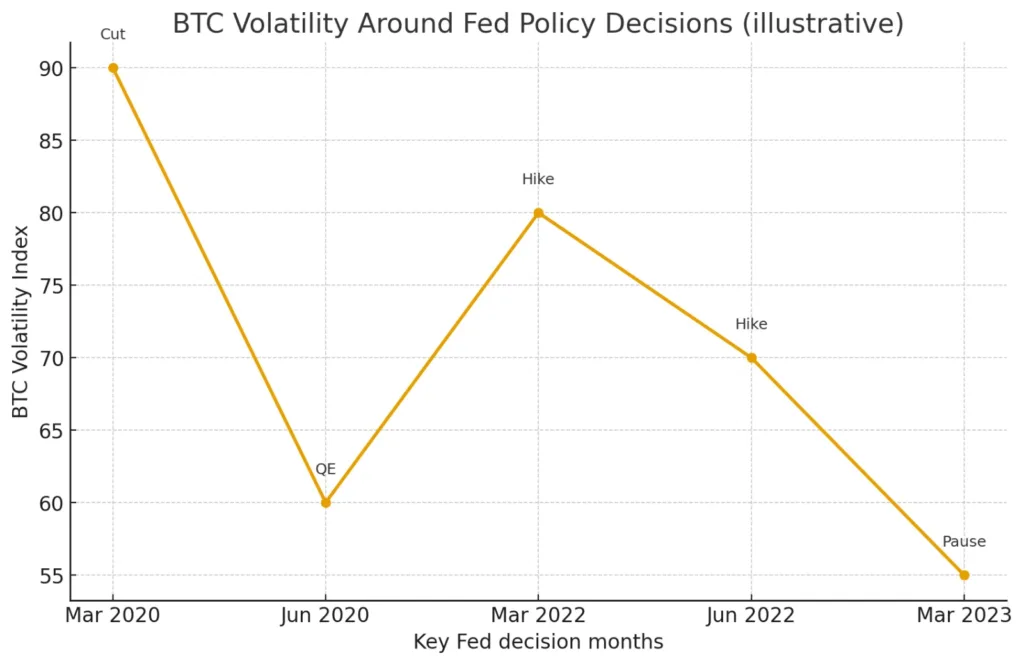

The clearest response to Fed rate announcements is fluctuations in price. Bitcoin, frequently referred to as “digital gold,” typically experiences considerable fluctuations during the Federal Open Market Committee (FOMC) meetings. This volatility is influenced not just by the actual decision whether to increase, decrease, or maintain rates but also by the guidance given by the Fed chair during news briefings. Traders seek to factor in projections regarding future monetary policy, resulting in increased trading volumes. Altcoins, having smaller market capitalizations and reduced liquidity relative to Bitcoin, frequently display exaggerated forms of these fluctuations. Consequently, the Fed’s statements and measures can ignite both uptrends and downturns in the cryptocurrency market.

Liquidity represents another vital aspect. When interest rates rise, borrowing costs increase, leading to a reduced availability of capital in various markets. In the realm of crypto, this may result in diminished investments from institutional investors, who may opt for the security and returns of U.S. Treasuries rather than the fluctuations of Bitcoin or Ethereum. On the other hand, when the Fed lowers rates, liquidity pours into the system, and risk assets like crypto typically see an increase in speculative interest. This is one reason Bitcoin achieved new peaks during times of historically low interest rates, when liquidity was plentiful and investors sought alternative returns.

Institutional actions have a significant influence on the sensitivity of crypto rates. Hedge funds, venture capital firms, and asset managers that invest in crypto do so while closely monitoring the Fed’s policy direction. Elevated rates tighten valuations, rendering risky investments less appealing. This impacts not just the secondary market for tokens but also the primary funding for blockchain startups and decentralized finance (DeFi) initiatives. As capital tightens, venture operations diminish, and token launches might be delayed or reduced in scale. Conversely, a supportive Fed policy promotes bold capital investment, fostering innovation and fresh speculative stories in the crypto space.

Stablecoins introduce an additional level of complexity. These digital assets, which link their worth to fiat currencies, are deeply connected to U.S. interest rates. Issuers of stablecoins such as USDT or USDC frequently maintain substantial reserves in short-term Treasuries and other interest-generating assets. As rates increase, these reserves produce greater returns, enhancing the profitability of stablecoin issuance. This dynamic carries significant consequences: it encourages issuers to increase supply, which enhances liquidity in the crypto ecosystem. Simultaneously, it links the stability of stablecoin markets more closely to the monetary policy of the Federal Reserve.

