From trust to verifiable logic

Parametric insurance exemplifies the core function of blockchains: transforming subjective assessments into logic that machines can verify. While traditional insurance depends on adjusters, claims departments, and lengthy discussions, parametric insurance links payments to clear, verifiable indicators. If the signal fires, the contract requires no photos, no affidavits, no negotiations. In this world, governance is not a barrier overseen by institutions; it is a tapestry crafted from data streams, algorithms, financial reserves, and votes from token holders.

This fabric is carried by four actors. Oracle networks gather data from the outside world and provide on-chain measurements with robust safeguards against tampering. An AI risk engine processes these metrics, calculates loss probabilities, and suggests premiums, caps, and triggers that maintain the pool’s solvency while staying competitive. A DAO grants human legitimacy: it curates oracles, approves model enhancements, and distributes funds to coverage areas. Ultimately, a capital pool operates: it holds funds in escrow and disperses payouts immediately once the trigger conditions are satisfied. The sophistication is round. Pool output generates telemetry; telemetry transforms into new training data; the model suggests modifications; the DAO approves; the pool readjusts and the cycle restarts.

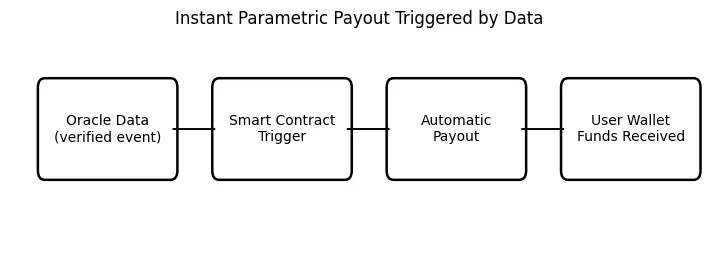

The mechanism: From data to payout

A parametric policy is a coded connection between a trigger and a payout. The purchaser chooses a coverage period, a trigger mechanism, and a payment timetable; the pool reserves funds; the oracle network monitors. When the observed variable exceeds the threshold for rainfall below a monthly index, a depeg lasting longer than a tolerance period, or a validator downtime surpassing an uptime SLA, the contract triggers automatically.

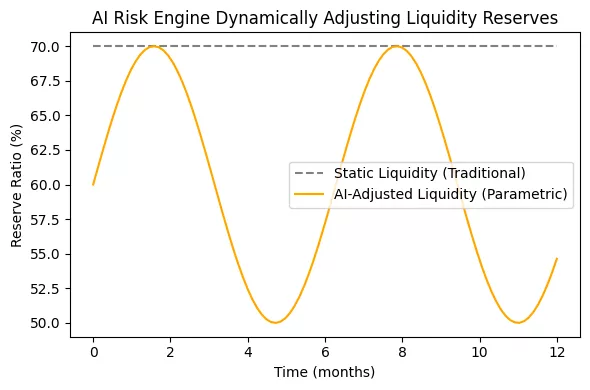

The AI risk engine transforms this into enduring micro-economics. Instead of setting prices annually, the engine regularly recalculates expected loss, tail risk, and correlation with other active covers. Premiums and capacity fluctuate with the market: rising when volatility and correlations increase, subsiding when circumstances stabilize. This adaptability prevents capital from escaping in times of stress and diminishes the motivation to “adverse-select” the group. The DAO is not designed to micromanage; rather, it establishes boundaries: maximum leverage, reserve ratios, approved oracle sets, and secure deployment processes for new models. When failures happen, each state transition is recorded on-chain, allowing for swift analyses and adjustments of parameters without ambiguity.

The governance loop: human judgment without human bottlenecks

In parametric systems, trust is generated through process instead of personality. Token-holders choose oracle groups, establish circuit breakers, and approve model updates; the model generates recommended parameters; the pool implements them. Importantly, the loop operates slowly when needed and instantly when it should. Governance is intentional for structural modifications, introducing a new oracle and adjusting reserve floors while distributions continue to be automatic. The division maintains clear incentives: participants cannot postpone payments to enhance quarterly outcomes since there are no quarterly-only regulations.

The most persuasive experiments grant the AI proposal authority without executive control. It can propose stricter triggers for a region starting the drought season or reduce rates following a month of stable volatility; the DAO subsequently approves through time-locked voting. Eventually, the protocol functions like an algorithmic mutual: participants manage risk tolerance, machines enhance operations within that tolerance, and capital providers gain clear, mark-to-market returns.

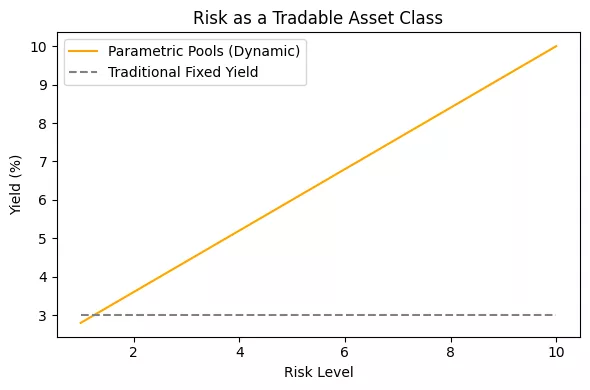

Stakeholders and capital: turning protection into a market

For users, the process is pleasantly straightforward: link a wallet, choose a cover, view the precise trigger, and pay a clear premium. Beneath that simplicity lies a marketplace in which risk transforms into a programmable asset. Stakers provide funds to designated cover lines and earn a return based on actual losses, usage, and charges. Due to the parametric nature of policies, loss evaluation is binary; capital accounting is precise; and secondary markets can exchange “risk tokens” signifying exposure to a specific set of triggers. This enables diversification: a treasury can combine weather risk in Kenya with validator-uptime risk in Europe and global stablecoin-depeg risk, reducing correlation and stabilizing returns.

Clarity does not remove risk. Oracle manipulation, correlation surges, and governance control are genuine. Strong designs employ multi-source oracles with medianization, implement conservative reserve floors, and incentivize continuous voter engagement to prevent the silent centralization of power. On-chain governance allows all parameters, both favorable and unfavorable, to be visible and fixable in a public manner.

Toward predictive and autonomous insurance

Governance in parametric insurance is transforming into a hybrid intelligence framework that merges algorithmic foresight with communal judgment.In future protocols, neural networks will assess risks and independently suggest governance actions. DAOs will verify them, turning insurance into a predictive, self-tuning entity able to avert losses before they happen.

Conventional insurers might continue to function not as exclusive guardians of trust but as verifiers, information suppliers, and financial backers for decentralized collectives. The essential role of the industry is evolving from shielding against loss to preventing issues by forecasting. This innovative governance framework eliminates human bias and moral risk while maintaining human values embedded in clear guidelines.

In this scenario, every factor from premium pricing to capital distribution becomes adjustable. All individuals, from agriculturalists to DeFi investors, can obtain equitable, prompt protection. Insurance without insurers does not mean eliminating accountability; rather, it focuses on allocating it more wisely

Parametric governance represents the realization of blockchain’s potential:a transparent, verifiable system where truth equals data, trust equates to code, and justice is immediate.