The narrative of contemporary finance involves ongoing transformation: markets expand the meanings of money, liquidity, and collateral to access new yield opportunities. What starts as effectiveness frequently transforms into complication, and ultimately into vulnerability. In the current crypto markets, this cycle is occurring again. At its core is a subtle yet robust engine: the fusion of liquid restaking tokens (LRTs) and tokenized Treasury bills (T-bills).

Each of these innovations is intriguing on its own. Restaking extends Ethereum’s proof-of-stake framework, enabling staked ETH to be used not only for network safety but also for securing additional protocols via mechanisms such as EigenLayer. Liquid restaking protocols subsequently create LRTs, tradable assets that signify a claim on restaked ETH and its yield flows. These tokens enhance liquidity and enable capital to be “counted twice” within DeFi. At the same time, tokenized T-bills introduce one of the safest and most liquid assets globally, representing short-term U.S. government debt, onto blockchain platforms. Initiatives such as Ondo Finance, the Benji Fund from Franklin Templeton, and BlackRock’s tokenized funds provide crypto investors with blockchain-based access to actual yields.

Yet, when these two forces converge, they produce an outcome greater than their individual contributions. Combined, they create the framework of a carry trade: acquire or create stablecoins at a low cost using LRTs, invest those resources into tokenized Treasuries earning over 5%, and repeat the cycle. The trade gains are derived from the difference between ETH staking rewards and Treasury interest rates, enhanced by leverage and rehypothecation. It is a sophisticated financial cycle, yet it bears a striking similarity to the frameworks of shadow banking prior to the 2008 crisis.

Similar to how shadow banks before the crisis converted safe assets into collateral chains to support leverage, DeFi is currently converting LRTs and tokenized T-bills into the basis of a novel, obscure credit system. The risks are well-known: liquidity discrepancies, collateral vulnerability, recursive leverage, and regulatory gaps. However, the rapidity, extent, and openness of crypto systems render the experiment both more lively and more vulnerable.

This functionality explores the concealed carry trade created via LRTs and tokenized Treasury bills. It dissects the mechanisms, examines the motivations fueling expansion, assesses the systemic similarities with shadow banking, and outlines the tipping points that might convert current innovation into future contagion.

Parallels to shadow banking

The concealed carry trade of LRTs and tokenized Treasuries is not developing in isolation. It reflects past periods in finance when tools designed to enhance efficiency and liquidity led to the emergence of shadow credit systems that matched traditional banks in scale but functioned with significantly less regulation. The resemblances are not merely figurative. The arrangements, motivations, and dangers of DeFi’s restaking cycle resemble those of the shadow banking system that collapsed during the 2008 global financial crisis.