Psychology and emotions are also important. Crypto traders are well-known for being highly responsive to macroeconomic news. A hawkish Federal Reserve that indicates a lengthy battle against inflation usually diminishes optimism, strengthening a risk-averse attitude that pushes prices down. In contrast, a dovish turn implying that increases in rates are halting or that reductions might occur can ignite euphoric surges.

Ultimately, it’s crucial to acknowledge that the Fed’s impact on cryptocurrency is not consistently direct. Numerous investors beyond the U.S. engage in trading digital assets, and some might think they are immune to Fed policy. Nonetheless, since the U.S. dollar continues to be the global reserve currency and most cryptocurrencies are priced in dollars, the ripple effects of interest rate changes are unavoidable. When the Fed acts, it alters global capital movements, and those movements will inevitably enter or exit crypto.

The impact of Federal Reserve policy on Crypto volatility

In analyzing the relationship between Federal Reserve actions and cryptocurrencies, a notable aspect is the significant impact that monetary tightening or easing has on volatility in digital assets. In contrast to equities or bonds that possess decades of historical data to shape expectations, the crypto market remains in its early developmental phase. Consequently, the reaction to Fed decisions frequently seems intensified, resulting in exaggerated market fluctuations.

The fluctuations start prior to the official statements. Traders in traditional finance and cryptocurrency monitor Fed speeches, meeting minutes, and inflation data closely. These occurrences act as signals of expectation: if the Fed is predicted to increase interest rates, capital starts to shift away from high-risk investments. For cryptocurrencies, frequently seen as the pinnacle of speculative assets, this indicates significant drops prior to the actual enforcement of policies. Conversely, dovish indications hinting at a possible halt in increases or even reductions in rates can initiate swift surges in Bitcoin and altcoins, occasionally in just a few hours.

An essential factor in this situation is liquidity. With rising interest rates, financial system liquidity tightens, resulting in reduced cash available for speculative asset investment. This is intensified by the existence of leveraged positions in cryptocurrency markets. As liquidity diminishes, margin calls and liquidations increase, intensifying volatility.

Simultaneously, crypto’s distinctive framework operating continuously around the clock on worldwide exchanges intensifies the impact of Federal Reserve policy. Stock markets halt during weekends and after trading hours, whereas crypto reacts continuously in real time. A dovish statement issued on a Friday afternoon in Washington could lead to extended weekend fluctuations in Bitcoin and Ethereum, ensnaring both retail traders and institutions in a whirlwind of anxiety or excitement.

Federal decisions involve more than mere figures; they also concern emotions. If investors feel that the Fed is unable to manage inflation, confidence in fiat systems diminishes. This story can ironically create a safe-haven appeal for Bitcoin, which some consider a protection against currency devaluation. The irony is that the same Fed decision a rate increase could simultaneously create short-term selling pressure (because of reduced liquidity) while also strengthening the long-term narrative of Bitcoin as “digital gold” that resists manipulation by central banks.

In the end, the Fed serves as both a stabilizing and destabilizing force for cryptocurrency. Its policies stabilize inflation expectations within the larger economy but create instability for speculative assets such as cryptocurrencies, where investors are highly sensitive to shifts in dollar liquidity. This duality renders Fed-watching a crucial element of crypto trading strategies, as volatility can represent both a risk and an opportunity based on one’s position.

Case studies – Fed rate shifts and Crypto market reactions

To anchor this analysis in actual events, it is helpful to examine how particular Federal Reserve rate choices have traditionally impacted the crypto market. Although correlation doesn’t necessarily mean causation, significant Fed policy changes frequently coincide with critical phases in cryptocurrency price cycles.

A prominent case study originates from 2017, a year that is famously remembered for the Bitcoin bull run which propelled the asset from below $1,000 in January to almost $20,000 by December. The Fed increased rates three times that year, yet the crypto market soared anyway. This apparently conflicting result emphasizes that although rates are significant, they engage with other strong influences like worldwide acceptance, speculative excitement, and the initiation of futures markets. The bull market was fueled more by the excitement of retail speculation and the story of Bitcoin as “digital gold” rather than by conventional monetary policy. It is important to mention that after rates were increased multiple times, the wider stock market started to slow down in early 2018, which correlated with Bitcoin’s significant drop to under $4,000. Although it’s not accurate to claim that the rate increases directly triggered the crash, they contributed to a tightening macroeconomic environment that reduced liquidity in all risk assets.

