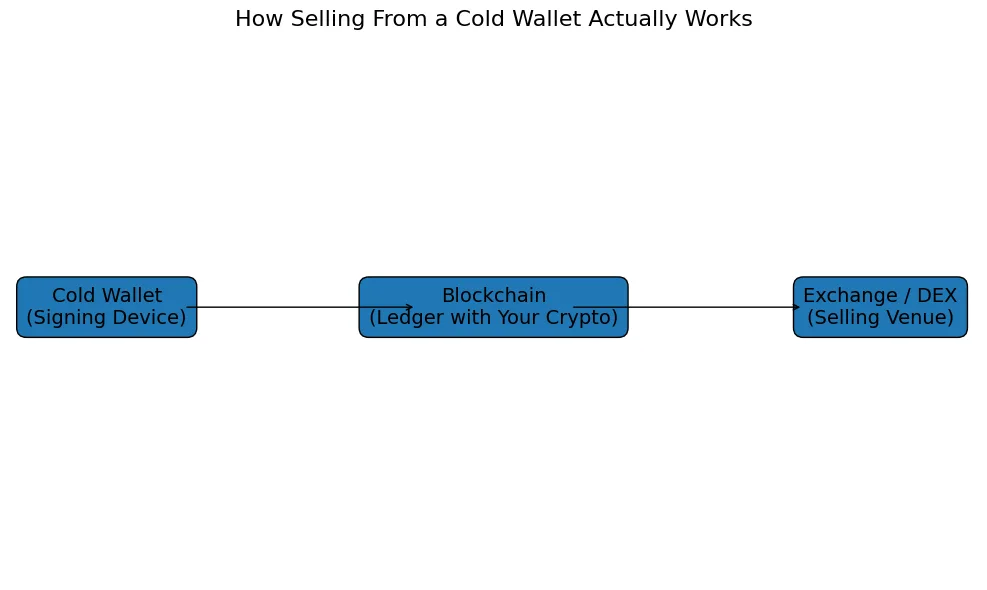

Understanding what a cold wallet really does

A trading platform is not what a cold wallet is. It is a signature device that reliably authorizes blockchain transactions by storing your private keys offline. Your coins are never inside the gadget; they are always on the blockchain. Because the wallet itself is unable to conduct deals, selling appears more difficult. Rather, it only completes the transaction that transfers your assets to a location where they can be sold. The selling process is much simpler to comprehend once this distinction is made explicit.

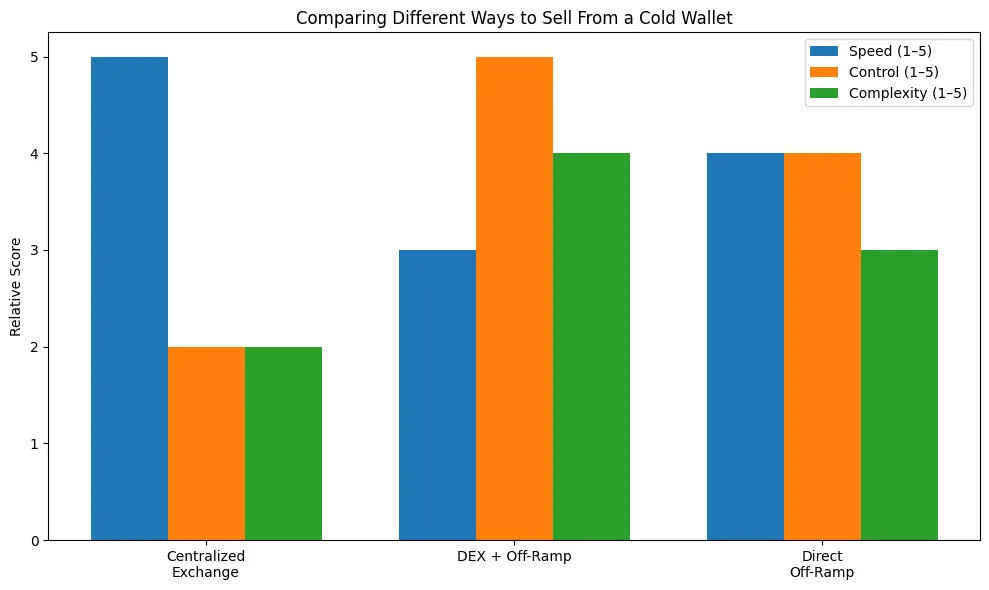

Selling through a centralized exchange

Moving your cryptocurrency from your cold wallet to a centralized exchange is the quickest way to sell. After connecting your device, you launch the relevant cryptocurrency app, confirm the deposit address on the hardware screen, and sign the transaction. You can sell your cryptocurrency for fiat money and withdraw it to your bank account once the transfer has reached the exchange. Because the exchange manages all trade execution and offers liquidity, this approach is the most practical. As soon as the blockchain transfer is verified, the cold wallet’s function is terminated.

