Two metals, one macro moment

Gold and silver are not just responding to price; they are responding to regime. The present situation is characterized by late-cycle monetary conditions, high government debt, weak confidence in fiat currency stability, and a world economy fluctuating between fears of a slowdown and soft-landing optimism.

In this scenario, gold is acting as a monetary anchor, whereas silver is caught up in its conflicting roles as a precious metal and an industrial material. The comprehension of the present-day market necessitates the distinction between noise and structure and psychology and price.

Macro framework: Why metals matter now

Accretion of precious metals habitually is not by the conspicuous inflation headline but by the real interest rate and the risk of the central bank losing credibility. The market is receptive to the notion of the end of a policy era characterized by intense restriction, although the cuts may come later than what is now expected. Simply put, that expectation is enough to bring about a change in the behavior of capital allocation. Gold is the direct beneficiary of this shift.

Real yields that stop rising do not mean the price of gold will not be pushed up by a prevailing market trend-it only needs a cessation of the last tight monetary policy. The metal silver on its part, as a supporting factor, needs a growing consensus concerning the future of global prosperity and the related demand for industrial applications.This asymmetry hence also explains why gold hits up against cycle highs, while silver lags at a considerable distance.

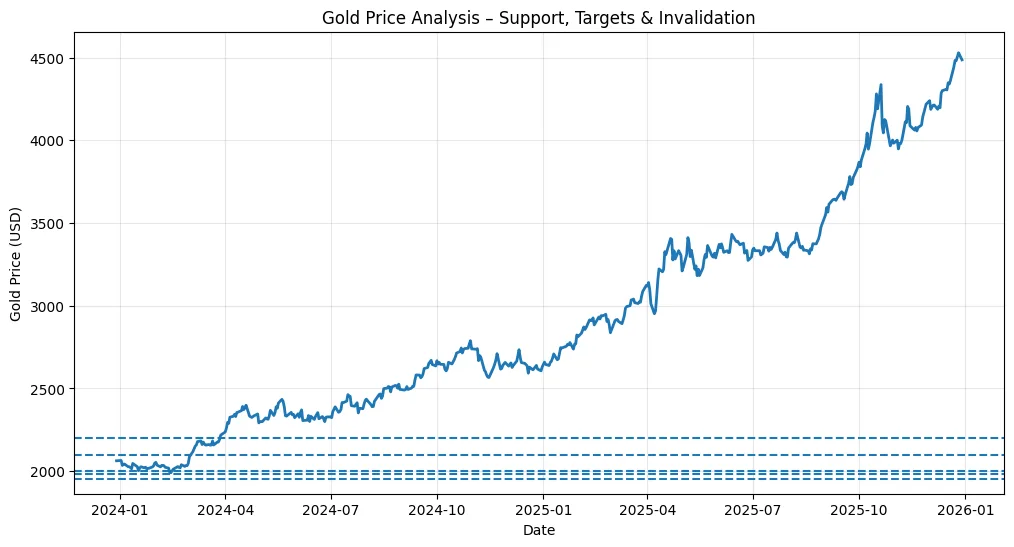

Gold price analysis: Structure over speed

Gold prices are now holding steady over the previous breakout area, a very positive sign from a technical standpoint that indicates buying rather than selling. The $1,980-$2,000 area has been repeatedly protected by the market and is now the main structural support. The general bullish market trend still holds as long as the price stays above this area.

The resistance that is closest and immediate is located in the interval of $2,070-$2,100, which has been the point of very important peaks and where the power of the trend has been exhausted for the last few weeks.

Invalidation is evident and orderly. A prolonged weekly closing beneath $1,950 would indicate a more extensive corrective move towards $1,880-$1,900, where the re-entry of long-term investors is anticipated. The macro bullish scenario gets considerably weaker if the price goes below that level.

Institutional investors build a substantial, almost unshakeable stream of buying or selling, more or less matched or balanced.