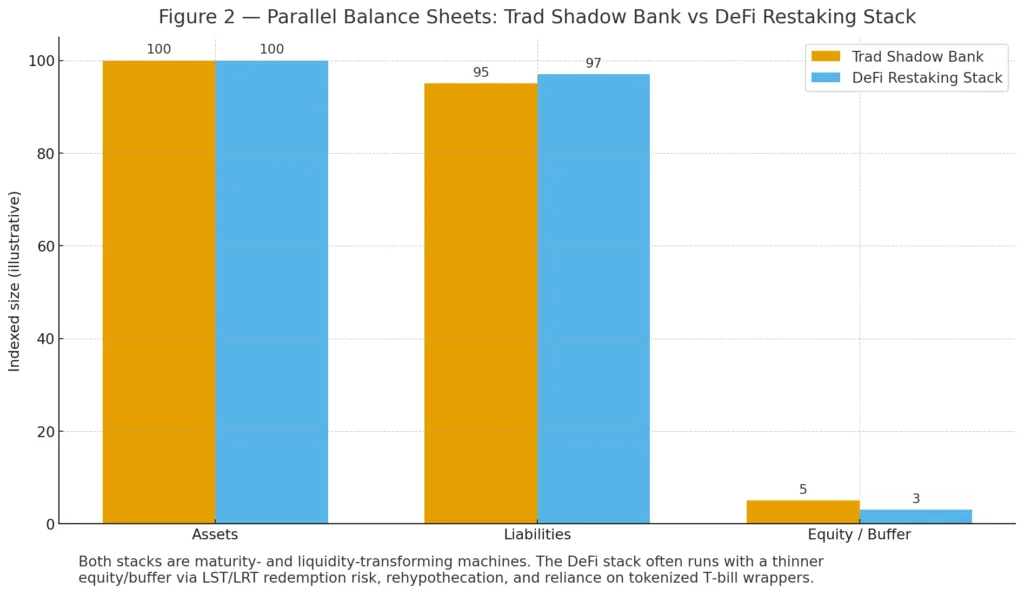

In conventional finance, shadow banking described actions such as repo lending, structured credit instruments, and off-balance-sheet vehicles. These systems generated credit and liquidity without the safeguards or capital reserves typical of traditional banks. A Treasury security, viewed as the most secure collateral, could be utilized in the repo market, borrowed against, and then lent out again, occasionally multiple times within a single day. Every transaction appeared stable on its own, yet the entire system relied on ongoing trust, liquidity, and the belief that collateral would consistently retain its value. Once those assumptions failed, the downfall spread quickly.

The DeFi version is remarkably similar. Just as Treasuries served as the foundational collateral for shadow banking, Ethereum has taken on that role for decentralized finance. Restaking converts ETH into a versatile asset: it fortifies Ethereum, aids supplementary protocols, and produces new tradable rights as LRTs. These tokens are subsequently rehypothecated within lending protocols, similar to how Treasuries were handled in repo markets. Every reuse increases liquidity and facilitates credit generation, while also intensifying systemic interdependence.

Tokenized Treasury bills provide an additional dimension to the comparison. During the shadow banking period, short-term tools such as asset-backed commercial paper and money market funds offered reliable value and immediate liquidity, despite being ultimately connected to longer-term or less liquid assets. Tokenized Treasuries currently hold a comparable position. They are promoted as secure assets native to blockchain, carrying the endorsement of U.S. government support. They move through DeFi like cash equivalents, recognized as collateral and exchanged with the expectation of consistent redemption. However, their liquidity is only as robust as the entities that issue them and the regulatory frameworks that allow their functioning.

The carry trade cycle LRTs took loans using stablecoins invested in tokenized T-bills, then reinvested into collateral, closely mimicking the maturity transformation that characterized shadow banking. Investors take loans in short-term, adaptable markets and invest in assets considered secure and stable, obtaining the difference between borrowing expenses and investment gains. Similar to 2008, this spread captures significant capital, attracting institutions, hedge funds, and retail investors together. The desire for higher yields intensifies the cycle, and the lack of stringent regulatory protections promotes the expansion of leverage until it reaches uncharted boundaries.

Liquidity discrepancies are another comparison. Shadow banks guaranteed immediate liquidity on assets secured by longer-term or less liquid guarantees. Likewise, DeFi protocols enable immediate borrowing and redemption using tokenized T-bills that, in reality, might not be instantly redeemable or transferable. Should redemption queues develop or off-chain settlement decelerate, a liquidity shortage might spread throughout the system. Similarly to how investors in 2008 became anxious when money market funds “broke the buck,” a rapid decline in confidence regarding tokenized T-bill liquidity might initiate a series of liquidations and a movement away from LRT-backed collateral.

Opacity also connects the two systems. In shadow banking, intricate networks of rehypothecation and derivatives rendered it almost impossible to determine who ultimately possessed which risks. DeFi offers transparency via blockchain records, yet the interoperability of protocols may mask actual risk. A single LRT can support numerous lending and borrowing networks among protocols, complicating the assessment of systemic leverage. Tokenized Treasuries introduce an off-chain layer of opacity: although the tokens are present on-chain, their redemption and support are still connected to traditional financial institutions, whose balance sheets are more opaque to DeFi users.

The cultural psychology is also well-known. Prior to 2008, shadow banking was viewed as a success of financial innovation, serving to optimize the value of secure assets and address worldwide liquidity needs. The same discourse exists around restaking and tokenized Treasuries currently. Proponents contend that these advancements democratize yield access, enhance capital efficiency, and intensify liquidity within cryptocurrency markets. Critics argue that efficiency and democratization frequently serve as a marketing veneer for leverage and vulnerability. Both perspectives might be accurate, but history indicates that efficiency improvements often bring risks that only become apparent in times of stress.