Jump to 2020, and the dynamics changed completely. When the COVID-19 pandemic occurred, the Fed slashed rates to almost zero as an emergency measure, simultaneously implementing remarkable amounts of quantitative easing. This influx of liquid funds, along with government stimulus payments, drove one of the most significant increases in asset prices ever recorded. Shares surged, real estate values increased, and digital currencies entered a significant bull market. Bitcoin increased from $3,800 in March 2020 to more than $60,000 by April 2021. Ethereum and various altcoins experienced substantial increases. During this time, the relationship between Fed policy and crypto was much more apparent: plentiful inexpensive cash established the ideal conditions for speculative assets to flourish.

The subsequent shift occurred in 2022. Confronted with inflation at its peak in forty years, the Fed initiated the quickest rate-increase cycle since the early 1980s. Beginning from almost nothing, the federal funds rate rose past 4% by the year’s conclusion. The cryptocurrency market experienced one of its most significant declines ever. Bitcoin dropped from more than $45,000 at the start of 2022 to below $17,000 by the end of the year. Ethereum, once over $3,000, fell to roughly $1,200. Liquidity disappeared, leveraged companies went under, and the sector experienced remarkable collapses like Terra/Luna, Celsius, and FTX. Although not all of these resulted directly from rate increases, the restrictive atmosphere heightened weaknesses in the system. With credit conditions becoming stricter and investors reducing risk, the speculative excesses of the cryptocurrency surge collapsed. The cryptocurrency downturn of 2022 reflects the stock and bond market declines that followed the Fed’s aggressive shift, highlighting the significant influence of monetary policy on digital currencies.

Times of optimism, like when markets anticipated rate reductions, triggered brief rallies. On the other hand, any indications from the Fed that rate cuts would be postponed frequently resulted in sell-offs. Bitcoin’s rise above $30,000 in 2023 and later in 2024 was driven in part by hopes for more relaxed conditions and increased mainstream acceptance, yet it never entirely separated from Federal Reserve cues.

When considered collectively, these instances illustrate a trend: cryptocurrency flourishes in relaxed monetary contexts with plentiful liquidity, while it faces difficulties during tightening phases. The strength of the response can fluctuate based on various industry-related factors, yet the general direction is clear. Rate reductions and easing usually align with bull markets, whereas rate increases and tightening are associated with crashes or lengthy bear periods.

This situation is unlikely to alter in the near future. While crypto continues to rely significantly on speculative capital, liquidity, and investors’ risk preferences, the Federal Reserve’s choices will keep influencing its price cycles strongly. The case studies from 2017, 2020, and 2022 offer guidance on how upcoming Fed actions could influence the path of digital assets.

Extended case studies – Fed rate shifts and Crypto market reactions

Although the significant events of 2017, 2020, and 2022 highlight overarching trends, looking into smaller Fed actions and their short-term effects on crypto uncovers the subtleties of market sentiment and liquidity behavior. These instances demonstrate how minor adjustments or faint indications from the Fed can provoke significant responses in digital assets, owing to the market’s speculative and heavily leveraged characteristics.

In late 2018 and early 2019, after the initial tightening cycle following years of near-zero rates, Bitcoin and various cryptocurrencies had already faced a severe decline. By December, Bitcoin had dropped to approximately $3,200 from its 2017 high of about $20,000. Throughout this time, even slight remarks from the Fed could sway sentiment. Any indication of ongoing tightening strengthened the risk-averse sentiment, whereas dovish cues might trigger minor relief rallies. The core narrative for crypto adoption stayed optimistic, yet the Fed’s direction acted as a liquidity regulator, managing the capital accessible to risk assets. The market reacted in expectation, with minor rallies frequently aligning with nuanced dovish statements, showing that crypto traders paid just as much attention to forward guidance as they did to real rate adjustments.

By the middle of 2021, when the Fed started talking about tapering its quantitative easing initiatives, cryptocurrency markets responded proactively once more. Bitcoin faced multiple declines during months when the Fed indicated a slow decrease in asset buying. Although there wasn’t an official rate increase, the anticipated decrease in liquidity resulted in a shadow tightening impact. Investors recognized that reduced money printing would lead to a decrease in speculative funds entering cryptocurrencies. Bitcoin’s value dropped from approximately $64,000 in April 2021 to around $30,000 by July, influenced by macroeconomic risk-off sentiment heightened by significant leverage and speculative positioning. The episode demonstrated how shifts in liquidity expectations alone, without any direct changes in interest rates, could significantly affect crypto markets.