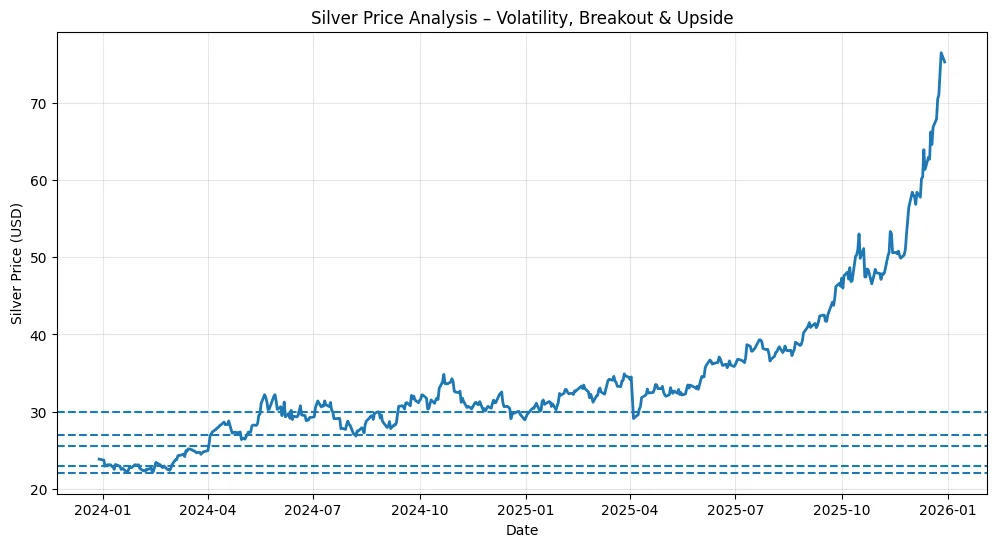

Silver price analysis: Optionality with conditions

Silver remains a highly volatile and low-trend-confirmation trade. The precious metal is staying above $22.50–$23.00, which is an important demand zone that has been effective in stopping the fall of prices. This zone draws the dividing line between healthy consolidation and structural weakness.On the positive side, Silver has to get back above $25.00–$25.50 to prove a legit trend reversal.

Silver would then be targeting $27.00–$28.50, where historical selling is concentrated, acceptance above this area would mean. In case of a global growth overhaul, the upward movement towards $30.00 will be seen as possible if the momentum is strong enough. The invalidation is harsher than the one for gold. A sharp slide below $22.00 will bring the silver price down even faster, up to $20.50–$21.00, which its demand sensitivity being the reason for this huge fall reflecting the situation that has come up with the changing of the investment atmosphere and the industrial demand price shifts.

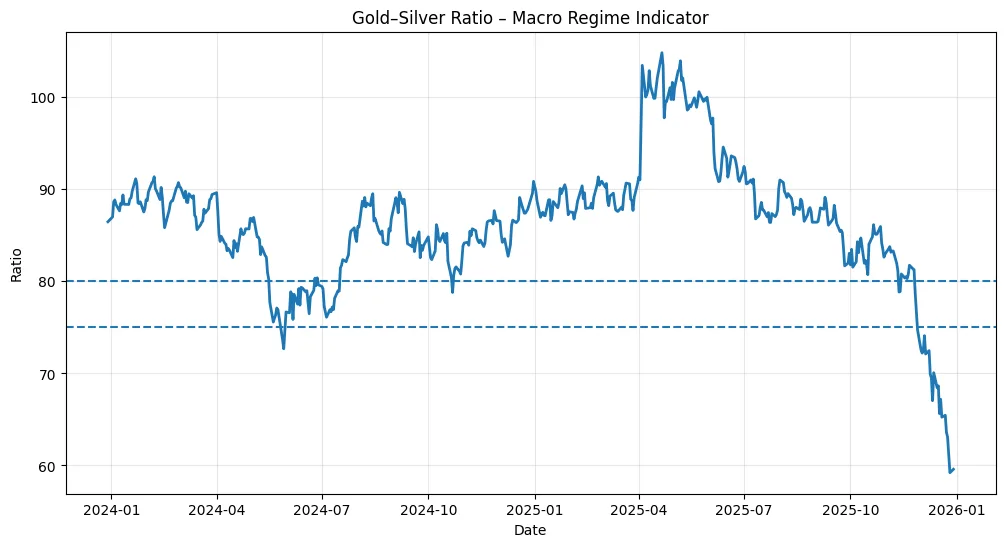

Gold–Silver Ratio: The regime indicator

The gold-to-silver ratio is still very high and is consistently staying above the historical average. This indicates a market focusing on the preservation of capital rather than the participation in growth. High ratios are usually maintained during the late cycle and stressful situations and are only reduced when the market’s confidence in growth returns.

A lasting fall below the 80-78 area would be the initial indication of silver’s structural outperformance. Gold, however, still holds the top position for the time being.

Short-term trader perspective

For those engaging in short-term trading, gold must be viewed as a range-respecting asset which requires the application of both patience and precision. Buying opportunities at $2,000-$1,990 are still open, while the targets for price increases go to $2,080-$2,100 and cancellation of the trade is just below $1,950. Only in the case of a confirmed breakout with volume will expansion trades be considered attractive.

In contrast, silver is a volatility instrument. One should not take sides but be opportunistic instead. One can get into long positions only at $25.50 and target $27+, while the breakdown trade at $22.00 entails an asymmetric risk of loss. Silver is a hard timing issue; it is easy to be wrong if you only rely on your conviction without the support of confirmation.

Long-term investor perspective

Gold acts as a strategic insurance for long-term investors. Accumulation is still valid above $1,900, provided that one is aware that volatility is not a risk loss of structure is. The function of gold is to preserve purchasing power, to insure against wrong policies, and to smoothen portfolios during liquidity shocks. For investors silver is like a convex growth hedge. Its size should be smaller and it should be held with patience. Its payoff is not linear and is dependent on the macroeconomic inflection period. Long-term investors should be willing to suffer losses in order to receive large returns during deflationary cycles.

Strategic allocation framework: Gold vs Silver

In a defensive or uncertain macroeconomic context, the gold investment gets the highest recommendation.The shift in allocations can be in favor of 55–60% gold and 40–45% silver, thereby taking silver’s higher rate of return while gold still acts as a safe haven.

Aggressive macro positions may at times lead to an over-representation of silver, but such strategies need excellent risk management and strong growth indicators.