The milestone moment

A psychological threshold has been subtly breached by the financial landscape. The most recent PwC AIMA survey, which was published this month, shows that more than 55% of hedge funds globally already have cryptocurrency holdings. A structural shift toward exposure to blockchain technology has replaced the discrete experiments of digital-native quant funds. The hedge-fund industry, which has historically been at the sharp end of global finance, has started to incorporate cryptocurrency as a legitimate asset class worthy of permanent allocation rather than as a speculative side bet.

The information presents an engaging narrative. Over 100 hedge fund managers with a total of almost $1 trillion in assets under management were polled for the report. Compared to just 47% a year earlier, more over half now own digital assets directly or through derivatives. Although most continue to limit exposure to less than two percent of total assets as they work through liquidity and custody issues, the average allocation has increased to about seven percent. The slow evolution of cryptocurrency from a fringe alternative to a structural foundation of multi-asset portfolios is the larger story behind these figures.

The drivers behind the surge

The reasons behind this adoption boom are structural, not emotional. Regulatory clarity has improved in key jurisdictions: Europe has created a MiCA framework, the US is finalizing custodial rules, and hubs like Singapore and Dubai are still creating institutional-grade ecosystems. As a result, imprecise legal definitions, unclear tax treatment, and poor custodial standards practical barriers that once discouraged are gradually vanishing. Since hedge funds are built on the ability to arbitrage inefficiencies, they are naturally gravitating toward a maturing market where price differences and volatility offer chances.

In addition to laws, macroeconomic factors are pushing capital in this way. After several years of persistently high real interest rates, diversification into assets with asymmetric return profiles has become a sensible defense against inflation and rate-cycle volatility. Bitcoin is now viewed by the same organizations that once considered it speculative as an uncorrelated tool that may operate as a buffer against portfolio volatility by capturing upside when traditional risk assets stop.

Changing the market’s micro-structure

More than just inflows, the entry of hedge funds represents a re-engineering of the flow of liquidity. Funds are increasingly using complex derivatives, cross-asset hedging, and high-frequency arbitrage tactics to populate cryptocurrency markets that previously relied heavily on retail and prop-trading momentum. Execution speed is growing, bid-ask spreads are getting smaller, and centralized marketplaces are increasingly reflecting on-chain liquidity.

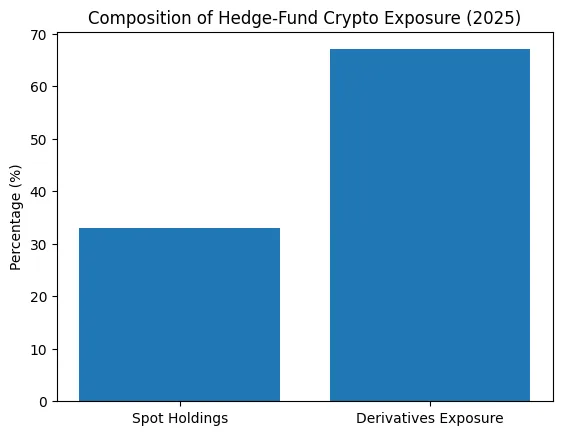

However, there is a paradox in this institutionalization. Crypto inherits Wall Street fragility more and more as it adopts Wall Street mechanics. Since derivatives now account for more than two-thirds of hedge fund exposure rather than spot holdings, leverage and margin behavior can amplify volatility under stressful situations. The $19 billion liquidation wave in October showed that systemic feedback loops appear far more quickly in cryptocurrency markets when they undergo a significant correction. In other words, market structure is changing to become more integrated and efficient.

Tokenisation, DeFi, and the next layer of integration

Although liquid assets like Bitcoin and Ethereum are now the focus of hedge fund allocations, tokenization is quickly gaining traction. Within the next three years, over half of the managers polled say they would like to introduce tokenized fund structures. With real-time settlement and transparent ownership records, these vehicles would let investors to swap fund shares on-chain. In parallel, 43% of funds want to investigate DeFi protocols for the purpose of generating income or providing liquidity.

This is a subtle reorganization of the back-office core of finance, not just a curious technological advancement. Tokenisation enables T+0 settlement, atomic collateral transfer, and programmable compliance. The operational layers that previously divided fund administrators, custodians, and transfer agents are compressed in practice. Hedge fund portfolios may function 24/7 as these rails develop, bridging the gap between conventional clearing methods and blockchain liquidity.

Risks, correlations, and the path to maturity

The line separating cryptocurrency from the larger financial markets starts to blur as use grows. Current research on hedge fund correlations demonstrates that digital asset drawdowns during liquidity stress might cause rebalancing in equities or credit portfolios that are managed by the same companies. Risk models predicated on the idea that cryptocurrency acts autonomously are called into question by this convergence. Cross-market contagion becomes a real issue as allocation increases from single-digit percentages to double-digits.

Vulnerabilities in smart contracts, counterparty integrity, and custody are still top concerns. Many funds still see legal ambiguity as the largest barrier to scaling exposure, notwithstanding the entry of major custodians. Though risk frameworks are adapting, auditors are incorporating blockchain forensics, and portfolio managers are incorporating on-chain analytics into their trading screens, the trend still seems unchangeable. The ecosystem is coming to view cryptocurrency as an extension of global liquidity rather than as a separate entity.

The broader market implication

Crypto is approaching its “institutional middle age,” according to the 55 percent milestone. Infrastructure has replaced the early turmoil, and systemic capital is now drawn to infrastructure. Deep integration tokenized treasuries, on-chain fund shares, and regulated digital-asset exchanges knit into the same liquidity fabric as stocks and bonds is the next stage, not speculative hysteria.

Crypto no longer functions as an outsider in this new paradigm; rather, it becomes a structural component of capital markets. As liquidity increases, price volatility may decrease, but systemic risk will move rather than vanish. The result is a 24-hour trading market where hedge-fund algorithms arbitrage between centralized and decentralized venues while being equally regulated by code and compliance.

The focus changes from adoption to adaption when more than half of hedge funds own cryptocurrency. The question now is how markets will change under the influence of institutions, not if they will join. Crypto becomes less isolated, liquidity more synced, and risk more communal with each additional allocation. Future market structures will probably resemble a hybrid organism, with global pulses, institutional governance, and decentralized trains.