Capital shifted to secure assets like Treasuries, diminishing interest in risky, speculative investments. The cryptocurrency market underwent a series of cascading liquidations, with leading exchanges indicating billions in mandatory sales. Stricter monetary policy along with crypto-specific leverage intensified the downturn, underscoring the systemic vulnerability of digital assets to Fed measures.

With inflation pressures subsiding in 2023 and 2024, the Fed indicated a possible conclusion to the steep increases, prompting a preemptive reaction from crypto markets. Even prior to the cuts happening, the expectation of easier liquidity sparked rallies. Traders and institutions accounted for the possibility of future easing, boosting capital investment in Bitcoin, Ethereum, and other promising assets. This proactive attitude showed that beliefs regarding monetary conditions can be as influential as real changes in interest rates. Bitcoin consistently rose from under $30,000 in early 2023 to over $40,000 by mid-2024, driven by renewed institutional interest, ETF approvals, and narrative-led adoption. The market’s response indicated that the psychological aspect of Fed policy its interpretation and expectations continues to be a key factor influencing cryptocurrency price movements.

Multiple patterns arise from these episodes. Leverage consistently magnifies the impact of Fed policy, transforming small rate adjustments or indications into significant price fluctuations. Cryptocurrency markets frequently align with stock markets during major policy changes, mirroring the wider risk-on or risk-off attitudes. Stablecoins have an indirect yet vital function in conveying Fed influences into crypto liquidity, as increased U.S. interest rates improve yields on the fiat reserves supporting these digital currencies. Ultimately, emotions and stories are extremely significant.

The historical and micro-level evidence highlights that the Fed’s measures, whether via actual rate adjustments or communication, significantly impact crypto markets. Bitcoin and other digital assets, while created to function without central banks, are still very responsive to liquidity situations, risk-free returns, and investor sentiment influenced by the Federal Reserve. The interplay of leverage, future-oriented strategies, and the U.S. dollar’s global supremacy guarantees that Fed choices, whether historical, current, or expected, persist in influencing the rise and fall of crypto volatility and speculative trends.

Future Fed policy scenarios and Crypto market implications

In the future, the course of the Federal Reserve’s monetary policy will continue to be a key factor influencing crypto market dynamics. Although historical cycles offer important insights, the upcoming phase of Federal Reserve actions presents distinct challenges and uncertainties that may influence digital assets in groundbreaking manners. Market participants currently encounter a more intricate environment, where anticipations, forward guidance, and macroeconomic conditions intertwine with the changing story of cryptocurrencies.

One possible scenario is that the Fed adopts a “higher-for-longer” approach to interest rates. In the context of cryptocurrencies, this situation usually indicates an ongoing risk-averse environment. Investors might favor assets that offer consistent returns, like bonds, money market instruments, or interest-earning stablecoins, over tokens with high volatility. In crypto, leveraged trading might decrease, leading to smaller speculative rallies, while price corrections could last for extended durations. This atmosphere likewise deters the establishment and financing of new blockchain initiatives, as venture capital and institutional investments consider the elevated cost of capital in light of unpredictable returns. Nonetheless, even in this situation, some crypto narratives like Bitcoin serving as protection against fiat erosion may still be attractive to long-term investors who value macro hedging more than short-term trading.

A different situation entails progressive rate reductions as inflation normalizes and economic expansion slows down. Historically, periods of monetary easing have created a favorable environment for speculative investments, and cryptocurrency is no different.The expectation of these cuts frequently results in premature positioning, as traders and institutions gather assets ahead of formal policy alterations. In this scenario, crypto markets are expected to undergo phases of prolonged bullish activity, fueled by retail excitement, rising leverage, and a revival of venture interest in blockchain advancements. The speed and clarity of the Fed’s messaging are vital; clear guidance can ease the shift and lessen abrupt fluctuations, while uncertainty can trigger intermittent surges in trading.

A third, more extreme situation involves policy errors or unforeseen macroeconomic shocks. For example, if inflation turns out to be more enduring than expected or if the economic forecast declines sharply, the Fed might need to make swift, unexpected changes. Such actions typically provoke abrupt, significant changes in risk perception. In the crypto markets, the effects might be intensified due to the significant leverage, worldwide retail involvement, and continuous trading format. ,whereas unforeseen dovish measures might lead to abrupt surges as capital rushes back into speculative assets. These instances highlight the dual aspect of Fed influence: it stabilizes expectations in conventional markets while also potentially introducing volatility into speculative, less-regulated environments such as cryptocurrency.