When considered together, the similarities are hard to overlook. Restaking represents Ethereum’s repo market, while LRTs act as its rehypothecated claims, tokenized Treasuries serve as its money market funds, and stablecoins function as its short-term funding tools. Similar to the way shadow banking expanded to compete with the traditional banking system, DeFi’s concealed carry trade could evolve into a shadow credit system within the cryptocurrency realm. The essential issue is whether DeFi will take lessons from the past and create safeguards against instability, or if it will undergo the same pattern of innovation, enthusiasm, and failure.

Incentives driving growth

If the dynamics of the carry trade clarify how liquid restaking tokens and tokenized Treasuries connect, the subsequent inquiry is why this cycle is growing so rapidly. The solution is found in motivations. All participants in this developing ecosystem protocols, investors, stablecoin issuers, and traditional institutions have strong motivations to promote trading, even as systemic risks build up out of sight.

At the protocol level, the competition for supremacy fuels innovation and boldness. EigenLayer, as the trailblazer of restaking, encounters both the chance and the burden of leading the way. Its success relies not just on drawing in ETH deposits but also on keeping restaked assets liquid and appealing for additional use. Liquid restaking providers like EtherFi, Kelp DAO, and Renzo vie for market share by issuing their branded LRTs and providing incentives such as enhanced yields, governance token rewards, and liquidity mining initiatives. The more deposits they draw in, the larger their market share, and the more firmly their tokens establish themselves within DeFi’s collateral ranking. In these protocols, leverage is not merely an outcome but an integral aspect: rehypothecation fuels utilization, and utilization reinforces supremacy.

The attraction for investors is clear. In a high interest rate setting, conventional yields such as U.S. Treasuries provide appealing returns, yet access may be restricted for international players. Tokenized Treasuries remove obstacles by providing access to those yields via blockchain technology. Simultaneously, LRTs provide a means to enhance ETH exposure while simultaneously tapping into various sources of yield. Merging the two gives the impression of a nearly risk-free carry trade: borrow at low rates in crypto, gain better returns in Treasuries, and increase ETH exposure at the same time. In an environment where speculation prevails, the allure of double-digit returns supported by “secure” assets is too tempting to resist.

Issuers of stablecoins have an essential function as well. For centralized issuers such as Circle and Tether, the rise of tokenized Treasuries enhances the perceived security and validity of their reserves. For decentralized issuers such as MakerDAO or Frax, incorporating LRTs and tokenized Treasury bills into collateral pools enhances liquidity and bolsters peg stability. As demand increases for stablecoin borrowing to support the carry trade, issuers gain more from fees, scale, and influence. Thus, the growth of the carry trade directly corresponds with the operational frameworks of stablecoin issuers.

The larger ecosystem strengthens itself via reflexivity. With increased investment in restaking and tokenized Treasuries, yields seem consistent, liquidity expands, and trust strengthens. This assurance draws in more participants, whose contributions further strengthen the narrative of security and potential. The success of the trade itself serves as the rationale for its persistence, mirroring how shadow banking expanded prior to 2008 until it became essential to the financial system.

At the core of all these motivations is a more basic force: the human desire for returns. Crypto markets emerged during a period of low interest rates, where investors learned to pursue double-digit returns through DeFi farms, lending platforms, and speculative cryptocurrencies. As interest rates increased and conventional yields became appealing, the tendency to pursue excessive returns did not disappear. Instead, it shifted focus to tools that combined the reliability of physical assets with the flexibility of DeFi. In this regard, tokenized T-bills and LRTs serve as the ideal means: they ensure both security and effectiveness, all while providing the excitement of leverage and yield enhancement.

Consequently, the motivations are synchronized throughout each level of the system. Protocols seek expansion, investors desire profits, stablecoin creators aim for acceptance, and institutions pursue significance. Everyone has a justification for ignoring the dangers and extending the cycle. This very alignment is what renders the system vulnerable. When all parties gain from growth, there’s no motivation to establish safeguards until the system encounters its initial significant challenge.

Points of fragility: Where it can break

Each financial innovation brings both potential and risk. During stable periods, restaking and tokenized Treasuries seem to provide a smooth combination of yield, liquidity, and efficiency. However, historical evidence indicates that systems relying on leverage and maturity transformation are susceptible to abrupt shifts. Similar to how shadow banking collapsed when trust weakened, DeFi’s concealed carry trade might break along several fracture points. These points of fragility are not just theoretical; they reflect the vulnerabilities of both DeFi and traditional finance, amplified by the composability and rapidity of blockchain markets.

