The end of one global trade

Bitcoin, being the king of crypto, was moving along with the global liquidity, Ethereum was influenced by the tech sentiment, and the altcoins were just playing around with the risk cycles. The capital was moving freely across not only desks but also borders, exchanges, and narratives. What determined the market movement was not its geographical location but the global beta that was prevalent at the time.

However, that period is now coming to an end. De-globalization has started to influence the movement of capital, creation of regulations, and the interaction of financial systems in a new way. The effects of the emerging trade-transacting regions, the setting up of local supply chains, and the government issuing different monetary policies are such that crypto is no longer responding in a consolidated way as a market. Rather, it is slowly starting to show the different realities of different regions. Crypto is transitioning from global beta to the different regional betas.

Fragmented policy, fragmented price action

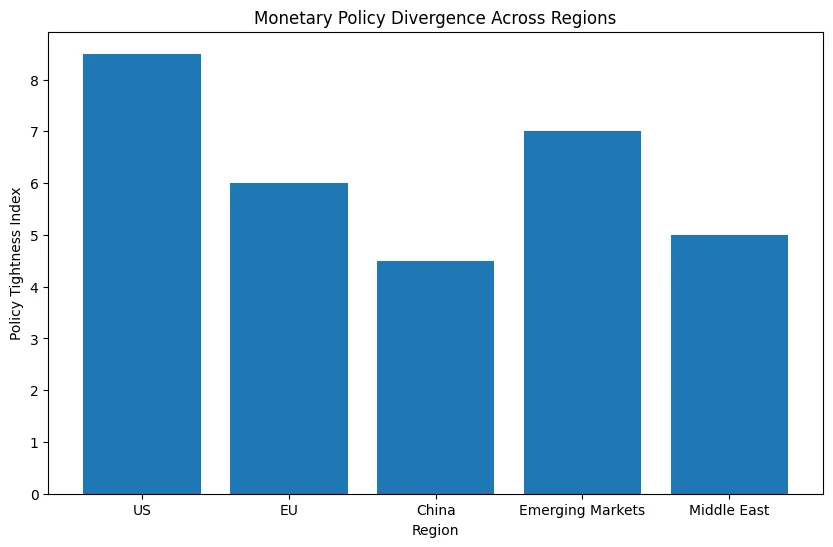

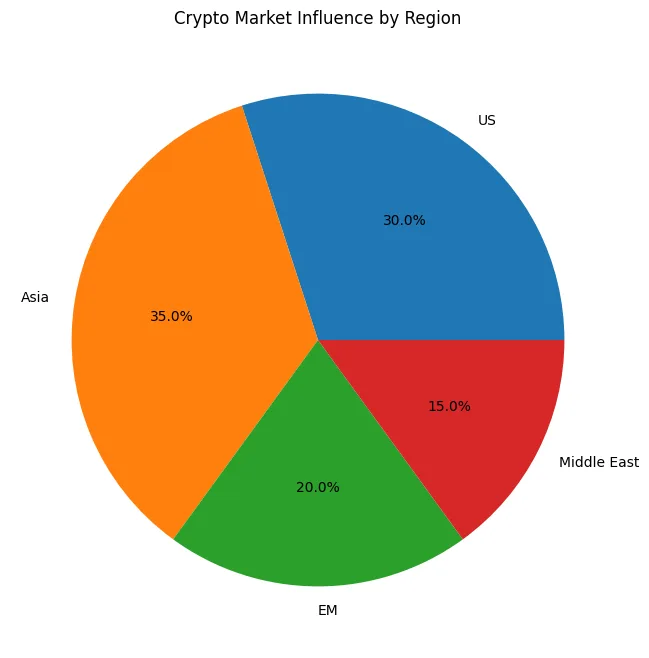

The economic policy worldwide after the pandemic did not go back to being in sync. The United States imposed strict monetary controls, China kept its policy steady only for certain sectors, Europe was under the pressure of low economic growth due to its structural factors, and the countries with developing economies were able to cope with the stress on their currencies. The differences in the economic policies of the major countries have an impact on the crypto market. Bitcoin in the US is becoming more and more liquidity-sensitive and a macro asset. Price behavior is now influenced by ETF flows, Treasury yields, and Fed expectations.