Investor psychology will remain a significant influence. Even with anticipated policy trajectories, market sentiment may differ from fundamentals, resulting in rallies, corrections, and occasional bubbles. Traders analyze Fed statements through various perspectives: macroeconomic projections, liquidity predictions, risk appetite/safety sentiment, and the positioning of other market players. The forward-looking aspect of cryptocurrency markets intensifies every signal, and the active interaction between perception and reality guarantees that the Fed’s impact is both instantaneous and lasting.

Quantitative and technical indicators for anticipating fed-driven Crypto moves

For investors looking to understand the relationship between Federal Reserve policy and cryptocurrency markets, a blend of quantitative and technical tools has become essential. Although macroeconomic insights offer a wider perspective, the extreme volatility and constant trading of cryptocurrencies require a more detailed, data-oriented method to predict market responses. Traders and organizations utilize these indicators not just to understand price movements but to strategically position themselves before liquidity changes and sentiment fluctuations influenced by the Fed.

A fundamental method involves monitoring interest rate-sensitive assets that act as indicators of market expectations. This encompasses Treasury yields, the yield curve, and rates for short-term funding. Alterations in these assets frequently occur before variations in risk tolerance: as the yield on U.S. Treasuries escalates, the expense of retaining non-yielding crypto surges, leading to adjustments toward conventional safe-haven investments.Advanced traders track these signals as they occur, incorporating them into algorithmic frameworks that assess the likelihood of cryptocurrency market surges or downturns based on expected Fed actions.

An essential quantitative metric is the liquidity of the market and funding rates within cryptocurrency exchanges. Funding rates, indicative of the cost to hold leveraged positions, showcase the supply and demand forces for borrowed funds. Elevated positive funding rates indicate robust bullish sentiment, typically driven by abundant liquidity in the wider financial system. On the other hand, increasing or high funding costs could suggest a decline in speculative capital, coinciding with times of Fed tightening.

Technical analysis also adds to these macro and liquidity indicators. Crypto traders carefully analyze chart patterns, moving averages, and momentum indicators to detect trends and predict reversals. For example, exponential moving averages (EMAs) can indicate changes in market sentiment that might align with Fed announcements.Relative strength indicators (RSI) and volatility bands offer further insight, enabling traders to identify overbought or oversold situations that may prompt rapid reactions to policy announcements. These technical indicators are especially valuable as they incorporate real-time market sentiment, showcasing how participants uniformly perceive Fed signals.

From an institutional perspective, derivative markets provide advanced signals. Futures curves, implied volatility from options, and open interest offer insights into anticipated market stress or excitement. For instance, a steepening of the Bitcoin futures curve might suggest preparatory positioning for interest rate reductions, while increasing implied volatility in crypto options could indicate market unease before a significant Fed announcement. Hedge funds and algorithmic trading firms utilize these indicators to hedge risks, refine entry and exit strategies, and adjust leverage proactively, making sure that macroeconomic changes lead to strategic decisions instead of reactive trading.

Sentiment analysis, while qualitative, is progressively incorporating into quantitative models. Machine learning models gather information from news, social media, and trading forums to detect immediate changes in investor sentiment. Due to the sentiment-driven nature of crypto markets, minor shifts in perception like a hawkish comment from the Fed chair can lead to significant reactions.

Ultimately, the interaction between on-chain data and macroeconomic indicators generates a distinct collection of metrics not found in traditional finance. Measurements like net inflows to exchanges, alterations in stablecoin supply, and transaction activity on the network serve as early indicators of liquidity distribution and speculative interest. When paired with expected Fed actions, these on-chain metrics allow investors to evaluate the probability of bullish or bearish trends with unmatched detail.

Essentially, predicting crypto movements influenced by the Fed necessitates a comprehensive analytical strategy that combines macroeconomic understanding, market liquidity, derivative strategies, technical analysis, sentiment analysis, and on-chain indicators. While no single metric offers a full overview, a thoughtful integration of these tools enables investors to understand the nuanced signals present in policy messages, price movements, and liquidity shifts. The outcome is an advanced structure that converts the otherwise unpredictable behavior of crypto markets into practical insights, allowing both retail and institutional players to maneuver through the Federal Reserve’s significant impact.

