A market no longer moving as one

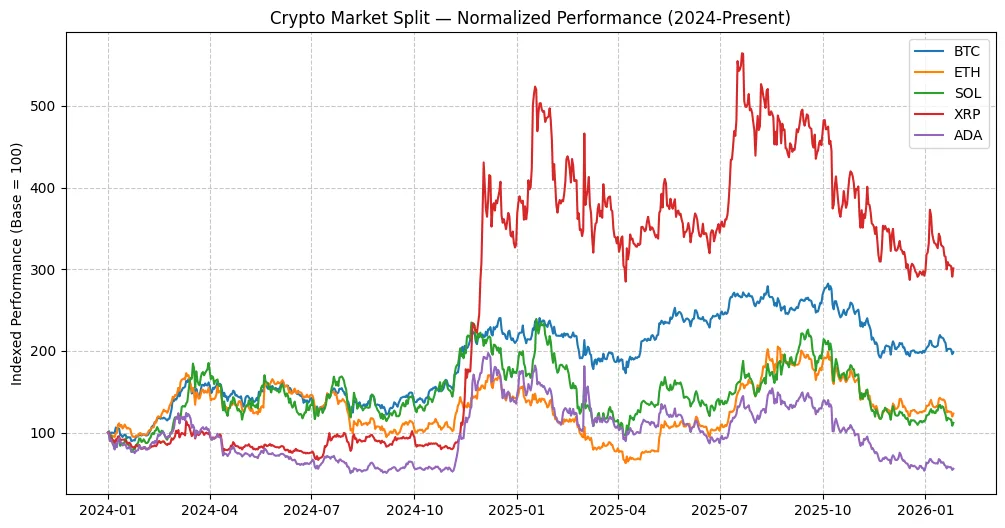

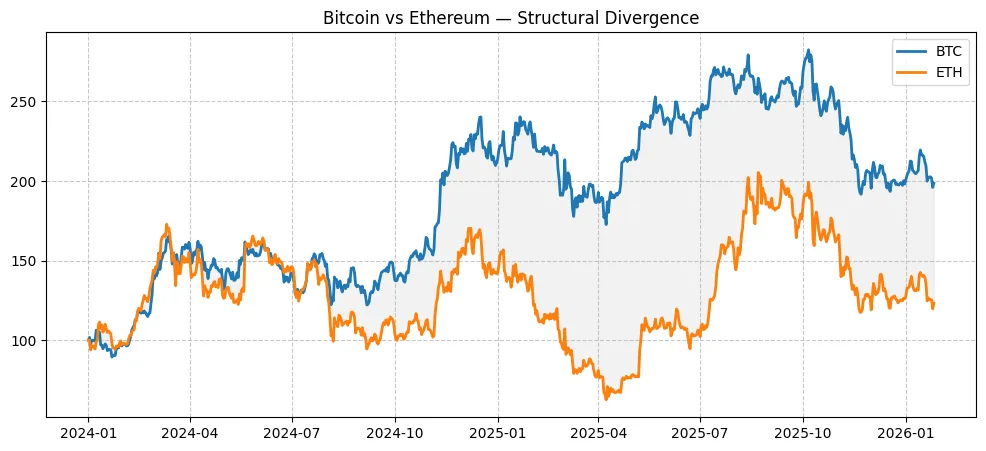

The cryptocurrency markets used to show identical price movements throughout their trading hours. The entire market followed Bitcoin’s price increase. The market experienced a panic situation which caused all assets to be sold at once. The markets exhibited high correlation between assets while traders showed intense emotional reactions which caused them to move their funds. The current market situation shows signs of breaking the established pattern. The price movements of major assets have started to show different trends since the previous months. Bitcoin now operates as a financial tool that protects against geopolitical threats.

Ethereum increasingly operates as infrastructure. Solana functions as a speculative asset which investors use to assess its growth potential. The existing altcoins from previous years demonstrate a pattern of trading in a horizontal manner while their value keeps declining. The observed data distribution follows a systematic pattern of spread which leads to different results.

The system operates through two separate parts which function independently from each other. The global economic situation compels cryptocurrency markets to develop different trading patterns. The combination of wars and supply-chain interruptions together with trade partitioning and currency volatility, and increasing debt default danger, is changing how investors allocate their capital. Investors now view cryptocurrency as multiple distinct markets instead of one unified market. They are assigning roles. The uncertainty about the future gets absorbed by Bitcoin.