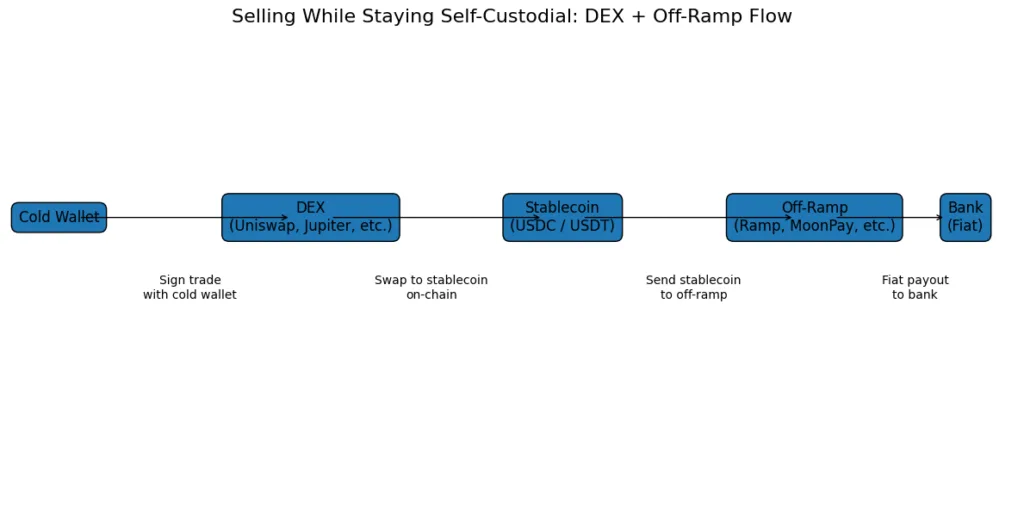

Selling through a decentralized exchange

You can sell through a decentralized exchange if you would rather maintain complete self-custodial control. You open a DEX like Uniswap, connect your cold wallet with MetaMask or WalletConnect, and exchange your assets for a stablecoin like USDC. Your stablecoin stays in your wallet even after the sale is completed on-chain. You still require an off-ramp in order to convert this stablecoin into currency. This approach sacrifices some simplicity in favor of security and sovereignty, particularly with relation to the last stage of cashing out.

Using modern crypto off-ramp services

You can now pay out straight from your cold wallet via a number of off-ramp businesses. On an off-ramp platform, you start by submitting a sale request. They provide your transaction a temporary on-chain address. The service transfers the money to your bank after converting your cryptocurrency into local currency. These solutions completely eliminate the need for centralized exchanges, albeit availability and costs vary depending on where you live.

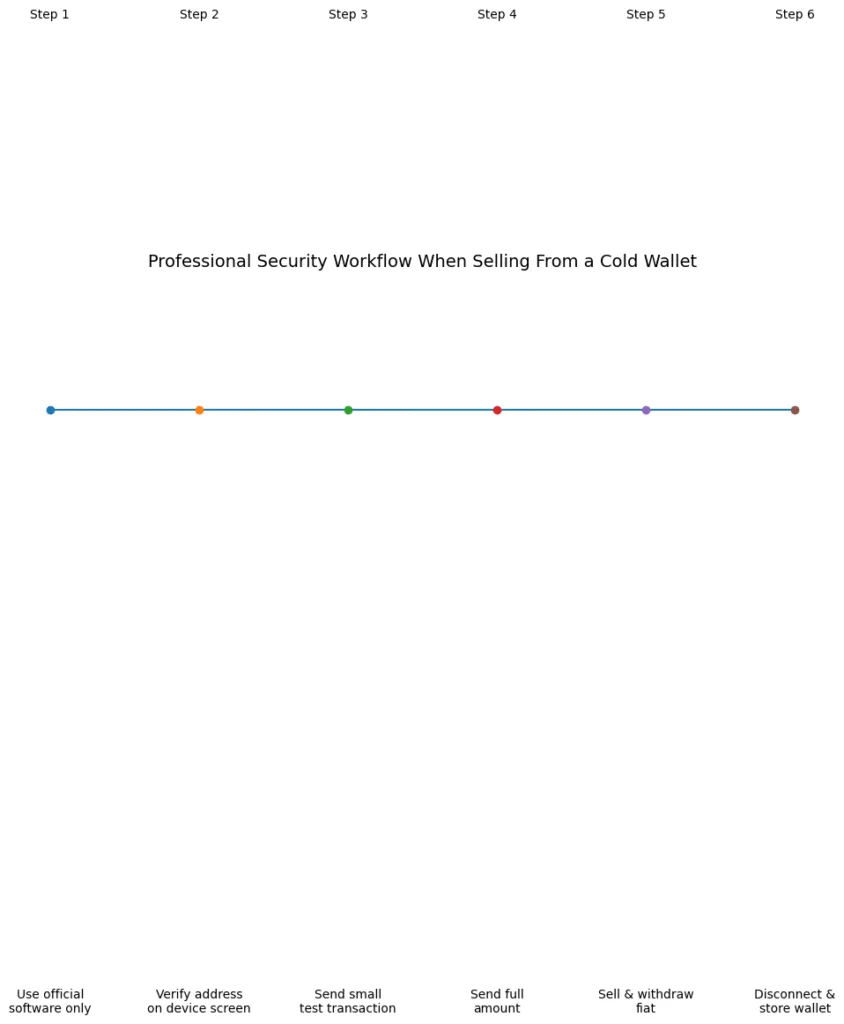

The safest way to sell professional workflow

Every time they transfer money from a cold wallet, seasoned investors and professional traders adhere to a strict security protocol. Initially, they only engage with verified domains and official software. Since the hardware device is impervious to viruses that could alter the computer screen, they only rely on the address shown on it while preparing a transfer.

They start with a tiny test transaction to make sure the routing is accurate and the receiving platform recognizes the deposit, rather than to safeguard the actual amount. They submit the entire cash and wait for many confirmations after the test is successful. They don’t start trading or selling again until after that. They are shielded from phishing assaults, phony interfaces, and chain selection errors that frequently result in permanent losses by this methodical and cautious approach.

Selling from a cold wallet is ultimately not a difficult procedure. Starting with offline signatures and concluding on a reliable trade or off-ramp platform, it is a regulated, secure process. Your key is protected by the cold wallet. Your value is transported via the blockchain. The last conversion is completed by the selling location. Regardless of how much you are going, knowing each step provides you total assurance.