The evolving correlation between Crypto and traditional markets under fed policy regimes

During the last ten years, one of the most captivating trends in the cryptocurrency landscape has been its evolving connection with conventional financial markets, especially concerning Federal Reserve policy. During the initial years of Bitcoin and other digital currencies, correlations with stocks, bonds, and commodities were either weak or varied. Cryptocurrencies were primarily considered alternative assets, functioning independently of central bank decisions and traditional risk-on/risk-off fluctuations. During this time, investors typically regarded crypto as a specialized, high-risk, high-reward component of their portfolios, mostly shielded from the wider macroeconomic environment.

This trend started to shift as cryptocurrencies evolved, liquidity expanded, and institutional involvement rose. By the end of the 2010s, particularly during the pandemic liquidity surge of 2020–2021, digital assets more closely resembled trends observed in stocks and risk-sensitive commodities. The unmatched surge of inexpensive capital and nearly zero interest rates stimulated concurrent investments in tech shares, growth stocks, and cryptocurrencies. In this setting, Bitcoin, Ethereum, and significant altcoins started to show increased positive correlations with the Nasdaq and various growth-focused indices. The common factor was liquidity: investors pursuing yield or capital gains were attracted to all high-beta assets, leading to their prices fluctuating together during times of monetary expansion.

The Fed’s policy significantly influenced this correlation. During periods of rate cuts and quantitative easing, cryptocurrencies and stocks typically increased simultaneously, as funds poured into riskier assets. On the other hand, when the Fed indicated tightening, the correlation frequently increased in the reverse direction, leading to simultaneous declines in both equities and crypto. This became especially clear during the intense rate-hiking phase of 2022, as Bitcoin’s drop paralleled significant equity indices, and volatility surged in both markets.

Nonetheless, the relationship is not fixed and is influenced by various factors, such as the stage of the Fed policy cycle and market mood. In initial tightening phases, cryptocurrencies frequently precede equities in risk-averse behavior due to their greater volatility and speculative orientations. Traders in digital assets often respond proactively, decreasing exposure before expected stock market sell-offs. Conversely, in dovish or easing periods, cryptocurrencies might initially trail equities as institutional investors first shift their allocations toward traditional growth assets before funneling liquidity into riskier, higher-beta tokens. Grasping these subtle timing variations is essential for investors aiming to decipher Fed signals and strategically position themselves in both markets.

Moreover, some macroeconomic and structural occurrences can momentarily detach crypto from conventional correlations. For example, developments in regulation, enhancements to the network, or milestones in adoption can influence price movements regardless of shifts in liquidity caused by the Fed. However, across medium to long-term perspectives, the influence of interest rate policies continues to be predominant.

Stablecoins and DeFi ecosystems add layers of complexity to the correlation landscape. Since stablecoin reserves are typically stored in interest-earning U.S. assets, fluctuations in Fed rates directly affect yield prospects and liquidity movements. As rates increase, these yields draw capital away from riskier digital assets, reinforcing the negative correlation with cryptocurrency. In periods of easing, capital may return to risk assets, strengthening positive correlations with growth-focused equities. In this regard, stablecoins serve as both a channel and enhancer of market dynamics influenced by the Fed, connecting traditional finance and cryptocurrency liquidity instantaneously.

Strategies for investors to manage Fed-driven crypto volatility

Navigating the cryptocurrency markets in the shadow of Federal Reserve policy requires more than an understanding of macroeconomics; it demands strategic planning, disciplined risk management, and the ability to interpret the nuanced signals embedded in both monetary policy and market behavior. Unlike traditional assets, cryptocurrencies trade 24/7, are highly leveraged, and remain largely sentiment-driven, amplifying the impact of Fed announcements, rate changes, and forward guidance. Investors who successfully manage Fed-driven volatility combine macro foresight with tactical execution, employing strategies that address liquidity shifts, speculative surges, and systemic risks.

A key approach is diversifying portfolios with both crypto and traditional assets. Investors mitigate the effects of simultaneous sell-offs caused by tightening cycles by appropriately balancing their exposure to equities, bonds, commodities, and digital assets.Maintaining a variety of assets especially those that are negatively correlated with higher-risk investments can cushion the impact. This does not remove volatility but offers a systematic method for managing capital during macroeconomic strain, enabling investors to stay active in crypto markets without excessive exposure to sudden Fed-induced fluctuations.