Ethereum captures institutional positioning. High-beta chains attract momentum capital. The lower market capitalization assets need an explanation. The crypto market is developing into distinct social classes. Most retail traders continue to trade cryptocurrency as if it were still 2021.

Geopolitics has entered the order book

The current cycle operates under different principles because geopolitical tensions now function as active components of the situation. The situation establishes direct effects which determine military movements in the area. The world economy experiences fragmentation because Middle Eastern conflicts and U.S.-China economic separation and Red Sea shipping threats and European defense budget increases. Investors now prefer assets which provide protection against market volatility instead of assets which generate higher returns.

The preference of the market appears through the movements of digital currency investments. The market share of Bitcoin increases when world political tensions reach their highest points. During times of local wars, people use stablecoins more than usual. Institutional investors who want to generate investment returns through secure technological systems drive up ETH staking inflows. Investors continue to allocate high-risk funds into certain markets which demonstrate strong developer activity. The crypto market responds to worldwide economic unrest just like traditional financial markets do. The crypto market responds to global economic disruptions in a faster manner than traditional financial markets.

Market liquidity transfers between different financial markets within a few hours instead of taking several weeks. Blockchain networks demonstrate immediate changes in user attitudes throughout their entire network. Macro economic news now creates market reactions which occur before stock index futures start trading. The situation has evolved into actual reality. The cryptocurrency market functions as an active measurement tool for worldwide political developments.

Capital is choosing sides

The most important development right now is not price direction.The capital markets show active changes today because investors choose between different kinds of financial assets. Large wallets are behaving defensively. The investors accumulate Bitcoin and hold stablecoins during periods of market uncertainty while they choose to invest in Ethereum-based infrastructure projects. Mid-sized funds move between Solana and Layer-2 networks to search for better performance compared to their current assets.

Retail traders remain scattered across narrative-driven altcoins, often unaware that structural flows have already moved upstream. The market has divided into two separate sections. One side is positioning for macro resilience. The other side is still pursuing market unpredictability.

The gap between two assets explains their different market structures because one asset maintains structure while the other asset experiences gradual decline. The capital keeps backing Bitcoin because it continues to protect its value yet numerous altcoins cannot find their way back to market status. The distribution of volatility across different chains shows inconsistent patterns. Capital is not leaving crypto. The industry experiences an internal reshaping of its capital resources.

Infrastructure is winning over ideology

Another quiet shift is happening beneath price action.The performance requirements of institutions now outweigh the decentralization narratives. Institutions require systems which provide continuous operation and compliance processes and predictable settlement times and capacity to grow. They are building their projects on both Ethereum and Ethereum-adjacent platforms.

They are implementing three financial systems which include tokenized treasuries and stablecoin rails and permissioned DeFi layers. Organizations prioritize operational speed above their need for absolute system integrity. Organizations base their operational choices on system reliability instead of pursuing maximum performance. Real-world assets keep entering Ethereum because of this characteristic. This is why Layer-2 ecosystems are expanding.

This is why Solana remains relevant despite volatility.Crypto is professionalizing.The professional capital market operates without emotional responses. The company develops its solutions throughout an extended period. The company moves its financial resources through a systematic allocation process. The company proceeds with its operations through a silent exit strategy.

Volatility is being stored, not released

The markets which maintain their current state of non-impulsive behavior demonstrate that their trading activity has not yet reached a state of stabilization. The current price patterns show that market participants exercise self-control instead of displaying weakness. The market liquidity situation has reached a state of coiling. The market operates with minimal leverage. Market participants maintain their positions until they receive confirmation which will determine future trends.

The current phase represents the behavior that occurs before an imminent expansion starts. The upcoming resolution will create an uneven impact which affects different elements in various ways. The first assets to move will be those that maintain alignment with macroeconomic stability.

The infrastructure layers will develop after the initial stabilization point. The high-beta chains will experience their most significant growth at a later time. The narrative tokens will either lag behind or completely fail to perform. The upcoming movement will create an unbalanced effect which will impact different areas. The assets which organizations maintain through structural support systems will create financial advantages for their owners. The people who seek to obtain broken liquidity systems will experience sudden market changes.