The initial vulnerability is found in liquidity discrepancies. In reality, U.S. Treasuries are both liquid and dependable, whereas their tokenized counterparts rely on off-chain settlement mechanisms. When a tokenized Treasury is redeemed for cash by an investor, the issuer is required to sell or transfer the underlying securities. This procedure is not immediate, particularly if there is a spike in redemptions. In the meantime, DeFi protocols consider tokenized T-bills as cash equivalents, enabling them to act as collateral for immediate borrowing. The discrepancy between off-chain settlement delays and on-chain immediate liquidity results in a typical liquidity trap. During a stressful event, if redemption lines emerge, panic may disseminate among protocols that depend on tokenized Treasuries as collateral.

Another stress factor is the fluctuations in ETH and LRTs. LRTs are fundamentally linked to ETH’s value, as they signify rights to restaked ETH. A significant drop in ETH’s market value may lead to margin calls and liquidations in lending markets where LRTs serve as collateral. This risk is heightened by the self-reinforcing characteristics of the carry trade. A decline in ETH lowers the worth of LRTs, impacting stablecoin borrowing ability, which subsequently compels unwinding of positions secured by tokenized Treasuries. The spread of contagion extends beyond DeFi and reaches the real-world applications of tokenization. The closer the loops, the quicker the unwinding.

The dynamics of stablecoins introduce an additional level of vulnerability. Numerous variations of the carry trade rely on obtaining stablecoins at known expenses. However, in DeFi, stablecoin interest rates are not static; they vary with usage, liquidity needs, and overall market circumstances. During stressful periods, borrowing rates for stablecoins can surge dramatically. If borrowing expenses exceed Treasury returns, the carry trade turns from gainful to unprofitable. At that moment, logical investors would collectively liquidate their positions, increasing volatility. The similarities to 2008 are evident: just like repo rates surged and disrupted shadow banking, stablecoin rates might serve as the pivot of instability in DeFi’s shadow credit ecosystem.

Regulatory action signifies a potential turning point. Tokenized Treasuries are presently functioning in an ambiguous zone. Although initiatives such as Ondo Finance and Franklin Templeton aim for compliance, the overall ecosystem remains minimally regulated. If authorities conclude that tokenized T-bills are unregistered securities or present systemic risks, they may limit issuance, redemption, or utilization. An abrupt regulatory crackdown would not only halt liquidity but also erode trust in these instruments as reliable collateral. Considering the geopolitical significance of Treasuries and the examination of stablecoin reserves, it’s easy to foresee regulators viewing tokenized Treasuries as systemic sooner rather than later.

The risk of rehypothecation chains masking actual leverage is also present. In conventional shadow banking, Treasuries were used as collateral repeatedly, leading to confusion about who actually bore the risk. In DeFi, composability speeds up this issue. One LRT might be placed in one protocol, used as collateral in another, encapsulated into a derivative, and then reintroduced as security in a different location. Tokenized Treasuries may experience comparable cycles. Every link seems secure on its own, but the overall leverage throughout the system remains unmonitored. When shocks occur, unwinding turns chaotic due to unclear exposures. Blockchain transparency does not resolve this issue; it only reveals it afterward, when it’s too late.

The risks associated with smart contracts introduce a distinct aspect to cryptocurrency. Both LRT protocols and issuers of tokenized T-bills depend on smart contracts for handling issuance, redemption, and collateralization. Bugs, exploits, or governance issues could destabilize the entire carry trade at any moment. In conventional finance, operational risks are present but are mitigated by regulatory frameworks and institutions. In DeFi, a single coding mistake or a malicious individual could quickly dismantle billions in leveraged assets. This technical vulnerability is heightened by the reality that restaking is an experimental approach lacking a long-term stress record.

Ultimately, there exists the vulnerability of confidence itself. In shadow banking, trust was the sole genuine safety net. The system operated effectively while investors regarded money market funds as secure. When that confidence shattered, even secure investments failed to stop the turmoil. DeFi is alike. Investors view LRTs as reliable collateral and tokenized Treasuries as equivalent to cash due to their perceived safety. However, if a significant depeg, exploitation, or freeze on redemptions takes place, that confidence might dissipate rapidly. Panic would unfold not through reasoning but instinctively, as participants hasten to withdraw, redeem, or liquidate their positions ahead of others. In markets constructed on deceptive liquidity, reflexivity represents the greatest systemic threat.

