For more than ten years, the crypto sector has been characterized by spectacle. Manic bull runs, trending meme tokens, and staggering valuations have kept digital assets in the news. However, beneath the celebrations, a more profound change has subtly taken place. The industry is shifting from a hype-driven mindset to something more lasting: infrastructure. At what appears to be the height of its prominence, crypto is at a crossroads transitioning from storytelling to functionality, from speculation to incorporation.

The end of the speculative era

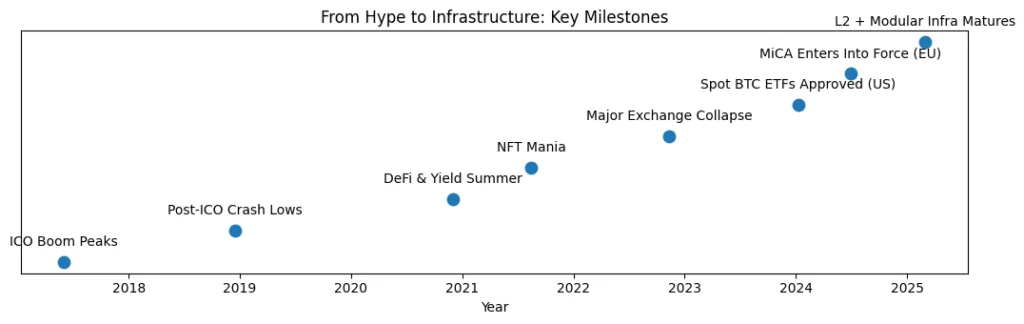

Each sector requires its foundational stories, and those of crypto are widely recognized. The 2017 ICO surge sparked a frenzy that vowed to decentralize all aspects. Billions were invested in unproven initiatives with nothing but a white paper. By 2021, NFTs transformed profile images into cultural assets, while meme tokens soared to valuations in the billions.

Yet every surge of excitement ultimately fell apart under its own pressure. Token values plummeted, regulators closed in, and retail investors faced significant losses. The trend was evident: periods of joy succeeded by sudden pullbacks. What has altered in recent years is that the emphasis has started to shift away from speculative excess. Investors, organizations, and developers are more focused on establishing sustainable practices instead of pursuing immediate profits.

Infrastructure rising

Today’s discussion focuses less on “which coin will increase tenfold” and more on the infrastructure the digital economy will utilize. This is the most crucial and least showy stage of crypto.

Institutional structures are finally coming into alignment. Bitcoin ETFs in the U.S. have made cryptocurrency exposure standard for mainstream investors. Custody options and compliance services now enable large funds and corporations to manage digital assets without the operational headaches of previous years.

