A market at the fault line

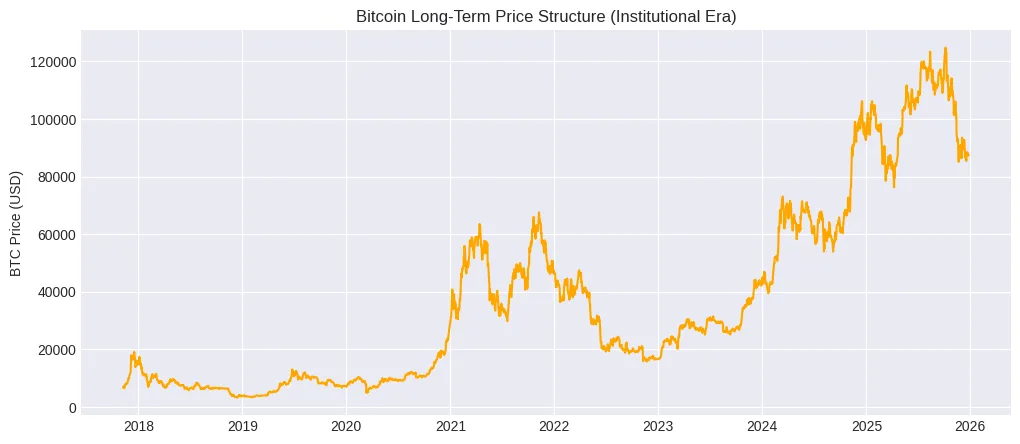

With the year 2025 coming to an end, the crypto market is no longer disputing the presence of institutions but rather what kind of market they will eventually set up. The industry is now situated at a crossroads marked by two different futures, and one of them sees crypto getting matured with regulations, being a balance-sheet-based asset class, and also, the custodians, ETFs, structured products, and macro-driven capital flows taking over the market.

The second future picturizes a prolonged adjustment period, an extended winter, where the price fluctuations get limited, thin out the narratives, and the speculative money fight to re-establish the dominance that they once had. The question as we enter the year 2026 is not whether the crypto market will continue but in what form. Will crypto turn into a slower, institutionalized market or will it undergo a longer period of digestion where the unwinding of the excesses from the previous cycle is done much slower than what most people might expect?

The institutional shift is no longer theoretical

Institutional involvement isn’t a news topic anymore; it has become part and parcel of the market. The introduction of spot ETFs, approved custodians, prime brokerage firms, and trading places up to compliance have changed the structure of the market in a fundamental manner. Today’s crypto capital is different in behavior from the flows that characterized previous cycles. It is less aggressive, more sensitive to interest rates, and more restricted by mandates.This shift has already changed how core assets like Bitcoin and Ethereum trade. Momentum is increasingly tied to macro variables rates, liquidity, balance-sheet capacity rather than purely reflexive narratives.

