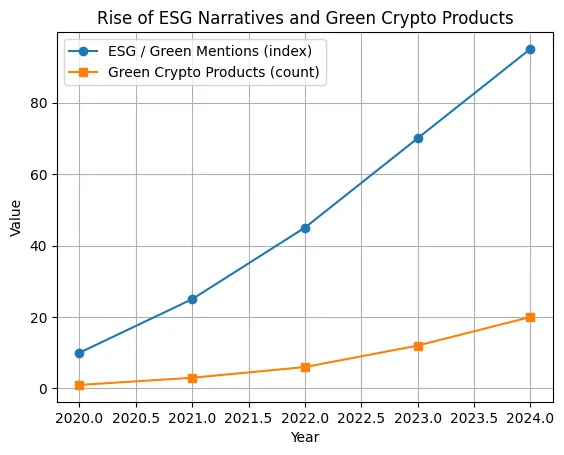

Crypto is no longer just about freedom, yield, and decentralization; it is now increasingly being assessed through the lens of sustainability. In the early narrative surrounding Bitcoin’s energy use, blockchains were depicted as environmental villains, with headlines comparing their electricity consumption to that of entire countries. Since then, the landscape has evolved. After implementing proof of stake, Ethereum’s energy footprint was decreased by more than 99%, and other chains with low-energy or carbon-neutral designs were added. Capital has evolved in the meanwhile. Institutional investors are under pressure to adhere to ESG standards, regulators are developing transparency guidelines for digital assets, and even regular consumers are becoming more conscious of the environmental impact of their financial choices.

This intersection is exactly where the Green Token feature is located. It views sustainability as a tangible, user-level choice within the transaction flow rather than as an impersonal marketing promise. The user actively picks a greener path and may observe and quantify the impact of that choice, as opposed to a protocol declaring, “We are green.” This change in agency gives any wallet, exchange, or payments software that uses it a competitive edge in a market where narratives drive flows and perception is just as important as performance.

Innovation: The green rails concept

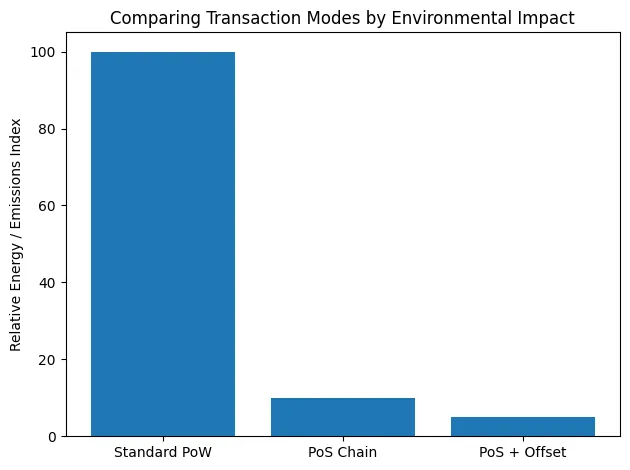

The fundamental idea of Green Token is to reward customers for initiating an on-chain transaction by providing them with a “green rails” toggle. An option such as “Use Green Rails,” which briefly explains that it contains a carbon offset or routes the transaction via a low-energy chain, appears when a user loads a card, sends a payment, or makes a swap. The algorithm selects networks that meet predefined sustainability criteria, including proof-of-stake chains or validators powered by renewable energy, if they decide to take part. The protocol can automatically obtain micro-offsets to offset the expected emissions for chains that are energy-intensive or antiquated.

What distinguishes this as a genuine crypto feature rather than a marketing layer is the on-chain reward. Green Tokens, a reward unit that may be redeemed for fee reductions, access to premium services, staking benefits, or badge accumulation, are given to users each time they select the green option. Instead of merely being told that something good happened in the background, the user experiences an immediate, tangible benefit and a visible record of their effort. This progressively gamifies sustainability and gradually persuades consumers to select greener rails without sacrificing control or functionality.

Architecture and tokenomics

Three levels form the foundation of the Green Token system. The first is the routing intelligence module, which rates the networks according to sustainability criteria, latency, cost, and reliability. It assesses which networks are accessible for a certain asset or corridor. This engine prioritizes eligible chains and marks the transaction as green for downstream accounting when the green rails toggle is turned on. Every time a green transaction is completed, Green Tokens are minted and distributed via the rewards contract, which makes up the second layer. To make GT a recognizable feature within the app rather than a stand-alone gimmick, this contract can be integrated with already-existing loyalty or staking systems. The third layer is the carbon accounting and offset pipeline, which translates transactions into emission estimates and matches them with verified offsets on the chain using registry integrations and external data inputs.

