- The regular breaches in cryptocurrency underscore a basic weakness arising from transparency, decentralization, and permanence.

- Instead of eroding trust, hacks often bolster stories, attracting both attackers and investors.

- The “fragility premium” persists because risk, volatility, and resilience are intrinsic to the nature of crypto.

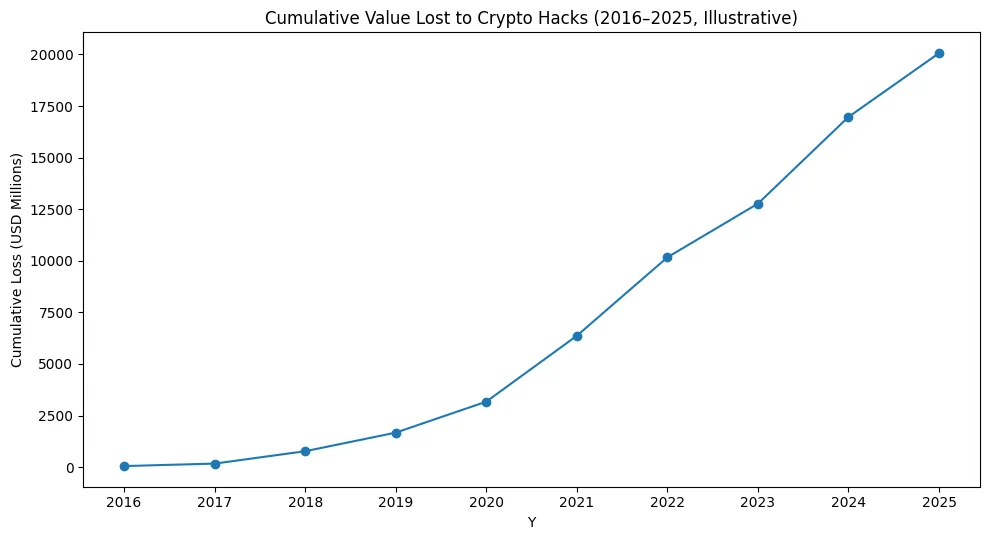

Each bull market in crypto appears to set new highs not just in valuations but also in the magnitude of hacks and breaches. Billions of dollars disappear in moments: extracted from bridges, taken from exchanges, siphoned from decentralized finance systems. Every time, the headlines bring up the same inquiries about why investors would have faith in a system so vulnerable to breaches? Why invest money in an industry that continually reveals its own vulnerability.

The contradiction is remarkable. In conventional finance, scandals undermine confidence and reduce valuations. In the crypto world, hacks exist alongside growth, suggesting that vulnerability itself has turned into a feature that investors are willing to accept. The story is not one of rejection but of perseverance: markets dip momentarily, then bounce back. Exploits expose weaknesses, yet they highlight the magnitude and significance of what is being created. If billions are in danger, then billions must be significant.

This paradox cannot be accounted for by excitement alone. The vulnerability of crypto is ingrained in its essence. It is a system created to remove intermediaries, distribute control, and enable participation from all. However, those same principles create weaknesses. A poorly set up smart contract, an ignored code route, or a breached private key can lead to disastrous outcomes not seen in regulated finance. Security audits and bug bounties are in place, yet the speed of innovation surpasses the ability to prevent.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

And still, investors remain. Institutions persist in investigating custody options, regulators aim for clarity instead of prohibitions, and retail traders resurface with each upward trend. The premium continues because fragility is regarded not as a failure but as the expense of radical transparency. In a market that values openness, fluidity, and unrestricted creativity, the hazards are acknowledged as part of the deal.

Vulnerability also generates storytelling inspiration. Every hack turns into a pressure test, a warning example, and, ironically, a marker of magnitude. No one attempts to strike vacant vaults; only ecosystems that are valuable for exploitation draw ongoing attacks. The fragility premium, therefore, relies not only on risk but also on validation. If your protocol is targeted by hackers, you are significant.

This aspect examines why fragility continues, why it fails to discourage investors, and why the contradiction of being “hacked again” has not obliterated crypto but rather attracts focus and even valuation advantages that no other asset class can maintain.

The anatomy of fragility

To grasp why hacks persistently affect crypto, one must analyze the various vulnerabilities within its structure. In contrast to conventional finance, where risk frequently stems from human error or deceitful motives, crypto instability arises from a more intricate combination of technology, incentives, and governance.

