A defensive shift, not a speculative one

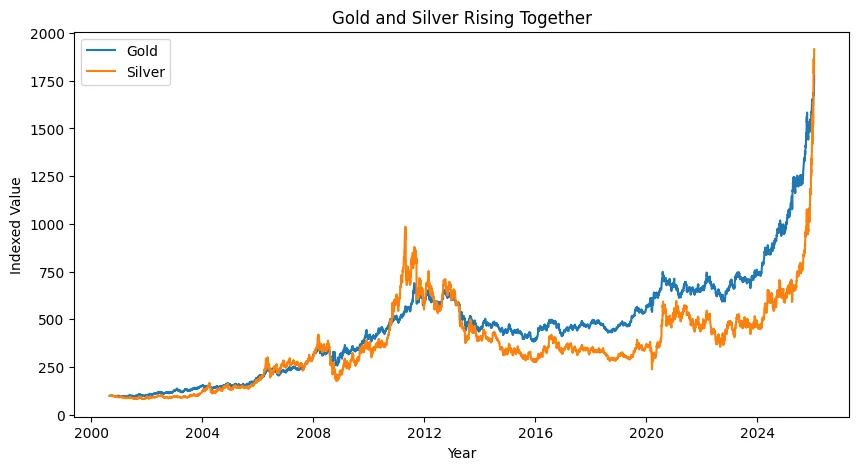

Gold and silver do not look up due to the fact that investors have found the traditional safe havens again. They are going up because the world financial system is getting more and more stress signals. All these issues together have made the very capital allocation—for example, if you put your money in one bank, you might find it hard to get it back or get the real value of your money out of such assets that do not rely on the approval of the institutions. This is not a trade based on momentum. It is a change in the structure.Gold’s increase, in the very first place, always indicates a long-term requirement for reservation against the depreciation of currencies and digging the instability.

On top of that, silver’s increase in price through the second layer that takes monetary hedging and the demand from industries together. The two metals’ performance shows that the market is not positioning itself for short-term volatility but for long-term uncertainty. In fact, it is not the news that investors are reacting to. What is driving them is the very structure of the global financial environment.

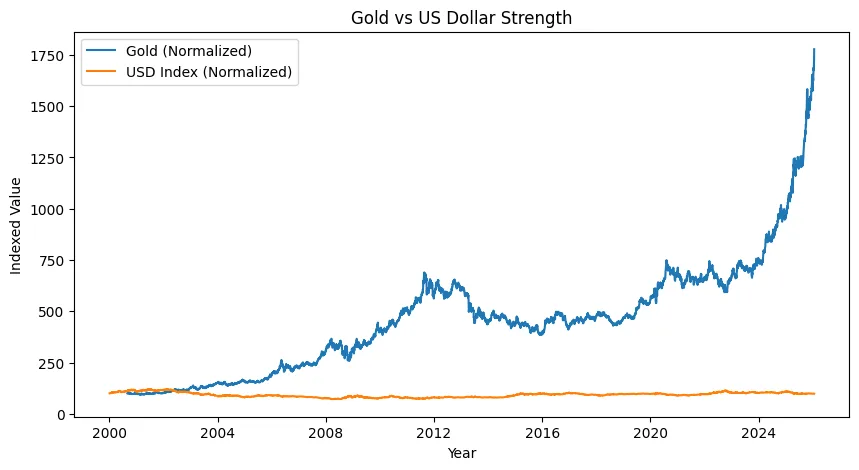

Why gold is breaking records

Gold is a very good investment in times of losing trust in monetary policies and today’s macroeconomic conditions are exactly the same. Even when the inflation rates become stable the real purchasing power keeps diminishing in the big economies. The growth of wages has not been able to make up for the high prices that have lasted for years and now it is the households and the institutions that are more vulnerable to the long-term dilution of the currency. On the other hand, gold gives the guarantee of being a value store that is not dependent on the trustworthiness of the central banks.

Moreover, the level of sovereign debt has hit the roof. The Governments are still borrowing money to cover their fiscal deficits and that is why they are increasing the long-term currency risk and thumping the monetary stability. The picture is made even more complex by rising interest costs which makes the policymakers to weigh the financial stability against the inflation control. Gold, in such a scenario, enjoys being the neutral asset that is not affected by the policy cycle. Geopolitical fragmentation is yet another factor that strengthens this scenario.

The ongoing power struggle, together with the regional conflicts, have not only made the global coordination very difficult but have also eroded the confidence in it. Historically, during the times of increased political risk, capital flows into the assets that are not linked with any single government or institution. The gold’s superb performance is the indication of this shift towards the neutrality, the resilience, and the long-term preservation. This has not been a rally driven by fear. Rather a rally driven by no trust in the central banks.

