For over ten years, Bitcoin has been characterized as various things, including digital gold and a safeguard against financial instability. These assertions were straightforward to uphold during a period of nearly zero interest rates and growing central bank balance sheets. The 2024–2025 interest rate cycle, which signifies the first prolonged easing phase following the most intense tightening in four decades, offers a clearer evaluation. If Bitcoin genuinely serves as a hedge, its performance should significantly alter in response to policy changes, shifts in liquidity conditions, and the repricing of traditional assets.

What hedge actually means

A thorough evaluation necessitates clarity in definitions. In the realm of financial economics, a hedge refers to an asset that is either uncorrelated or negatively correlated with another asset on average. A safe haven, however, imposes a stricter requirement, demanding that this relationship remains valid particularly during times of market distress. The ongoing discourse surrounding Bitcoin has muddled these definitions, resulting in conflicting conclusions that are influenced more by the specific time frame or crisis under consideration than by reliable statistical data.

The post-2024 monetary regime

The timeframe of 2024–2025 ought to be perceived not merely as a singular policy shift but rather as a comprehensive regime. Following the peak of interest rates, markets shifted from a plateau phase into initial rate cuts and subsequently into wider expectations of easing. During this timeframe, asset prices were influenced less by the absolute interest rate levels and more by investors’ interpretations of the rationale behind the easing measures, whether viewed as a means to bolster growth or as a reaction to developing economic vulnerabilities. This differentiation is essential for comprehending the correlations associated with Bitcoin.