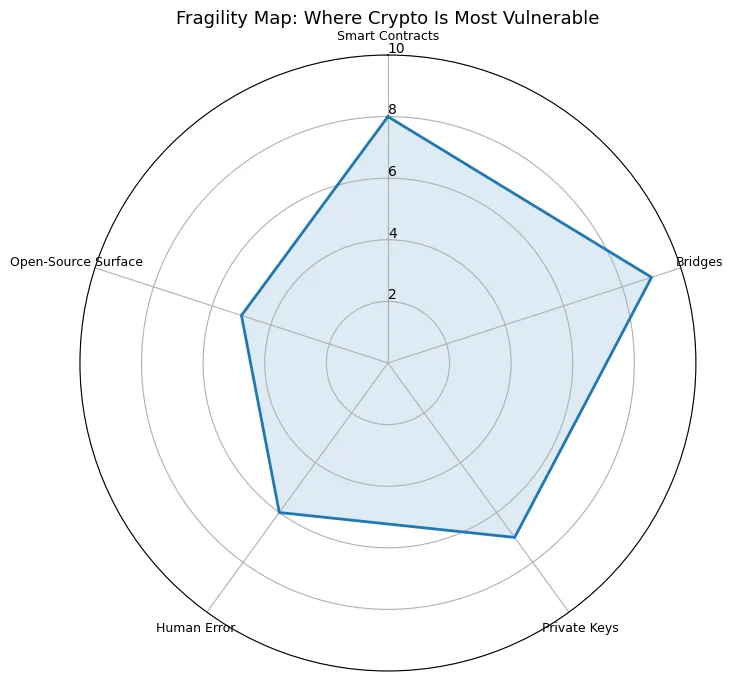

At the heart are smart contracts, the autonomous code segments that regulate decentralized applications. Their grace is also their weakness. Once a contract is deployed on a blockchain, it becomes unchangeable; it cannot be modified without agreement, implying that a single unnoticed flaw can turn into a lasting vulnerability. Notable events, like the DAO hack in 2016 or recent attacks on DeFi protocols, demonstrate that even carefully audited code can contain weaknesses. In contrast to conventional systems, which can implement patches overnight, blockchain systems do not have a quick “off switch” for emergencies.

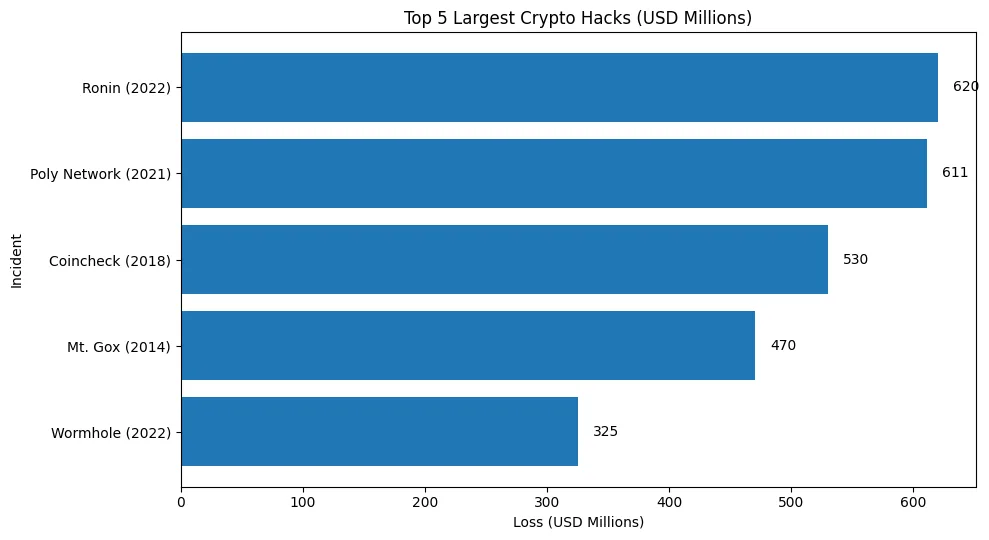

Next, there are the bridges, the linking structure of a multi-chain ecosystem. As funds move between Ethereum, Solana, BNB Chain, and new Layer 2s, cross-chain bridges act as the portals. Regrettably, they have also shown to be the vulnerable weak point of crypto. Bridges contain significant quantities of secured assets, rendering them appealing objectives. The 2022 Ronin Bridge exploit, which siphoned more than $600 million, along with the Wormhole hack that resulted in a loss of $325 million, highlighted the vulnerability of these inter-chain connectors. Security researchers often refer to bridges as the “honeypots” of cryptocurrency, as attackers continually test for vulnerabilities.