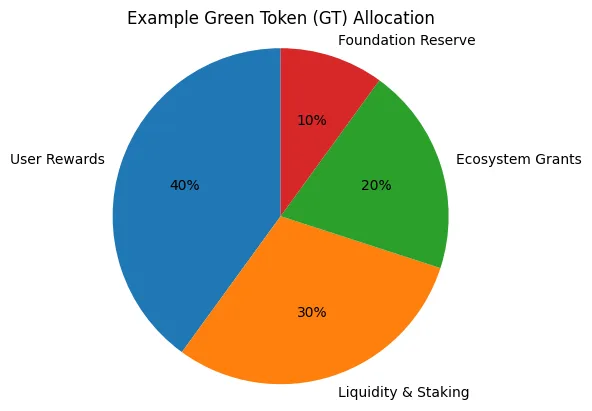

The system is connected by tokenomics. Consider a fixed supply of Green Tokens that are distributed across ecosystem incentives, user rewards, liquidity, and a foundation reserve. To produce a gentle deflationary pressure, a tiny amount of GT may be burned each time users exchange it for benefits or cost reductions. This ties consistent use of the green rails feature to the token’s long-term worth. Governance hooks can also give GT holders the ability to vote on things like which offset partners are reliable, which chains are green, and how aggressive the reward schedule should be. In this way, rather than merely accepting the sustainability norm, the community actively co-authors it.

Impact and adoption

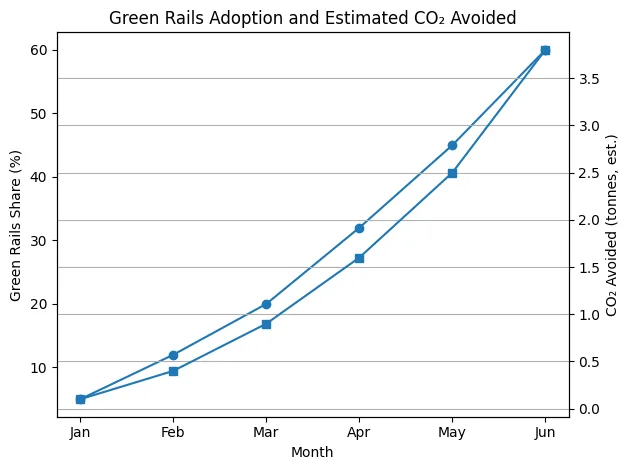

The ease of use of the feature will determine its level of user acceptance. Most users will most likely leave the toggle on by default if activating green rails only adds a minimal or no cost and the advantages are obvious. By employing milestones, success indicators, and soft social evidence like a message outlining the amount of carbon the user has avoided since turning on the feature the software can encourage this behavior. In the same way as owning specific NFTs or taking part in a DAO signal today, green train membership eventually becomes an integral part of their identity as a conscientious cryptocurrency user.

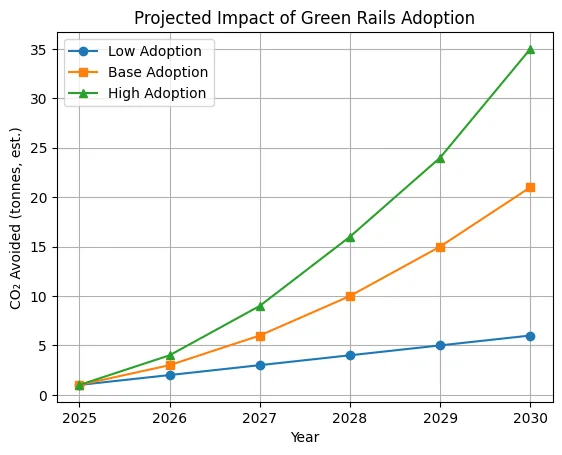

From the platform’s point of view, there are two outcomes. First, there are regulatory and reputational advantages, particularly in industries where ESG reporting is becoming increasingly important. Because it can generate a transparent dataset that displays transaction volumes, expected emissions and offsets, and user involvement in green rails, one platform will stand out from the others when institutional partners are deciding where to channel their flow. Second, the network layer offers a strategic advantage. Chains that invest in environmentally friendly infrastructure and transparent metrics will be more attractive as routing targets, which will increase fees, liquidity, and ecosystem strength. Sustainability becomes a competitive factor that may influence the crypto rails’ future structure.

Challenges and outlook

There are always trade-offs associated with sustainability features. It is technically challenging and frequently depends on assumptions to estimate the actual carbon footprint of a transaction across many networks. Any system that expands on carbon offset markets needs to be ready to defend the caliber of its credits because the markets themselves are being scrutinized. And there is the straightforward issue of price. Budget is consumed by offsets, rewards, and routing restrictions; if the system is overly generous in its early phases, it may put a burden on the platform’s economy. It will be crucial to preserve credibility and financial stability through openness, cautious assumptions, and well-defined boundaries around rewards.

The path forward is evident in spite of these obstacles. Traditional finance is gradually shifting toward required climate disclosures and examination of sponsored emissions, and cryptocurrency will increasingly cohabit with traditional money. A product has a compelling story to tell regulators, partners, and the general public if it can show that its customers are actively selecting cleaner rails and supporting offsets in addition to transacting. That narrative becomes data thanks to the Green Token feature. It keeps track of how many users turn on the toggle, how much carbon is avoided or offset overall, and how the app’s rails change over time to support networks with less impact. This type of integrated, quantifiable sustainability layer is probably going to go from being a nice-to-have experiment to the norm in a future when performance, impact, and reputation are all important.