Another essential element is the active observation of Fed communications. Investors are paying more attention to FOMC meeting minutes, remarks by the Fed chair, and economic indicators like inflation, employment, and growth statistics. Foreseeing possible rate increases or decreases enables traders to modify their positions beforehand, preparing for expected market responses instead of responding afterward. Certain utilize algorithmic or quantitative models that combine these macro signals with on-chain and exchange information, producing real-time predictions of liquidity movements and volatility.

The management of leverage is especially vital in this context. High leverage increases both profits and losses, and in times of Fed tightening, margin calls can lead to significant liquidations. Prudent use of leverage or entirely avoiding it during expected rate increases helps avert forced sales that heighten volatility.These instruments are particularly useful when central bank policy is ambiguous or when markets reflect conflicting expectations regarding the speed and extent of rate adjustments.

Stablecoins act as a tactical tool in handling Fed-induced volatility. Investors can maintain liquidity and generate returns by temporarily reallocating funds into interest-earning stablecoins or short-term Treasury-backed digital assets, while reducing their risk of sudden market drops. This method utilizes the strong link between stablecoins and U.S. monetary policy, employing the consistent income streams produced by rate-sensitive reserves as protection in volatile times. As conditions improve or policies relax, capital can be redirected into higher-beta assets, allowing for tactical involvement in future rallies.

Timing and scaling positions is an important strategy. Rather than executing large, comprehensive trades based on expected Fed actions, experienced investors frequently enter or exit positions gradually. This method lowers the chance of improper reactions and enables modifications as new data becomes available. For example, if a rate increase is anticipated, certain traders might partially close positions prior to the announcement and subsequently re-enter during the post-announcement stabilization, taking advantage of short-term fluctuations while preserving long-term exposure.

Ultimately, it is essential to have a long-term perspective that is aware of macro factors. Although volatility driven by the Fed can lead to significant fluctuations, grasping the overall patterns of tightening and easing enables investors to place temporary declines within a wider framework of market growth. Crypto, in spite of its high-beta characteristics, has traditionally bounced back from times of Fed-driven strain, particularly when bolstered by adoption trends, network expansion, and technological advancements. Through the combination of macro awareness, tactical execution, and disciplined risk management, investors can approach volatility not as a danger but as a chance, allowing them to capitalize on both short-term market disruptions and long-term structural expansion

Essentially, handling crypto volatility influenced by the Fed involves combining macroeconomic insights with strategic actions, utilizing methods like diversification, stablecoins, hedging, scaled investments, and vigilant oversight of monetary policy. In this way, investors can convert the natural risks of a Fed-affected crypto market into strategic chances for growth, resilience, and knowledgeable involvement in a more intricate financial landscape.

Long-term implications of Fed policy on Crypto adoption and market structure

With the ongoing maturation of the cryptocurrency market, the impact of Federal Reserve policy reaches beyond just short-term fluctuations and price volatility. In the long run, the Fed influences not just investor actions but also the structural development and acceptance of digital assets. Grasping these dynamics is crucial for predicting how cryptocurrency might merge into the larger financial system, how market players will respond, and how regulatory and technological structures might evolve in response to Fed-induced macroeconomic trends.

A major long-term impact of Fed policy is its influence on the opportunity cost associated with owning digital assets. When interest rates are low, the comparative appeal of crypto rises, especially for investors looking for greater returns or different stores of value. Negative real yields on bonds or savings accounts drive capital into Bitcoin, Ethereum, and other cryptocurrencies, promoting adoption by both retail investors and institutional players. In contrast, extended periods of increased interest rates enhance the attractiveness of risk-free or lower-risk investments, diminishing speculative interest and decelerating the pace of capital influx into digital assets. As time passes, these recurring movements impact the speed of market expansion, liquidity, and general acceptance.

The structure of the crypto ecosystem is also influenced by Fed policy. Extended low interest rates and supportive monetary conditions frequently encourage innovation and growth. Venture capital investments rise, blockchain companies obtain financing, and decentralized finance (DeFi) systems thrive. The access to inexpensive capital drives the growth of infrastructure, such as exchanges, custody solutions, and institutional-level products. In contrast, tightening cycles restrict financing, raise project capital costs, and compel certain ventures to merge or collapse. Consequently, the ecosystem’s health is closely linked to the macroeconomic environment created by the Fed, as liquidity cycles directly affect the quantity, scale, and viability of projects in the sector.