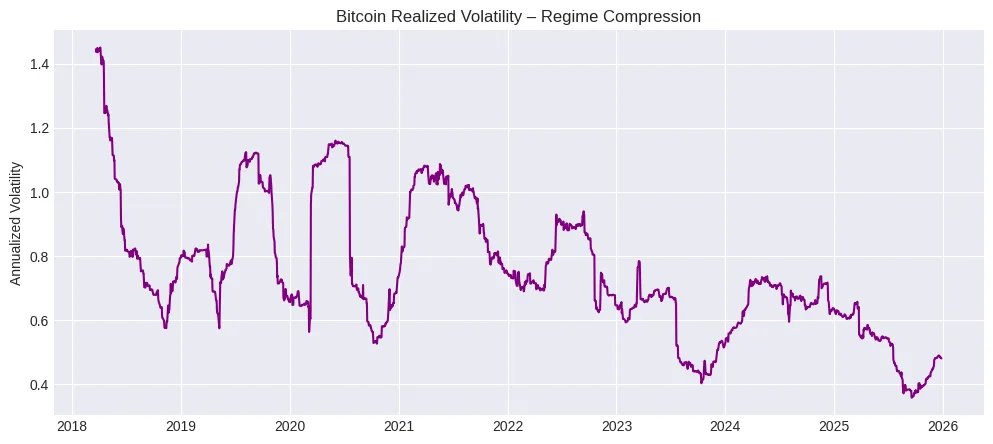

Drawdowns are met not with panic selling, but with rebalancing. Rallies are sold into systematically, not emotionally. This does not kill volatility, but it redistributes it across longer horizons.Institutions do not chase parabolic moves the way retail once did. They accumulate, hedge, and monetize volatility. That alone reshapes the rhythm of the market.

Liquidity has altered its form, and it has not returned

Among the dynamics that are going to be most misunderstood in the upcoming years, there is liquidity. Many market players think that if there is plenty of liquidity, then the institutions have adopted the market. But this is not the case, each institution has its own liquidity and the amount is very limited. Liquidity is only present in specific assets, instruments, and venues and is very much concentrated. It might even be the case that liquidity is reduced outside the core.Both Bitcoin and Ethereum are more and more like macro assets, they take the flows that used to go to the altcoin universe and flow into the bigger ones.

On the other hand, mid-cap and long-tail tokens have to deal with thinner books, wider spreads and a lowered participation rate that is structural. This divergence leads to the top of the market appearing healthy, while in reality, a lot of the ecosystem is already being drained slowly.Extended winters are not usually about price decline only. They are about opportunity cost.

Capital in the core assets refuses to move and rotation gets weaker. When weak rotation is the case, then also innovation funding is slowed down. The moment the funding is slowed down, the narratives die.

The volatility paradox of institutions

Institutions mitigate chaos but they also limit the extreme positive prices. The very techniques that stabilize the markets, like risk limits, hedging programs, and volatility targeting, also inhibit the huge price increases. For investors who are used to 10x stories every quarter, this can be very hard to tell apart from stagnation. However, under the surface, volatility does not cease to exist. It moves to another place. It reveals itself through the shape of the term structure, options skews, funding dynamics, and correlations among different assets.

The crypto market becomes less of a directional euphoric atmosphere and more of a situation where one has to deal with positioning, convexity, and relative value. For the professional traders, this is not the time for inactivity. Rather, they consider it as a shift in the trading environment.

Regulation as a gravity field

As we foresee regulations up to the year 2026, they are not going to be just a gatekeeper but a gravity as well. It is responsible for drawing the activities towards the compliant centers while pushing the outskirts further away. It is not that regulations will stop the innovations completely, however, it will be a lot more expensive not to conform and the area of unstructured speculation will be even smaller. The growth of regulatory clarity in the main jurisdictions is going to market make the situation more predictable and at the same time, paradoxically, more competitive.

Investors’ profits are going to get smaller because the market imperfections will be completely eliminated through arbitrage. Thus, if at the beginning being early was the main characteristic of the investor who could obtain a high profit, it is now being precise. The present scenario is one where investors are going to need to have large volumes, and possess a lot of data as well as having very strict and disciplined approaches. Those who are dealing with a lot of noise will find it hard.

Is this an elongated winter season or a different climate?

If one were to characterize this stage as a winter, it would imply an eventual return to a warmer, noisier, and more disorderly atmosphere. Yet, this belief might not be entirely correct. The situation that the cryptocurrency sector confronts at the dawn of 2026 does not resemble a winter but rather looks like a climate change. The once sharply defined seasons will not come back in a timely manner; instead, they will fade away. Retail-oriented excitement and the like may still take place, but it will probably be of an intermittent nature in contrast to the traditional repetitive nature of cycles.

The underlying condition of the market is gradually transforming into something serene, lighter, and more firmly grounded on the global capital flows. This situation is advantageous for those who are knowledgeable about macro linkages, liquidity cycles, and risk transfers and can thus navigate through the markets. Those who are patient enough to wait until the market regains the characteristics of 2021 may find it a very long wait. On the other hand, those who are quick to adapt to the new reality of crypto might find themselves already in the right position.