GammaGuard™ functions as a risk intelligence system which operates in real time to protect prediction-market platforms that function like digital options markets. The basic structure of prediction contracts may seem straightforward but their contract expiration results in highly irregular payoff structures which display extreme convexity. Market makers face sudden delta swings because small changes in the underlying variable lead to abrupt shifts in implied probability which require them to execute hedging activities. The GammaGuard system allows organizations to convert their concealed structural danger into usable actionable intelligence.

The structural problem in prediction markets

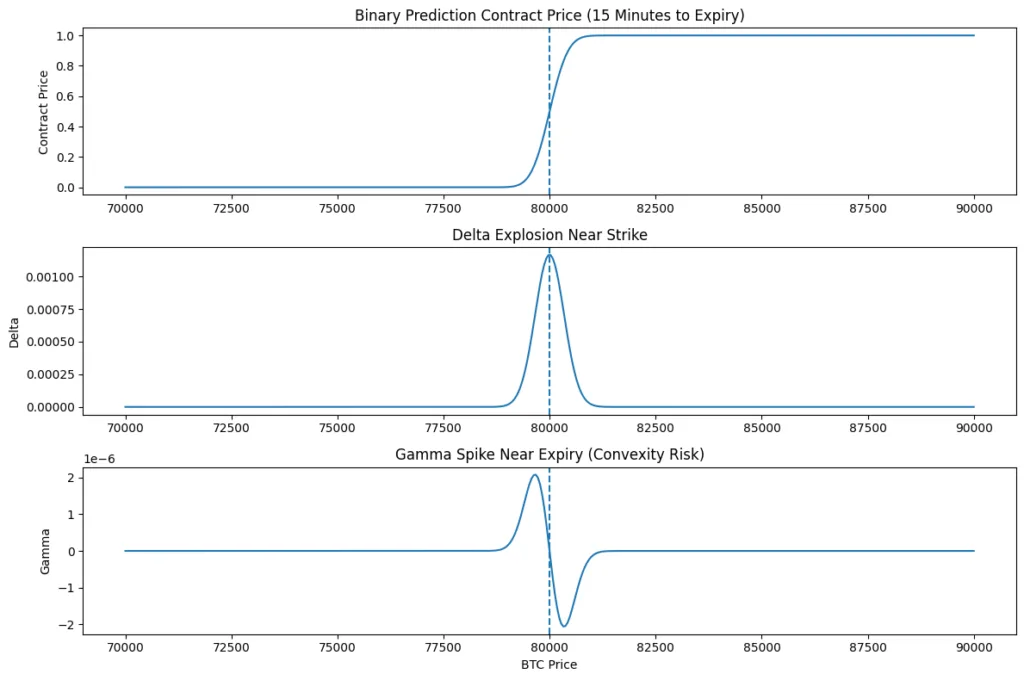

Prediction contracts function as binary options. Gamma reaches its peak strength at probability boundaries during the time period before expiration. A contract which trades at a fifty percent probability mark can change its risk exposure with small price changes. Liquidity providers face the danger of acquiring unpredictable market positions due to their failure to monitor convexity in real time. Most platforms track volume and open interest, but few measure nonlinear risk accumulation. GammaGuard addresses this blind spot.

Real-time binary greeks engine

The system uses a live Greeks computation engine which handles digital-style contracts as its main operational component. The system continuously measures delta and gamma in real-time market conditions while detecting areas of maximum exposure sensitivity through its convexity hotspot identification system.

GammaGuard models contracts as dynamic risk surfaces which change their properties according to time decay and volatility fluctuations instead of treating them as fixed probability indicators. The system enables capital allocators and market makers to predict risk events instead of waiting to respond after those events occur.

Expiry compression monitoring

The time taken to solve a problem becomes shorter which leads to increased convexity risk. The GammaGuard system starts a compression monitoring process which tracks increasing gamma levels together with decreasing liquidity measurements.

The system provides early warnings about market conditions that reach unstable territory which allows traders to adjust their capital investments and spread positions before hedging pressure starts to increase. The system safeguards liquidity providers throughout the last trading minutes because this period experiences maximum market pressure from forced rebalancing activities.

Inventory stress and capital allocation

The system develops an inventory stress dashboard which displays multiple short-term volatility scenarios to show its exposure. The system determines hedge requirements when the essential variable experiences minimal shifts during short time periods.

GammaGuard permits clients to distribute their investment funds according to market conditions which depend on convexity risk and inventory distribution. The process changes decision-making from instinctive methods to organized systems that use quantitative research.

Oracle confidence integration

The event resolution mechanisms serve as the foundation for prediction markets. GammaGuard uses an oracle confidence layer which measures consensus dispersion together with dispute probability and reporting consistency and information velocity. The market receives new data which causes probability shifts that lead to immediate risk metric updates. The exposure modeling process needs to include price changes together with governance and resolution risk.

Adaptive spread and margin framework

GammaGuard recommends that liquidity providers should implement dynamic spread widening together with margin adjustments to protect their funds in areas that contain concentrated gamma risk. The system uses intelligent price adjustments to determine spreads which vary between different probability levels according to the current convexity level and inventory situation.

The system protects against insolvency during market volatility while it enables continuous operation of liquidity functions during stable market conditions. The system protects against insolvency during market volatility while it enables continuous operation of liquidity functions during stable market conditions.

Strategic impact

GammaGuard repositions prediction-market platforms as derivatives-aware financial systems rather than speculative interfaces. Outcome will achieve a competitive advantage through its capital allocation system which integrates convexity analytics, expiry compression monitoring, inventory stress modeling, and oracle-based risk intelligence. The future of prediction markets will be defined not by user interface enhancements but by intelligent risk infrastructure. The evolution requires GammaGuard as its essential driving force.