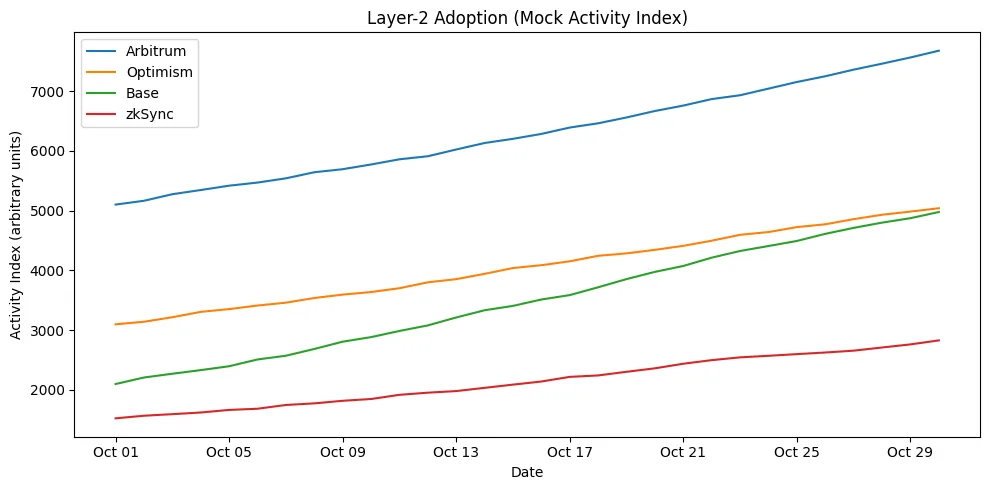

Simultaneously, scalability solutions are turning into a reality. Layer-2 rollups, modular blockchains, and data availability networks are resolving the obstacles that caused previous bull runs to be unsustainable. The emphasis has moved from “is it scalable?” to “which architecture will prevail?”

Additionally, there is an increasing convergence with conventional finance. Tokenized treasuries and blockchain settlement systems are transforming crypto into an unseen back office for worldwide money markets. JPMorgan’s blockchain settlement systems and the rising interest in tokenized bonds indicate that the infrastructure has moved beyond theory and is currently operational.

The regulatory realignment

No pivotal moment would be finished without oversight. For years, the cryptocurrency sector flourished in a gray area, depending on unclear regulations and scattered supervision. That period is rapidly coming to an end.

In Europe, MiCA has established the first global all-encompassing regulatory framework for digital assets. In the U.S., the SEC’s prominent legal actions against exchanges and token creators have necessitated clarity, albeit through dispute. At the same time, Asian centers like Singapore and Hong Kong are establishing themselves as regulated yet innovation-friendly environments.

The difficulty lies in expenses. Adhering to regulations is costly, and for smaller startups, the strain can be overwhelming. However, for an industry often criticized for its lack of transparency and excess, regulation provides something essential: credibility. The infrastructure stage relies not only on technology but also on legal clarity.

Beyond financial speculation

For crypto to refrain from being characterized solely by speculative trading, it needs to demonstrate its significance beyond asset values. Promisingly, practical applications are starting to emerge.

In developing markets, stablecoins have become vital instruments for remittances, providing more affordable and quicker options compared to conventional money transfer services. In DeFi, lending and credit systems are offering options for communities with limited banking access.

Beyond finance, blockchain is gradually entering various other sectors. Gaming initiatives are testing asset ownership and transferability. Supply chains are utilizing blockchain to authenticate sources, ranging from food safety to high-end products. Identity systems, which have long posed a challenge in digital economies, are now discovering blockchain-based solutions.

These instances might not dominate the headlines of bull-market surges, but they indicate that the industry is gradually integrating itself into the foundation of global trade.

Risks at the peak

However, declaring this as the conclusion of hype would be hasty. Infrastructure may transform into yet another speculative narrative. Tokenized treasuries, for example, offer efficiency but could risk concentration in novel manners. Layer-2 networks can fragment liquidity and create centralization pressures, compromising the decentralization that initially attracted early users.

There is also the risk of excessive financialization. If cryptocurrency primarily serves as a means to repackage current financial products instead of offering new economic chances, it risks getting integrated into the very system it aimed to challenge. Simultaneously, the emergence of surveillance-friendly stablecoins and centralized custody options prompts inquiries about whether cryptocurrency is sacrificing its defiant spirit for institutional acceptance.

To put it differently, the industry is experiencing maximum visibility while also being at its highest risk. Infrastructure provides stability, yet it may also weaken the groundbreaking innovation that distinguishes crypto.

Turning point or illusion?

It is yet to be determined if this indicates genuine maturity or merely another stage in a recurring cycle. The risk is that infrastructure turns into merely another catchphrase, concealing new types of speculation. The potential, nonetheless, is much larger: to integrate crypto as the unseen foundation of the worldwide economy, fostering a new age of efficiency, transparency, and accessibility.

At the height of its exposure, crypto is now facing the toughest inquiry: can it provide enduring value beyond the excitement? The response will decide if this turning point is seen as the time crypto matured or just another peak before the next decline.