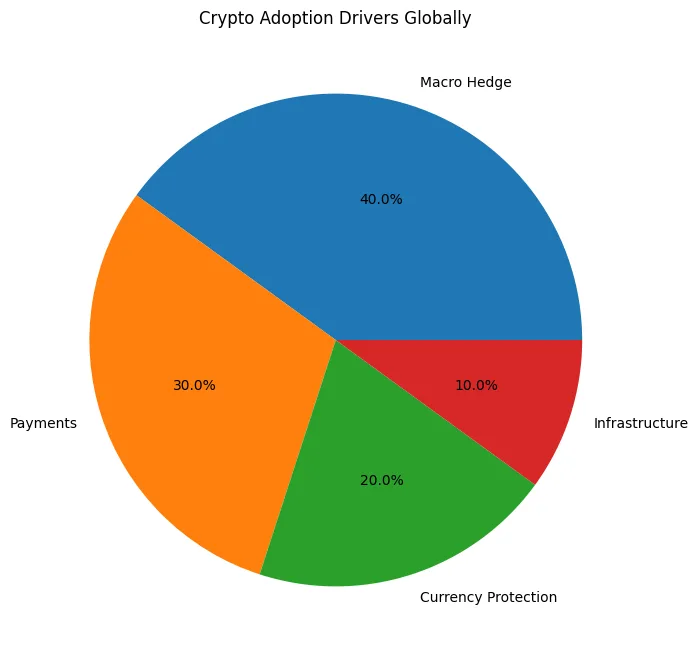

In Asia, the use of stablecoins mirrors the needs for capital mobility, the demand for cross-border settlements, and the participation of retail. In Latin America, the use of crypto is mainly due to the unstable currencies rather than speculation. In the Middle East, the focus is on the tokenization and the infrastructure development as the main narratives. The one asset, however, is being influenced by different reasons across the world. The price movement still appears to be global but the forces behind it are becoming localized.