Rolling correlations and the risk-asset problem

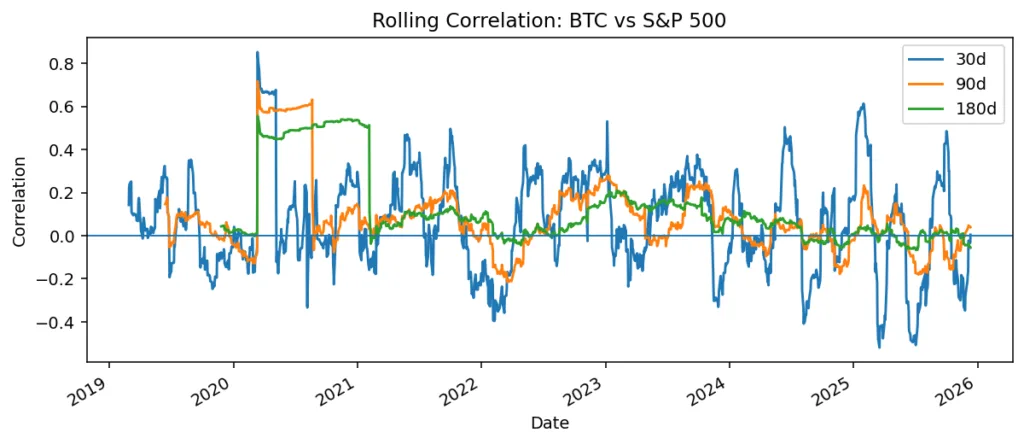

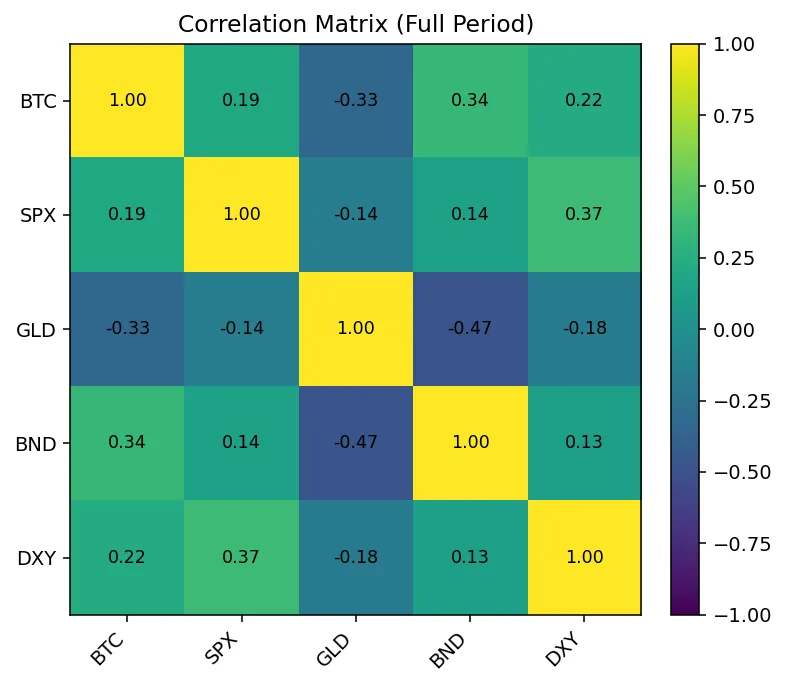

The analysis of rolling correlations indicates that Bitcoin does not exhibit a consistent relationship with conventional hedging assets. Its correlation with US equities varies significantly, ranging from nearly zero to strongly positive in various macroeconomic contexts. When interest rate reductions are perceived as beneficial for growth and risk tolerance, Bitcoin acts similarly to a high-beta risk asset, increasing in value alongside equities. Conversely, when monetary easing signals economic distress, correlations diminish and may even become negative; however, these instances are typically brief and erratic.

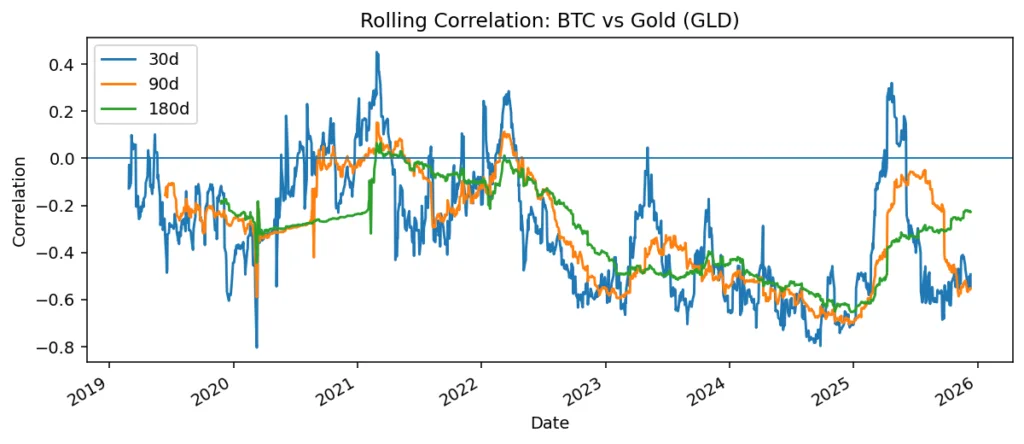

The correlation between Bitcoin and gold is often negative and inconsistent, frequently experiencing sharp fluctuations during times of market stress.In contrast to gold, which typically detaches from risk assets during spikes in volatility, Bitcoin’s connection with gold diminishes exactly when one would anticipate the emergence of hedging properties.

Even over extended periods, the correlation does not stabilize around zero, highlighting that Bitcoin does not possess the defensive traits associated with gold.

