The market didn’t collapse. it matured.

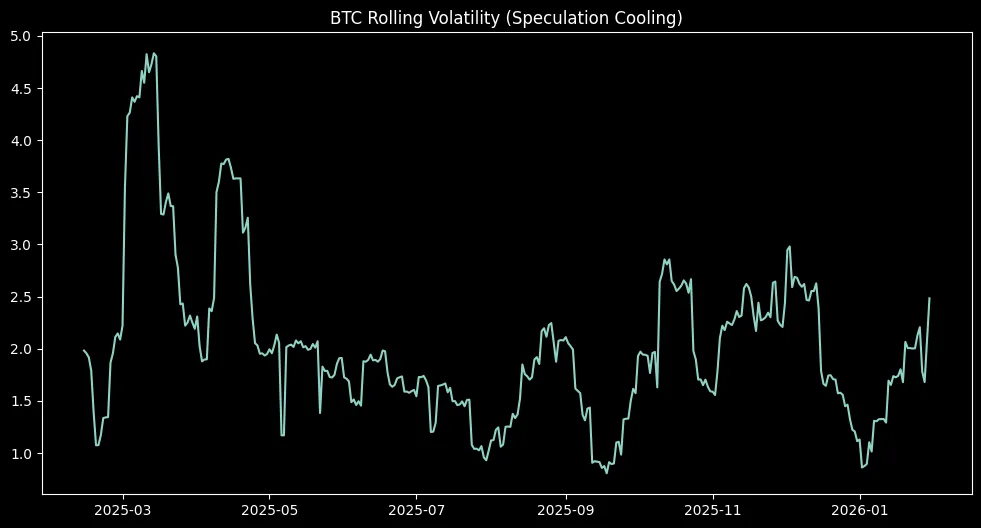

The market experienced neither a total collapse nor an extreme surge of excitement which created an atmosphere of excessive celebration. The market now operates through hidden patterns which show that people who engage in speculative trading will vanish over time. The market has changed from its 2021 state which operated like a gambling facility that reacted to player behavior. The trading environment in that period featured sudden price increases because traders used their leverage to place bets on popular securities which produced short-term price increases.

The market experienced explosive price movements during breakouts which led to traders buying back their assets during price declines. The market price followed a pattern that showed emotional reactions from traders which created disordered price movements resulting from crowd behavior. The present time period shows a complete transformation in its essential characteristics. The current market conditions lead to price compression which replaces previous price explosions. The current situation shows decreasing market fluctuations instead of increasing ones. People lose their ability to focus because their attention spans shorter than before.

The process of market entry now requires people to meet specific criteria because all types of investors are no longer permitted to become involved. Investors make their financial moves in a manner that uses discretion while demonstrating their dedication to their objectives. The situation demonstrates a strength which has reached its full development stage. The cryptocurrency market develops into a legitimate financial market which operates according to established rules after its period of speculative activity ends.

Leverage Is no longer driving the cycle

The initial structural transformation emerges through changes in derivative market dynamics. The market continues to show open interest but now experiences shorter and less intense leverage spikes that take on a defensive posture. Funding rates fail to maintain their extreme levels. Traders no longer pile into directional bets with blind conviction. Instead, traders build multiple positions which they protect through hedging and they terminate when market conditions shift. Leverage worked as an accelerant throughout earlier market cycles.

Its usage increased market upswings while making market downswings more severe. The present use of leverage functions as a risk management instrument rather than serving as a tool for market speculation. Market participants deploy it tactically, not emotionally. Discipline has taken the place of momentum. The statement shows that price movements now occur through controlled market exposure and planned market positioning. The market now operates without speculation as its main driving force.

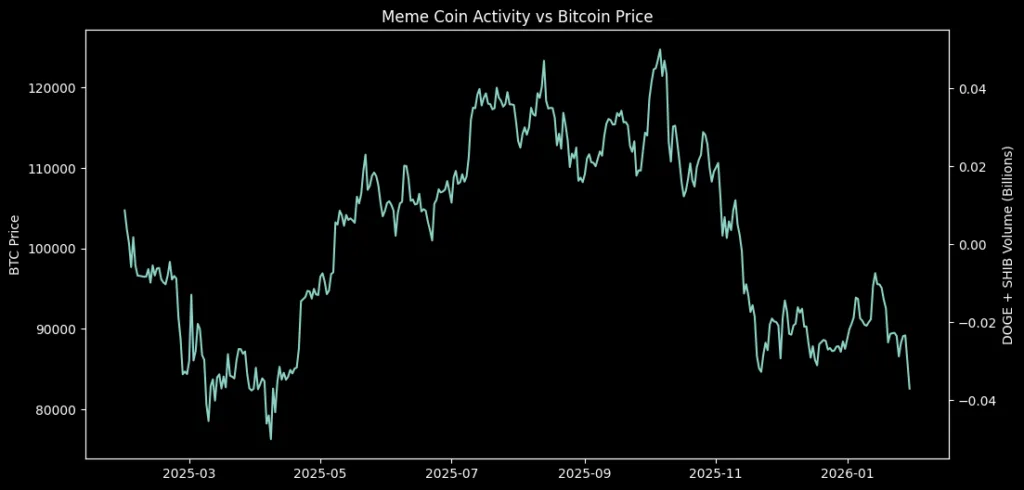

Meme rotations are losing their power

The process of meme-based trading changes has experienced a complete reduction in strength. The market displays short-lived price increases, yet these increases do not spread into the wider market. Capital now moves between different narratives without establishing a continuous flow pattern. The market experiences decreased liquidity, which now moves between assets at an accelerated pace. The viral excitement of the moment fails to establish ongoing market momentum.