Collectively, these weaknesses create a network of possible failure areas. Liquidity imbalances, collateral fluctuations, funding pressures, regulatory disruptions, concealed leverage, operational failures, and confidence declines all converge. Each of them could spark a fire, but the actual threat is contagion: how a single failure spreads through interconnected networks. ETH downturns might trigger LRT liquidations, leading to a decline in stablecoin liquidity, which negatively impacts tokenized Treasury collateral, causing further instability in stablecoins, which in turn results in additional liquidations. It is the reasoning behind shadow banking, revived on-chain, enhanced by the quick settlement and worldwide accessibility.

The concealed carry trade is therefore not weak due to its irrationality. It is delicate because it is logical. Each participant behaves rationally based on incentives: optimize returns, utilize collateral, and rely on liquidity. However, when all individuals adhere to the same reasoning, systemic risks build up unnoticed until they explode. The excellence of the carry trade is simultaneously its weakness; it turns secure assets into the engine for risky degrees of interconnected leverage.

Case studies & current market data

The dangers of restaking and tokenized Treasuries are not merely theoretical. They are happening in real time as billions of dollars pour into funds and protocols that represent the workings of the concealed carry trade. Analyzing several case studies reveals how the system is already evolving into a shadow banking framework within crypto.

The key cornerstone is EigenLayer, which has swiftly become one of the most significant protocols in Ethereum. By the middle of 2025, it had garnered more than $15 billion in restaked ETH, positioning it as the second largest protocol on the network after Lido. Its framework enables users to deposit ETH or liquid staking derivatives such as stETH, which are subsequently “restaked” to provide security for other services. EigenLayer doesn’t create a native token, but its network of liquid restaking providers does produce one. eETH from EtherFi, ezETH by Renzo, and rstETH from Kelp DAO are some of the most popular LRTs, each signifying claims on restaked ETH and sharing part of EigenLayer rewards with holders. These tokens currently exchange in DeFi money markets, creating the collateral foundation for borrowing and leverage.

The swift increase of LRTs has demonstrated both potential and risk. EtherFi’s eETH exceeded $3 billion in supply shortly after its launch, propelled by substantial yields and strong incentives. Nonetheless, its price has sometimes fallen below ETH parity during liquidity shortages, indicating potential risks during more significant stress events. If a slight depeg disrupts markets, one can envision the effects of a systemic unwinding where several LRTs experience redemption stress at the same time.

On the opposite end of the spectrum, tokenized Treasuries have surged in popularity as the inaugural real-world asset success story in crypto. By mid-2025, Ondo Finance has taken the lead, distributing more than $500 million in tokenized U.S. Treasuries via its OUSG product. These tokens are supported by Treasury ETFs managed by BlackRock and can be exchanged for cash via Ondo’s platform. Their attractiveness is clear: a blockchain-based asset generating over 5% with the trustworthiness of U.S. government bonds. Ondo has advanced by providing yield-generating stablecoins like USDY, which are supported by short-term Treasuries and promoted as secure, interest-earning options compared to USDC or USDT.

Established giants are also participating. The Benji Investments fund from Franklin Templeton has introduced tokenized Treasuries to retail and institutional investors, amassing over $400 million in assets. BlackRock, the largest asset manager globally, has tested on-chain Treasury products, indicating that tokenization is progressing from experiments to mainstream finance. These actions indicate that the lines between DeFi and TradFi are becoming less distinct.

The connection is already apparent. LRTs are being utilized as collateral in Aave and Morpho to generate USDC, which is subsequently invested in Ondo’s tokenized Treasuries. These Treasuries, in turn, are now starting to be utilized as collateral in lending markets, closing the loop. MakerDAO has begun testing the incorporation of tokenized T-bills as collateral for DAI, further intertwining DeFi’s leading decentralized stablecoin with this framework. All of these integrations enhance the system while also intensifying systemic connections.

