Ways people actually buy “before listing”

Understanding what “before listing” really means in practice is helpful when designing a feature.Three primary methods are used by the majority of users to obtain new tokens early. First, launchpads and presales, both centralized and decentralized.

This occurs when a project offers tokens before they can be traded freely, either on its own website or on a launchpad like Binance Launchpad, KuCoin Spotlight, PinkSale, or BSCPad. After connecting their wallet and committing a base asset such as ETH, BNB, SOL, USDT, or USDC users can obtain tokens instantly or at the token generation event, sometimes with vesting.

Secondly, new DEX listings without a large centralized exchange listing. In this instance, early buyers switch into a new pair, say TOKEN/ETH or TOKEN/BNB, on a DEX like Uniswap, PancakeSwap, or Raydium, as soon as liquidity is offered. This is the traditional “purchase on DEX before Binance” tactic, but it is also the location of the majority of scams, including rug pulls, honeypots, and fraudulent contracts.

Third, airdrops and private or semi-private rounds. Although platforms may arrange “community private sales” with KYC, private or seed rounds are usually reserved for VCs and angels. Airdrops serve as pre-listing exposure rather than “purchasing”; users engage with a testnet or protocol, receive tokens for free, and those tokens eventually list.

You can choose to support launchpads and presales, new DEX listings, airdrop/testnet possibilities, or all of them for your feature. Then, you can standardize them under a single idea, such as “early access opportunities.”

Turning “our criteria” into a scoring framework

You need a consistent criterion framework that converts unprocessed project data into a risk or quality score in order to make this a functional feature. You can begin with a basic model even if you decide to change the numbers later.

In general, you should consider four sets of criteria. First, the safety of contracts and liquidity. This covers if ownership is renounced or controlled by a multisig, whether liquidity is locked, how long it is locked, and whether the contract contains features that can block sales, alter fees to extremely high levels, or blacklist addresses. These are the fundamental rug-pull and honeypot checks.

Tokenomics and vesting come in second. In this case, the distribution of supply among the team, presale, private investors, marketing, and liquidity is important. Additionally, you examine if team and private allocations are fully unlocked at launch, which would permit quick dumping, or if they are locked and vest over time.

Distribution and decentralization come in third. With known liquidity and vesting contracts excluded, you examine the concentration of the top holders. There is a serious concern if one or two externally held wallets control the majority of the supply. Thresholds like “top 10 non-locked holders must own less than a specific percentage” can be specified.

Social and traction indications come in fourth. You can examine the age and consistency of the project’s social accounts, engagement quality, and growth during the past few days, even though you cannot completely rely on any one metric. The number of holders, volume, and whether activity appears to be organic or controlled by a small number of wallets are all examples of on-chain behavior that you may monitor.

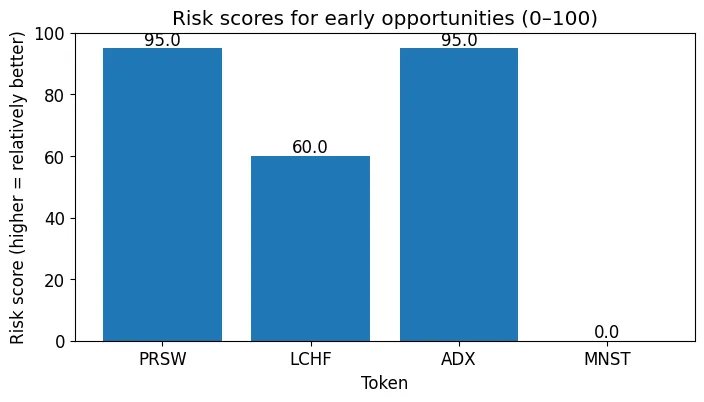

This criteria engine can produce discrete levels like “low risk,” “medium risk,” and “extremely high risk” or a numerical risk score between 0 and 100. After that, your feature can choose which opportunities to display, which to fully conceal, and which to display with caution.

Gathering on-chain and off-chain data for the feature

Your feature requires data in order to apply your criteria. You must read the DEX liquidity pool and the token contract on-chain. You can view the total supply, top holders’ balances, tax settings if they are visible through public variables, and dubious features like trading controls or blacklists from the token contract. You can find out how much liquidity is added, how much is locked, and for how long by looking at the lockers and liquidity pool.

Web3 libraries, an ABI for regular ERC-20 tokens, and, if available, specialized ABIs for lockers or presale contracts can be used for Ethereum-compatible chains. As an alternative, you can utilize third-party APIs that provide you with a summary of this information.

You can obtain social data off-chain by using third-party aggregators or the APIs of websites like Telegram, Discord, and Twitter/X. You monitor the number of followers, the date the account was created, the frequency of posts, and the level of engagement. To keep the feature current, you can save these together with the on-chain measurements in your own database and then periodically perform your risk rating.

UX flow in your app and risk messaging

Your feature can show “before listing” chances in an honest and comprehensible manner for users after you have a clear model and scoring.

The following is a basic flow. Start by obtaining or consuming fresh opportunities from the sources you have selected, such as launchpads, DEX pair monitors, and your own curation for testnets or airdrops. Second, create the criterion inputs and calculate a risk score and label for every opportunity. Third, store the outcomes and make them available to your front end.

Your interface may provide an early project list or grid on the user’s end. You display the name, symbol, chain, opportunity type, and a graphic depiction of the risk label for every item. When a user opens a particular project, basic tokenomics, ownership, top holder concentration, liquidity lock status, and social information are displayed in plain English.

Strong risk messaging should also be incorporated right into the experience. This means that the early opportunities area will have a global disclaimer alerting readers to the extremely high risk involved and the possibility of losing their whole investment. Additionally, it includes contextual warnings: if the score is low, you can discourage impulsive purchases by displaying a red banner and highlighting the specific criteria that failed (such as “liquidity not locked” or “top holders control most of supply”).

Before completing the transaction, your buy flow will connect to the user’s wallet, pre-fill the correct contract address and DEX or launchpad URL, and display a confirmation page that highlights the main risk indicators.