Regulation as a regional signal

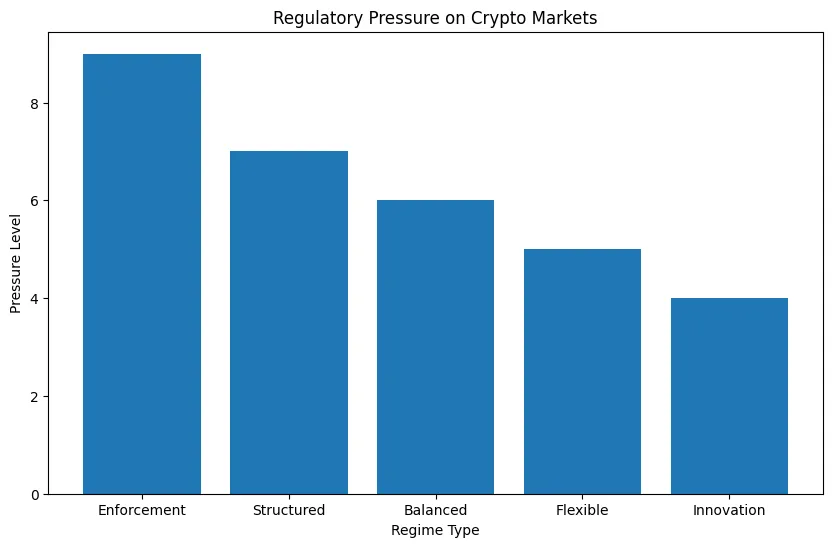

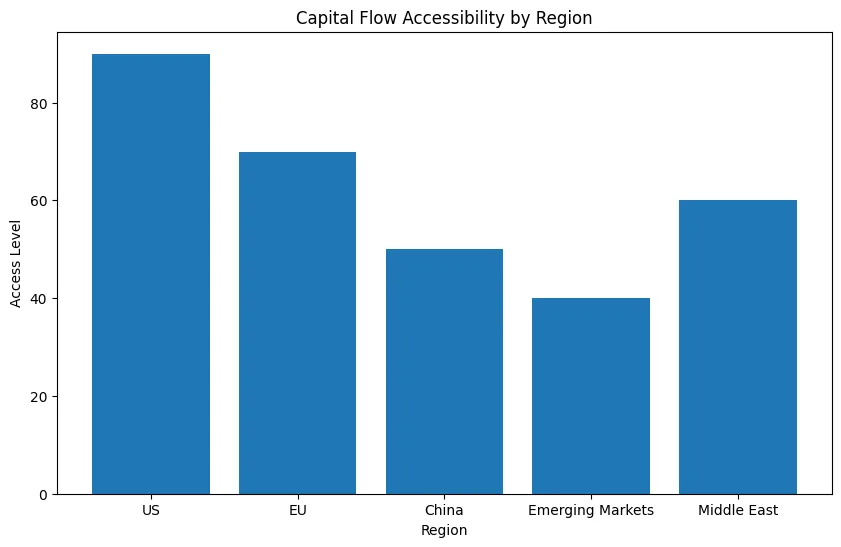

De-globalization is not solely an economic issue. It is a matter of regulation too. The United States is distinguishing crypto by means of both enforcement and financial integration. Europe is doing it through comprehensive legislative measures such as MiCA. Asia is practicing innovation along with capital controls. The Middle East is positioning the cryptocurrency as an infrastructure for financial modernization. Each of the regulatory regimes influences capital behavior in a different way. In the areas where compliance is strict, there is the dominance of institutional flows.

Where there is great accessibility, the leading factor is retail adoption. In the regions where the movement of capital is restricted, stablecoins and on-chain rails become the most important. The different regulatory environments and their impact on capital flows are reflected in the volume, volatility, and preference for assets. The crypto markets no longer only respond to “global sentiment.” They are responding to the local regulations.

Liquidity is no longer uniform

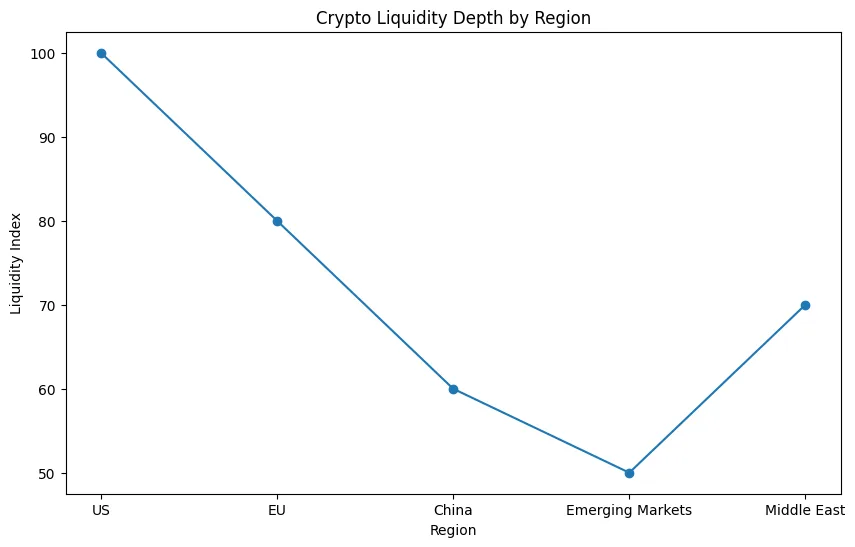

Historically, the global exchanges and stablecoins set up a situation where there was a liquidity pool everywhere. Money was effortlessly transferred from one place to another, leading to a reduction of price differences and the alignment of cycles.

The process of de-globalization has its own impact such as nowadays access to banking services varies from one area to another, and there are also differences in fiat on-ramps, availability of stablecoins, and compliance costs that together make market participation fragmentary. Even access to derivatives is not uniform across different jurisdictions. This is the reason why there are liquidity pockets in various regions.

Some areas have depth in their order books and tight spreads while others experience shallow markets with high volatility. The difference in these factors over a period has an influence on the strength of different assets, the popularity of different stories, and the pricing of risk. It is liquidity itself that has become regional.

Narrative divergence

The narrative of Crypto is not identical anymore in all regions.In America, Bitcoin is more and more presented as a macro hedge and financial asset. In Asia, crypto is considered as a new technology layer in payments revolution, gaming and infrastructure. In the case of developing nations, it is a tool for survival. In the case of the Gulf countries, it is a means of modernization.

The market dynamics are influenced by these narratives. When the stories differ, the money movements are different. Price changes become a consequence of different flow of money. The world of crypto is still a common one technology-wise, but a different one meaning-wise according to the regions.

From one market to many

De-globalization does not imply that countries will isolate themselves from each other. It only refers to dividing the world into parts. Crypto is not making separate ecosystems but entering different demand zones. One blockchain can have various applications in different areas. An asset can have multiple risk premiums attached to it. The concept of global beta is changing to that of regional sensitivity.

Macro factors are still important, but they do not have a consistent impact anymore. Local policy, currency stability, regulation, and adoption drivers are now the factors that determine how crypto will perform in different regions. The market is turning into a multi-polar one.