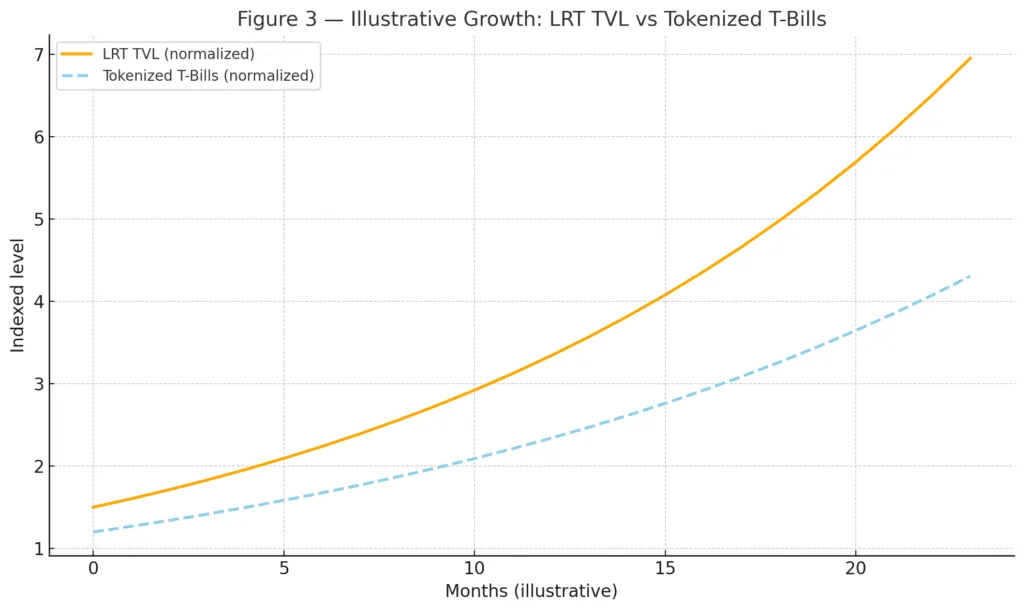

The figures might not yet match the trillions of shadow banking seen before 2008, but the growth rates are remarkable. In 2023, the total value of tokenized U.S. Treasuries on public blockchains was under $100 million. By 2025, they exceeded $1.5 billion among all issuers. LRTs, on the other hand, surged from nothing to tens of billions in availability in less than two years. The pace of adoption is reminiscent of the rapid expansion of money market funds in the 1980s or asset-backed commercial paper in the early 2000s innovations that appeared secure until they turned into key points of systemic risk.

Even in their early stages, these instruments have shown signs of stress fractures. In times of ETH volatility, LRTs have experienced short liquidity squeezes and slight depegs, demonstrating their responsiveness to market sentiment. Tokenized T-bills, although theoretically stable, have experienced redemption bottlenecks due to compliance reviews or custodial delays faced by issuers. In each instance, the perception of immediate liquidity faced the truth of operational limitations.

Collectively, these case studies demonstrate that the concealed carry trade is not just a theory. It is active, growing, and drawing in some of the most influential participants from both DeFi and TradFi. EigenLayer, EtherFi, Ondo Finance, Franklin Templeton, and BlackRock are developing the framework of a concealed credit system using blockchain technology. Currently, it appears as advancement: increased yield, enhanced liquidity, improved efficiency. However, the success of these experiments guarantees that, once evaluated, the repercussions will not be limited to remote areas of crypto.

Future outlook: shadow bank or safety net?

The emergence of liquid restaking tokens and tokenized Treasuries represents a significant development rather than just a fleeting trend. It mirrors more profound structural dynamics in both DeFi and conventional finance. On one hand, cryptocurrency investors seek secure yields and collateral that can be leveraged. Conversely, established institutions are exploring tokenization to update markets and attract new interest. The convergence is forming a structure resembling shadow banking: generating credit beyond conventional boundaries, driven by tools that guarantee security while hiding vulnerability. The outcome of this evolution as a stabilizing link between TradFi and DeFi or a destabilizing reminder of 2008 will rely on its progress in the years ahead.