The active participation of retail investors has now decreased. The crowd no longer moves as a single organism. Our current market environment displays extended periods of stability that experience short periods of market activity. The market no longer provides liquidity through attention. The market no longer operates according to established patterns that succeed with high probability. The market experiences a decline in its ability to respond to changes while undergoing a transition to more selective operations.

Holding behavior has fundamentally changed

The situation which replaced speculation now exists in a much more silent state. The on-chain data shows increased coin dormancy together with extended holding times and decreasing exchange balances.

The supply of Bitcoin which long-term holders possess continues to grow. Ethereum functions as a basic operational system instead of a trading platform. Stablecoins increasingly operate as settlement rails rather than leverage fuel. The evidence does not show any indications that gamblers have participated in this activity.

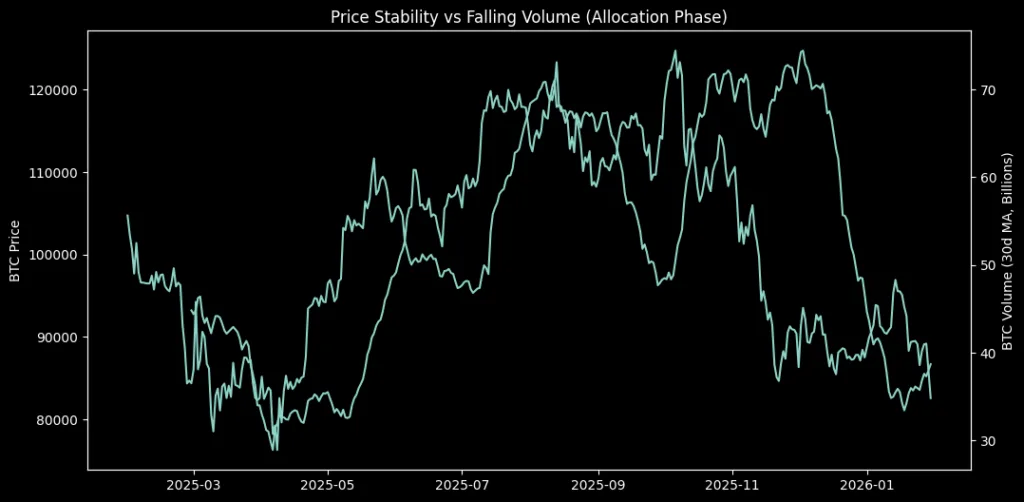

The data shows that allocators have left their distinct marks on the situation. Investors now redirect their funds toward investments which offer longer-term benefits. Investors use consolidation periods to build their positions instead of waiting for breakouts to happen. Investors treat assets as balance-sheet elements instead of speculative investments. The cryptocurrency market is developing its ability to store digital assets.

Institutions are absorbing volatility

The changes in behavior show people experience slower rally movements and controlled drawdown situations. The selling pressure gets handled through ETF inflows which operate without drawing attention. Investors who hold large stakes buy additional shares when stock prices experience periods of stability. Bitcoin has become a preferred collateral asset for corporate treasuries and asset managers who use it for their business operations. Sovereign risk and macroeconomic pressure now drive cryptocurrency market movements more than social media trends.

The cryptocurrency market has stopped functioning as an independent system that operates outside traditional financial systems. It is now becoming part of the financial system. The presence of institutional investors leads to reduced price fluctuations in the market. The capital that exists on balance sheets serves to stabilize price movements. The market now experiences demand through structural factors instead of emotional buying patterns. The situation which once appeared to be disorganized now shows signs of intentional design. The market began to experience a decrease in speculation activities. The process of speculation started to decrease until it completely vanished.

Crypto is entering its mature market phase

The explanation holds significance because mature markets execute their growth through gradual developments which generate returns to investors who maintain their long-term investments. Investors who use emotional trading methods will experience losses while institutional investors will benefit from their selected investment methods.

The trading environment transforms from automatic trading systems to investment allocation systems. The current path of cryptocurrency development follows this established route. Bitcoin now serves as digital assets used for macroeconomic purposes. Ethereum now functions as essential financial infrastructure. Stablecoins now serve as underground systems which support monetary transactions.

The market now separates into different operational segments instead of existing as one unified investment market. The process of financial system development proceeds through this specific pattern of growth. Traders who follow momentum trends no longer control the cryptocurrency market. The market now operates through institutional investors who develop their investment strategies.

The transition most people are missing

This shift feels uncomfortable because it doesn’t have any action to it. There is no manifest extremeness. No overall story. No coordinated retail boom. Instead, there is quiet accumulation, muted volatility, and structural positioning within compressed price ranges. To traders, this feels inert. To allocators, this feels strategic. The cryptos are not dying. They are becoming investible.