A further long-term consequence is the impact on regulatory involvement and institutional acceptance. In times of relaxed monetary policy, increased risk-taking and climbing cryptocurrency prices draw the interest of regulators and conventional financial entities. Governments and companies start to explore the incorporation of digital assets into their strategic plans, either via ETFs, custody services, or payment systems. On the other hand, when Fed tightening leads to market contractions, adoption may slow briefly, as institutions approach cryptocurrencies more cautiously and regulatory agencies concentrate more on reducing systemic risks. This recurring pattern demonstrates how Fed policy indirectly influences the regulatory and institutional framework of the crypto market over time.

The Fed’s impact also reaches market structure regarding trading practices and liquidity makeup. Low-interest environments promote margin trading, leverage, and speculative movements, potentially enhancing liquidity and market depth while also raising systemic risk. Conversely, times of elevated rates usually decrease leverage, restrict speculative involvement, and direct the market toward more cautious investors. These changes affect volatility, bid-ask spreads, and general market efficiency. In other terms, Federal Reserve policy impacts not just the overall participation rate but also the kinds of market participants prevailing at any moment.

On a larger level, the Fed’s monetary choices contribute to supporting or disputing the story of crypto as an alternative financial system. Times of monetary growth and low interest rates frequently strengthen the case for Bitcoin and similar assets as safeguards against the devaluation of fiat currencies. On the other hand, in tightening cycles, when conventional assets offer attractive yields and risk management options, the “digital gold” concept encounters practical challenges. Eventually, these macro-driven stories influence investor views, adoption trends, and the development of crypto’s position in diverse portfolios.

Conclusion and forward-looking summary

The complex connection between the U.S. Federal Reserve and the cryptocurrency market is simultaneously contradictory and enlightening. Cryptocurrencies emerged from a desire for financial autonomy, intended to function independently of central banks and conventional monetary systems. However, as digital assets have developed, their outcomes have become more closely linked to the rise and fall of U.S. monetary choices. Grasping this link is crucial for investors, developers, regulators, and anyone aiming to maneuver through the changing digital finance environment.

Historically, times of accommodating Fed policy marked by low interest rates and increased liquidity have aligned with positive momentum in cryptocurrencies. The post-2008 zero-interest climate encouraged early uptake, and the liquidity surge during the pandemic boosted participation from both institutions and individuals, leading to remarkable price increases. In contrast, harsh tightening measures, like those seen in 2022–2023, revealed the susceptibility of crypto markets to increased borrowing expenses and liquidity reduction. These patterns highlight the dual function of Fed policy: it acts as a macroeconomic stabilizer for the overall economy and a volatility enhancer for high-beta assets such as cryptocurrencies.

The consequences for investors are complex. Short-term fluctuations in the market are very responsive to rate announcements, Fed guidance, and changes in global liquidity, resulting in quick and occasionally overblown responses in both Bitcoin and altcoins. Simultaneously, the sustained acceptance and structural development of crypto are affected by cycles of capital access, risk tolerance, and funding circumstances all of which are determined by the Fed’s monetary policy. Grasping these layers enables market participants to implement strategies that mitigate risk, seize opportunities, and align with macroeconomic trends instead of merely responding to price fluctuations.

In the future, the Fed will probably continue to be a key driving force in the cryptocurrency landscape. Although crypto markets are growing, increasing in liquidity, and experiencing wider adoption, the U.S. dollar’s position as the global reserve currency guarantees that Federal Reserve policies will impact worldwide capital movements, investor actions, and asset valuations. For digital assets, this indicates that periods of growth and decline, speculative enthusiasm and risk aversion, will remain strongly connected to interest rate strategies, inflation forecasts, and balance sheet actions. The skill to understand these macro signals will progressively set apart experienced participants from those surprised by volatility.

Additionally, as the institutional adoption increases and regulatory structures develop, the connection between Fed policy and crypto will become more fundamentally integrated. Hedge funds, asset management firms, and corporate treasuries involved in the digital asset sector will consider interest rates, actual yields, and liquidity conditions when distributing capital. Stablecoins and other interest-sensitive assets will further link crypto markets to the broader financial landscape, establishing feedback loops between conventional and digital finance. This integration does not lessen crypto’s decentralization principle but instead places it within a wider economic context, where monetary policy and macroeconomic trends must be acknowledged.

In the end, the narrative of Fed impact on crypto is one of adjustment and consciousness. Bitcoin and other digital currencies may have started as substitutes for money managed by central banks, but their development has demonstrated that no asset operates independently from worldwide financial influences.