A potential path is merging and solidifying. In this situation, tokenized Treasuries are established as a recognized and regulated asset class, with significant custodians and asset managers offering reliable assurances. LRTs, on the other hand, develop into fundamental collateral in Ethereum’s financial ecosystem, featuring more defined guidelines regarding risk management, leverage restrictions, and liquidation processes. Within this framework, the concealed carry trade might transform into a valid on-chain credit system. Instead of collapsing under pressure, it has the ability to manage volatility by spreading risk through clear protocols and institutional collaborators. Proponents claim this represents the organic evolution: blockchain frameworks revitalizing financial markets, while DeFi serves as the testing platform that enhances efficiency.

The contrary path is disintegration and turmoil. In this situation, the interaction between LRTs and tokenized Treasuries expands quickly without sufficient supervision or protections. Protocols persist in promoting aggressive rehypothecation, stablecoin issuers increase their dependence on these assets, and investors flock to them, believing in their security. Ultimately, a jolt occurs: an ETH decline, a regulatory crackdown, or a freezing of redemptions in tokenized Treasuries. Liquidity diminishes, spreads reverse, and trust plummets. The outcome would be a cascading unwinding similar to the fall of shadow banking: the instruments that offered security transform into catalysts of fear. DeFi has yet to face a “Lehman moment,” but a crisis in this carry trade might be the initial one.

There exists a middle route, similar to the development of conventional shadow banking post-2008. In that environment, money market funds persisted but faced more stringent regulations, repo markets remained operational but with more rigorous collateral requirements, and off-balance-sheet entities were either integrated into banks or closed. The variant of DeFi might take a comparable path. Tokenized Treasuries may persist, albeit with increased regulation from oversight bodies. LRTs may continue to exist, but there would be restrictions on their use as collateral. Stablecoins may face increased regulation, particularly as they interact with tangible assets. The carry trade would not vanish but would become more limited, less automatic, and more clear-cut.

A lot relies on regulators. U.S. regulators are currently examining stablecoin reserves and tokenized securities. The SEC and Treasury Department have expressed interest in the structure of blockchain-based funds, particularly regarding their connections to real-world debt markets. Regulators in Europe and Asia are testing pilot programs for tokenization while being wary of systemic risk. If regulators intervene promptly, they might steer this innovation towards safer alternatives. If they delay until a crisis has passed, the industry might encounter extensive regulations that hinder its growth.

The decisions made by the protocols themselves will be equally significant. DeFi values open-ended innovation, yet it has also gained insights from previous mistakes. The failures of TerraUSD and FTX have caused lasting impacts that affect current structures. Resilient restaking protocols and tokenization initiatives can avoid shadow banking errors by implementing conservative collateral guidelines, being transparent about risks, and collaborating with regulatory bodies. If they pursue growth regardless of the consequences, they might guarantee that history will repeat itself.

Anticipating the future, the concealed carry trade reflects both the potential and risk of DeFi. It demonstrates that blockchain can integrate real-world assets with digital finance into a cohesive system, generating efficiencies that conventional markets find hard to replicate. However, it also shows how swiftly those efficiencies can turn into vulnerabilities when intertwined with leverage, incentives, and human actions. The upcoming years will decide if the system evolves into a stabilizing foundation of global finance or falls into another cautionary narrative.

Conclusion

The concealed carry trade originating from liquid restaking tokens and tokenized Treasuries represents one of the most important experiments in crypto finance currently. At first glance, it seems sophisticated: restaking garners extra returns from Ethereum, LRTs render that capital liquid and composable, stablecoins offer leverage, and tokenized T-bills grant entry to the globe’s most secure asset. The loop is effective, lucrative, and highly attractive to both DeFi users and institutional investors seeking to enter blockchain-based markets.

However, beneath the sophistication exists delicateness. The same mechanics that create profitability in the trade leverage, collateral recycling, and liquidity assumptions also render it susceptible to shocks. Similar to how shadow banking appeared as a source of efficiency before 2008, only to expose itself as a channel of systemic risk, DeFi’s shadow banking might experience a similar trajectory. Liquidity imbalances, collateral fluctuations, and the nature of confidence are not solely flaws of crypto; they represent universal principles of finance. On blockchain infrastructure, they might unfold more quickly and with reduced latency.

The question now is not if LRTs and tokenized Treasuries will influence the future of finance. They already exist. The issue at hand is whether this future will be viewed as a narrative of integration and growth, or simply as another installment in the enduring saga of shadow banks fluctuating with the ebb and flow of trust.