Fragility also reaches beyond code to include human mistakes. Private keys, which are the cryptographic signatures that protect wallets, are frequently lost, stolen, or obtained through phishing scams. In contrast to a stolen credit card that can be revoked and replaced, a compromised private key cannot be undone. Exchanges strive to address this by implementing custody solutions and multi-signature wallets, but users frequently continue to be the weakest link. Scams involving social engineering, counterfeit interfaces, and phishing schemes manipulate trust instead of technology.

Layering on top of this is the open-source ethos of cryptocurrency. Transparency is praised: code is accessible, transactions are observable, and governance discussions occur online. However, transparency also makes the ecosystem vulnerable to opponents who can examine each line of code for vulnerabilities. In conventional finance, protection via secrecy conceals certain weaknesses. In cryptocurrency, the belief is that public testing strengthens systems, but in reality, it provides attackers an advantage.

The structure of fragility uncovers a stark reality: weaknesses are not accidental; they are fundamental. They emerge from the fundamental principles that render crypto groundbreaking: openness, decentralization, and immutability. To take apart fragility would be to weaken the very spirit of the industry. Thus, the paradox continues: fragility is not a flaw in crypto’s framework; it is an inherent aspect of its design.

The economics of being hacked

In numerous sectors, consistent violations result in reputational catastrophe. A bank that experiences customer fund theft will probably fail. A social media firm that reveals user information could experience a market value drop of billions in an instant. However, in the crypto space, breaches that sometimes exceed the losses from entire corporate scandals often do not signify the demise of an ecosystem. Conversely, prices rebound, investors come back, and projects proceed. In what manner can fragility exist alongside resilience.

The initial response can be found in the dynamics of risk premium. Crypto is currently valued like a frontier market. Investors entering this area are not looking for security; they are pursuing exceptional returns in relation to the risks involved. A protocol that promises a 20% staking yield or a token with 100x growth potential cannot be assessed using the same criteria as a blue-chip stock. The vulnerability is inherent in the deal: investors acknowledge that some funds will be lost to scams, similar to how venture capitalists anticipate many startups will not succeed. The possibility of asymmetric gains balances the inevitability of occasional breaches.

An alternative explanation involves liquidity depth and the trust of the community. During significant hacks, token values frequently plummet but seldom reach zero. Communities unite, developers split chains, or treasuries allocate recovery funds. Exchanges can act to freeze stolen assets, and ethical hackers occasionally return money after taking advantage of weaknesses. This fosters an impression that hacks are not deadly but manageable occurrences, strengthening the idea that ecosystems are capable of adapting. Communities’ readiness to endure losses by purchasing dips or backing forks provides markets with a strength not observed in traditional finance.

Hacks, in a paradoxical way, act as demonstrations of scale. A protocol that loses $500 million in an exploit indicates that it initially had $500 million in locked capital. Attackers prioritize their efforts on significant targets; they focus on the most critical infrastructure. Consequently, the scale of the hack turns, in a distorted reasoning, into a confirmation of a project’s significance. This clarifies why valuations after hacks can rebound swiftly: the breach underscores importance as well as vulnerability.

The dynamics of insurance further strengthen this. An expanding sector of DeFi insurance protocols provides compensation for losses due to hacks. Although coverage remains restricted, the mere presence of such markets implies normalization. In equities, insurance is inherent due to regulation and governmental support. In cryptocurrency, investors are eager to invest in larger premiums directly. The cost of fragility is integrated into the economics of the ecosystem, similar to how volatility is factored into options markets.

In the end, the financial aspects of experiencing a hack depend on psychological factors. Crypto investors perceive fragility not as disqualifying but as unavoidable. The perpetual danger is embedded in the tale of “early adoption,” where instability, loss, and resurgence are integral to the experience. Being hacked, in a peculiar sense, signifies you’ve made it: it indicates you were deemed worthy of attention, and that status alone warrants a value that the markets are reluctant to overlook.