Bitcoin versus gold

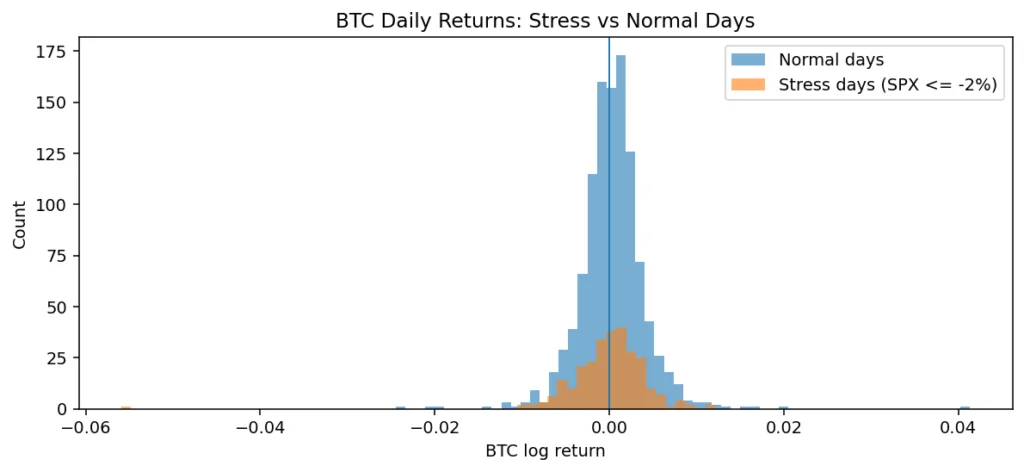

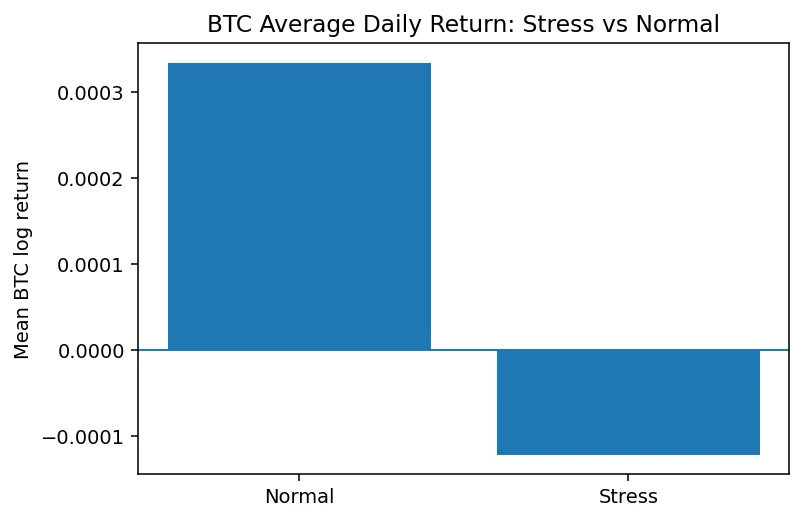

The comparison with gold highlights the limits of the digital-gold thesis. While Bitcoin and gold sometimes move together during periods of dollar weakness or falling real yields, their behavior diverges sharply during equity drawdowns. Gold’s correlation with equities typically declines when volatility rises, reinforcing its role as a hedge. Bitcoin does not show this pattern reliably. In stress-only samples, Bitcoin often falls with equities, failing the traditional safe-haven test.

Rates, liquidity, and real yields

In the post-2024 period, Bitcoin’s most significant macroeconomic relationship is not directly with inflation, but rather with real yields and liquidity conditions. A decrease in real yields and a relaxation of financial conditions generally bolster Bitcoin prices, irrespective of whether inflation is increasing or decreasing. This indicates that Bitcoin acts less as a hedge against inflation and more as an asset that is responsive to the opportunity cost associated with holding non-yielding assets and to changes in global liquidity.

The balance-sheet shift after spot ETFs

The introduction and swift expansion of spot Bitcoin ETFs in 2024 significantly transformed the composition of Bitcoin’s investor base in a fundamentally important manner.

Institutional investors and asset managers emerged as the marginal holders, incorporating Bitcoin into diversified portfolios instead of viewing it merely as an independent monetary hedge.

Consequently, Bitcoin is becoming more influenced by balance-sheet management and risk-budget limitations. In times of de-risking or when targeting volatility, it may be sold in conjunction with equities and other risk assets, thereby strengthening correlations at the very moment when hedging characteristics would typically be anticipated.

Regression evidence and regime dependence

Basic return regressions strengthen the correlation findings. Equity returns continue to be a crucial explanatory factor for Bitcoin during a significant portion of the post-2024 timeframe, whereas fluctuations in real yields typically present the anticipated negative sign. Inflation-related variables contribute minimal explanatory strength once interest rates and growth expectations are accounted for. This suggests that Bitcoin’s behavior is more accurately interpreted as dependent on the prevailing regime rather than as a structural hedge, with the macroeconomic context influencing which factor prevails at any specific moment.

A conditional hedge, not a universal one

Following the 2024–2025 rate cycle, Bitcoin cannot be characterized as a universal hedge or a dependable safe haven in the conventional sense. Its hedging properties seem to manifest only under particular macroeconomic conditions, usually when declining real yields are viewed as monetary debasement instead of a reaction to economic fragility.

Even then, balance-sheet effects linked to institutional ownership can overwhelm those dynamics. Bitcoin today behaves as a hybrid asset whose correlations shift with policy, liquidity, and investor composition. Treating it as a permanent hedge is not supported by the evidence, but understanding its regime-dependent role offers a more accurate and useful framework.