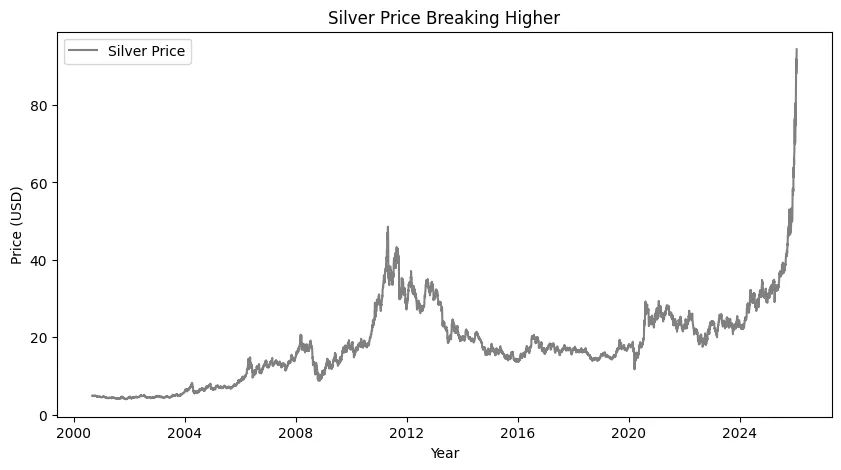

Why silver is surging with it

Silver’s surge has a distinct and intricate character. Gold’s competitor of the precious metals market, silver, contributes to an investor’s portfolio as a hedge against inflation and at the same time the demand for it in the industry pushes its price up. The financial uncertainties are not the only reason the metal is in demand; rather, the tech and power transitions are also poorly.

Silver is a major component, virtually indispensable for all the major applications like solar and wind power generation, EVs, electronics, and smart infrastructure. At the same time, there are almost no new mines coming on stream, and existing mines are facing various problems that have resulted in longer than usual supply cycles. Hence, the overall mining output has been unable to follow the rising demand. Due to this supply-demand imbalance, silver is sometimes referred to as a white metal with less golden attributes.

However, in times of crisis or macroeconomic downturns, it is easier to get rid of the silver than gold for a variety of reasons including lower premiums, so it is still an attractive alternative for investors looking for ”tangible” assets with lower entrance costs than gold. Besides, it offers both macro protection and growth-linked exposure, so there shouldn’t be any surprise if silver eventually takes over gold in the latter scenario. Silver has been the metal of choice in the early stages of the rally driven by macroeconomic factors and it usually takes the lead after broader participation enters the market.

By breaking through the last resistance level recently, the metal connected directly with the general market trend and at the same time didn’t lose its identity at the same time. Therefore it should be seen as a gradual reallocation of investment toward real assets that maintain their value not only during economic cycles but also technological ones.

What this means for global markets

Gold and silver at the same time reaching new highs is a situation the markets are not very often influenced by short-term factors. The markets are instead reacting to long-term structural forces. Such price changes generally signify loss of trust in fiat-money based systems, more hard collateral demand, and a transition to assets that keep value through coercive and monetary regimes.

This should not be interpreted as an alert for a financial crisis to take place soon; rather it is an indication that the investors are changing their outlook. Stability is not taken for granted anymore, it is now resilience that is to be prioritized. Money is going to assets that can endure policy unpredictability, huge geopolitical tensions, and long-term economic transformation. Under such conditions, gold and silver play the role of an insurance policy. They do not guarantee spectacular profits but rather the same level of being. Their power is a reflection of a scenario where risk is no longer something that comes and goes; it is now an inherent feature of the environment.

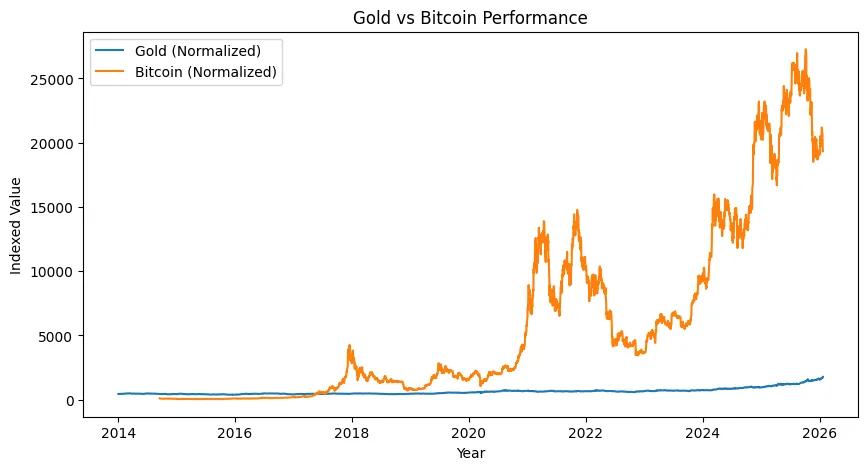

The crypto connection

In this situation, crypto and precious metals are not in rivalry. They are just the same macro response in different forms. Gold signifies stability, trustworthiness through history, and value retention while Bitcoin signifies liquidity, ease of use, and the decentralized financial structure. When metals go up in price, it indicates that the System is being cautious. When crypto goes up in price, it indicates that liquidity is being expanded and technology is being adopted.

Both react to the financial stress in the same way but through different avenues. Gold acts to counteract the flow of funds away from the institutions. Bitcoin basically works towards the complete elimination of such dependency. Both of these markets are seen as a refuge in the case of monetary looseness and fiscal largess since they still operate outside the radar of finance. The only thing they do differently is their roles. One is a preserver. The other is a creator.