The psychology of fragility

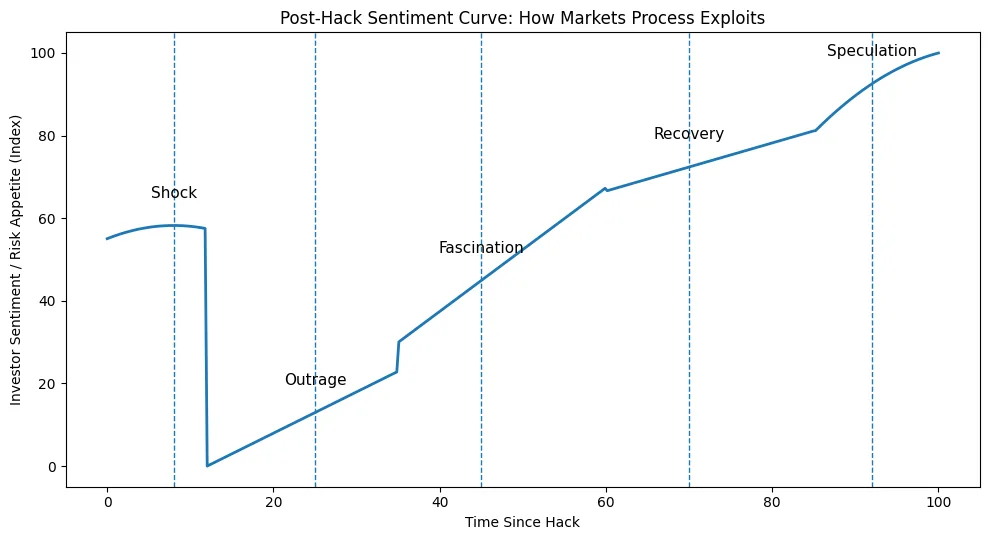

While economics clarifies the reasoning behind the pricing of fragility, psychology sheds light on the reasons it is accepted and even welcomed. In conventional markets, investors desire consistency. Blue-chip shares, state bonds, and covered deposits offer reassurance. Crypto investors, on the other hand, appear to rush toward the flames. Every hack ignites anger, but that anger swiftly shifts to intrigue, and intrigue frequently drives renewed conjecture. Why does fragility not deter, but draw in.

A portion of the explanation is based on risk identity. Crypto is not just an asset category; it is a movement founded on defiance against traditional systems. Participants frequently take pride in being early adopters of a volatile, experimental realm. While traditional finance considers hacks to be disastrous breakdowns, those within the crypto world see them as stress tests demonstrating that the system is active and competitive. To withstand a hack and remain invested turns into a mark of pride, an exhibit of belief. The fragility is inherent to the narrative; it constitutes the narrative.

A different aspect is the gamification of risk. Cryptocurrency markets operate at a rapid pace, with token values fluctuating dramatically in just a few hours. For numerous traders, the excitement comes not from consistent compounding but from the volatility alone. Hacks increase this instability, causing drops that are succeeded by speculative recoveries. Opportunistic traders view hacks as opportunities, a moment to “purchase the blood in the streets.” The events that ought to undermine confidence turn into short-term profit chances, strengthening the belief that fragility is merely another market occurrence to trade.

The psychology is also influenced by survivorship bias. Investors who endured the Mt. The Gox collapse, the DAO hack, and the Terra implosion all recount tales of resilience while still yielding profits. These stories eclipse the many investors who never bounced back. New entrants embrace the belief: deficits are short-lived, recoveries are certain. In this manner, fragility is reinterpreted as a rite of passage instead of a hindrance.

Additionally, hacks foster an unusual type of trust creation via transparency. When money is taken, the blockchain reveals all transactions and the movement of the misappropriated assets. In contrast to typical scandals, where deceit remains concealed for years, the failures in crypto are apparent and immediate. Ironically, this transparency strengthens the notion that the system, though delicate, is at least truthful about its vulnerability. Investors might incur losses, yet they do not feel misled; rather, they sense a challenge.

At its essence, the psychology of fragility revolves around perspective. To those not involved, hacks signify disarray. For those in the know, these are the struggles of an uprising. Fragility doesn’t diminish the narrative; it enhances it. It changes losses into collective experiences, instability into thrill, and risk into identity. In cryptocurrency, experiencing a hack is not only survivable but also part of the community.

Regulation, security, and the future of the fragility premium

The persistent inquiry is if the fragility premium can last forever. Can a sector sustain growth while losing billions to breaches, or will oversight and evolving infrastructure eventually diminish the contradiction? The solution resides in the conflict among security, monitoring, and innovation.

On one side, the regulation is progressing. Governments and international organizations are no longer viewing crypto as a marginal novelty. The European Union’s MiCA framework for crypto-assets, the U.S. SEC’s efforts for definitive securities classifications, and Asia’s initiatives for licensing exchanges all indicate an emerging phase of accountability. Oversight brings the demand for stricter security protocols, the implementation of audited custody methods, and the assurance of investor safety. For institutional capital, this is essential: pension funds and banks will not accept the type of systemic vulnerability that retail investors overlook.

However, there are boundaries to regulation. Crypto was created to withstand centralized control, and enforcement faces challenges from the borderless aspect of code. A DeFi protocol is susceptible to attacks from any location globally, and no regulatory body can resolve a smart contract flaw instantly. Despite more robust frameworks, fragility will endure as it is systemic rather than incidental. The issue is not if hacks will persist, but rather how markets will adjust to them.

In the meantime, the sector is progressing in security protocols. The formal verification of smart contracts, multi-party computation for custody, and decentralized insurance protocols are advancing. Bug bounty initiatives currently provide rewards worth millions to ethical hackers. Certain projects promote their durability, highlighting audits and “battle-tested” code as a feature. These actions can lower risk, but they cannot eradicate it without compromising the open, permissionless spirit that characterizes crypto.

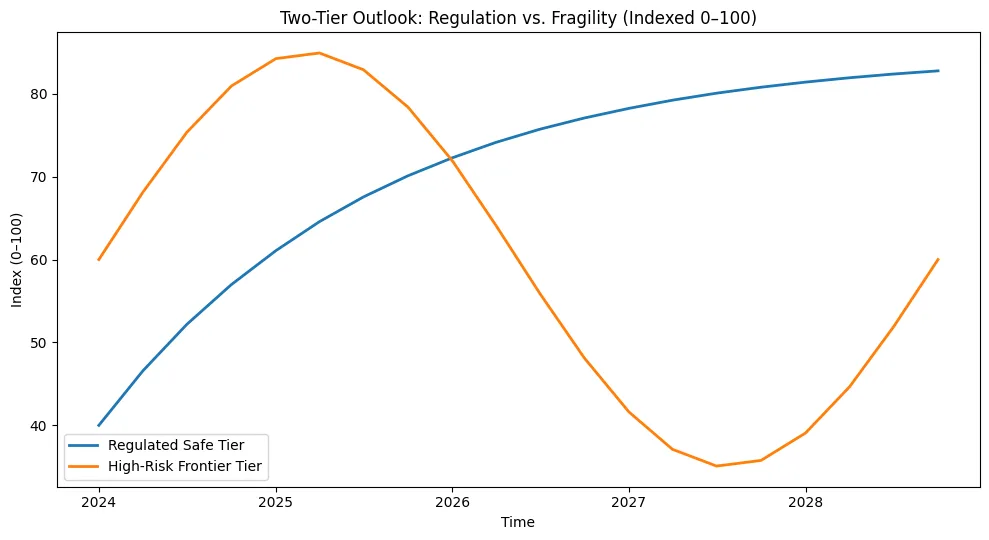

The most probable result is a dual-layered ecosystem. On one level, heavily regulated exchanges, custodians, and stablecoin issuers will serve institutional investors with strict compliance and insurance. Conversely, decentralized protocols will keep innovating at the periphery, with their valuations reflecting fragility as a type of premium. Investors will understand how to distinguish: certain funds will be directed towards “secure crypto,” while other funds will intentionally pursue the unpredictable, high-risk frontier.

In the end, the fragility premium might not vanish but transform. Similar to high-yield bonds in conventional finance, risk itself transforms into an asset class. Hacks will continue to happen, but markets will adjust by pricing them more effectively, providing insurance against them, and even incorporating them into structured products. Fragility cannot be eliminated; it will be formalized.

The irony is notable: the weakness that detractors cite to disregard crypto might be the characteristic that guarantees its longevity. Vulnerability drives innovation, draws interest, and sustains the high-risk, high-reward balance that renders crypto captivating. Breach occurred once more? Investors might express their disappointment, yet they seldom leave. In crypto, fragility isn’t the final outcome; it’s the value that sustains the game.

Rita Dfouni

Rita Dfouni